Welcome to the cryptocurrency world—a groundbreaking digital phenomenon revolutionizing the financial landscape.

In this article, we will demystify the intricate workings of crypto, shedding light on its core principles and functionalities.

Designed with startup founders in mind, our concise exploration will empower you with a clear understanding of how cryptocurrency operates. By embracing these simplified concepts, you will be equipped with valuable insights to navigate the potential opportunities and challenges that this transformative technology presents.

Let’s embark on this informative journey together and unlock the secrets of crypto’s inner workings.

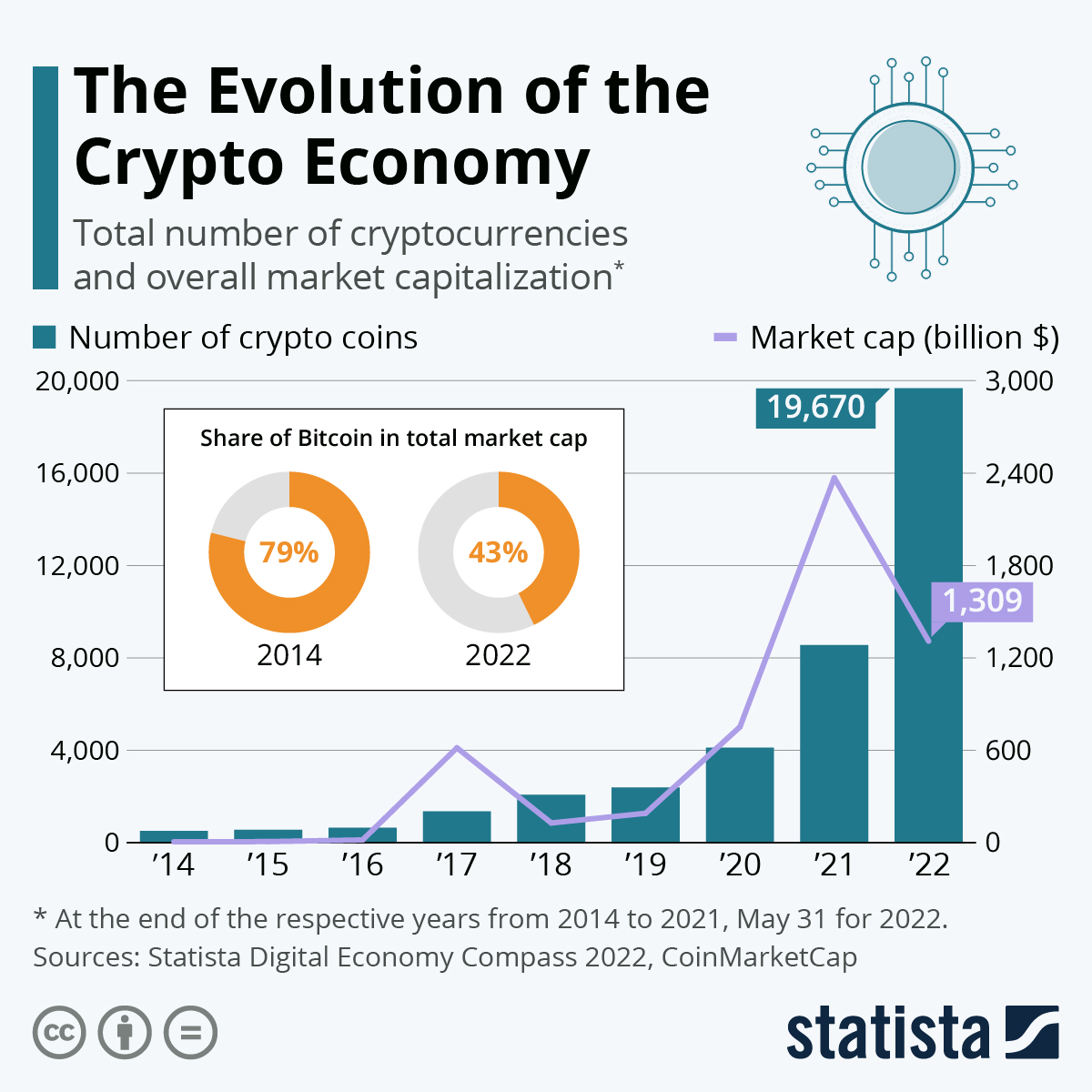

Crypto Market Statistics:

- The market cap is $1.1 trillion in the second half of 2023.

- In January 2023, the value of all existing cryptocurrencies was around $804 billion.

- $112 billion is traded in cryptocurrency daily.

- 65% of crypto users are Bitcoin owners.

Understanding Cryptocurrency

A cryptocurrency is a digital form of money created and held electronically. It’s powered by blockchain technology, which records financial transactions and other crypto market data. Unlike traditional currency, it’s not regulated by a single governmental entity like a central bank, making it decentralized and independent from conventional financial markets.

There is significant debate about the potential benefits and drawbacks of using cryptocurrency as an investment tool or a currency to conduct daily crypto transactions.

It is divided into two sides:

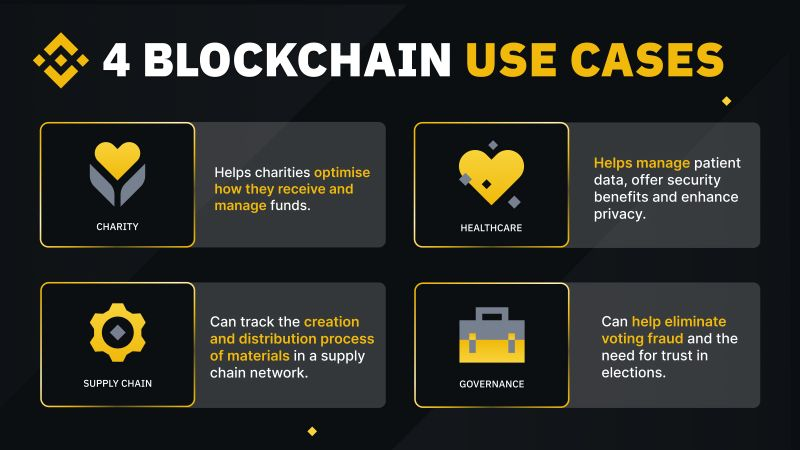

- The Bullish: Claiming that it has the potential to revolutionize many industries like finance, international trade, insurance, real estate, and more.

- The Conservatives: They are concerned about its high volatility, lack of government regulation on exchanges, and potential security risks when storing funds online.

Either way, the cryptocurrency market user penetration is 8.8% in 2023 and is expected to hit 12.5% and 999.30m users by 2027.

Source: Investors

Cryptocurrency was once seen as something only tech-savvy individuals were interested in due to its complex nature. But now, thanks to all the educational resources, you can quickly learn the basics about this new economy and its trading aspects.

With a clear understanding of its purpose and benefit coming into focus, this provided stability could lead cryptocurrency to become an accepted payment method worldwide. This could help startups and entrepreneurs find alternative ways to receive payments or develop tech.

How Does Cryptocurrency Work?

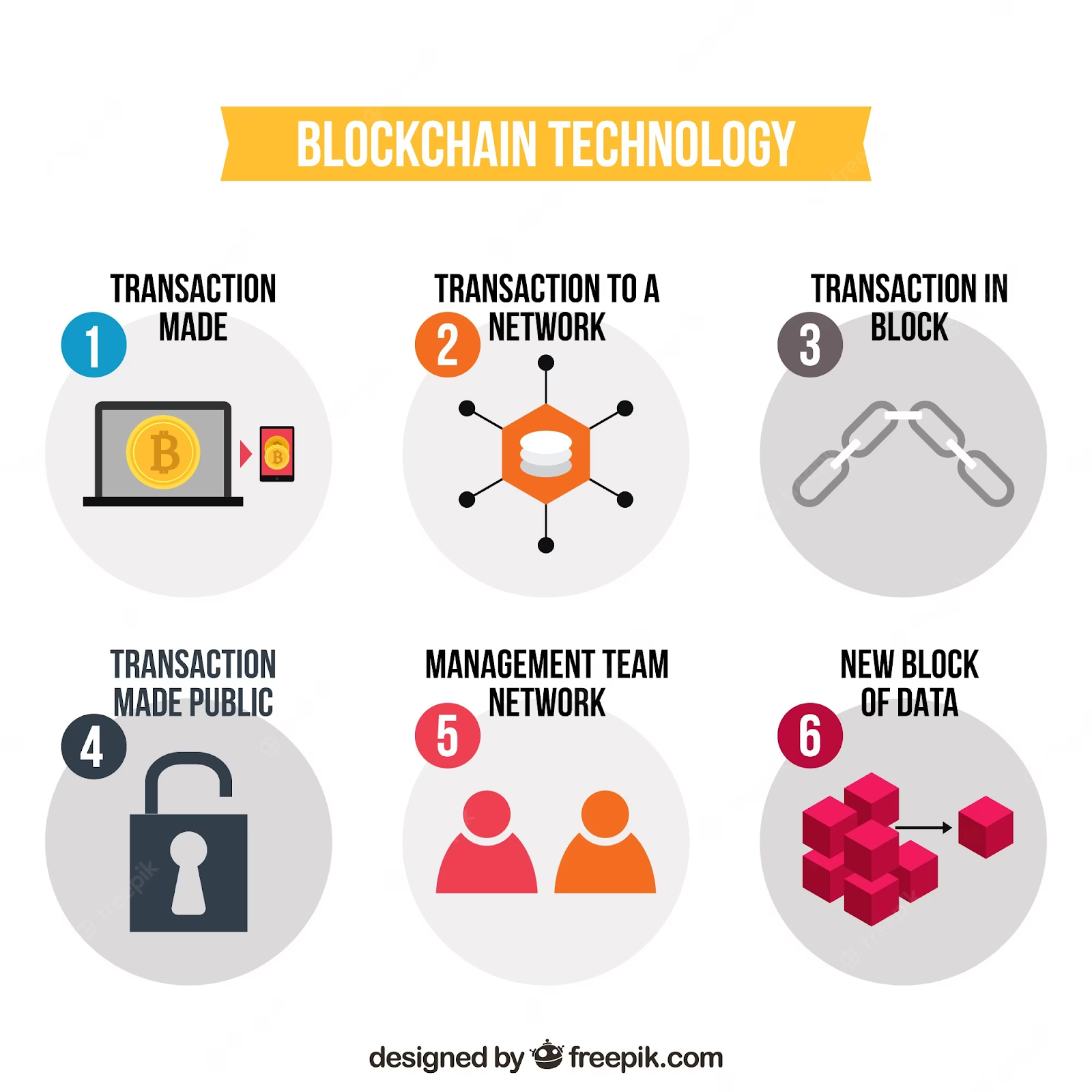

Cryptocurrencies work using the blockchain. This decentralized technology is spread across many computers that manage and record transactions.

The entire process is secure and transparent, as everyone on the network can see the transactions but not who’s making them. This is the cryptocurrency’s core and appeal.

Here’s a simple breakdown of how it works:

- Transaction Creation: When someone wants to send a cryptocurrency (like Bitcoin) to someone else, they create a transaction. This includes the sender’s cryptocurrency address, the receiver’s address, and the amount to be sent.

- Transaction Verification: This operation isn’t processed right away. It needs to be verified. This is done by a network of computers known as nodes. They confirm the transaction details, including the validity of the sender’s and receiver’s addresses. And most importantly, whether the sender has enough cryptocurrency in their account to send.

- Block Creation: Once the transaction is verified, it’s added to a block. This is like a page in a ledger or record book. It contains a list of verified transactions.

- Block Addition to the Blockchain: When a block is filled with transactions, it’s added to the blockchain, the entire ledger or record book containing all the blocks of transactions. This is done by a process known as mining, where powerful computers solve complex mathematical problems to add the block to the chain. The first computer to solve the problem gets rewarded with a small cryptocurrency amount.

- Transaction Completion: Once the block is added to the blockchain, the transaction is complete. The cryptocurrency is transferred from the sender’s account to the receiver’s.

How Does Crypto Compare To Traditional Currencies?

If you’re considering entering cryptocurrency trading to protect your startup capital, you should also consider how cryptocurrencies compare to traditional government-issued currencies.

While a central governmental authority backs traditional currencies, their value is maintained by an internal balance sheet and reserve funds, cryptocurrency is decentralized, meaning it has no main governmental body.

But those aren’t the only differences:

| Cryptocurrency | Traditional Currencies | |

| Physical Existence | Cryptocurrencies are entirely digital. They exist only in the blockchain network. | Traditional currencies exist in physical (coins, notes) and digital forms. |

| Control | Cryptocurrencies are decentralized. No single entity has control over them. | Traditional currencies are centralized and controlled by governments and central banks. |

| Transaction Verification | Transactions are verified with computers across the globe. | Banks or other financial institutions verify transactions. |

| Anonymity | Cryptocurrencies offer certain anonymity. Transactions are public, and the identities of the parties involved remain unknown. | Traditional banking systems require personal identification and are not anonymous. |

| Supply | Algorithms limit the supply of most cryptocurrencies. For example, there will only ever be 21 million Bitcoins. | The supply of traditional currency can be adjusted by central banks, often in response to economic indicators. |

| Transaction Speed | Depending on the cryptocurrency, transactions can be faster than traditional banking systems, especially for cross-border transfers. | Traditional transactions, especially international ones, take a few days to process. |

| Transaction Cost | Transaction costs are lower for cryptocurrencies. | Transaction costs are high for traditional currencies, whether it is withdrawing, national or international transfers. |

| Security | Cryptocurrencies use cryptographic security and a private 12-word key, making them highly secure. However, losing it means losing access to your funds. | Traditional banking systems have robust security measures but can be susceptible to fraud or hacking. Lost or stolen cards can be replaced. |

The Crypto Marketplace

A crypto marketplace, AKA a cryptocurrency exchange, is a platform where you buy, sell, and trade cryptocurrencies. They operate similarly to stock exchanges, but instead of trading stocks, users trade digital currencies.

You can exchange fiat currencies (like USD, EUR, GBP) for cryptocurrencies (like Bitcoin, Ethereum), trade one cryptocurrency for another, and in some cases, participate in more advanced trading activities like futures and options trading.

There are multiple online platforms you can access to. For example:

- Binance

- Coinbase

- PancakeSwap

You can find decentralized and centralized exchanges providing the same experience. The difference is that the first gives you more anonymity than the second.

The Pros & Cons Of Crypto Marketplace

Pros

- Accessibility: Crypto marketplaces make buying, selling, and trading cryptocurrencies easy. All you need is an internet connection and a digital wallet.

- Variety: Most crypto marketplaces offer a variety of cryptocurrencies to choose from.

- Liquidity: Crypto exchanges provide high liquidity, which means you can buy and sell cryptocurrencies with minimal impact on the price.

- Advanced Trading Options: Some platforms offer advanced trading options, like futures and options trading, margin trading, and more.

Cons

- Security Risks: Crypto marketplaces are targets for hackers. While many exchanges have robust security measures, there’s always a risk.

- Regulatory Risks: Regulations for cryptocurrencies are constantly changing. This can impact crypto exchange operations.

- Complexity: Using crypto marketplaces can be complex and overwhelming for beginners.

- Transaction Fees: Most crypto marketplaces charge fees for trading, depositing, and withdrawing funds.

Now, how can you use a crypto exchange? Let’s consider Alice’s example.

She is a graphic designer entrepreneur who has heard a lot about Bitcoin and has decided she wants to invest to protect her funds from inflation. She chooses Coinbase, a popular crypto marketplace known for its user-friendly interface.

Alice signs up, completes the necessary KYC (Know Your Customer) procedures, and links her bank account. She then deposits USD into her Coinbase account.

Once the funds are available, she goes to the Bitcoin page and enters the amount she wants to buy. She reviews the transaction, including the current exchange rate and the platform’s fees.

After confirmation, the Bitcoins purchased appear in her Coinbase wallet. She can then sell BTC whenever she needs to fund her work or lifestyle.

In this process, Alice has exchanged fiat currency (USD) for a cryptocurrency (Bitcoin) using a crypto marketplace (Coinbase).

Currency Pairs And Exchange Security

Cryptocurrency trading involves exchanging one currency pair with another. Currency pairs comprise two currencies, usually expressed as a ratio.

They show the value of one currency relative to another. Most crypto trading happens through them, and the value fluctuations allow crypto traders to profit.

For example, a familiar currency pair is BTC/USD, which implies trading Bitcoin for US dollars.

When buying and selling on an exchange, users must consider the currency pairs and the security of their platform.

There are two crypto exchanges: decentralized and centralized.

- Decentralized exchanges pose a risk because user fund protection depends entirely on users.

- Centralized exchanges provide user protection and market oversight to ensure fair investing practices. They also make it easier for customers to register and deposit their funds since they must give various regulations documents to access the platform.

Although choosing an exchange is ultimately up to you, it’s essential to keep an eye out for fraudulent activities and scams that can quickly happen within crypto markets if proper precautions are not taken.

Here are the pros and cons of the exchange types to help you choose one:

Decentralized Exchanges (DEXs)

Pros:

- Anonymity: DEXs don’t require users to provide personal information, which is a significant advantage for those concerned about privacy.

- Control Over Funds: In a DEX, users retain control over their funds, which are held in their digital or hardware wallets rather than on the exchange. This reduces the risk of losing assets due to exchange hacks.

- No Need for Permissions: DEXs are open to anyone, anywhere, without needing approval from a central authority.

- Innovation: DEXs often support the latest tokens and DeFi projects faster than centralized exchanges.

Cons:

- User Experience: DEXs are harder to use than centralized exchanges, particularly for those new to cryptocurrency.

- Speed and Efficiency: Transactions on DEXs are slower and more expensive due to network congestion and gas fees.

- Liquidity: DEXs have lower liquidity than centralized exchanges, which leads to higher price slippage.

- Lack of Customer Support: If you encounter a problem on a DEX, there’s typically no customer support team to help you.

Centralized Exchanges (CEXs)

Pros:

- Ease of Use: CEXs have user-friendly interfaces that provide beginners a more direct experience, including tutorials.

- High Liquidity: They have higher liquidity than DEXs, which leads to better price stability and less slippage.

- Speed: Transactions on CEXs are faster as they don’t rely on blockchain confirmations for trades within the exchange.

- Customer Support: CEXs usually have customer support teams to assist users with issues.

Cons:

- Control of Funds: In a CEX, the exchange controls the users’ funds. If it gets hacked, users could lose their assets.

- Privacy: CEXs require users to undergo a Know Your Customer (KYC) process, which involves providing personal information.

- Centralization: Central authorities can impose restrictions, such as blocking certain users or countries.

- Regulatory Risk: CEXs are more likely to be subject to regulatory scrutiny and potential legal action.

I started using Binance when I first heard of crypto. And after five years in this world, I still use it. But how would you know which one to use, and what are the latest crypto insights without promoters?

Investing In Crypto Assets

Investing in crypto assets is becoming more prevalent as entrepreneurs contemplate diversifying their portfolios with digital currency or staying away from it.

Cryptocurrency is a hot topic due to its sudden increase and decrease in value — which can be rewarding and risky, depending on market conditions.

When considering investing in crypto assets, there are a few key points to consider:

- What is the purpose of the crypto asset? Each cryptocurrency is created with a specific purpose or use case in mind. If there’s no use, it doesn’t have value. Understanding this can help you assess its potential. You could compare a company without a value proposition to a crypto without purpose.

- Who is behind the crypto asset? Look at the team developing and managing the cryptocurrency. Do they have a track record of success? Are they transparent about their operations?

- What problem does it solve? The most successful cryptocurrencies solve a problem or fill a particular niche, just like a startup would. Does the crypto asset you’re considering have a unique selling proposition?

- What is the market cap? The market capitalization gives you an idea of its size compared to other tokens.

- How is the crypto asset stored and secured? Understanding the security measures in place for a cryptocurrency is crucial. This includes blockchain and wallet security.

- What is the level of liquidity? Liquidity refers to how easily a cryptocurrency is bought and sold. Higher liquidity means you can sell cryptocurrency faster.

- What is the regulatory environment? Cryptocurrencies are subject to different regulations in different countries. For example, income taxes or capital gains tax. Understanding these can help you assess potential risks.

- What is the coin’s supply schedule? Some cryptocurrencies have a maximum supply limit, which can influence their price over time.

- Is the coin widely adopted? Coins that are widely used and accepted tend to be more stable.

- What are the trading fees? Some cryptos have higher transaction fees, which could eat your profits if you plan to trade frequently.

Knowing all this can help you better understand your risk exposure when buying crypto as an entrepreneur.

Compared to traditional currencies, crypto assets are less secure and, therefore, too risky for significant investments. However, many startup owners view cryptocurrency as an attractive investment opportunity due to its decentralized nature, global acceptance, low transaction fees, and potential for exceptional returns.

No matter your opinion about them, having a balanced view and researching the cryptocurrency market is essential before making any financial decisions.

As crypto assets serve as an alternative investment source and show growth potential, consider all aspects of investing before making a financial movement.

I can’t recall how many times I’ve lost money due to rug pulls and misinformation.

Crypto Assets Pros & Cons

Investing in crypto assets may be lucrative, but it also comes with its fair share of risks.

Here’s a list of the pros and cons of investing in crypto assets:

Pros

- High Potential Returns: Cryptocurrencies have shown the potential for significant price increases in a short period, leading to high potential returns for investors.

- Liquidity: Cryptocurrencies are traded 24/7 on various exchanges worldwide, like Binance, providing high liquidity and the ability to exchange anytime.

- Transparency: Using blockchain technology ensures that all transactions are transparent and traceable, reducing the risk of fraud.

- Diversification: Cryptocurrencies offer a new asset class that provides diversification benefits to an investment portfolio.

- Innovation: Investing in cryptocurrencies allows you to be part of innovative technologies that can potentially transform various industries.

Cons

- Price Volatility: Cryptocurrencies have extreme price volatility. Their value can change quickly, which increases the risk quote for many investors.

- Regulatory Risk: The regulatory environment for cryptocurrencies is uncertain. Regulation changes can impact a cryptocurrency’s value, and regulatory crackdowns can even lead to the loss of funds.

- Lack of Consumer Protection: If your cryptocurrency is stolen from your digital wallet or loses your access key, it can be hard or even impossible to get your money back.

- Limited Use: Despite growing acceptance, cryptocurrencies are accepted for transactions sometimes, limiting their use as a currency.

- Technological Risks: Cryptocurrencies are based on technology. If this technology fails or crashes, its value may be compromised.

- Market Manipulation: The cryptocurrency market is still small and less liquid than traditional financial markets, making it susceptible to manipulation.

Doing thorough research and considering your risk tolerance before investing in crypto assets is vital. It may also be beneficial to consult with a financial advisor.

Let’s see how these attributes combine in a real-life situation:

Crypto Investment Example

John, a software engineer who created a startup, is interested in blockchain technology. He decided to invest in Ethereum in early 2017. He was drawn to crypto’s potential to revolutionize the tech industry with its ability to provide smart contracts and decentralized applications.

When John bought ETH, it was priced at around $10. He invested in the hopes of making a quick earn to invest in his startup. By the end of the year, the price had skyrocketed to over $700. This exponential growth demonstrated the high potential returns of his investment.

His investment added a new asset class to his crypto portfolio, previously heavily concentrated in stocks and bonds. As a tech enthusiast, he enjoyed being part of cutting-edge technology that could revolutionize many industries. He also developed smart contract functionalities in his startup while holding ETH.

However, his investment was just getting started. Despite the high returns, John had to stomach extreme price volatility. The ETH value fluctuated wildly, sometimes dropping by over 20% daily. In 2018, rumors circulated that the SEC might classify Ethereum as a security, creating uncertainty and leading to a significant drop in price.

He also had to consider the technological risks. Ethereum faced several technical challenges, including scalability issues and competition from similar platforms, potentially impacting its value. He also noticed that the coin’s price moved drastically due to the actions of a few whales, indicating potential market manipulation.

Despite these challenges, he held onto his Ethereum investment, believing in the technology’s long-term potential. He understood the risks and only invested money he could afford to lose.

Promoters And Future Opportunities Of Cryptocurrency

A cryptocurrency promoter is an individual or organization supporting crypto adoption and use.

They highlight their benefits, such as decentralization, security, transparency, and potential for high returns — as I did above.

Promoters can include:

- Blockchain technology advocates.

- Investors and speculators.

- Tech companies.

- Financial institutions.

- Governments.

They play a crucial role in the cryptocurrency ecosystem and help to drive adoption, develop new use cases, and create a community around a particular cryptocurrency.

They use social media, blogs, forums, and other platforms to share information or engage with the community.

For example, the Coingecko Index, which tracks the prices of 1,381 cryptocurrencies across significant exchanges worldwide, is up nearly 40% since August 2020.

Or Goldman Sachs and Black Rock Management LLC, which increased capital investments as large institutional investors to show optimism around cryptocurrency’s future.

But what kind of opportunities I’m talking about?

- Financial Inclusion: Cryptocurrencies could provide services to the unbanked and underbanked populations.

- Decentralized Finance (DeFi): DeFi applications recreate traditional financial systems – such as loans and insurance – more transparently and efficiently using blockchain technology.

- Asset Tokenization: Blockchain technology can create digital tokens that depict real-world assets—for example, real estate, art, and other non-fungible tokens. You could also create your own cryptocurrency.

- Cross-Border Payments: Cryptocurrencies can make fast and cheap cross-border payments, particularly useful for remittances.

- Smart Contracts: Smart contracts automate process executions, reducing the need for intermediaries and reducing costs.

- Privacy and Security: Cryptocurrencies provide higher privacy and security than traditional financial systems. This is key in countries with unstable governments or economic systems.

- Web 3.0 and the Decentralized Internet: Cryptocurrencies and blockchain technology are critical components of the Web 3.0 vision, a decentralized Internet where users control their data.

These are opportunities where startups and entrepreneurs can step in and develop an innovative and groundbreaking project that uses blockchain to optimize resources, processes, and security for users.

Source: Twitter

How To Launch A Crypto Startup

After learning more about cryptos and all their benefits, you may wonder how to launch a crypto startup. This involves eight steps, each requiring careful planning and execution:

- Identify a Problem That Needs Solving: This issue should be enough for people to pay for a solution.

- Choose a Crypto Business Type: You could pick anything from a cryptocurrency exchange to a blockchain development company.

- Understand Functionalities And The Associated Costs: Once you’ve decided on the type of business you want to start, you need to understand your business’s approach and the costs associated with developing a unique value proposition.

- Market Research And Target Identification: Conduct thorough market research to understand the landscape of the crypto industry and identify your target audience. It’s the best way to tailor your product or service to the potential customers’ needs.

- Build Your Team: Assemble a team with the necessary skills to bring your vision to life. This could include software developers, blockchain experts, marketing professionals, and more.

- Develop Your Product or Service: With your team in place, you can begin developing your product or service. You should create an MVP, a prototype you can show to the market as a test.

- Pitch to Community and Investors: Once you have a solid plan and a prototype or MVP, it’s time to pitch your idea to potential investors. Participate in startup competitions, networking events, or directly contacting venture capitalists.

- Launch and Iterate: You can officially launch your startup after securing funding. Remember, launching is just the beginning. Based on feedback and performance, you must iterate and improve your product or service.

How To Integrate Crypto Payments In Startups

Integrating cryptocurrency payments into a startup is a strategic move, especially considering the growing popularity of digital currencies.

This may be complex and may involve legal and tax implications. It’s recommended to consult with a professional or legal advisor to understand these implications.

Here are the steps to do it:

- Understand The Basics: Before integrating cryptocurrency payments, you should understand how cryptocurrencies work, including the underlying blockchain technology.

- Choose The Right Cryptocurrencies: Decide which cryptocurrencies you want to accept. You could use Bitcoin to show friendly options to your customers, but there are others like Ethereum, Litecoin, and more that you might consider.

- Select a Cryptocurrency Payment Gateway: Choose where you want your cryptos to go through. Some popular options include BitPay, CoinGate, and CoinBase Commerce. Yet, you could also choose easier options like Binance Pay.

- Payment Gateway Integration: Once you’ve chosen a payment gateway, integrate it into your website or app. This usually involves adding code to your site, which the payment gateway provider will supply.

- Make Payment Test: Before going live, test the payment process to ensure everything works smoothly. This will help you identify and fix any issues before your customers find them.

- Go Live And Monitor: After testing, you can go live. It’s essential to monitor the process closely, especially in the early stages, to ensure everything works as expected and address any issues promptly.

- Educate Your Customers: Ensure you educate your customers about how to make payments using cryptocurrencies. Create a guide or FAQ on your website or prepare another type of content.

Answers To Common Questions

Are There Any Risks Associated With Cryptocurrency?

Yes, there are risks associated with cryptocurrency. You need to look out for this:

- The extreme volatility of cryptocurrency prices leads to significant losses if the price suddenly drops before you can sell your holdings.

- Cyber security concerns regarding storing and trading digital currency due to its decentralized nature.

- Scams and fraudulent activities related to cryptocurrency.

What Types Of Cryptocurrency Are Available?

There are hundreds of different types of cryptocurrencies available in the market. The most popular ones are:

- Bitcoin (BTC).

- Ethereum (ETH).

- Ripple (XRP).

- Litecoin (LTC).

- Bitcoin Cash (BCH).

Each of these currencies offers different benefits to users, from enhanced security to fast transaction times to low fees.

There are also “altcoins” or alternative coins that offer various features and advantages specific to their use case. For example:

- Dogecoin

- Shiba Inu

- Terra

- AXS

- SLP

- Dash

How Does Cryptocurrency Work?

Cryptocurrency is a medium of exchange where coin ownership is recorded in a database. Cryptocurrency utilizes cryptography to secure transactions and control the creation of new virtual currency units.

Every cryptocurrency transaction adds a record to a shared public ledger. Transactions are securely recorded using complex mathematical algorithms that encrypt the transaction data. This makes it impossible for anyone to alter or delete information.

Each transaction is then verified by thousands of computers worldwide, and once the majority of computers agree on its validity, it is officially added as another “block” onto the chain.

Like traditional financial products, you can then use cryptocurrencies as payment for goods or services. Some merchants accept Bitcoin or another cryptocurrency as payment directly. Others use third-party providers such as Coinbase to process payments.

Many online sellers now accept virtual currencies due to their convenience and low fees compared to traditional payment methods.

You can also use cryptocurrency exchanges – like Binance – to trade various crypto coins for one another or traditional fiat money such as the US dollar or Euro.

The Cryptocurrency Fever Is Barely Starting

While cryptocurrencies offer the potential for high returns, volatility, and risk are day-to-day situations. I’ve covered the basics, from understanding cryptocurrencies to how to trade them. But as an entrepreneur or startup founder interested in crypto, you must keep learning to apply blockchain tech to your business.

Regularly research and update your knowledge about the cryptocurrencies you’re interested in. Informed decisions are often the best and the only way to make profits.

Only invest what you can lose and diversify your investment portfolio to spread risk. Security should be a top priority, so use secure wallets and reputable exchanges.

Cryptocurrency trading is not about making quick money. It’s about understanding and being part of a new financial system.

Disclaimer

This article is intended solely for informational and educational purposes and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product, or to adopt any investment strategy. The author and publisher of this article are not financial advisors. Cryptocurrencies are highly volatile and trading or investing in them carries significant risks, including the potential for complete investment loss. Past performance is not indicative of future results.

The author and publisher of this article have made every effort to ensure the accuracy of the information provided herein. However, they make no guarantee or warranty, express or implied, as to the reliability, completeness, or accuracy of the information. The author and publisher shall not be held liable for any losses, damages, or costs, direct or indirect, incurred due to the use of, reliance on, or any decisions made based on, the information provided in this article.

Before making any investment decisions, readers should conduct their own due diligence and consult with a qualified financial professional. The author and publisher disclaim any liability for any adverse effects or losses caused by reliance on the information provided in this article.

This disclaimer is subject to change without notice. It is the reader’s responsibility to check for updates to this disclaimer.