Starting a business is an exciting but often quite daunting undertaking. Having the right bank, among so many other things, is an essential part of the business. Whether you’re a one-person show or a small business owner with staff, it is vital to maintain a clear distinction between your business and personal finances.

The best banks for small businesses offer entrepreneurs a comprehensive solution for all their business banking needs, such as no-cost or low-cost business checking accounts, savings accounts, credit cards, business loans, and merchant services. As a new business owner, selecting the right bank for your startup is a critical decision that influences your startup’s prospects. But what features, specifically, should you look for in a bank?

We looked at several banks with a reputation for serving small businesses, to help you select an institution that serves your startup’s unique requirements. In addition to the prime considerations such as cash deposits, mobile check deposits, free ATMs, account types, and fees, we took a wider view of the more subtle aspects of business banking, case by case.

Five Best Banks For Startups In 2023

Here are the five best banks for startups with all the banking services you need in 2023.

- Chase: Best Full-Service Bank for New Businesses

- Silicon Valley Bank: Best Bank for Venture-Backed Startups (acquired by First Citizens Bank)

- Bank of America: Best for Continuous Incentives and Minimal Cash Deposit Costs

- Wise: Best Online Bank for Intl. startups (best APY)

- Novo: Best Digital-Only Bank for Startup Funds and Faster Payments

Chase: Best Full-Service Bank For New Businesses

Overview

Serving as J.P. Morgan’s retail and commercial banking division, Chase Bank is a financial services company with over $3.3 trillion in global operations and assets. In addition to its 4,700 branches, Chase Bank also offers access to 16,000 ATMs. Its size alone provides big-bank features beneficial to small business owners, such as generous rewards and account bonuses, plus access to brick-mortar banks for in-person services around North America.

We recommend Chase as one of the top banks for small businesses due to its extensive breadth of services. In addition to their checking accounts, small business owners can use other Chase services, like business loans, credit cards, and savings accounts.

Chase offers three distinguished types of business checking accounts: Chase Business Complete Banking, Chase Performance Business Checking, and Chase Platinum Business Checking. The Chase Business Complete Banking account is widely regarded as one of the best checking accounts for entrepreneurs and startups.

Image Source: Chase

| Terms | Chase Business Complete Banking |

| Account Opening Deposit Required | None |

| Minimum Required Balance | None |

| ACH Payment Fees | $25 for the first 25 fund transfers per month, 15 cents for each additional transfer, with $2.50 returning fee |

| Transaction Limit Before Fees | Unlimited electronic transactions; 20 paper transactions each month without charge; after the cap, 40 cents per transaction |

| Monthly Fees | $15; waived if certain requirements are met* |

| Domestic Wire Transfer Charges | For outgoing wires, up to $35, and for incoming wires, up to $15 |

| International Wire Transfer Charges | Approximately $50 for outgoing and $15 for receiving wire transfers. |

| ATM Fees | $3 plus third-party charges for inquiries, transfers, and withdrawals at non-Chase ATMs |

| Overdraft Fees | $34 for each transaction following the initial one that results in a negative account balance of $50 |

| Annual Percentage Yield (APY) | N/A |

*You can avoid paying the $15 monthly fee if you meet any of the following conditions at the beginning of each billing cycle: 1) a $2,000 minimum daily balance, $2,000 in net purchases on the Chase Ink Business Card, $2,000 in deposits from Chase QuickAccept or other Chase transaction banking; 2) connecting a Chase Private Client Checking account; or 3) proving qualified military status.

Chase Business Complete Banking: Top Features

Despite Chase Business Complete Banking being an entry-level Chase business checking account, it nonetheless comes packed with useful extras that may help your company succeed.

Waivable Monthly Fee

The Chase price for Business Complete Banking is $15 per month; however, there are numerous methods to waive this charge. To have this cost waived, you must fulfill one of the following conditions throughout each billing cycle:

- Maintain a minimum daily balance of $2,000.

- Make total purchases of $2,000 or more with your Chase Ink Business Card.

- Make deposits of $2,000 or more using Chase QuickAccept or other qualified Chase Payment Solutions business transactions.

- Connect a Chase Private Client Checking account.

- Provide acceptable evidence of military status.

Payment Acceptance Via Chase QuickAccept

Chase accepts payments in a fairly straightforward manner. When utilizing QuickAccept on the Chase Business website or mobile app, you may get your money the same day at no additional charge. Among its other capabilities, QuickAccept allows you to process card transactions, give refunds, and keep track of disputes. There are no hidden fees or recurring costs, just a straightforward pricing system.

The payment processing fees are as follows:

- Key Entry Transactions: When entering card information using an app or a Smart Terminal, there is a key entry transaction fee of 3.5% + 10 cents for each authorized transaction.

- Swipe/Dip/Tap Transactions: Using a card reader or Smart Terminal, the fee for a swipe, dip, or tap transaction is 2.6% + 10 cents.

The business checking account feature of Business Complete Banking comes with a recurring monthly service charge. This cost is usually $15 for every monthly statement period but can be waived entirely if you meet one of the abovementioned requirements.

Access On The Go

The Chase website and mobile app both provide access to your Business Complete Banking account, allowing you to perform several banking functions in addition to using QuickAccept. Chase’s online banking allows you to:

- Check balances

- Transfer money across accounts

- Schedule bill payments

- Setup account notifications

- Enroll and check account statements

- Process wire transfers

- Transfer funds using Chase QuickPay using Zelle

Whether it’s a business checking account, savings account, certificate of deposit, business line of credit, or payment solutions account with Chase, you have full access to all of them through a single online login.

Account Opening Bonus

One of the most attractive features of a Chase checking account is the possibility of earning a $300 bonus just for signing up. The bonus is only available every two years from the time of your previous registration and only once per account.

In addition, you’ll only be eligible for the bonus if you fulfill one of the following conditions:

- Open a fresh Chase Business Checking account by visiting a branch or Chase online.

- Deposit at least $2,000 into your new bank account within 30 days after registration.

- Maintain a minimum balance of $2,000 for 60 days following bonus participation. Your company’s existing balances at Chase or one of its subsidiaries cannot be used to cover the shortfall.

- Five eligible purchases must be made and completed within 90 days of offer registration.

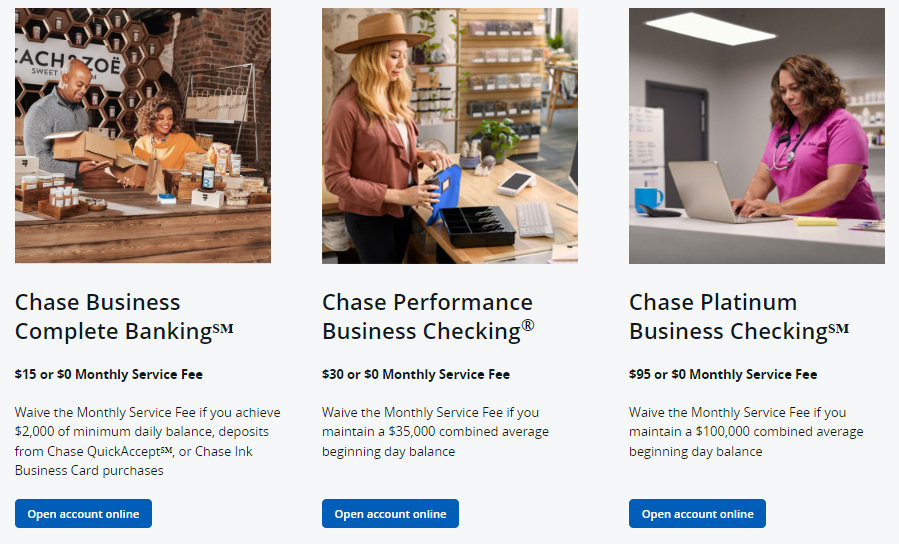

Fraud Protection Services

With Chase’s Fraud Protection Services, you can guard your finances against fraudulent transactions. You can have your checks reviewed and authorized, set spending restrictions, and receive notifications about your account. Chase will verify the validity of your checks by comparing them to a file you supply detailing your check-writing activity. The service is elective and provided on demand.

Image Source: Chase

Chase Business Credit Cards Offer Benefits And Financial Savings

Chase offers additional benefits associated with its Chase Ink Business Unlimited credit card and its savings account. You may get 1.5% cash back on everything you buy using Chase Ink Business Unlimited Credit Card, plus an additional $750 cashback as a bonus. Monthly checking account fees of $15 are waived if cardholders charge $2,000 or more to their accounts each month.

Chase will not charge any monthly fee for the savings account if you create one with Chase and connect it to this Chase checking account.

Access To Chase Business Services

Chase Business Services is an additional advantageous feature for small-business entrepreneurs. Services offered by Chase include the aforementioned QuickDeposit, in addition to Access & Security Management, Billing and Collection Services, Payment Solutions, Wire Transfers, ACH Payment Solutions, and much more.

Physical Debit Cards

Chase is an excellent option for businesses that make extensive use of debit cards because it includes a free business debit card with each account. Within the Chase network, you may use your debit card as much as you like and withdraw money from any ATM without incurring any fees. Business debit and employee cards are also easily available for companies who require them.

Pros

- $300 bonus upon account opening

- Accessibility to online, mobile, and branch banking, in addition to a vast ATM network.

- No-fee cash deposits up to $5,000 every statement cycle

- Unlimited online transactions

- No minimum balance requirements

Cons

- Limited amount of monthly fee-free paper transactions

- No accounts earning interest

- Low savings rates

Why We Chose Chase?

Due to its multiple outstanding banking services, Chase is one of our top selections for business banking platform for small businesses. Entrepreneurs that are used to online money management should find Chase Business Complete Banking to be an appealing choice. Their wide range of services includes business checking accounts, merchant accounts for accepting credit and debit card payments, business credit cards, lines of credit, and loans for expanding businesses.

If you want more options for sending and receiving money, the account also gives you access to QuickDeposit, wire transfers, and online Bill Pay. QuickAccept and QuickDeposit help alleviate some of the difficulties associated with ensuring the seamless flow of funds throughout your company. To get a bird’s eye perspective of your company’s finances, you can use the app to manage notifications, set up recurring payments, transfer funds internationally, and generate paperless reports.

Silicon Valley Bank: Best Bank For Venture-Backed Startups

Overview

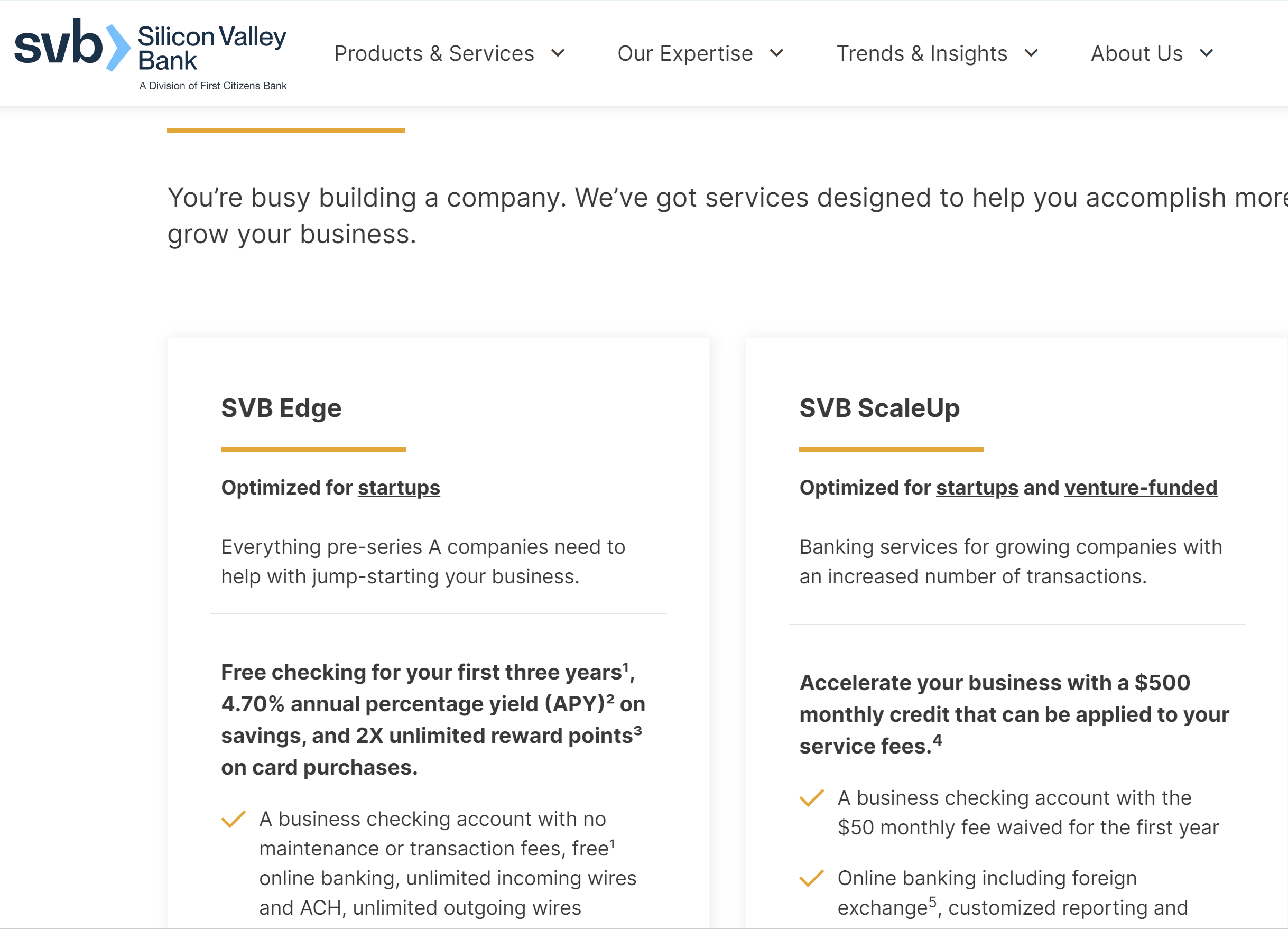

Silicon Valley Bank (SVB) business checking accounts are perfect for startups and venture-funded enterprises. Silicon Valley Bank currently offers two types of checking accounts: SVB Edge and SVB ScaleUp.

Startups and entrepreneurs can open an SVB Edge account for free. For the initial three years, it includes unlimited transactions without any monthly fees, a savings account with 2% interest, and a merchant services solution that enables you to take credit and debit card transactions.

SVB ScaleUp, meanwhile, is geared toward growth-oriented startups and venture-funded businesses. In addition to the standard capabilities, such as remote deposit capture, safe deposit services, payment processing automation via SVB Transact Gateway, and fraud prevention, you also get a full complement of extra services at no additional cost for an entire year. Account holders receive a $500 monthly credit against servicing expenses.

Image Source: SVB

Both accounts provide integration with managerial accounting tools such as QuickBooks, Xero, and Expensify, as well as optimization of online and mobile banking and eligibility for the SVB Innovators Card.

| Terms | SVB Edge | SVB ScaleUp |

| Required Opening Deposit | None | None |

| Required Minimum Balance | None | None |

| Transaction Limit Before Fees | None | None |

| ATM Fees | None | None |

| Cash Deposit Fees | None | None |

| APY | None | None |

| Monthly Fees | None for 3 years; $50 thereafter | None for 1 year; $50 thereafter |

| Domestic Wire Transfer Fees | Incoming: Up to $12Outgoing: Up to $17 | Incoming: Up to $12Outgoing: Up to $17 |

| International Wire Fees | Incoming: Up to $12Outgoing: Up to $30 | Incoming: Up to $12Outgoing: Up to $30 |

SVB Business Bank Account: Top Features

Startup Resources

SVB develops banking options, especially for companies in the healthcare, life sciences, and technology sectors. More than seventy-five specialists in startup banking are at your disposal to help you through every phase of business development. SVB provides its customers with access to a variety of resources, including workshops, consultations, regional networking events and summits, webinars, and investor gatherings.

SVB Direct Connect

For more efficient financial management, SVB clients have access to SVB Direct Connect, which enables them to immediately synchronize their current and previous account information with the bank’s Open Financial Exchange service. It’s compatible with a wide variety of accounting and expense-tracking apps.

Image Source: SVB

SVB Transact Gateway

SVB Transact Gateway facilitates your business’s efficiency by connecting your company’s accounting software and internal systems with its online banking payments and info, thus automating the initiation, processing, accounting, and reconciliation of payments.

Image Source: SVB

Bill Pay Plus

Bill Pay Plus allows you to establish payment schedules, allowing you to automate bill payments. By scanning, uploading, or getting them through email, you can easily digitize your bills and keep them alongside contracts and other key documents for quick access and accountability. With Bill Pay Plus, your SVB account information is kept private when you make payments through your account. All of your data is encrypted, and your transactions are protected.

Image Source: SVB

Remote Capture Services

To facilitate remote transactions, SVB offers three distinct types of Remote Capture Services: Mobile Deposit, Remote Deposit Capture, and Remote Lockbox. With mobile deposit, you may effortlessly deposit your check using a smartphone or by scanning multiple checks using a desktop scanner.

The Remote Deposit Capture service offered by SVB includes a free single-feed scanner. There are multi-feed scanners on the market that can process up to 50 checks at once. In order to handle a large number of checks and remittance documents, SVB also offers a remote lockbox service. The remote lockbox feature allows for the simultaneous scanning of several pages or documents utilizing full-page or multi-feed scanners located in different buildings.

Image Source: SVB

SVB Innovators Card

SVB Innovators Card is a credit card tailored to the needs of startup founders and their finance teams. It’s easy to use for making digital payments, and you can check your costs to learn more about your business’s financial status. You won’t be charged anything yearly, and neither you nor your employees will be charged for any liabilities. In addition, it allows you to double your reward points. When you use an SVB innovators card, it automatically syncs your transactions with major digital payment applications.

Image Source: SVB

Dedicated Customer Support

Last, but by no means least, SVB places a strong emphasis on customer care. Young businesses working with SVB will be appointed account managers, who are mercifully free of constant upsells or promotion pitching. SVB provides you with the email addresses and phone numbers of your account manager and customer support staff so that you can receive assistance anytime you want it.

Pros

- 2% interest rate when linking SVB checking account to money market account.

- Flexible loan solutions for newly founded and venture-funded businesses

- Integration with popular accounting software like QuickBooks

- Depending on the checking account, no monthly costs for a year or three.

- Assistance and resources from more than 75 startup banking specialists

Cons

- Monthly credit of $500 under SVB ScaleUp cannot be utilized to pay the $50 monthly charge.

- Branches located in only 16 states

- No APY

Why We Chose Silicon Valley Bank?

Silicon Valley Bank’s business checking solutions are designed for venture-backed startups seeking access to financing resources and a fee-free checking account. SVB ScaleUp is a premium checking account for growing businesses that comes with perks, including remote deposit capture, lockbox support, and fraud prevention measures.

SVB is a wonderful option because of its integration with accounting software, partnerships with businesses that offer discounts to entrepreneurs, and outstanding business credit cards. Additionally, its lending solutions make it simple for entrepreneurs to maintain their business operations and advance their expansion objectives.

Bank Of America: Best For Continuous Incentives And Minimal Cash Deposit Costs

Overview

Your business checking account is the hub for your company’s finances. A business checking account allows you to manage your company’s finances by accepting payments from customers, depositing checks and cash, issuing payments, and more. Bank of America, the second biggest bank in the United States in terms of assets, provides business checking accounts for entrepreneurs with a variety of services and features to choose from.

With limitless fee-free electronic transactions, large cash deposit limits, and three account opening options, Bank of America’s business checking distinguishes it from national and regional brick-and-mortar competition. Bank of America is a great option if you’re searching for a full-service, traditional bank that offers a great business checking account.

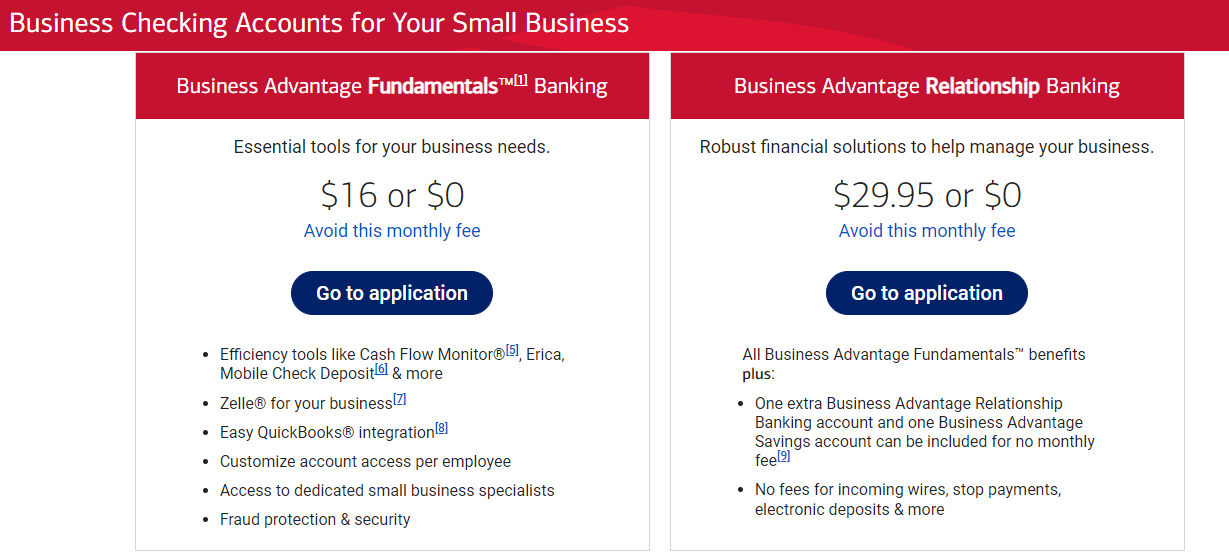

It provides two types of business checking accounts: Business Advantage Relationship Banking and Business Advantage Fundamentals Banking. You can easily switch between the two to tailor your banking experience to the specific requirements of your company.

Image Source: Bank of America

| Terms | Business Advantage Fundamentals™ Banking | Business Advantage Relationship Banking |

| Minimum Opening Deposit Required | $100 | $100 |

| Required Minimum Balance | None | None |

| ATM Fees | No fees on Bank of America ATMs, $2.50 per transaction for ATMs outside the network, $5 for international ATMs | No fees on Bank of America ATMs, $2.50 per transaction for ATMs outside the network, $5 for international ATMs |

| Transactions Fee | Free, unlimited electronic transactions, Up to 200 fee-free non-electronic transactions, after which 45 cents per item. | Free, unlimited electronic transactions, Up to 500 fee-free non-electronic transactions, after which 45 cents per item. |

| Cash Deposit Fee | Free up to $7,500 per month, 30 cents per $100 deposited | Free up to $20,000 per month, 30 cents per $100 deposited |

| Domestic Wire Transfer Fees | Fee varies, depending on wire receiving/sending account and bank type | Free for incoming wires, outgoing fee varies, depending on wire receiving/sending account and bank type |

| International Wire Fees | Fee varies, depending on wire receiving/sending account and bank type | Free for incoming wires, outgoing fee varies, depending on wire receiving/sending account and bank type |

| Monthly Fee | $16 (waived with a $5,000 combined monthly average balance, by making $250 in net new qualified purchases on a business debit card, or by joining Preferred Rewards for Business program offered by Bank of America ) | $29.95 (waived with a $15,000 combined monthly average balance or by joining Preferred Rewards for Business program offered by Bank of America) |

| APY | None | None |

Bank Of America Business Banking: Top Features

Preferred Rewards For Business

You can receive the following perks by joining the bank’s preferred rewards program for businesses:

- No monthly charges

- 25% to 75% bonus rewards on qualifying credit cards

- Enhanced interest rate on your savings account

- Discounted interest rates on specific lending packages

- Refund for payroll services

- Financial guidance from a Merrill financial solutions consultant

To be eligible for the Preferred Rewards for Business program, you must have an active Bank of America business checking account and an average daily balance of at least $20,000 in authorized Bank of America business deposit accounts and/or Merrill business investment accounts over a three-month period.

The requirements change depending on which tier you choose.

Gold Tier: To reach the Gold Tier, you must have a cumulative average daily balance of $20,000 or more for a period of three months.

Platinum Tier: The Platinum Tier requires a combined average daily balance of $50,000 or more over the course of three months.

Platinum Honors Tier: To reach the Platinum Honors Level, your average daily balance in your Platinum Honors Account must be $100,000 or more over a period of three months.

Unlimited Fee-Free Electronic Transactions

Both Bank of America business checking accounts allow limitless fee-free electronic transactions, such as ACH, debit card transactions, electronic debits, and deposit transactions conducted via a mobile check deposit app, remote deposit online, or at a Bank of America ATM.

This feature sets Bank of America business checking apart from brick-and-mortar competitors, particularly as the majority of conventional banks have a preset monthly charge that covers both electronic and non-electronic transactions.

Access To Investment Solutions With Merrill

In partnership with Merrill, Bank of America gives you access to a variety of investment options and individualized counseling from a Merrill adviser. A Merrill advisor can help you establish your financial plan and investment strategy. Your adviser will work with you one-on-one to develop a strategy that is tailored to your company’s unique needs and objectives. With the right guidance, you can manage your portfolio using tax-smart investing methods to reduce the taxes owed on your investments.

In addition to other banking solutions, Merrill, in cooperation with Bank of America, offers access to individual and small business 401(k) accounts. Additionally, they provide a simplified employee pension individual retirement accounts (SEP IRA) and savings incentive match plan for employees (SIMPLE IRA) accounts.

Cash Flow Monitor

Cash Flow Monitor by Bank of America is a comprehensive financial tool that helps businesses better manage their resources. This tool provides users with a detailed overview of their cash flow and spending trends, allowing them to make better decisions about their finances. It also offers features such as automatic budgeting, allowing users to set a budget and track spending in order to maximize their available funds.

Image Source: Bank of America

Additionally, Cash Flow Monitor provides users with insights into how their spending affects their cash flow, as well as the ability to set alerts when particular thresholds are met. Cash Flow Monitor can help businesses better understand their cash flow, identify trends, and make informed decisions. It can help companies save money and time, as well as make sure they are making the most of their resources.

Small Business Resources

Small Business Resources from Bank of America is an excellent learning resource for entrepreneurs. With tools, resources, and information, Bank of America provides support to business owners from startup to success. Small business resources provide advice and guidance on topics such as business planning, financing, and marketing, as well as help in setting up and managing finances.

Additionally, Bank of America provides access to a network of mentors and advisors that may assist company owners in making decisions and overcoming obstacles.

Pros

- A nationwide network of 16,000 Bank of America ATMs and 4,200 branch locations.

- 200 free monthly transactions for basic accounts

- Free digital tools for monitoring the company’s financial performance

- Online, phone, or in-person account opening options

- Ongoing rewards

Cons

- Requires a minimum $100 account opening deposit

- High incidental fees

- Non-Bank of America ATM usage fees

Why We Chose Bank Of America?

Bank of America is among the best banks for startups owing to its extensive services and resources. It offers a wide range of products and services tailored specifically to the unique needs of startups. From checking and savings accounts to business lending, Bank of America has everything a startup needs to get off the ground. With their online banking app, they offer quick and easy access to funds and the ability to manage finances in a secure and efficient manner. Additionally, they provide access to financial advisors and other business services to help startups succeed.

Another reason to choose Bank of America might be its stellar commitment to customer service. They understand that startups are often in the process of creating something new and need guidance and support. As such, Bank of America provides personalized customer service and specialized solutions to fit the needs of each startup. This includes offering advice on financial planning and budgeting, along with providing access to the latest industry trends and news.

Wise: Best International Banking Solution for Global Startups

Overview

Formerly known as Transferwise, Wise is a financial technology company that offers an international business account tailored for startups. Wise Business is designed to simplify banking for startups by eliminating fees, including no minimum balance or monthly fees. This makes it an attractive option for businesses looking to reduce costs. One of Wise Business’s key features is the ability to hold over 40 currencies, making it ideal for businesses with a global presence or those looking to expand internationally.

Wise offers two types of accounts: The Wise account for personal use and Wise Business. Although both accounts provide an easy, low-cost way to send international transfers and receive payments, the Wise Business account is specifically designed for businesses.

This account provides additional features and tools tailored for business use, making it easier to manage finances, reduce costs, and ensure timely payments. For startups looking to streamline their international transactions and manage finances efficiently, the Wise Business account is the more suitable choice.

Image Source: Wise

| Terms | Wise Business Account |

| Account Registration | $31 |

| Account Opening Deposit Required | None |

| Minimum Required Balance | None |

| ACH Payment Fees | Fees for ACH payments are normally around 1% when charged as a percentage of the transaction. |

| Transaction Limit Before Fees | None |

| Monthly Fees | None |

| Domestic Wire Transfer Charges | Variable fee (depending on the currency) |

| International Wire Transfer Charges | Variable fee of around 0.47% + fixed fee of around 4.15 USD |

| ATM Fees | 1.5 USD + 2% of amount over 100 USD |

| Annual Percentage Yield (APY) | 4.85% on USD balance |

Wise Business Account: Top Features

1. Mid-Market Exchange Rate

Exchange rates are set by banks and other providers, but the ‘real’ rate is the mid-market rate. This rate is the midpoint between the buying and selling prices of a currency. Different organizations use different data sets to calculate the mid-market rate, so it can vary slightly. The mid-market rate is considered the fairest rate and a market gold standard for currency exchange rates.

Ideally, Mid-market exchange rate is used by banks and money transfer services when trading between themselves and is rarely passed on to customers.

However, given that Wise was created to facilitate low-cost international payments, it ensures that all international transfers use the mid-market exchange rate and a low transparent fee. This means Wise uses the mid-market rate when sending and receiving money to and from individuals or businesses.

The sources from which Wise pulls the rate are updated in real-time when the trading market is open. This means that you get a fair rate when making international transfers. Additionally, Wise allows you to lock in the current rate until the transfer is complete, ensuring the amount you or the recipient will receive.

Wise business accounts also allow for a higher maximum transfer amount, which is ideal for businesses with high transaction values. To enable this, Wise built its own payment network to move money without incurring high international transfer fees. This often results in cheaper and faster payments compared to using a bank or alternative provider.

2. International Payments in Over 160 Countries

Operating an international business can be complex, with challenges such as different time zones, language barriers, and setting up international payments. Traditional banks often require subscriptions, endless paperwork, and charge hefty transaction fees for international business accounts.

But with Wise, you are able to expand internationally, hold different currencies, and convert easily and at a low cost.

With Wise Business, you can manage all your multi-currency payments in one account, saving up to 2x compared to traditional banks. Whether you’re paying a programmer from India, or a freelancer in New York, Wise Business offers fast, affordable, and efficient international payments with no hidden fees.

Wise also allows you to hold and send over 40 currencies to more than 160 countries, with account details available in 9 currencies, all in one international business account. This multi-currency account enables you to operate internationally without the need for costly foreign transfers and hidden bank fees.

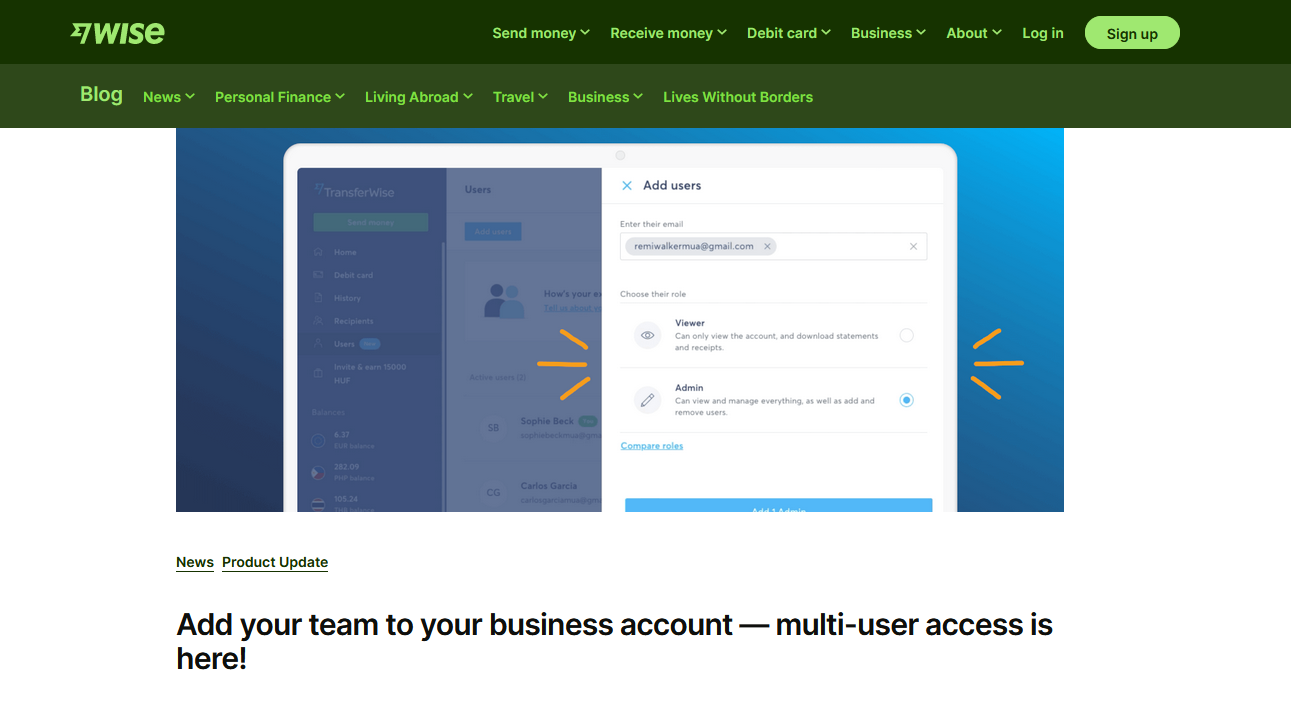

3. Team User Permissions

Wise Business offers Multi-User Access (MUA), allowing you to add users to your business account with the permissions they need to perform their jobs effectively. With MUA, you can assign different levels of access to team members based on their roles:

1. Viewer: Can view the account, connect to accounting software, and download statements.

2. Employee: Can spend with their own Wise business card(s) up to pre-set limits and view their own activity.

3. Preparer: Can set up single payments and batch payments for approval, view the account, and download statements.

4. Payer: Can make and manage payments, convert between balances, and download statements.

5. Admin: Can view and manage everything, add and remove team members, and spend with business card(s).

It’s important to note that team members can only access the business account(s) they are invited to and cannot access your personal account. Additionally, admins and employees in supported countries can have their own Wise business card, and ownership of the Wise business account can be transferred to another admin if needed.

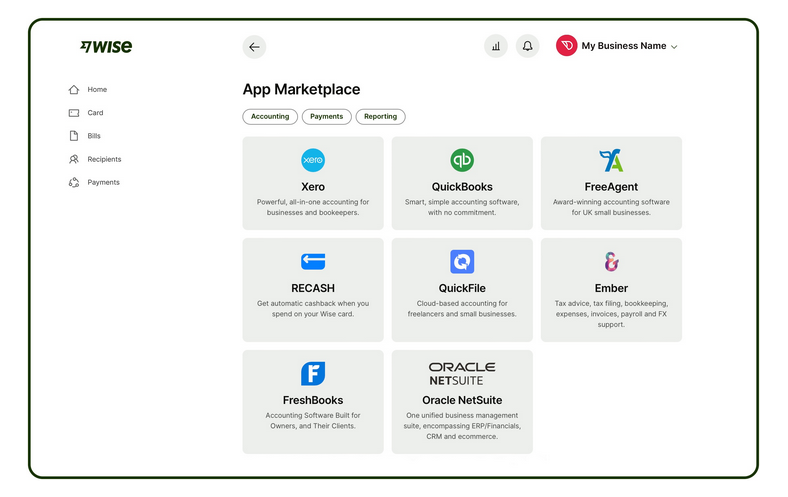

4. Accounting Software Integration

Wise Business offers seamless integration with leading accounting software, providing you with a comprehensive view of your business finances and streamlining your financial reporting process.

Once your account is synced, you can easily track transactions, including incoming payments from customers and clients, and outgoing payments to suppliers and team members, in over 40 currencies. This integration saves you time and simplifies financial reporting.

Wise Business provides bank feed syncing for several accounting software globally. The software currently supported includes Xero, QuickBooks, FreeAgent, FreshBooks, Wave, Sage, Oracle Netsuite, and QuickFile. However, availability may vary by region.

With Wise Business, you can choose which currencies you want to automatically sync with your accounting software, ensuring that your financial data is up-to-date and accurate. And if the accounting software you’d like to connect isn’t listed, you can request it through the link in the App Marketplace. Wise will get in touch with you if the requested app becomes available.

5. Set Up Direct Debits for Recurring Payments

Wise Business allows you to set up direct debits for recurring payments, including subscriptions, bills, and other fixed recurring costs. With an upgraded account, you can open account details in any of the 8+ currencies available and share them with your service providers for seamless direct debits paid directly from your balance in the right currency.

Wise Business allows you to set up these scheduled transfers, which will be funded from your Wise balance. If you don’t hold a balance in the currency you’re planning to send money from, Wise will open one for you. You’ll need to transfer money to this balance first before the transfer is sent to your recipient though.

For time-sensitive transfers paid from your Wise balance, it’s recommended to schedule them at least 3 days in advance. This is because the selected date is when the transfer is sent out, not necessarily when your recipient will receive the money.

Pros

- 4.13% APY

- Low start up fee with no monthly cost and no minimum balance

- Easy to use, intuitive, and user-friendly platform

- Timely Completion of Transfers

- No monthly fee

Cons

- Excess ATM withdrawal fee of $1.50 plus 2% of amount over $100

- Wise does not offer credit facilities or loans

- No or check cash deposits

- Exchange rates are competitive but not typically the cheapest on the market

Why We Chose Wise

Wise stands out as a top choice for business banking platforms due to its unique approach to international transactions and financial management. Unlike traditional banks, Wise focuses on providing fair and transparent pricing, especially for international transfers. This means that businesses can save significantly on currency conversion costs, as Wise uses the mid-market exchange rate and charges a low, transparent fee.

Wise stands out for its multi-currency account, integration with accounting software like Xero and QuickBooks, and team user permissions to ensure secure and efficient account management. These features, coupled with Wise’s cost-effectiveness and transparency, make it an ideal choice for startups and businesses seeking streamlined international transactions and financial management.

Novo: Best Digital-Only Bank For Startup Funds And Faster Payments

Overview

To clarify, Novo is not a bank. It’s a privately held IT firm that works with the Middlesex Federal Savings, F.A., to deliver digital banking services to customers. Through its financial partner, Novo provides the same FDIC insurance and security safeguards as a traditional bank but with a robust set of digital capabilities tailored specifically to the needs of small businesses.

Novo offers a single business checking account for US-based entrepreneurs who run small businesses or work as independent contractors.

Image Source: Novo

If your company is seeking a business checking account that doesn’t need a minimum balance to start, doesn’t charge monthly maintenance fees, and doesn’t charge any sort of interest, then a Novo account is a great option. Novo reimburses all ATM expenses; however, it lacks savings and lending options. Although you cannot physically deposit money into your Novo account, you may buy a money order and deposit it using the mobile app.

| Terms | Novo Business Checking Account |

| Required Opening Deposit | None |

| Required Minimum Balance | None |

| Monthly Fee | None |

| Automated Clearing House (ACH) Fees | None |

| Domestic Wire Transfer Fees | None to receive; cannot send domestic wires but can make ACH transactions free of charge |

| International Wire Fees | Novo collaborates with Wise to provide “low-cost” international wire transfers |

| ATM Fees | ATM fees refunded at the end of each month |

| APY | None |

Novo Business Checking Account: Top Features

Custom Invoice Creation

You are able to generate and send invoices using the website or the app while saving time and being paid more quickly using Novo Invoicing. You can create as many invoices as you like, with the added benefit of them being cost-free. These invoices may be set up for automatic bank transfer (ACH) and check payments, as well as a direct connection to services like Stripe, Square, and PayPal for easy online payment processing.

Image Source: Novo

Novo Reserves

Novo Reserves feature enables you to set aside cash for taxes, profits, salaries, and other significant company needs. You may create up to five reserves and transfer funds between them using the app.

All ATM Fees Are Refunded Each Month

Novo is a wonderful option if you often use ATMs and don’t want a physical facility for your business banking requirements. Novo lacks its own ATM network, but it does pay back ATM costs at the end of each month, both domestic and international.

Business Software Integration

There are hundreds of more apps that Novo can connect with, including popular ones like Stripe, Shopify, and QuickBooks.

Image Source: Novo

The service provides useful features such as checking the status of client payments directly in your Novo dashboard, in addition to international money transfers and monitoring QuickBooks activities, among others. Novo’s business checking account provides a simple entry point into a wide variety of digital resources that can improve the efficiency of your company’s operations.

Service & Product Discounts

The Novo Perks program provides its members with exclusive savings on a variety of high-quality goods and services for their businesses. If you join up for additional services and accounts through Novo’s partners like Google Cloud, QuickBooks, HubSpot, and more, you may save money and enjoy discounts on your monthly fees.

Some of the perks include:

- Up to $2,000 in Google Cloud credits and free use of 20+ products for eligible enterprises.

- 30% discount on the first six months of any QuickBooks online bundle

- 30% off the first year’s subscription to HubSpot and 15% off subsequent years

- $500 in credit for spending $500 on Google Ads.

Free Of Cost Services

There is no monthly maintenance fee, and there aren’t too many other fees to worry about, either. No fees are charged by Novo for outgoing or inbound ACH transactions, domestic or international wire transfers, debit card replacements, paper checks, bill payments, or printed statements.

There is a $27 charge for returned checks with insufficient amounts or uncollected payments. While the Novo website states that there is no minimum balance requirement, a $50 minimum deposit is necessary to have access to all account services.

Pros

- Zero maintenance fees

- Pays back all ATM fees

- Unlimited free transactions

- Provides a fee-free, online-only small business checking account.

- Excellent app with valuable integrations to other small business tools

Cons

- No physical branches

- Unable to make direct cash deposits

- Account bearing no interest

Why We Chose Novo?

The use of mobile banking applications and other online resources to manage day-to-day banking chores has increased the prevalence of digital banking within financial services. There has been an increase in cutting-edge online services and features aimed specifically toward banking for small businesses.

If you’re a small company owner who prefers to carry out the majority of their financial operations online, Novo’s business checking account may be a suitable fit. Not only is there no minimum balance required, but it also reimburses your ATM expenses every month, and there are no fees associated with incoming wire transfers or ACH transactions.

In addition to Novo’s built-in accounting and payment management features, you can connect your account with other popular business software solutions like QuickBooks, Xero, Stripe, and PayPal. Novo may act as a central hub for your company’s finances, providing ease and visibility because it interfaces with so many applications.

Best Banks For Startups: A Comparison

| Bank | Chase | Silicon Valley Bank | Bank Of America | Wise | Novo |

| Required Opening Deposit | None | None | $100 | None | None |

| Minimum Balance Required | None | None | None | None | None |

| Monthly Fees | $15; can be waived if certain requirements are met | SVB Edge: None for 3 years; $50 thereafter SVB ScaleUp: None for 1 year; $50 thereafter | Business Advantage Fundamentals Banking: $16; can be waived if certain requirements are met Business Advantage Relationship Banking: $29.95; can be waived if certain requirements are met | None | None |

| ATM Fees | $3 plus third-party charges for enquiries, transfers, and withdrawals at non-Chase ATMs | None | No fees on Bank of America ATMs, $2.50 per transaction for ATMs outside the network, $5 for international ATMs | 1.5 USD + 2% of amount over 100 USD | ATM fees refunded at the end of each month |

| Transaction Limit | Free (first 20), then 40 cents/ transaction | None | Business Advantage Fundamentals Banking: Free, unlimited electronic transactions, Up to 200 fee-free non-electronic transactions, after which 45 cents per item Business Advantage Relationship Banking: Free, unlimited electronic transactions, Up to 500 fee-free non-electronic transactions, after which 45 cents per item | N/A | None |

| Cash Deposit Fees | Free up to $5,000 per month; then $2.50 for every $1,000 | None | Business Advantage Fundamentals Banking: Free up to $7,500 per month, 30 cents per $100 deposited Business Advantage Relationship Banking: Free up to $20,000 per month, 30 cents per $100 deposited | N/A | None; cash is deposited through money orders |

| Annual Percentage Yield (APY) | N/A | Up to 4.70% annual percentage yield on qualifying balances | N/A | 4.85% on USD balance | N/A |

| Online Tools And Software Integrations | FreshBooks® Invoiced, Keap, Zelle, Fiskl | QuickBooks, Xero, Expensify, Modern Treasury | QuickBooks, Quicken, Xero, Ramp | Xero, QuickBooks, FreeAgent, FreshBooks, Wave, Sage, Oracle Netsuite, and QuickFile | Stripe, Shopify, QuickBooks, Square, PayPal, HubSpot, Wise |

| Domestic Wire Transfer Fees | Incoming: up to $15Outgoing: up to $35 | SVB Edge: Incoming: up to $12Outgoing: up to $17 SVB ScaleUp: Incoming: up to $12Outgoing: up to $17 | Fee varies, depending on wire receiving/sending account and bank type | Variable fee (depending on the currency) | None to receive; cannot send domestic wires but can make ACH transactions free of charge |

| International WireTransfer Fees | Incoming: up to $15Outgoing: up to $50 | SVB Edge: Incoming: up to $12Outgoing: up to $30 SVB ScaleUp: Incoming: up to $12Outgoing: up to $30 | Free for incoming wires, outgoing fee varies, depending on wire receiving/sending account and bank type | Variable fee of around 0.47% + fixed fee of around 4.15 USD | Novo collaborates with Wise to provide “low-cost” international wire transfers |

Requirements To Open A Business Bank Account As A Startup

Each bank on this list may have varying requirements for opening a business bank account. Generally, you will need the following:

- Employer identification number (EIN) or, if you’re a freelancer, a Social Security number.

- Doing-business-as (DBA) certificate or certificate of assumed company name

- Business formation documents

- Company records, including your ownership agreements

- Business licenses

- Photo ID issued by the government, such as a passport or driver’s license

Our Methodology: How We Chose The Best Bank For Startups

We looked at dozens of business checking accounts from both online and conventional banks to decide which ones were the most suitable for startups, before narrowing down results by taking the following characteristics into account.

- Monthly fees

- Minimum opening deposit and balance requirements

- Transaction limits

- Fees for ACH and wire transfers

- ATM fees and accessibility

- Cash deposit costs and accessibility

- Interest yield, if applicable

- Other checking account perks

- Software integrations

- Additional business services and lending services

- Customer support

Each bank on our list is either a registered member of the Federal Deposit Insurance Corporation (FDIC) or is insured by the FDIC through partner financial institutions.

Frequently Asked Questions (FAQs)

How Does A Business Bank Account Differ From A Personal Bank Account?

A business bank account is used to manage the finances of a business. It differs from a personal bank account in several ways. Business bank accounts typically have more features than personal bank accounts, such as access to credit, debit, and merchant services, as well as specialized banking services like payroll and invoicing.

Business bank accounts also have more stringent requirements related to the account holder’s identity and business operations, including a business license and proof of incorporation. Business bank accounts also have higher fees than personal bank accounts. Finally, business banking accounts can be held in the company’s name rather than an individual, making it easier to separate business and personal finances.

Does A Small Business Require A Business Checking Account?

A business checking account is a necessity for small business owners. This type of account is not just for large companies; it is important for small businesses as well. A business checking account helps you to keep your personal and corporate finances separate, handle funds more efficiently, and have access to business banking services.

It also helps you to track your business income and expenses more accurately, which is important for filing taxes and keeping accurate financial records. In addition to protecting your personal assets from company-related lawsuits or debt recovery, business checking accounts may provide access to a business credit card or line of credit.

What Is Startup Banking?

Startup banking is a type of banking specifically designed to meet the needs of businesses in the early stages of their development. It can involve services such as capital assistance, custom solutions, and access to a network of banking professionals. Startup banks typically provide access to bank accounts, lines of credit, and merchant services, among other services. Startup banks offer more flexible terms and lower fees than traditional banks, making them more attractive to entrepreneurs.

Wrap Up

When it comes to finding the best bank for your startup, there is no one-size-fits-all solution, as no two banks are created equally. What matters most is that you find a bank that can provide the services and features that best meet your needs. To find the best bank for your startup, do your research, compare options, and weigh the pros and cons of each option. Ultimately, the best bank for your startup will be the one that suits your current and future requirements. With the right banking partner, you can ensure that your startup has the financial support it needs to help you make your entrepreneurial dreams come true.

![5 Best Banks for Startups [Post SVB Collapse]](https://startupgeek.com/wp-content/uploads/2023/09/best20banks20for20startups.jpg)