Are you looking for reliable software to automate your billing and overall AP processes? Bill.com may just be the right solution for your startup.

However, if you look them up on Google, you’ll probably find contrasting reviews – some extremely positive, and some quite negative. So, what’s the real truth about this software, and should you use it for your startup?

We’ll answer these and other questions below.

What Is Bill.Com?

Bill.com is an intelligent financial automation platform designed to streamline the accounts payable (AP) process for U.S.-based businesses. It promises to help organizations simplify the management of payables, invoices, and payments, and eliminate the complexities of paper-based processes with its digital tools.

Their website states that the software can help businesses:

- Cut bill time by 50%

- Get paid 2x faster

- Eliminate double entry and get vendors paid faster

The platform offers a user-friendly interface, making it easy to upload invoices from various sources, including desktops and mobile devices.

It also comes equipped with a number of handy, AI-powered features that let businesses quickly extract critical invoice data, automate the approval process, and much more. We’ll discuss these features in more depth below.

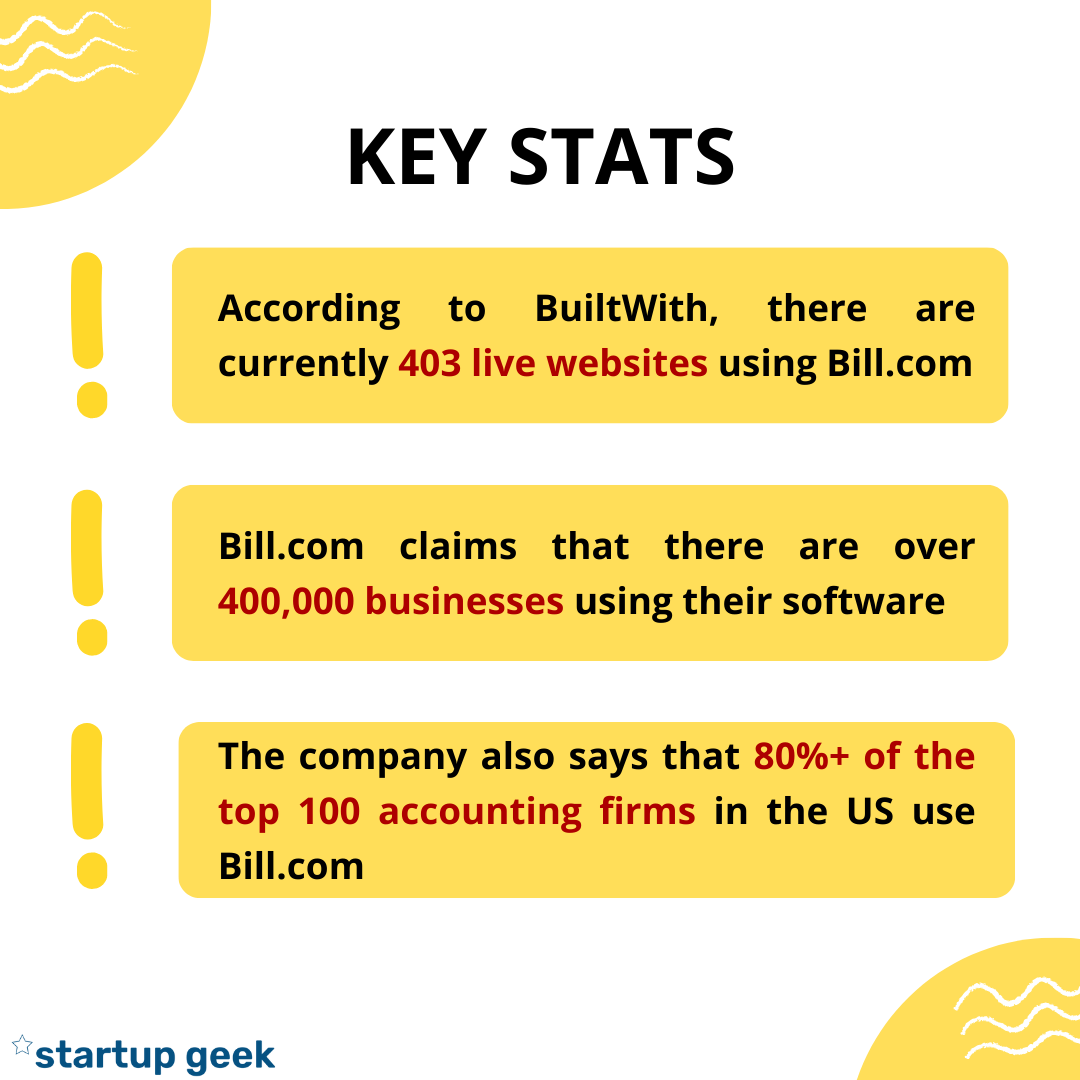

Key Stats For Bill.Com

Key Features Of Bill.Com

We’ll skip basic features like invoice and bill storage or analytics-related insights and focus on a few features that may be more unique to Bill.com.

Automated Invoice Processing

Bill.com’s automated invoice processing lets you collect and process invoices in mere minutes – and without sifting through paperwork or manually entering data.

The software lets you upload invoices from your desktop, snap photos using your mobile device, or have vendors email them directly to your Bill.com inbox. From there, you can start processing them automatically using Bill.com’s AI solution.

Their AI system instantly extracts key information from invoices, such as purchase date or buyer details, which accelerates the process of creating or paying bills.

Customized Approval Process

Managing approvals can be a logistical nightmare, but Bill.com puts you in the driver’s seat.

It lets you easily customize approval policies to suit your needs, automate approval workflows, and approve bills in just a few simple swipes or taps.

With Bill.com, you can also approve bills from anywhere using your mobile device thanks to the platform’s responsive design.

Payment Processing Features

Bill.com offers a unified platform for all your payment needs, ensuring convenience and flexibility for you and your vendors.

It has many payment options available, including ACH, credit card, virtual card, international wire, and paper checks, you can choose the method that aligns with your and your vendors’ preferences.

Bill.com also claims to implement rigorous security measures that protect your payment transactions, safeguard sensitive financial data, and ensure the confidentiality and integrity of your financial operations.

Finally, Bill.com can also help you manage international payments—at the moment, they support payments in over 130 countries.

Cash Management Features

Bill.com comes with in-built cash management features which help you handle your cash flow more effectively and make informed decisions more rapidly. Here are just some of its helpful cash management features:

- The personalized to-do list helps you stay on top of your financial responsibilities, ensure timely payments, and prevent unnecessary delays.

- Furthermore, Bill.com provides digital audit trails for every invoice, offering a transparent record of each financial transaction. This level of visibility ensures accountability and facilitates seamless tracking of payment processes.

- Detailed payment histories for all your vendors contribute to enhanced vendor management. With access to historical payment data, you can analyze payment patterns and maintain strong vendor relationships. This transparency fosters trust and collaboration, benefiting both your business and your suppliers.

Automated Reconciliation

Bill.com also comes equipped with auto-sync and data integration capabilities which streamline the reconciliation process and reduce the potential for manual entry errors.

The platform integrates with various accounting software solutions, including QuickBooks, Xero, Sage Intacct, and other popular accounting platforms. This helps you keep your books up-to-date and balanced.

Who Is Bill.Com For?

According to Bill.com, more than 400,000 companies use their service to automate their financial operations. This includes mainly small to medium businesses.

- Small businesses can use Bill.com to reduce manual efforts in managing payables, invoices, and payments and get more time to focus on core business activities, such as nurturing customer relationships and driving growth.

- Mid-sized businesses may particularly benefit from Bill.com’s streamlined approval processes and secure payment options.

Although larger businesses can certainly use Bill.com, too, the company seems to be particularly focused on SMBs. This may make them a good fit for your startup.

How To Set Up Bill.Com Properly

Setting up your Bill.com account takes just a few easy steps. Let us quickly walk you through them.

1. Go to the Bill.com sign-up page. Enter your details and click “Sign Up”. Make sure that all your details are correct, as they’ll be used on your future invoices and other documents. (You can, however, edit them later directly from your account.)

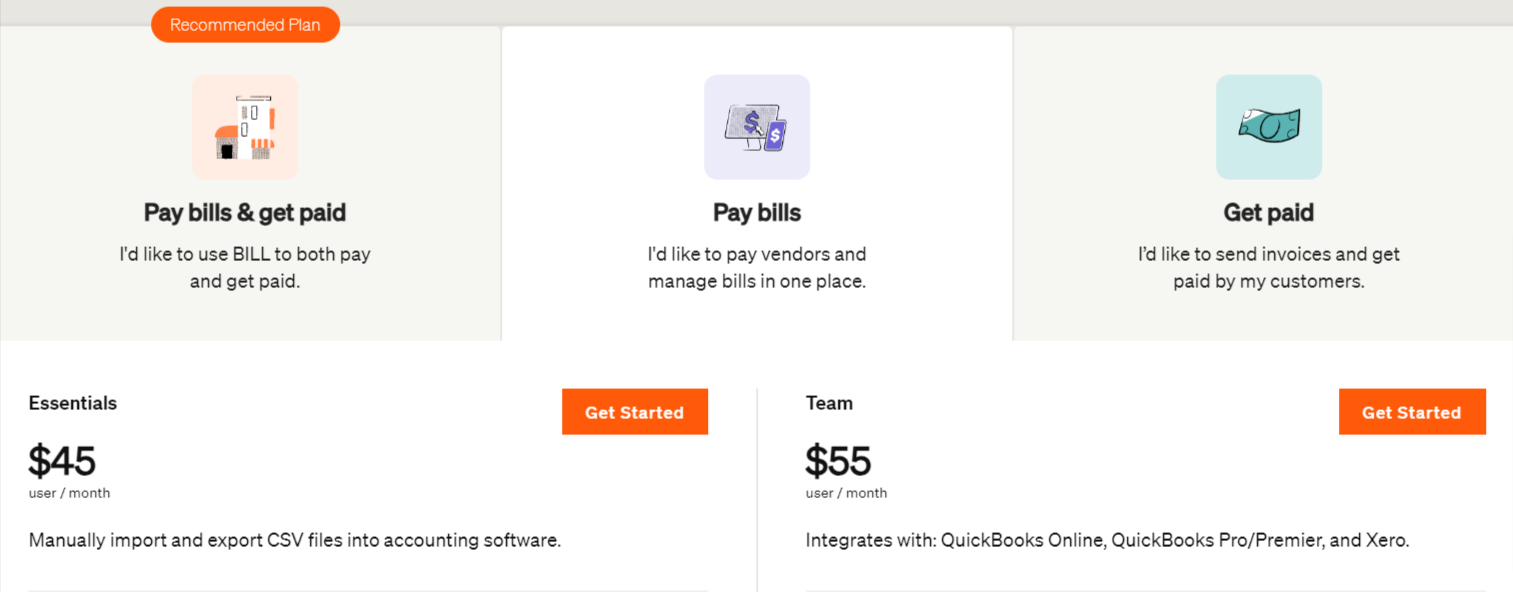

2. Once you sign up, you’ll be able to choose between three plans. Select the one that seems like the best fit. Note that, at the moment of writing, Bill.com is also offering a free 30-day trial to new users.

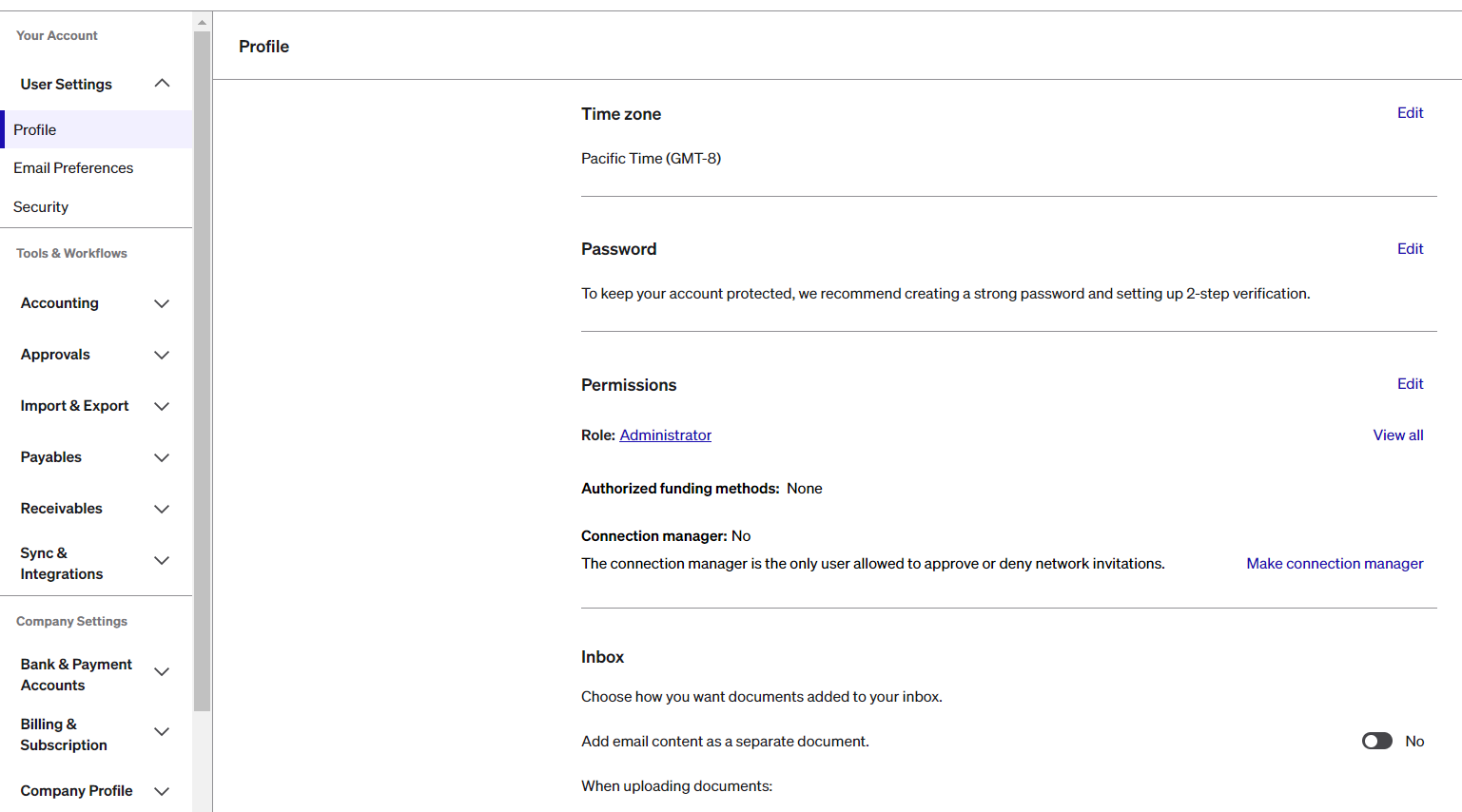

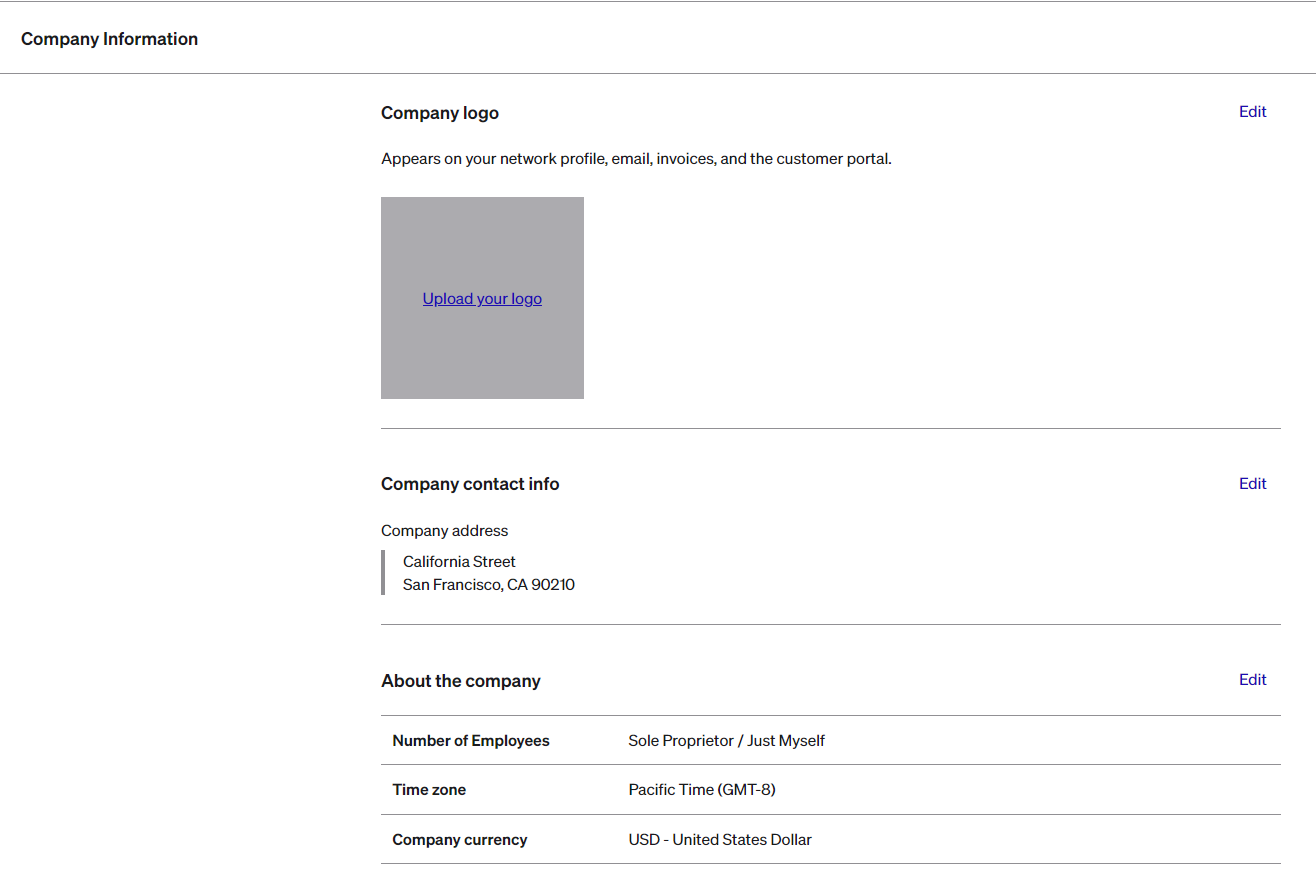

3. From there, you want to go to Settings by clicking the icon in the top right corner and start setting up your account. Use the scroll bar on the left-hand side to switch between different tab

4. For starters, we suggest setting up your company profile and making sure you’ve provided all the information you’ll need to pay vendors or get paid.

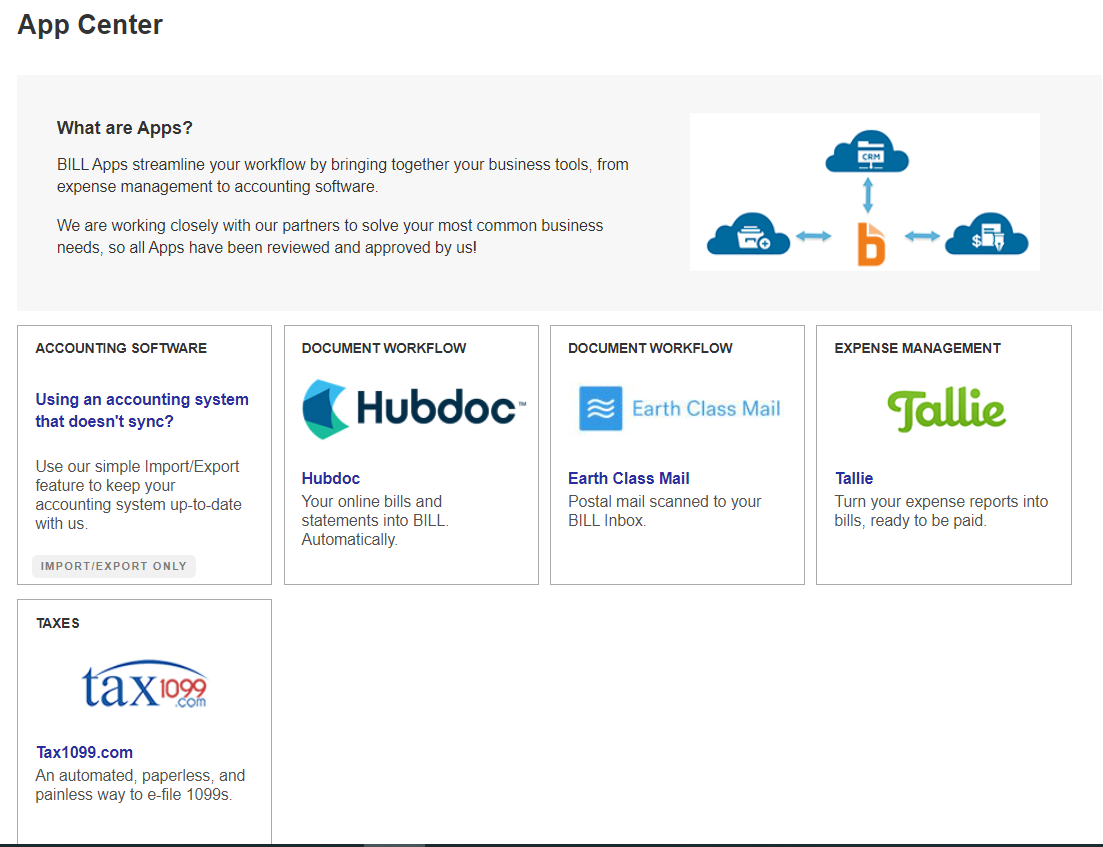

5. Next, make sure to integrate Bill.com with your other apps to ensure your books are up-to-date and balanced.

6. Finally, you want to start adding vendors and customers by going back to the main dashboard. You can choose between uploading a .csv file or adding your vendors and customers manually.

That’s all you need to do to get your Bill.com account set up and ready to go. Of course, there are other things you can tweak in the future, but this will be enough to start.

For more detailed information about the setup process—you can click the “Get Started” button in the left-hand menu and follow the platform’s built-in instructions:

Pricing & Plans

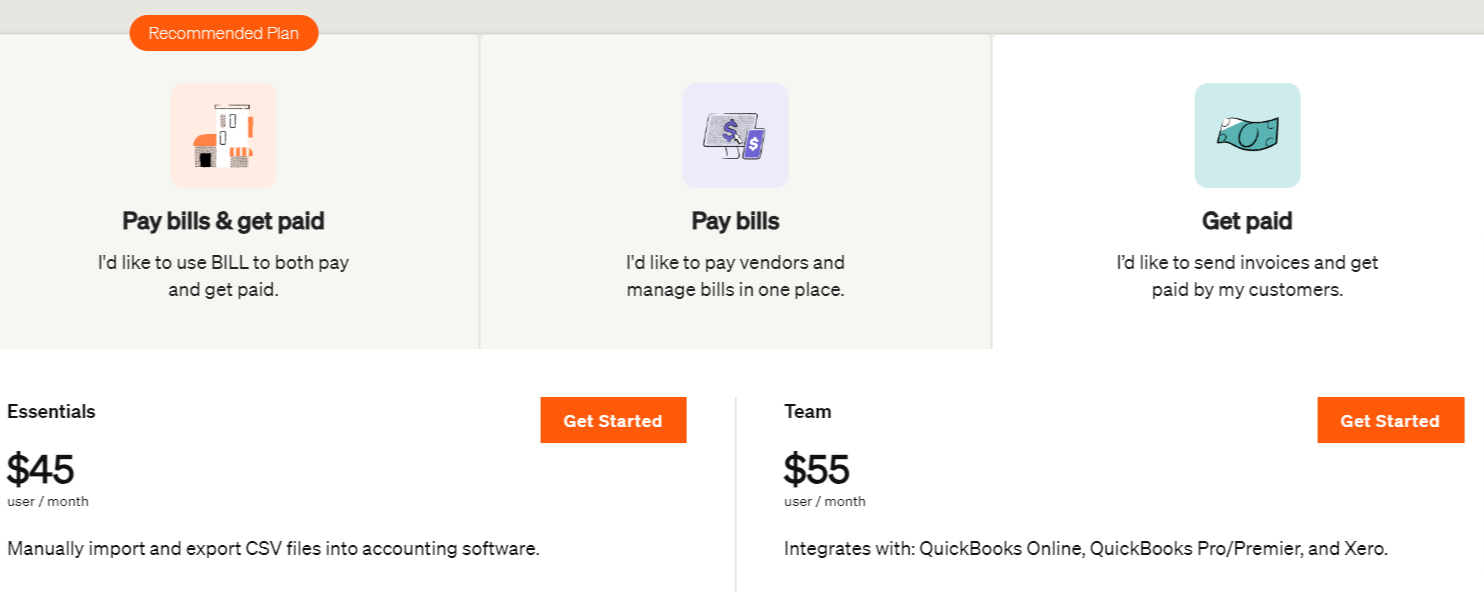

Bill.com offers three main types of payment plans:

- The “Get paid” plan allows you only to get paid.

- The “Pay bills” allows you only to make payments.

- The third, “Pay bills & get paid” plan allows you to both get paid and make payments.

Each plan also has two pricing options.

- “Get paid” — Essentials: $45 per user per month; Team: $55 per user per month

- “Pay bills” — Essentials: $45 per user per month; Team: $55 per user per month

- “Pay bills & get paid” — Corporate: $79 per user per month; Enterprise: custom pricing

How To Use Bill.Com

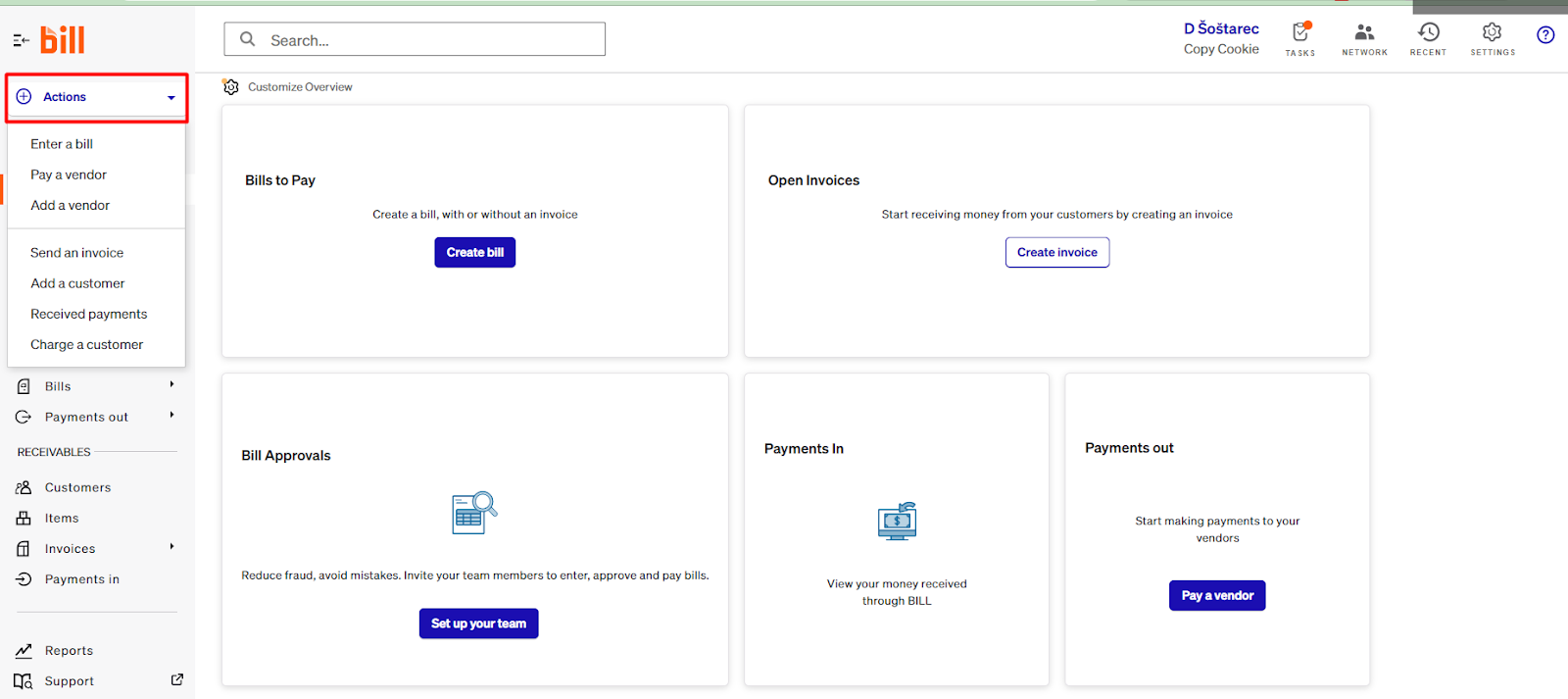

Bill.com is extremely intuitive, user-friendly, and easy to use. To use it, simply go to the main dashboard and find the function you need.

If you need to take a specific action, such as paying a vendor or entering a bill, you can do so by clicking on the “Action” tab in the left-hand corner. This will open a new menu from which you can choose a few quick actions.

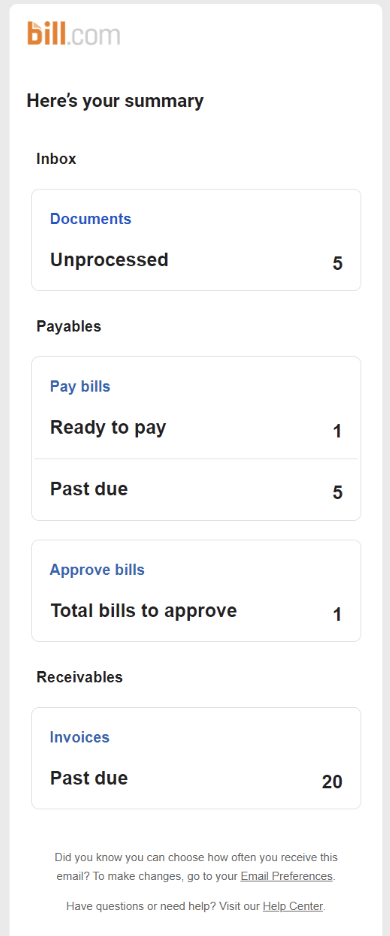

On the main dashboard, you’ll also see some important notifications, statistics, or reminders that may require some action on your part—such as updates about bills that need approval and bills that need paying.

We really like this feature as it lets you see the most vital info at a glance, ensuring you don’t miss any important details.

The Pros And Cons Of Bill.Com

We’ve already mentioned some of the many benefits that Bill.com offers to customers, from faster and more secure payments to streamlined approval workflows.

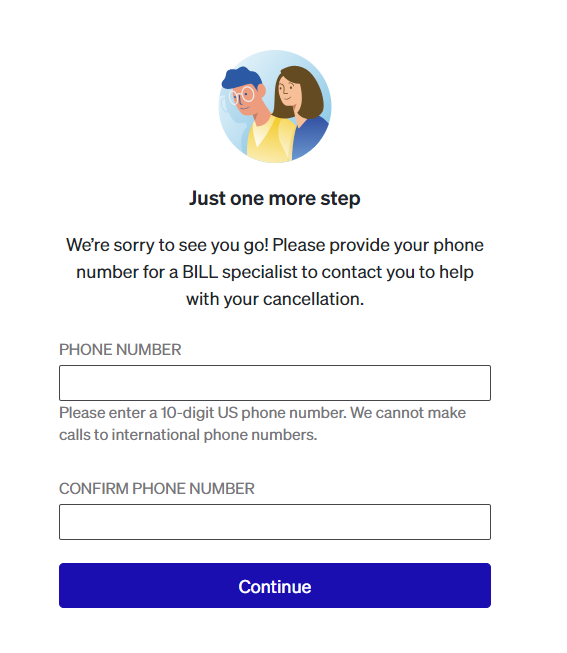

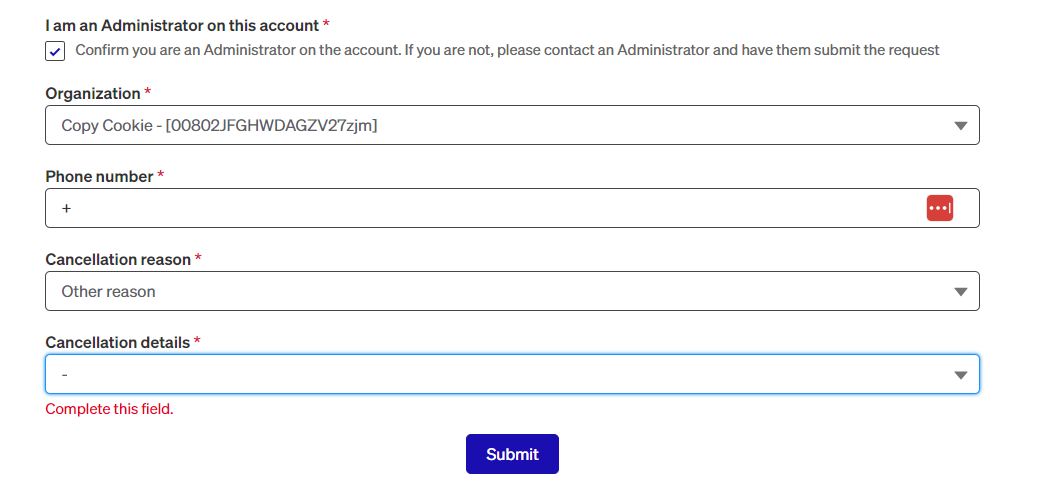

What we didn’t appreciate, however, was that canceling the service (despite the free trial) turned out to be a cumbersome process.

After choosing the option to cancel the service, we were required to enter a US-based phone number in order to get a Bill.com specialist to “help us” cancel our account.

It was simply not possible for us to freely cancel the service without being dragged into what seemed to be a “shooting-our-last-shot” type of sales call.

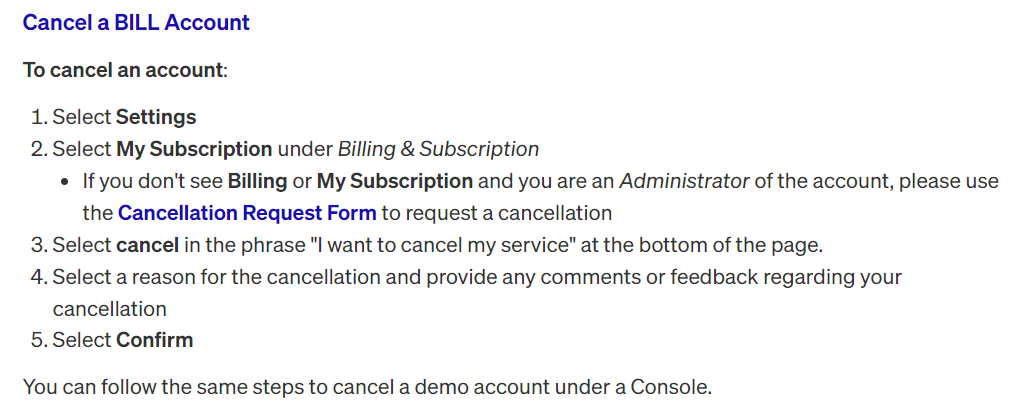

We also didn’t appreciate the company’s lack of upfront transparency about the difficult cancelation process. For example, their cancelation guide doesn’t state that a phone call will be necessary:

There’s also a cancellation form on their website, but don’t get your hopes up: it’s completely unusable at the moment of writing. The dropdown menu at the bottom simply doesn’t open, and the website won’t let you submit your form without choosing an option from it:

We tried getting help from an agent but, for now, we were only able to chat with their not-so-advanced website chatbot.

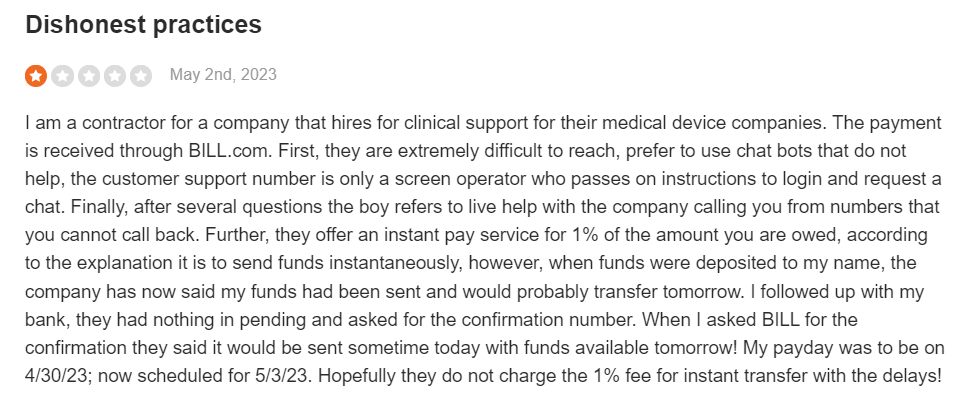

If you look at Bill.com’s reviews and ratings on sites like SiteJabber, you’ll find that many people have had a negative experience with the company’s customer service and had similar issues with the company’s “dishonest practices.”

Overall, it was quite disappointing to see that software with so much potential has such poor customer care and untransparent communication.

Is Bill.Com Right For Your Startup?

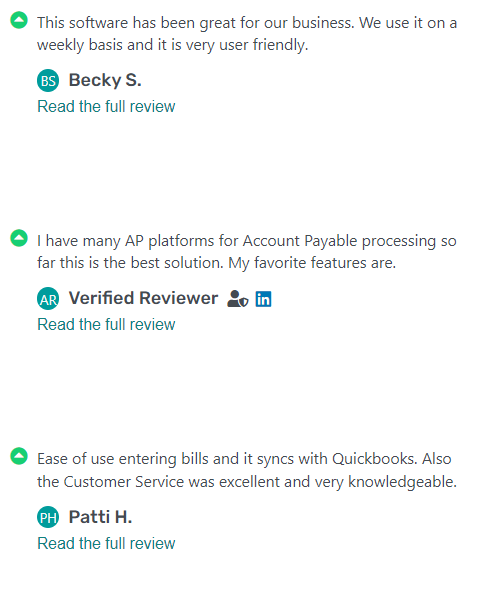

So, we’ve mentioned some negative online reviews (and our own negative experience) with Bill.com’s customer support. However, there are many positive reviews about the software itself.

For example, consider these reviews on G2:

So, what’s the verdict?

Well, if you ask us, Bill.com may be right for your startup if you’re looking for a well-designed platform to automate your AP workflow. However, if you want good customer support on top of good software, we suggest looking elsewhere.

We wouldn’t rely on their customer support employees to answer our questions or provide help in case something goes off the rails, at least not in a timely manner–and getting timely help is quite important when dealing with invoice-related things.

Top 3 Bill.Com Alternatives

If you don’t think that Bill.com is the right for you, here are three alternatives you can check out:

- Plooto is a powerful cash flow management platform for businesses, supporting 120,000+ vendors and 6000+ businesses. It offers automatic reconciliation, custom approval tiers, and real-time payment tracking, with pricing starting at $25 per month.

- DocuWare offers cloud document management and workflow automation with self-learning intelligent indexing. It caters to businesses of all sizes, providing scalable subscription options and strong enterprise features, with pricing starting at $300/month for small businesses.

- Tipalti offers a unified cloud platform with tax compliance, ideal for small, medium, or enterprise companies. It provides a 360-degree view of the AP process, reduces payment errors, and offers two pricing options: Tipalti Express and Tipalti Pro.

Conclusion

Bill.com is a pretty well-designed, intuitive software that can boost your efficiency and help you process a high volume of invoices in less time. We also appreciate that the company has a ton of learning resources and guides on the website, which makes it easier for users to set up their accounts and start harnessing the platform’s potential.

However, we were very extremely disappointed with the clunky cancelation process, the company’s lack of transparency, and poor customer service. While chatbots are helpful, they simply can’t answer all customer inquiries. Bill.com should definitely consider adding more human experts to the roster.

Personally, we wouldn’t use Bill.com for AP – especially because it’s quite high-priced considering the quality of the service. But, if you don’t think you’ll need a ton of support, Bill.com can still be a solid AP automation product for your startup.