Navigating the business world as a startup founder, you’ve likely come across the term “Trade Names.” But what exactly does it mean, and why is it crucial for your venture? In the early stages of a business, choosing the right trade name can set the tone for your brand’s identity. However, many founders often overlook the importance of setting up and maintaining their DBA (Doing Business As) status.

This guide will break down the essentials of trade names, helping you avoid common pitfalls and ensuring your business remains compliant. Dive in to equip yourself with the knowledge you need for a smooth entrepreneurial journey.

What is a ‘Doing Business As’ (DBA)?

A ‘Doing Business As’ (DBA) is when a business operates under a name different from its official legal name. It’s like a nickname for your business. It helps you use a catchy name that customers remember. While it doesn’t create a new company, it allows you to do business under that name. But remember, a DBA doesn’t give legal protection or separate your personal assets from business debts.

How It Differs From Official Legal Names of Businesses

A DBA is not the same as the official legal name of a business, which is known as the company name. While the company name refers to the actual registered name of the business, a DBA acts as a trading name or alias tied to the legal entity, which is filed at the state or county level. Businesses use their trade names for sales and advertising, allowing them to create a distinct, memorable identity that differs from their legal registration.

Global Perspective and Similar Concepts

In the context of a global perspective, using a DBA is common and recognized in many countries worldwide. However, the specific rules and procedures for registration may differ based on location. In some cases, a DBA can benefit businesses by allowing them to maintain personal privacy, use creative company names, and meet bank requirements, among other advantages. It’s also a cost-effective way for businesses to begin operations without the overheads of forming an LLC or corporation.

Nonetheless, while a DBA can offer some protection for the trade name at the state or county level, it may not completely prevent others from using the same name. If a business desires to secure its name nationally, it may consider registering a trademark, though it involves more complexity and expenses than a DBA.

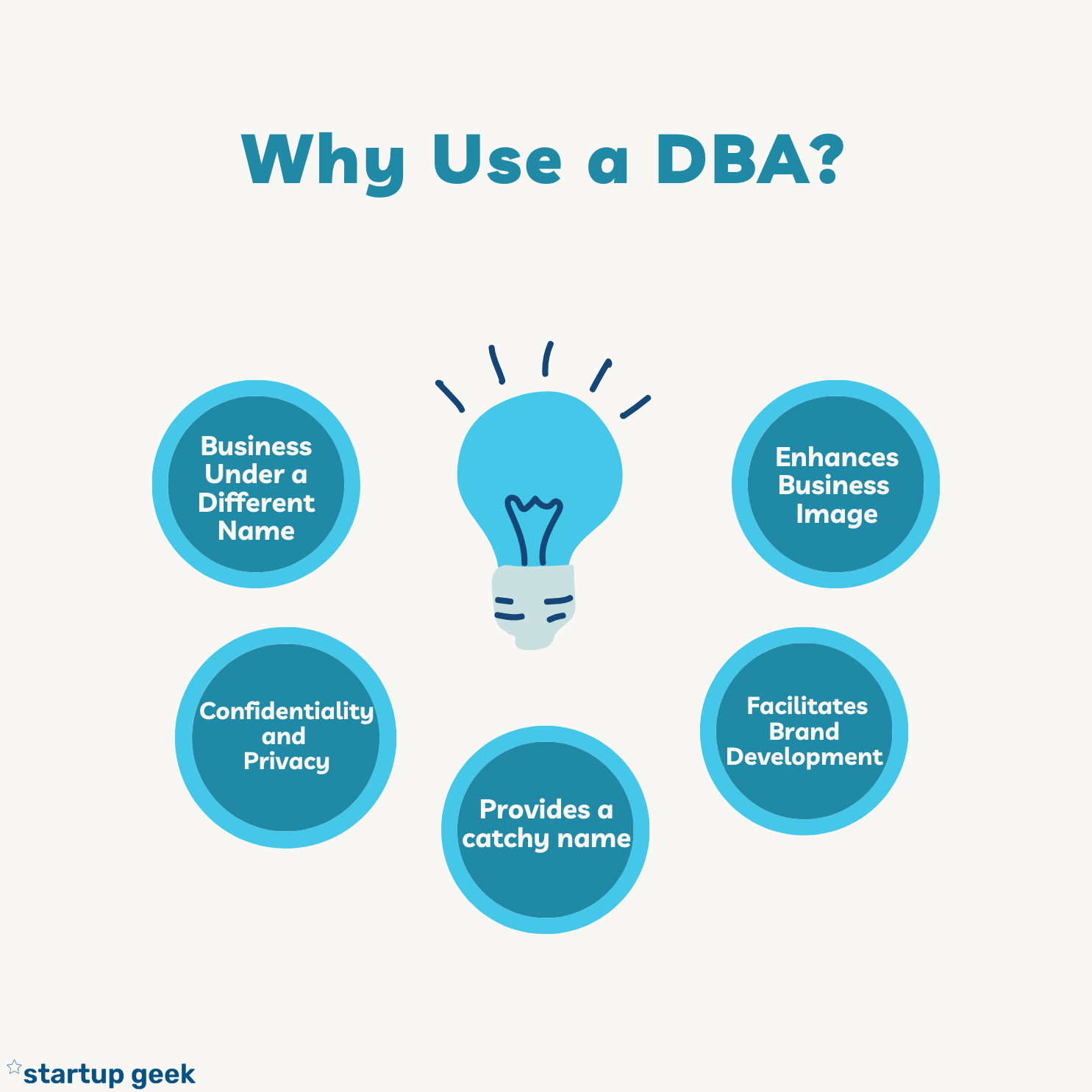

Why Use a DBA?

A ‘Doing Business As’ (DBA) is an essential tool for many businesses, especially startups and small enterprises. There are several reasons why you might consider using a DBA.

Allows for Conducting Business Under a Different Name

Firstly, a DBA allows a business to operate under a name that’s different from its official legal name. It’s particularly helpful if the legal name of your business doesn’t effectively represent the services or products you offer. For instance, if ‘Jane Doe Enterprises’ wants to open a bakery, she might prefer to use a more customer-friendly name like ‘Jane’s Sweet Delights’. Operating under such a catchy name can attract more customers and make the business easier to remember.

Enhances Business Image

Secondly, a well-chosen DBA can enhance the business image and help in shaping its identity. If you’re operating a tech startup, a futuristic-sounding DBA can project innovation and cutting-edge technology, while a rustic name can be perfect for a business selling handcrafted goods.

Confidentiality and Privacy

Another advantage is that a DBA offers confidentiality and privacy for business owners. If you’re a sole proprietor, using a DBA can help keep your personal name separate from your business operations. This is especially useful for those who prefer not to mix their professional and personal lives.

Facilitates Brand Development

The use of a DBA also facilitates brand development. It gives you the freedom to create a unique name, logo, and marketing strategy around your DBA, which is crucial for branding. It enables you to establish a clear brand identity that differentiates your business from competitors.

Practical Case Scenarios of Using a Dba

Finally, let’s look at a practical case scenario. Suppose a business owner operates multiple businesses under one legal entity. In this case, they can use a different DBA for each operation, simplifying management and helping customers identify each unique business.

Using a DBA is not just about having a catchy name. It’s a strategic decision that offers flexibility, boosts your business image, ensures privacy, aids in branding, and simplifies business operations.

Disadvantages of DBA

Here are some disadvantages that you can experience if you opt for a DBA.

Lack of Legal Protection

One significant drawback of a DBA is the lack of legal protection for personal assets. Unlike a Limited Liability Company (LLC) or corporation, a DBA doesn’t separate your personal assets from your business debts. This means that if your business runs into debt or faces a lawsuit, your personal assets may be at risk.

Limited Name Protection

Another downside of using a DBA is its limited protection for your business name. Registering a DBA in your state or county doesn’t prevent another business from using the same or a similar name in a different location. This can lead to confusion among customers and potential branding conflicts.

Renewal Requirements

Operating with a DBA comes with the administrative task of regularly renewing your registration, typically every five years. Neglecting to renew could result in losing your right to use your DBA, potentially leading to legal issues.

Perceived Lack of Professionalism

Finally, some potential partners or investors might perceive a DBA as less professional than an LLC or a corporation. They might see it as a sign that the business hasn’t invested in a formal structure, which could impact their willingness to engage with your business.

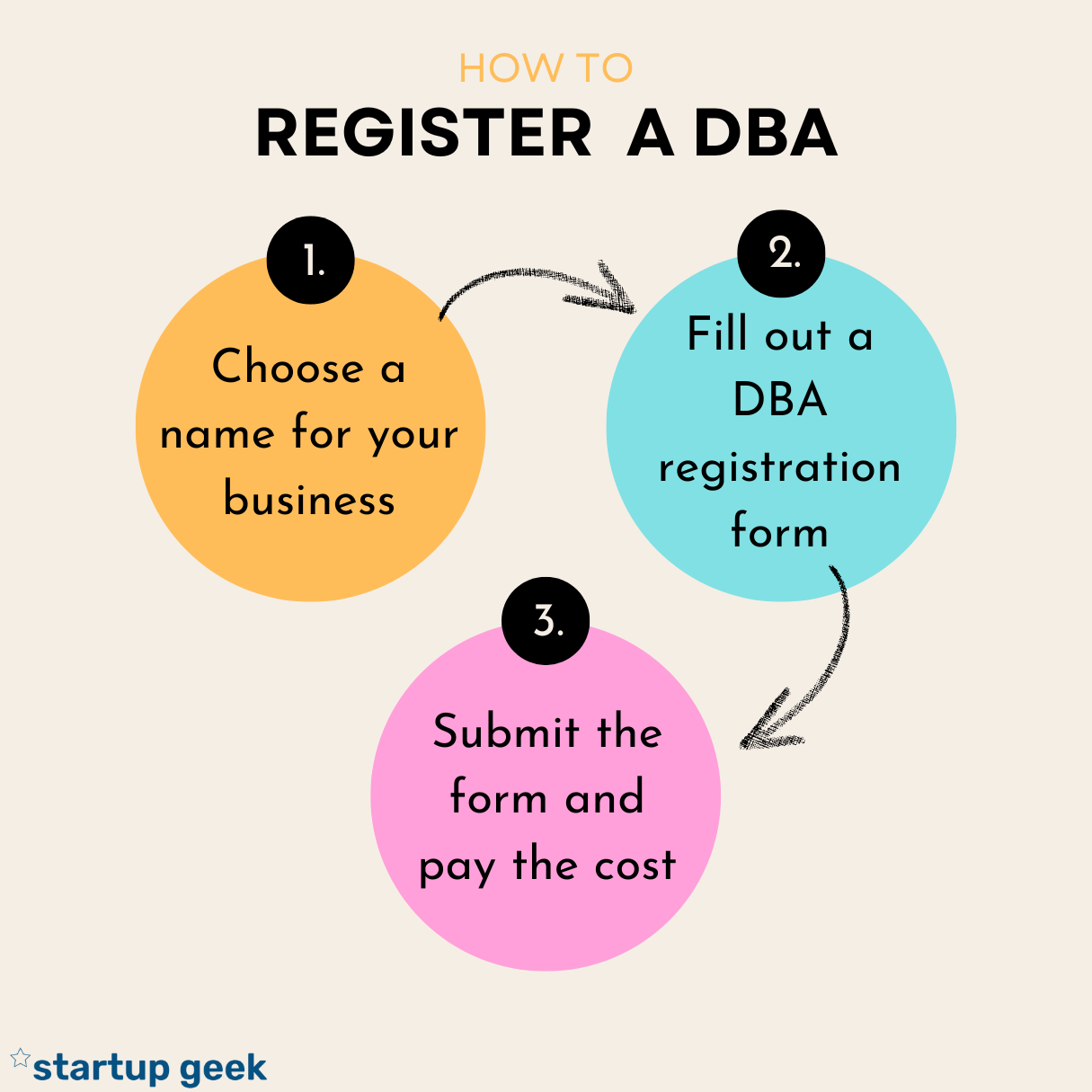

How to Register a DBA

Registering a DBA involves choosing a unique name, filling out a registration form, paying a filing fee, and possibly publishing a notice in a local newspaper. For example, you can share information about your DBA by publishing an Ad so that other companies won’t take it.

It’s a cost-effective way to operate your business under a different name, but it’s important to know the legal requirements and renew your registration as required.

Step-By-Step Guide

- First, you need to choose a name for your business. It’s important to pick a name not already used by another company. You can check this by doing a name search on your local county or state government’s website. Remember, the name you choose will represent your business to customers and the public, so it should be relevant and easy to remember.

- Next, you need to fill out a DBA registration form. This can usually be found online on your county or state government’s website. The form will ask for details about your business, such as its legal name, the DBA name you want to use, and your business address.

- After filling out the form, you need to submit it to the appropriate government office, usually the county clerk’s office or the secretary of state’s office. Depending on the state or county, a small filing fee may be associated with this step, ranging from $5 to $150.

Once your DBA is registered, you might be required to publish a notice in a local newspaper. This is a legal requirement in some states, and it informs the public that you are doing business under a new name. The newspaper will charge a fee for this service, and the cost can vary.

Frequency of Renewal

DBA registrations do not last forever. They need to be renewed every few years, usually every 5 years, although the exact time period can vary from state to state. Renewing your DBA involves filling out a renewal form and paying a renewal fee, similar to the initial registration process.

Legal Requirements and Restrictions

However, there are some legal restrictions to remember when registering a DBA. For instance, your DBA cannot include terms like ‘Inc.’ or ‘LLC’ unless your business is legally incorporated or is a limited liability company. Also, you cannot use a misleading or deceptive DBA that implies you are part of a government agency.

State-Specific Regulations for DBA

The rules for registering a ‘Doing Business As’ (DBA) in the United States can vary widely from state to state. Some states require you to register a DBA with the state government, while others only require registration at the county level. The fees associated with registering a DBA also differ among states.

Examples of State-Specific Regulations

For instance, in California, a DBA must be registered with the county clerk’s office where the business operates, and the business owner must publish a statement in a local newspaper for four consecutive weeks. Meanwhile, in New York, DBA registration is done at the county level, but no publication is required.

Impact on Multi-State Businesses

If a business operates in multiple states, it may need to register its DBA in each state where it does business. This can lead to additional administrative work and costs. Furthermore, the business may have to navigate each state’s different rules and regulations, which can be complex and time-consuming.

Common Mistakes to Avoid When Registering a DBA

By avoiding these common mistakes, you can ensure a smooth process when registering your DBA and avoid potential legal complications.

Choosing a Name Already in Use

A common mistake is choosing a DBA name already used by another business. Before settling on a name, make sure to perform a thorough search on your local government’s database to confirm that it’s unique. Using a name that’s already taken can lead to legal issues and confusion among customers.

Not Following Local Laws and Regulations

Different states and counties have varying rules regarding DBA registration. Not familiarizing yourself with these laws can result in non-compliance, which could lead to penalties. It’s essential to understand the regulations in your area, such as whether you need to publish a notice in a local newspaper or the period after which you need to renew your DBA.

Ignoring the Need for a DBA

You could be in legal trouble if you’re operating under a name different from your legal business name without a DBA. This might seem like a time and cost-saving measure in the short term, but ignoring the need for a DBA can have serious legal implications down the line.

DBA vs. Legal Entity: Which is Right for You?

Before going any further, remember there is no one-size-fits-all answer. The right structure for your business depends on your unique circumstances and long-term business goals.

Choosing the right structure for your business, whether it’s a ‘Doing Business As’ (DBA), a sole proprietorship, a limited liability company (LLC), or a corporation, is an important decision. Here’s a simple comparison to help you understand these options.

DBA Vs Sole Proprietorship and LLC

DBA: A Flexible Alias for Business Operations

A DBA is not a legal entity but an alias for a business. It’s a cost-effective way for you to operate under a different name without creating a new legal entity. However, a DBA doesn’t provide legal protection for personal assets, meaning if the business is sued or goes into debt, your personal assets might be at risk.

Sole Proprietorship: Personal Ownership Simplified

On the other hand, a sole proprietorship is a business owned by one person. Like a DBA, it doesn’t separate your business and personal assets. However, it’s simple to set up and gives you complete control over your business.

LLC: Enhanced Asset Protection

An LLC provides more protection for your personal assets. It separates your business and personal assets, meaning if your business faces a lawsuit or debts, your personal assets are typically safe. An LLC can be more complex to set up and manage than a DBA or sole proprietorship, but it can provide more credibility to your business.

Corporation: High-Level Asset Safeguard

A corporation is a more complex legal structure that provides the highest level of protection for personal assets. It’s owned by shareholders and managed by a board of directors. It can be expensive and complicated to set up, but it can provide benefits like raising funds through selling shares.

To choose the right structure, consider your business goals, the level of legal protection you want, the cost and complexity you’re willing to handle, and your plans for growth. Consulting with a business advisor or attorney can provide valuable insights tailored to your specific situation.

Tax Implications of Registering a DBA

It’s important to understand that a DBA is not a separate legal entity, which means it doesn’t change your business’s tax obligations. When tax season rolls around, your income and expenses from a business operating under a DBA are reported on your personal tax return if you’re a sole proprietor or on your company’s tax return if you’re an LLC or corporation.

Impact on Deductions and Expenses

Using a DBA does not directly impact your ability to claim business deductions and expenses. As long as the expenses are incurred for business purposes, they can typically be deducted regardless of whether you operate under a DBA or your own name.

Consideration for Sales Tax

One area where a DBA might have an impact is sales tax. If your DBA sells products or services subject to sales tax, you may need to collect and remit sales tax under that name. This requirement will depend on your state and local sales tax laws.

While a DBA allows you to do business under a different name, it doesn’t alter your tax responsibilities. It’s always advisable to consult with a tax professional to fully understand your business’s tax implications.

Frequently Asked Questions

Q1. Can a DBA have a separate bank account?

Yes, a DBA can have a separate bank account. In fact, it’s usually advisable to have a separate business bank account for your DBA to maintain a clear separation between your business and personal finances. This can simplify your record-keeping and make tax time easier. Remember, you’ll need to provide your DBA certificate when opening a bank account under your DBA name.

Q2. Is a DBA the same as a trademark?

No, a DBA is not the same as a trademark. A DBA is a name under which a business operates, while a trademark protects a business’s brand name or logo from being used by others. While registering a DBA gives you the right to use a particular name for your business in your state or county, it does not prevent others from using the same name. If you want nationwide protection for your business name, you should consider getting a trademark.

Q3. Can I transfer ownership of a DBA?

Yes, the ownership of a DBA can be transferred, but the process for doing so varies depending on local and state laws. Usually, it involves filing a new DBA registration form indicating the change of ownership. Consult with an attorney or business advisor for guidance on how to proceed in your specific location.

Q4. Do all business structures require a DBA?

Not all business structures require a DBA. If a sole proprietor or a partnership operates under a name that is different from the owner’s legal name, they need a DBA. Similarly, corporations or LLCs need a DBA if they want to do business under a different name than the one they registered when they formed their business entity. It’s important to review your business entity structure and understand the requirements for your specific situation.

Q5. How does a DBA influence the way a company handles bank transactions and organizational steps?

A DBA influences how a company handles bank transactions by allowing the business to open a bank account and conduct financial activities under the business’s fictitious name. This can be particularly helpful for partnerships and proprietorships where the business name may differ from the legal names of the owners. It provides a level of professionalism and can make the business more recognizable to customers.

In terms of organizational steps, having a DBA allows a company to conduct business, enter into contracts, and advertise under a name that is different from the legal name of the owner or the registered name of the corporation or LLC. This gives the business flexibility and can be a powerful tool for branding. However, it’s crucial to remember that all official filings, such as tax documents, should include both the DBA and the legal business name for clarity and legal compliance.

Final Words

In conclusion, a DBA, or “Doing Business As,” is an essential tool that allows businesses to operate under a different name than their legal one. This can provide various benefits, like enhancing branding or preserving privacy. However, it’s crucial to understand the process of registration, costs, and legal considerations involved. Consider your business needs, tax implications, and potential drawbacks before operating under a DBA.