Economic downturns are an inevitable part of the business cycle. They present both challenges and opportunities for businesses. During times of economic contraction, it can be difficult to navigate the decreased consumer spending and labor market uncertainty.

However, it’s important to remember that these periods can also provide opportunities for strategic innovation and growth.

By focusing on long-term goals and adapting to the changing market conditions, businesses can emerge stronger and more resilient than before. It may not be easy, but with the right mindset and approach, it’s possible to turn a challenging situation into a catalyst for success.

What Is An Economic Downturn

An economic downturn (also known as an economic recession) is a period of slowed economic activity marked by declining GDP (Gross Domestic Product), reduced global demand, sluggish job growth, increased borrowing costs, and reduced credit availability.

It affects businesses and individuals, often creating financial bubbles and pervasive effects across society.

Fortunately, a recession is not always permanent, and countries have been able to successfully recover from an extended period of costly recession over time with appropriate strategies and measures.

What Causes A Recession?

A recession is typically caused by a combination of factors that lead to a significant decline in economic activity across a country or region. Here are some common causes:

1. High-Interest Rates: Central banks often raise interest rates to combat inflation. While this can effectively control inflation, high-interest rates can discourage individuals and businesses from borrowing, leading to decreased spending and investment.

2. Bursting of Financial Bubbles: When the stock prices, real estate, or commodities rise rapidly and reach levels that aren’t justified by their intrinsic value, a financial “bubble” is created.

When these bubbles burst, as they inevitably do, they can lead to a sharp contraction in economic activity. One of the most notorious examples of the bursting of a financial bubble is the dot-com bubble of the late 1990s and early 2000s.

The dot-com bubble from 1995-2001 saw a rapid increase in stock prices for internet-based companies, fueled by investor speculation rather than solid financial performance.

By 2000, it became clear many of these companies weren’t as profitable as thought, leading to a crash in stock prices, company failures, and significant wealth loss, ultimately causing an economic recession in the early 2000s.

3. Financial Crises: Financial institutions play a crucial role in the economy, lending money to businesses for growthand individuals for consumption. When these institutions face a crisis, as was the case during the 2008 financial crisis, their ability to lend can be severely compromised, leading to a sharp contraction in economic activity.

4. Fiscal Policy: Fiscal policy refers to government spending and taxation. If governments cut spending or raise taxes significantly, it can lead to a contraction in the economy, potentially triggering a recession.

5. Global Factors: In an increasingly interconnected world, a recession in one country or region can have ripple effects across the globe. For example, a recession in a major economy like the United States can lead to decreased demand for exports from other countries (like China), potentially triggering a recession in those countries as well.

6. Natural Disasters or Pandemics: Events such as earthquakes, hurricanes, or health crises like the COVID-19 pandemic can also cause recessions. These events can disrupt supply chains, decrease consumer and business confidence, and employment levels, and lead to declines in spending and investment.

It’s important to note that these factors often interact in complex ways, and a global recession is usually the result of several of these factors occurring simultaneously.

Understanding The Impact Of An Economic Downturn

A recession, characterized by a significant decline in economic activity, can have a profound negative impact on businesses across multiple sectors. One of the most direct effects is a reduction in consumer spending, as people often tighten their belts in response to economic uncertainty.

This decrease in demand results in dwindling sales and revenues for businesses, particularly those in the discretionary sectors such as retail, hospitality, and tourism.

Similarly, corporate earnings of business-to-business (B2B) companies may also suffer due to reduced spending by other firms. As revenues decline, profitability is seriously affected, leading to potential financial distress, layoffs, or, in extreme cases, business closures.

Furthermore, a recession typically comes with a tightening of credit conditions. Banks and financial institutions are now more cautious about lending, and when they do, it’s usually at higher interest rates. This can present significant challenges for businesses that rely on borrowed capital for their operations or expansion plans.

Additionally, businesses may encounter difficulties in maintaining their supply chains, particularly if their suppliers are also struggling financially. On the labor market front, while there might be more people looking for jobs due to layoffs in various industries, companies might struggle to retain existing talent or hire new employees due to financial constraints, leading to a potential skills gap.

A good example of this was the 2008 financial crisis, often considered the worst economic disaster since the Great Depression of the 1930s, which was characterized by a swift and devastating collapse of the housing market, a global credit crunch, and subsequent large-scale recession.

The crisis came into full effect in the first quarter of 2008 with the collapse of Bear Stearns, a major investment bank. This was a tipping point that signaled the depth of the financial instability.

By the second quarter, the crisis had further deepened with significant asset devaluation, increased defaults on subprime mortgages, and the insolvency of several major financial institutions. This period marked a rapid escalation in the scale and severity of the crisis, leading to dramatic governmental interventions worldwide.

This confluence of catastrophes that characterize a recession can put considerable pressure on businesses (and in a good way sometimes), testing their resilience and adaptability in the face of mounting challenges.

Benefits Of Proactively Addressing The Downturn

Proactively addressing a recession, rather than reacting passively, can benefit your business in several ways:

1. Allows Businesses To Mitigate Potential Risks And Challenges

By anticipating changes in consumer behavior or market conditions, businesses can prepare and adapt their strategies accordingly. This may involve cost-cutting measures, restructuring, or pivoting to new markets or product lines.

A proactive approach also enables businesses to manage their resources more effectively, allocating them to areas that promise the highest return or protect core operations. Additionally, by acting early, businesses can secure better terms for any necessary financing before credit conditions tighten.

2. Provides Businesses With A Competitive Advantage

Companies that continue to innovate and adapt during tough times are often better positioned to capture new market opportunities or gain market share from less agile competitors. This resilience can translate into stronger performance during the economic recovery phase.

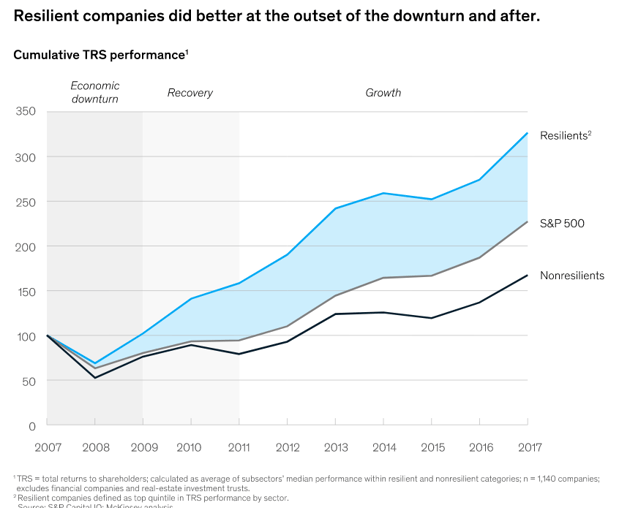

The key finding from the analysis is that ‘resilient’ companies significantly outperformed their ‘non resilient’ counterparts in terms of EBITDA margins, primarily by being more adept and swift in reducing their operating costs in relation to revenue changes, both during and after the 2007-2009 economic downturn.

This strategic cost management, rather than timing the cycle, helped them bolster their earnings.

3. Fosters A Culture Of Agility And Resilience Within The Organization

It can encourage teams to think creatively, work more efficiently, and become more adept at managing change and uncertainty. This cultural shift can have long-lasting benefits, enhancing the business’s ability to navigate future challenges and seize new opportunities.

In essence, a proactive approach to a recession can transform a period of crisis into a catalyst for growth and innovation.

Recession Predictors And Indicators

Predicting a recession is a complex task that many economists and analysts approach by doing economic research and examining a variety of economic indicators, labor statistics, and other measures. Here are some commonly used predictors and indicators of a potential recession:

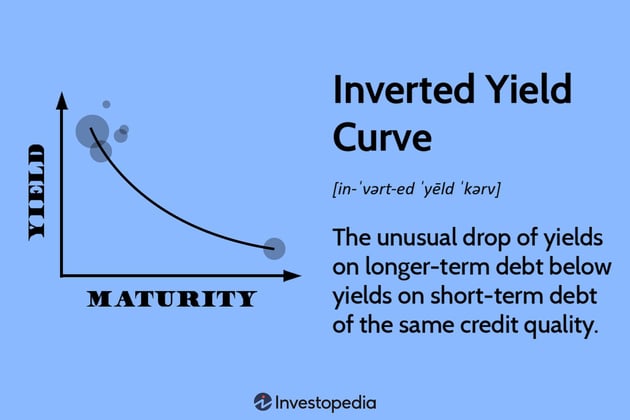

- Yield Curve Inversion: The yield curve is a graph that plots the interest rates of bonds with equal credit quality but differing maturity dates. Normally, long-term bonds have higher yields than short-term bonds due to the risks associated with time.

- Rising Unemployment: Unemployment rates are a lagging indicator, which means they tend to rise after a recession has already begun. However, a steady uptick in the number of jobless claims can suggest that businesses are starting to lay off workers in response to a slowing economy.

- Decrease in Consumer Confidence: Consumer confidence measures how optimistic consumers are about the state of the economy. It’s based on their saving and spending activity. If consumers believe the economy is doing well, they are more likely to spend money, driving economic growth.

- Decline in Industrial Production: Industrial production measures the output of the industrial sector, which includes manufacturing, mining, and utilities. It’s a real-time indicator of the economy’s health.

- Decreased Retail Sales: Retail sales data provides insight into the spending habits of consumers. A consistent drop in retail sales might indicate that consumers are spending less, either because they have less disposable income or because they’re worried about the state of the economy.

- Housing Market Slowdown: The housing market is often a good barometer of the overall economy. When credit is readily available, home sales typically increase. When lenders tighten their requirements, sales slow down.

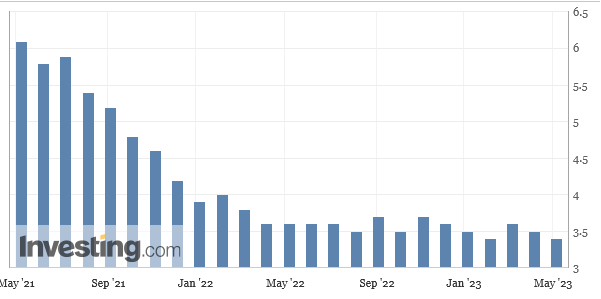

U.S. unemployment in the last 24 months

If the unemployment rate climbs significantly over several months, it could signal the onset of a recession.

Customer Confidence Index (June 2022-May 2023)

A sharp and sustained decline in consumer confidence can be a sign that individuals are tightening their belts, possibly in anticipation of a recession.

A consistent decrease in industrial production may suggest that companies are cutting back on production in anticipation of reduced demand, which could herald a recession.

Prolonged periods of declining retail sales often precede a recession.

If this slowdown is coupled with a drop in housing prices, it can be a sign that a recession is on the horizon.

Remember, no single indicator in the Bureau of Economic Research can predict a recession with complete certainty. Economists typically look at several of these indicators in conjunction to assess the overall health of the U.S. economy and the likelihood of a recession.

How To Survive A Recession And Thrive Afterward

We’ll explore key tactics that will not only help businesses survive a recession but also position them for substantial growth in the aftermath.

Strategy 1: Cost Efficiency And Reduction

During the 2008 financial crisis, McDonald’s emerged as one of the winners of the great recession, as the company managed to grow despite the economic recession. Achieving cost efficiency and strategically reducing costs can be critical for a business’s survival and eventual economic recovery.

McDonald’s Corporation took advantage of this strategy by optimizing its menu and streamlining its operations, which not only reduced costs but also improved service speed.

Importance Of Cost-Efficiency

Cost efficiency is not just about cutting costs; it’s about optimizing the use of resources to generate the best possible results. It involves reducing waste, improving processes, and increasing productivity.

During a recession, cost-efficiency can help a business maintain profitability, preserve cash, and stay competitive. Moreover, by becoming more cost-efficient, a company can position itself for faster recovery and growth when economic conditions improve.

Practical Steps To Reduce Costs Without Sacrificing Quality Or Service

There are several ways a business can reduce costs without compromising quality or service. These include streamlining operations, leveraging technology, renegotiating contracts, and focusing on core competencies.

1. Streamlining Operations: This involves identifying inefficiencies in the production process and implementing solutions to address them. This could mean reducing waste, simplifying procedures, or consolidating tasks.

2. Leveraging Technology: Technology can improve productivity and reduce costs. For example, automating routine tasks can free up employees’ time for higher-value work. Implementing digital solutions can also reduce the need for physical resources and lower overhead costs.

3. Renegotiating Contracts: During a recession, suppliers and vendors may be more willing to negotiate pricing in order to retain business. Businesses can take advantage of this to reduce costs.

4. Focusing on Core Competencies: By focusing on what they do best and outsourcing or eliminating non-core activities, businesses can improve efficiency and reduce costs.

When revenues decline, maintaining profitability often requires a disciplined approach to cost management. However, it’s equally important to ensure that cost-cutting measures do not compromise the quality of products or services, as this could harm a company’s reputation and customer relationships.

Strategy 2: Innovation And Diversification

Innovation and diversification can be powerful strategies for navigating a recession. While it may seem counterintuitive to invest in new ideas or markets when times are tough, businesses that do so often emerge stronger from a recession. They not only survive the difficult period but also set the stage for robust growth when the economy rebounds.

Role Of Innovation In Survival During A Downturn

Innovation allows companies to adapt to changing market conditions, meet evolving customer needs, and gain a competitive edge. By developing new products, services, or processes, companies can create new revenue streams, improve efficiency, and enhance their value proposition.

Innovation can also boost a company’s brand image and customer loyalty, which can be especially valuable during a recession when consumers may be more selective in their spending.

A notable example of successful innovation during a downturn is Apple Inc. During the 2001 recession, rather than scaling back, Apple forged ahead with the development of the iPod. The success of this product not only helped Apple weather the recession but also propelled the company to unprecedented growth in the following years.

Importance Of Diversifying Products, Services, Or Markets

Diversification is a risk management strategy that involves broadening a company’s range of products, services, or markets. During a recession, diversification can help a company mitigate risks and stabilize revenues.

If one product, service, or market is performing poorly, others may be doing well, offsetting losses and providing a degree of financial stability. Diversification can also open up new opportunities for growth. By entering new markets or introducing new products or services, companies can reach new customers and increase their market share.

Netflix is an example of successful diversification. In the wake of the 2008 financial and housing crisis, Netflix transitioned from a DVD rental service to a streaming service, which allowed it to tap into the growing consumer demand for online entertainment and secure its position as a market leader.

Innovation and diversification are essential strategies for surviving and thriving during an economic recession. By learning from successful examples, understanding the role of innovation, and recognizing the importance of diversification, businesses can better navigate challenging economic conditions and position themselves for future success.

Strategy 3: Employee Engagement And Retention

Employee engagement and retention is a crucial strategy for navigating an economic downturn. A classic example of a company that made the most of it is Southwest Airlines.

During the 2008 financial crisis, while other airlines were conducting mass layoffs, Southwest avoided layoffs through a combination of voluntary leaves, job sharing, and flexible work arrangements despite posting its first quarterly loss (in 17 years), in the third quarter of 2008.

As a result, they were able to maintain employee morale and customer service levels, and quickly rebound once the economy recovered.

Importance Of Maintaining A Strong Team During A Downturn

A strong, motivated team can be a company’s biggest asset during a recession. Engaged employees are more likely to go the extra mile to help the company succeed.

They are also less likely to leave, reducing turnover costs and ensuring continuity of knowledge and skills. Moreover, maintaining a strong team during a recession positions a company for quicker recovery and growth once the economy improves.

Strategies For Employee Engagement And Retention

1. Communication: Open, honest communication is key during a recession. Keeping employees informed about the company’s situation and plans can reduce uncertainty and build trust.

2. Recognition and Reward: Recognizing and rewarding employees for their hard work and contributions can boost morale and motivation, even if financial rewards are not possible.

3. Career Development Opportunities: Providing opportunities for learning and career development can help keep employees engaged and committed to the company.

4. Flexible Work Arrangements: Offering flexible work arrangements, such as remote work or flexible hours, can help employees balance work and personal responsibilities, reducing stress and increasing job satisfaction.

In times of an economic cycle or recession, businesses often face tough decisions, such as potential layoffs, wage freezes, or reduced hours. While these measures may help cut costs in the short term, they can also lead to decreased morale and productivity, and increased turnover, which can result in long-term consequences.

Therefore, focusing on employee engagement and retention can be a strategic approach to navigating through economic cycles and downturns.

Strategy 4: Customer Focus And Retention

During an economic recession, many businesses tend to focus on attracting new customers in an effort to boost declining sales. However, retaining existing customers is often more cost-effective and can provide a more stable revenue stream during challenging times.

By focusing on customer retention, businesses can build stronger customer relationships, improve customer loyalty, and enhance their reputation, all of which can contribute to their resilience during a downturn.

A classic example of successful customer retention during a downturn is Amazon during the dot-com crash in 2000. While many other online businesses went under, Amazon survived and eventually thrived, largely due to its focus on customer service.

The company went to great lengths to ensure customer satisfaction, offering easy returns, reliable delivery, and a wide range of products. This focus on customer service helped Amazon retain its customer base during the downturn and set the stage for its future growth.

Importance Of Retaining Customers During A Downturn

Retaining customers during a downturn is crucial for several reasons. First, it’s generally more cost-effective to retain existing customers than to acquire new ones.

Second, loyal customers are more likely to make repeat purchases, provide positive word-of-mouth, and be less price-sensitive, all of which can contribute to a company’s financial stability during a downturn.

Lastly, by retaining customers during tough times, businesses can strengthen customer relationships and enhance their reputation, which can provide a competitive advantage when the economy recovers.

Strategies For Customer Focus And Retention

1. Customer Service Excellence: Providing excellent customer service, including handling complaints effectively, can increase customer satisfaction and loyalty.

2. Customer Engagement: Engaging customers through regular communication, personalized offers, and loyalty programs can help maintain and strengthen customer relationships.

3. Value Proposition: During a downturn, customers often become more price-sensitive. By focusing on value, rather than just price, businesses can differentiate themselves from competitors and encourage customer loyalty.

4. Understanding Customer Needs: By understanding and responding to changing customer needs during a downturn, businesses can provide products and services that are relevant and valuable to their customers.

Strategy 5: Financial Planning And Management

Robust financial planning and management is a vital strategy to survive and thrive during an economic downturn. Companies need to manage their resources wisely, minimize unnecessary expenses, and make strategic investments to remain solvent and competitive.

Importance Of Robust Financial Planning During A Downturn

Robust financial planning is particularly important during a downturn as it enables businesses to maintain their financial stability and make informed decisions. By carefully forecasting revenues, expenses, and cash flow, companies can identify potential financial challenges and take proactive measures to mitigate them.

Moreover, strong financial planning can help businesses identify opportunities for cost savings, efficiency improvements, and strategic investments that can enhance their resilience and competitive advantage.

Strategies For Effective Financial Management

1. Cost Management: This involves identifying and reducing unnecessary expenses. It can include measures such as streamlining operations, renegotiating contracts, and optimizing resource use.

2. Cash Flow Management: This involves closely monitoring and managing inflows and outflows to maintain liquidity. It can include strategies like improving collections, extending payables, and managing inventory effectively.

3. Strategic Investment: Even during a downturn, there may be opportunities for strategic investment, such as in technology or talent, that can improve efficiency, competitiveness, or future economic growth and potential.

4. Financial Forecasting: This involves predicting future revenues, expenses, and cash flows to inform decision-making. It can help businesses anticipate challenges and take proactive measures.

Frequently Asked Questions

How Long Does An Economic Downturn Typically Last?

An economic downturn typically lasts anywhere from 6 months to 2 years. The exact length of an economic downturn depends on a number of different factors, including the severity of the downturn and the magnitude of macroeconomic policies implemented by governments.

During milder recessions, GDP typically contracts for only one or two quarters, meaning that an economic downturn can pass within a period of several months.

However, more severe recessions, such as the Great Recession of 2008-2009, can last for a much longer period of time. In such cases, it may take up to two years before national indicators like employment and inflation reach pre-downturn levels.

To survive and thrive during the early stages of a sustained recession, it is important to develop strategies that enable you to weather shorter periods of hardship while building capital and increasing savings to mitigate potential losses during a prolonged downturn.

What Are The Effects Of An Economic Downturn?

The effects of an economic downturn can range from minor to catastrophic, depending on the severity and length of the slowdown. Generally, when the economy slows, businesses begin to cut costs, which can include layoffs and wage reductions. As unemployment rises, consumer spending decreases which in turn leads to more business losses.

Public health and welfare may also be affected by reducing access to medical care, education, and other social services. Furthermore, poverty rates could skyrocket as people are unable to make ends meet.

Finally, increased uncertainty about the future of financial markets can lead people to feel stressed or anxious and cause them to become even more conscious about their finances.

How Could An Economic Downturn Be Prevented?

Preventing an economic downturn is easier said than done since so many factors are at work to cause such a situation. However, some practical steps can be taken to reduce the risk of a downturn.

First, governments should take proactive measures to make sure the economy is not based on one sector or industry, so it’s less likely to be hit hard if that single sector suffers a decline.

The 2008 financial crisis, for example, prompted an unprecedented response from central banks and international financial institutions worldwide. As the crisis deepened in the first quarter of 2008, central banks, like the Federal Reserve in the U.S., embarked on a series of emergency interventions. They drastically cut interest rates and pumped liquidity into the system to stave off a complete financial meltdown.

By the second quarter, the crisis had spread globally, affecting economies far beyond the epicenter in the United States. This prompted the International Monetary Fund (IMF) to step in, offering financial assistance and policy advice to countries grappling with economic instability.

The actions of central banks and the IMF during this period were critical in mitigating the worst impacts of the crisis and setting the stage for eventual recovery.

Second, governments can invest in infrastructure and education to create what is known as ‘human capital’. Investing in people helps increase their productivity and also encourages businesses to invest in them and give them job opportunities.

Third, governments should do economic research and create public policies to encourage new business creation, innovation, and entrepreneurial activity, which could help drive more growth and prevent economic stagnation.

Fourth, government fiscal policy (i.e., taxation and spending) should be carefully managed so that the national debt does not spiral out of control. Monitoring inflation rates and exchange rates are also essential for managing the health of the broader global economy.

Finally, monetary policy (i.e., interest rate changes by central banks) should be used judiciously to maintain macroeconomic stability. This requires careful analysis of current trends in the labor market as well as forecasting future developments in order to adjust monetary policy accordingly.

How Can Individuals And Businesses Prepare For An Economic Downturn?

Individuals and businesses can prepare for an economic downturn by taking the following strategies:

1. Establish Emergency Funds – Individuals should establish financial reserves that can be tapped into during a downturn so they have the necessary funds to pay bills or continue operations. Businesses need to ensure they build up cash reserves to weather any dip in sales or demands on resources.

2. Review Current Finances – It is important that people review their current finances and develop plans for how to manage their money if income decreases or debt increases. For businesses, analyze spending patterns, overhead costs, and cash flow to understand where money could be saved in preparation for a potential downturn.

3. Reevaluate Investment Strategies – Investing in and diversifying portfolios is beneficial both before and during an economic downturn. Make sure assets are properly allocated so individuals and businesses are protected in the event of a serious stock market decline or crash.

4. Minimize Risk & Maximize Profit – Minimize risk by reviewing contracts and policies, managing staff numbers, and finding alternative sources of income if needed. Businesses need to focus on cost-effective solutions while maximizing profit whenever possible by looking at new markets, increasing efficiency, and leveraging technology advancements to reduce operating costs.

5. Capitalize on Opportunities – Economic slowdowns often present valuable opportunities such as discounted gas prices or oil prices or discounts on materials or services, which businesses should take full advantage of if it does not harm the overall financial standing of the company. For individuals, consider switching to jobs with more secure employment options during times of negative economic growth or instability.

Wrapping Up

Navigating an otherwise economic business cycle or downturn is undeniably challenging. Yet, it’s crucial to remember that even in the midst of economic instability, opportunities for growth and innovation can arise.

For businesses currently facing a downturn, remember that history is laden with stories of businesses that not only survived economic downturns but emerged stronger and more efficient. Your business can be one of those success stories.

Economic downturns test the mettle of businesses, but they also provide a unique opportunity to redefine, reinvent, and revolutionize your operations. Keep your customers and employees at the heart of your decision-making and remember that this too shall pass.

Your business can not only survive an economic downturn but thrive and emerge stronger on the other side. Be proactive, be strategic, and be resilient. The future’s still bright.