Paying for goods and services online has become a normal part of life, for the majority of people. In the not-too-distant future, cash payments in traditional stores will become a thing of the past, and as eCommerce continues to boom, digital checkouts are processing staggering numbers daily.

To that end, it is crucial to have a seamless, flowing, customer-friendly payment system that supports multiple integrations and upgrades quickly, without fuss.

Fastspring ticks all of these boxes and more, offering a branded checkout experience that is feature-rich and integrates easily. Although it might be a little expensive, we like it. Find out why, right here.

What Is FastSpring?

FastSpring is a digital eCommerce platform offering solutions to all businesses for handling and managing subscriptions. This interesting company launched in 2005 selling software and games online. After a period of sustained growth with consumer demand, they evolved into a SaaS offering in 2011.

Currently, this California-based venture offers services in more than 200 countries, featuring a collection of cloud-based SaaS options that allow businesses to sell their digital products across all platforms.

FastSpring not only lets users manage subscriptions by processing online payments all around the globe but also provides a complete checkout experience. Rich with features, FastSpring is an ideal solution for all start-ups who want to manage their online billing effectively, without hindrance.

FastSpring Quick Facts

- This company has been around for over a decade (at the time of writing), with headquarters in Santa Barbara, CA.

- More than 3200 companies are using this platform.

- FastSpring supports 21+ languages and has support for 23+ currencies.

- In 2022, FastSpring revenue run rate hit $110M in ARR.

- FastSpring acquired SalesRight on Nov 19, 2020

Features Of FastSpring

Online payment systems should deliver a nice look and feel for your customers. Equally as important are the back-end features, however. Let’s take a look at what FastSpring has to offer.

Custom Checkouts

FastSpring offers customizable and intuitive checkout models to help optimize the buying experience and reduce cart abandonment.

Store Builder Library: With the FastSpring store builder library, businesses can implement and personalize checkout flows through a JavaScript library, created to incorporate e-commerce features.

Dynamic Marketing: FastSpring provides a seamless experience by optimizing the content, allowing users to check online stores via mobile, desktops, or tablets.

Embedded Checkout: You can directly embed the checkout page on your website to avoid pop-ups or redirects for checkouts. Using the branding tools of FastSpring or overriding the CSS, you can customize the checkout page that suits your website the best.

Popup Checkout: With JavaScript, you can directly integrate a popup checkout page on your websites, so customers don’t have to leave the current page to confirm the order.

Global Payment Support

FastSpring provides the best acceptance rates for customers’ purchases, regardless of the product model provided (subscription or one-time payment).

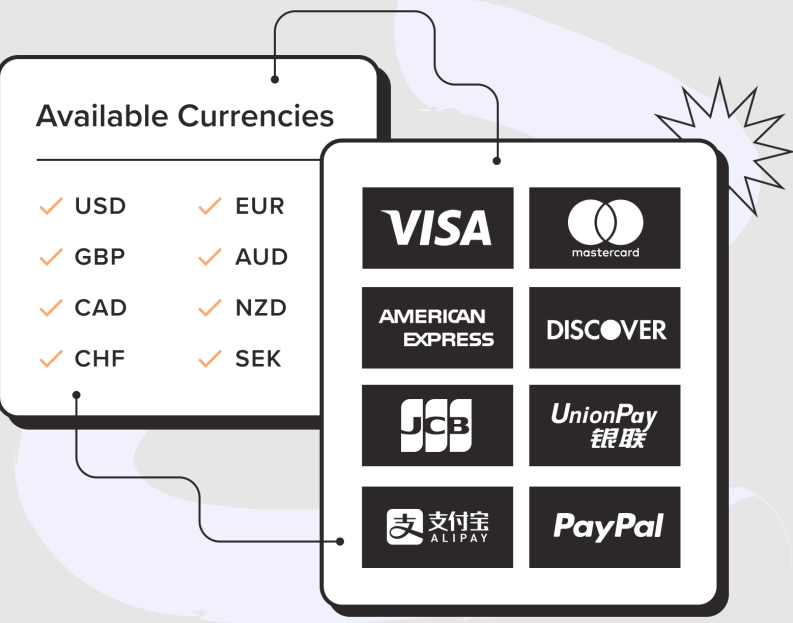

Localized Payment Methods: FastSpring helps the client switch seamlessly with global payments by changing to a local currency when required and featuring a wide range of payment methods.

Smart Payment Routing: Customers don’t have to contact your support team in case of a failed payment as FastSpring intelligent payment routing system uses a secondary gateway to ensure payment is successful.

Tax Collection and Subscription Management: Customers can opt for free trials, pause their subscriptions, use self-service portals, and more with the custom subscription option. This tool can also calculate sales tax, VAT, and GST during the checkout process and automatically update the rates if any changes are required.

Subscription Management

With the flexible subscription options, you can easily manage recurring plans by offering complete control to customers so they can cancel, pause, upgrade, downgrade, or change their billing intervals.

Flexible Billing: FastSpring provides a custom payment plan with the option to pause and get notified about future payments. This flexible approach might interest those who prefer something other than standard default payment plans.

Failed Rebills Recovery: Failed repayment on a subscription is a common occurrence in the eCommerce space. Fastspring automates failures with instant notifications, helping you to avoid a high churn rate and recapture revenue quickly.

Manage Free Trials: FastSpring allows you to customize your product’s trial period, allowing users to choose between a paid or free trial and the option to set the days.

Complete Control: You can set up a subscription using FastSpring in just a few clicks. Unless that is, you need more control – in which case you can integrate their subscription API, if required.

Reporting And Analytics

FastSpring provides insights into all your subscriptions and revenue, allowing you to check which products and plans are the best for your business.

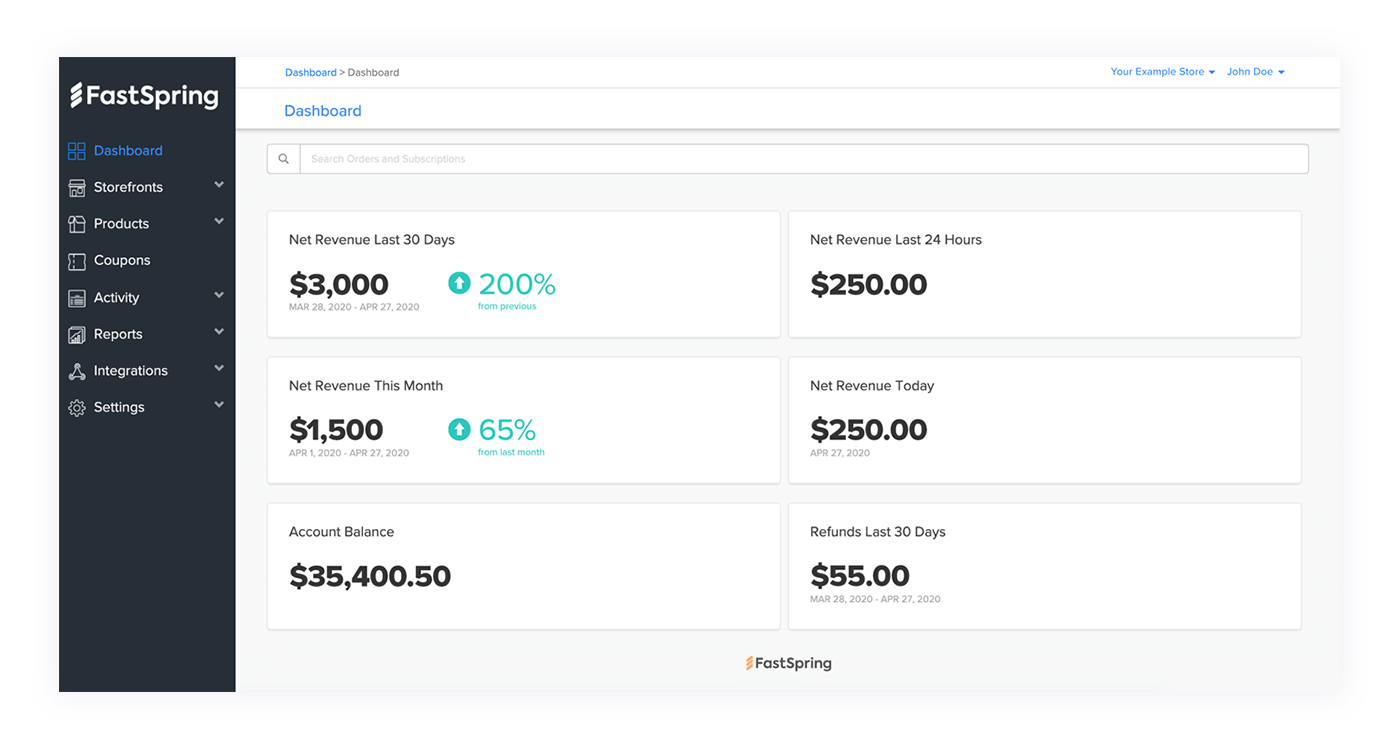

Simple Dashboard: This tool offers a simple revenue dashboard to help you easily understand the product’s performance. Learn more about transaction rates, net sales, and refund rates using the built-in widgets and see how each product contributes to your company’s revenue.

Save and Share Reports: With FastSpring reporting, you can customize the dashboard view and drill down to see reports regarding regions, products, and users. Save and export the reports in CSV, PNG, or XLSX format, and share these reports with anyone you want.

Security

FastSpring’s platform handles everything, including fraud prevention, managing chargebacks, and complying with current and new regulations to help your business expand its footprints.

Fraud Prevention: FastSpring partners with Sift (a company that ensures digital trust and safety), which conducts risk analysis using machine learning and AI to prevent fraud prevention. Owing to this partnership, FastSpring can improve approval rates and fraud detection to keep the entire payment process safe and secure.

Chargeback Management: This tool manages and reduces chargeback on your behalf with its built-in chargeback management features.

Affiliate Program

FastSpring has a global affiliate program and teams up with high-performing partners, allowing you to earn a commission on every paid user you deliver. The platform will help you set the best affiliate program that suits your unique needs, helping you expand your market and increase sales.

Manage B2B Orders

FastSpring improves your B2B orders by simplifying your billing operation and subscription and payment methods.

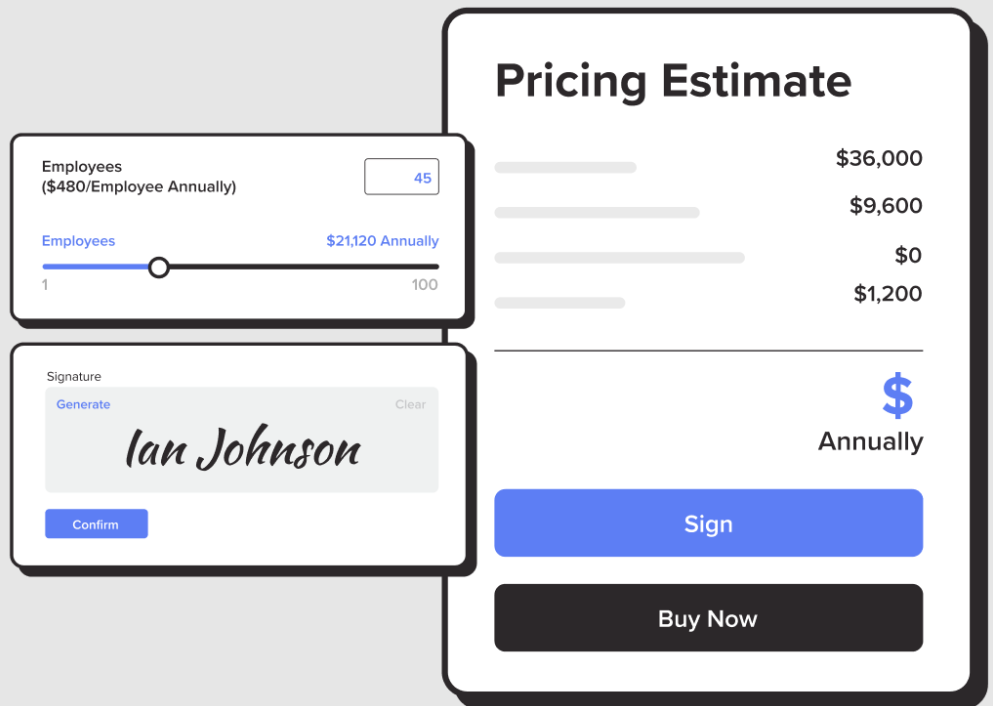

Seamless Buying Experience: With FastSpring digital invoicing, the customer buying experience might be described as smooth and continuous. Track purchases, create and manage customized quotes, and get real-time updates with this tool’s enhanced billing operations. You can put quote expiration and fulfillment terms, add a note for each quote, add tags, or add a coupon code discount option.

Custom Quotes

With the FastSpring interactive quoting tool, you can remove confusing pricing sheets by adding an all-in-one pricing option. This makes things easy for businesses offering plans based on customer usage, allowing them to choose a small, medium, and enterprise plan that suits them best.

Pros And Cons Of FastSpring

Pros

- Easy to setup

- Highly customizable

- Easy to learn using knowledge base and FAQ section

- Wide integration list

- Impressive security

- Multiple payment methods

- 23+ currency support

- Available in more than 200 regions

- More than $2 billion in transactions since 2022

Cons

- High credit card processing fees(8.9% or 5.9% of the value of the transaction)

- Payment management is not user-friendly, offering a poor user-navigation

- Third-party affiliate system

How To Setup And Use FastSpring

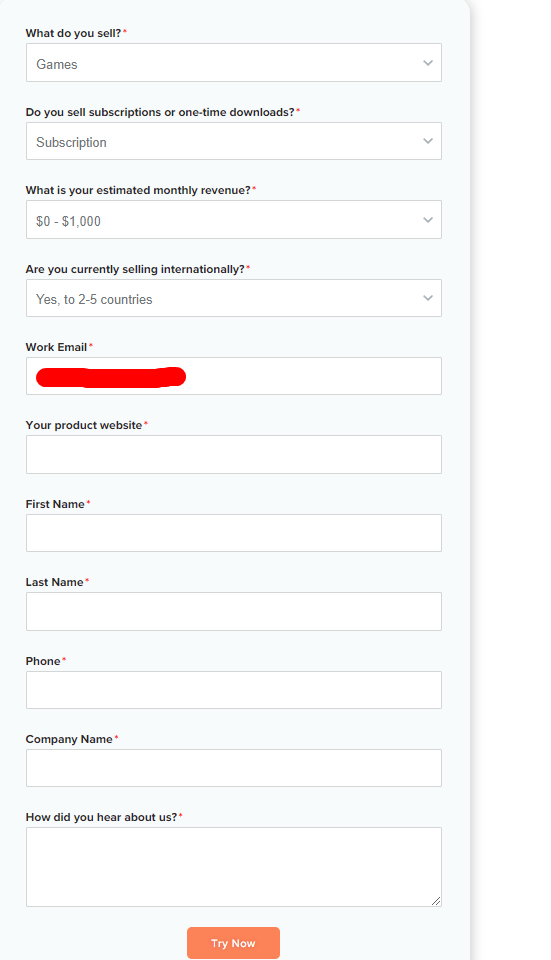

- Visit the FastSpring website and click “Try Now” or “Request a Demo.”

- You’ll see a small form asking you six questions; as you fill out the form, more questions will pop up asking about your website, name, and contact number.

- Once you are done providing the details, the platform will activate your free trial, allowing you to access the login page, where you can see your dashboard.

How To Get The FastSpring API

FastSpring asks you to sign an online contract and activate your account by confirming your email before you start receiving payments,

- Navigate to your dashboard and click on Integrations on the left panel.

- In the integrations window, select API Credentials, and click on Create to get an ID and password that is unique to your store.

FastSpring Integration

FastSpring provides powerful integration by partnering with the best third-party solutions like Nalpeiron, WordPress, and more.

Nalpeiron

Sign up for an account at Nalpeiron, integrate their service with FastSpring, and check your usage analytics, analytics on trial conversions, sales cycles, and more.

WordPress

FastSpring has a WordPress plugin that allows you to integrate your FastSpring Store with your WordPress website.

Impact

Impact provides affiliate marketing solutions, and with FastSpring integration, you can discover, connect with, and recruit a media partner directly from all around the world.

Mailchimp

With FastSpring integration, you can automatically sync customers from FastSpring to Mailchimp to try and win back customers who abandon their carts.

LicenseSpot

FastSpring integration allows you to create licenses, send them to the customers with minimal coding, revoke the activations, and invalidate products remotely.

FastSpring Vs Stripe

Stripe and FastSpring are both excellent tools if you have an eCommerce platform and would like to accept payments online. They allow you to set customized subscription options and have an easy-to-understand and navigate dashboard. On TrustPilot, Stripe has more reviews and is considered a top-rated product.

FastSpring is an eCommerce platform that helps businesses in payment processing, and customer management. FastSpring helps fulfill orders without errors, with the help of features like subscriptions, automatic billing, and more.

Conversely, Stripe is a payment gateway only, helping businesses accept online payments. Stripe’s e-commerce functionality is limited in comparison to FastSpring, as FastSpring offers multiple payment methods like PayPal, Google Pay, and Apple Pay, while Stripe is more focused on debit/credit card payments.

In addition, FastSpring charges a fixed monthly fee that changes with your revenue amount, while Stripe charges are based on the transaction amount plus a fixed fee. However, Stripe is more user and developer-friendly for startups and FastSpring is ideal for businesses that want an all-in-one e-commerce solution.

Price

Both platforms lack a free version, but Fast Spring does offer a free trial at no charge, while Stripe has a starting price of $0.3.

FastSpring

- An 8.9% fee of the total transaction value of the transaction.

- A 5.9% fee of the total transaction’s value, plus 95 cents for each processed transaction.

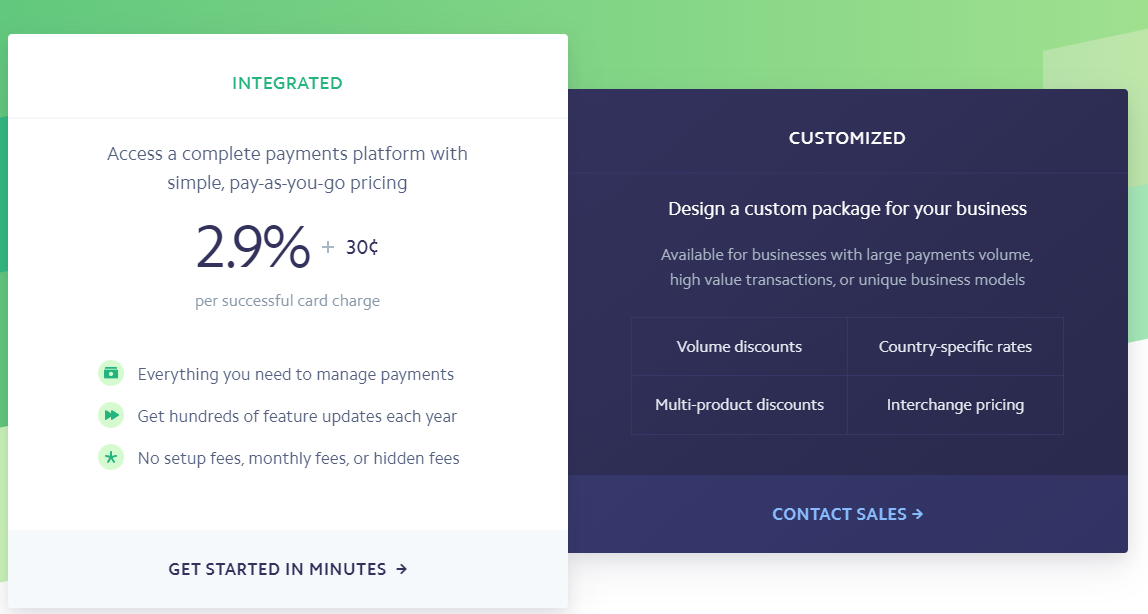

Stripe

- 2.9% + 30 cents per successful card charge or you can get a customized package.

- 2.7% plus 5 cents for in-person transactions.

- 3.4% plus 30 cents for manually keyed transactions.

- 3.9% plus 30 cents for international cards or currency conversion.

- $2 per account for Stripe Express.

Product Support Options

Both platforms offer email, FAQs/forums, blogs, and chat so customers can communicate with them. The most striking difference is that Stripe has a 24/7 live chat available, while FastSpring doesn’t.

Features

This is where FastSpring excels by offering 45 features, including CRM, Cataloguing/Categorisation, Discount Management, Email marketing, and more. In comparison, Stripe has only 37 features to offer, which include cryptocurrency processing, in-person payments, etc.

FastSpring Vs. Stripe: Comparison Chart

| Stripe | FastSpring | |

| Ease of use | ⭐⭐⭐⭐ (4.5) | ⭐⭐⭐⭐ (4) |

| Features | ⭐⭐⭐⭐ (4.5) | ⭐⭐⭐⭐⭐ (5) |

| Customer Support | ⭐⭐⭐⭐ (4) | ⭐⭐⭐⭐ (4.5) |

| Value for money | ⭐⭐⭐⭐ (4) | ⭐⭐⭐⭐ (4.5) |

| Functionality | ⭐⭐⭐⭐ (4) | ⭐⭐⭐⭐ (4.5) |

| Pricing | 2.9% + 30 cents per successful card charge | 8.9% per transaction 5.9% + 95 cents per transaction |

| Pros | Transparent pricing with no setup Highly customizable checkout flow Supports a wide variety of currencies Easy and quick to set up | Safe payment methods Developer support Multi-store management Usage monitoring CSS control Better coupon management Checkout popup |

| Cons | Limited functionality for in-person retail businesses and restaurants Requires a software developer | No free version No free trail Can’t sell physical goods |

Deployment

FastSpring is only available as a Cloud, SaaS, and web-based program with no mobile app for management; whereas the Stripe Dashboard app is available for Android and iOS devices.

Training

Stripe trains its customers using webinars, documentation, and videos, whereas FastSpring only uses documentation and videos.

Best For

If you want a complete e-commerce solution to sell your online products, which also includes features like subscription billing and CRM features, FastSpring is the best option might be the best option for your business.

You might prefer Stripe if you want a payment getaway to manage your online business payments for the products, including physical goods, but don’t want a CRM.

All-In-One Package

FastSpring seems more geared towards a fully encompassed solution, providing additional benefits such as currency localization, B2B invoicing, payment methods, tax collection, and more.

FastSpring Pricing Plans

FastSpring provides a refreshing flat price model, free of any hidden fees for add-ons. You can contact their sales and fill out the form to get a quote.

This platform charges per transaction, so you’ll have two options here.

- An 8.9% fee on the total value of the transaction.

- 5.9% fee of the value of the transaction plus 95 cents on every transaction processed.

Companies Using FastSpring

Over 3200 software and SaaS companies use FastSpring for secure and customized online payments. This platform is extremely convenient for those companies who want to offer customized subscription plans to their customers. These companies include Adobe, Intel, Ahref, RankMath, SignalHire, and more.

Capture One is a photo editing software available on a monthly and annual subscription and one-time purchase, which has seen a 40% increase in conversions and a 50% reduction in resources since using FastSpring.

SocialBee is a social media management tool available in three subscription plans with a 14-day free trial. FastSpring helped them focus more on building the product by handling their payment and administrative burden.

Ahref is an all-in-one SEO toolset that crawls the web, stores huge amounts of data, and makes it accessible via a simple user interface. FastSpring improved its subscription process easier by offering a simple four-step payment process.

Snov.io is an all-in-one CRM and outreach automation platform for lead generation, data and contact management, email verification, email sending, and email tracking. Fastspring helped them improve their sales through fraud prevention, including chargeback fraud and easy payment processing.

SignalHire is a platform that allows recruiters, sales professionals, and marketers to search for emails and phone numbers. With the help of FastSpring, their payment methods and processing became much faster and easier.

Rank Math is a WordPress SEO plugin that allows anyone to optimize their content with built-in suggestions based on best practices. Using FastSpring, Rank Math gave more control to the users, allowing them to change their payment methods, and customize their plans using Rank Math FastSpring Checkout page.

Sejda is a powerful PDF editing tool that allows you to make many changes to a PDF file without destroying it. Their subscription is powered by FastSpring, allowing them to take orders worldwide with multiple payment methods like Visa, Mastercard, PayPal, and American Express.

FastSpring And PayPal Collaboration

PayPal is included in the payment methods offered by FastSpring, with no fees to US vendors and a 2% fee up to a maximum of $20 per transaction to all non-US vendors for transfers to PayPal.

Final Words

With huge brands such as Adobe and Toshiba now using Fast Spring, their growing customer base serves as a healthy testament to the quality of service they offer. Feature-rich and full of practical functionality, Fast Spring is an impressive and quite satisfying platform, for various reasons.

The price might be an issue for many of you, however. While Fast Spring is, in our opinion, a fantastic product worthy of consideration, it does verge on the expensive side. You obviously need to decide if the premium pricing at play here is worth the features. It is a tough call.

The decision really comes down to one simple thing: if you are going to make use of the wide range of features, they could be worth the extra expense. For those of you who are not providing SaaS and follow a more traditional e-commerce sales model, you might be better off exploring cheaper alternatives.

Great product though, we have to say – regardless of pricing.