If you’re navigating the thrilling world of startups, you probably already know that funding is the lifeblood that keeps the heart of a startup pumping. It’s the key that opens doors to top-tier talent, revolutionary R&D, and a buffer against the inevitable hurdles along the startup journey.

But let’s be honest, securing that golden funding isn’t a walk in the park. It can turn into a complicated dance involving a ton of legal jargon, lengthy negotiations, and potential landmines for both starry-eyed startups and eagle-eyed investors.

But here’s the good news! There’s a not-so-secret weapon that has emerged in recent years to simplify this dance – it’s called the Simple Agreement for Future Equity, or more commonly, the SAFE note.

In this guide, we’re going to spill the beans on SAFE notes, breaking them down piece by piece so you can understand exactly what they are, how they work, and why they might just be the game-changer you’re looking for. So, buckle up and let’s dive in!

Definition Of A SAFE Note

Investing in startups, particularly through Simple Agreements for Future Equity (SAFE) notes, has surged in popularity. The Simple Agreement for Future Equity (SAFE) was invented by Y Combinator in 2013 as a new alternative to convertible notes.

The idea was conceived by Y Combinator partner and lawyer Carolynn Levy. The goal was to create a fundraising tool that had the advantages of convertible debt but without some of its disadvantages.

Convertible notes made fundraising easier for startups, but they had some inconveniences. For example, they required negotiation of details that would not be necessary if the startup sold stock to an investor. Instead, convertible notes gave investors the right to buy stock in a future equity round, on whatever the terms turned out to be.

However, convertible notes were treated as debt, and there were regulations about it, such as the requirement for a term and an interest rate not too far from market rates. The interest on convertible notes complicated conversion, and the fixed term of the debt caused extra work when it had to be extended.

SAFE, on the other hand, is essentially convertible debt without the debt. Similar to a convertible note, a SAFE provides the investor with the option to purchase stock during an equity round.

A SAFE can either have a valuation cap or be uncapped, just like a note. However, instead of purchasing debt, the investor obtains something more similar to a warrant. Therefore, there is no need to fix a term or decide on an interest rate.

The creation of SAFE was driven by the desire to make the process of raising early-stage capital more founder-friendly and in line with the philosophy of equity-based venture capital, rather than debt.

The SAFE document was designed to be simple and easy to read, even for those who didn’t have a strong grasp over legalese. It was first put into use in Y Combinator’s 2014 winter batch and has since become a popular tool for early-stage fundraising.

How Does A SAFE Note Work?

- Functioning Of SAFE Notes

It operates as an investment agreement or equity deal between a startup and an investor. Initially, an investor supplies the startup with capital. But instead of immediately receiving equity, the investor receives a SAFE note, which can be considered as a promise for future equity in the company.

- Triggering Events For Conversion Of SAFE Notes

Conversion of the SAFE note into equity isn’t immediate but happens at a later “triggering” event. Usually, this event is the next financing round where the startup sells equity (a priced round). However, other triggering events could be the sale of the company or an Initial Public Offering (IPO).

- Conversion Process Of SAFE Notes Into Equity

When the triggering event takes place, the SAFE note converts into equity. The number of shares the investor receives is determined by the terms of the SAFE note, with the valuation cap and/or discount rate often meaning that the SAFE investor gets a lower price per share than investors participating in the current round.

After the conversion, the SAFE note no longer exists, and the investor becomes a standard equity holder, typically holding preferred stock. As a holder of equity, the investor has the same rights as other equity holders in the same stock class.

Key Terms And Conditions In A SAFE Note

Understanding the key terms and conditions in a SAFE note is vital as it enables informed decision-making about potential future investments made, and it directly impacts your financial and ownership stake in a startup.

This knowledge can influence negotiations, helping you ensure a fair deal and protect your interests. Here are key terms to be aware of:

1. Valuation Cap

This is a predetermined fair valuation cap that sets the maximum price of convertible security at which the SAFE can convert into equity. It protects the investor by ensuring that they receive equity at no more than this valuation cap, even if the company’s actual valuation is higher at the time of conversion.

2. Discount Rate

This term provides a discount on the price per share at which the SAFE note converts into equity, relative to the price paid by future investors, in the next equity financing round. It offers an incentive to early SAFE investors by providing them with more equity for their investments in future priced round.

3. Pro Rata Rights

This is an optional term that gives SAFE note holders the right to maintain their percentage ownership in future financing rounds by buying additional shares.

4. Converting Events

A converting event encompasses three main scenarios in which investors can cash out: these are the insolvency event, the liquidity event, and the dissolution event.

Insolvency Event

This typically refers to a situation where a company is unable to meet its debt obligations, i.e., it can’t pay off the debts it owes. Insolvency can lead to legal procedures, including administration, liquidation, receivership, or bankruptcy.

Liquidity Event

A liquidity event is a situation or an event that allows investors to cash out or sell their stake in a company. This could be a sale of the company (acquisition by another company), an initial public offering (IPO), a merger, or another event that makes the investment liquid (i.e., convertible into cash).

Dissolution Event

This refers to the formal closure or winding up of a company’s operations. Dissolution can be voluntary, where the company’s owners decide to close down, or involuntary, where external entities (like creditors or regulators) force the closure. After dissolution, the company ceases to exist, and its assets are sold off to pay any remaining liabilities. Any leftover assets can then be distributed among the shareholders.

5. Equity Type

SAFE notes usually convert into preferred stock, which often carries additional rights and protections compared to common stock. However, the specifics will depend on the terms of the SAFE and the company’s equity structure.

As always, it’s crucial to have legal counsel review any investment agreements, including SAFE notes, before they’re finalized.

6. Early Exit Payback

This is a clause that may be included in investment agreements that states that, in the event of an early exit (such as a sale of the company), the investor has the right to be paid back their investment, often with a premium (an extra return that the investor is entitled to receive, over and above their initial investment, in the event of an early exit), before the proceeds of the exit are distributed to other shareholders.

This offers some protection to the investor if the company is sold before the investor has a chance to realize a return on their investment.

7. Most-Favored Nation Provisions

This is a clause that investors may include in their agreements with a company which ensures that if the company later offers better terms to another investor, the investor with the most-favored-nation clause will be entitled to those better terms as well. This clause is used to protect early-stage investors from being disadvantaged by terms offered to later-stage investors.

Categories Of SAFE Notes

SAFE notes can be broadly classified into two categories based on whether or not they have a valuation cap.

1. Capped SAFE Notes

A capped SAFE note has a valuation cap set in the agreement. This cap represents the maximum company valuation at which the notes convert into equity. It effectively sets a limit on the company’s value for the purposes of conversion, which can protect early investors from excessive dilution during a high-valuation financing round.

2. Uncapped SAFE Notes

An uncapped SAFE note does not have a valuation cap. This means the SAFE note will convert into equity at the price set by the next financing round, regardless of the company’s valuation.

Uncapped SAFE notes are advantageous for the startup as they don’t limit the conversion valuation. However, they pose more risk for the investors as there’s no cap to protect against high-valuation dilution.

How To Use Uncapped And Capped SAFE Notes (Scenario Example)

Imagine a startup company named TechRise.

1. Capped SAFE Note

TechRise raises an initial investment of $500,000 through a SAFE note with a valuation cap of $5 million. Now let’s assume that the company has 1,000,000 outstanding shares. With this cap, the SAFE note implies a price per share of $5 ($5,000,000 valuation / 1,000,000 shares).

Therefore, the SAFE note investors get 100,000 shares for their $500,000 investment ($500,000 investment / $5 per share).

A year later, TechRise conducts a priced equity financing round at a $10 million pre-money valuation. Despite this valuation, the SAFE note will convert as if the company’s valuation were $5 million.

So, the SAFE note investor’s equity remains at 100,000 shares out of now 2,000,000 total shares (original 1,000,000 + 1,000,000 + 100,000) new shares issued in the equity financing round), or 4.76%.

2. Uncapped SAFE Note

TechRise raises an initial investment of $500,000 through an uncapped SAFE note. A year later, TechRise conducts a priced equity financing round at a $10 million valuation. In this case, the SAFE note converts into equity at the price set by this round.

The new valuation implies a price per share of $10 ($10,000,000 valuation / 1,000,000 shares). Therefore, the SAFE note investors get 50,000 shares for their $500,000 investment ($500,000 investment / $10 per share).

The SAFE note investor’s equity is now 50,000 shares out of 2,050,000 total shares (original 1,000,000 + 50,000 + 1,000,000 new shares issued in the equity financing round), or 2.44%.

Types Of SAFE Notes

SAFE: Cap, No Discount

This type of SAFE note includes a valuation cap but does not have a discount rate. It protects the investor if the startup’s value skyrockets between the time of SAFE investment and the equity financing round. However, there’s no discount in this scenario, which means the investor doesn’t get the benefit of purchasing shares at a price lower than what’s offered during the equity financing round.

SAFE: Discount, No Cap

This SAFE note has a discount rate but does not include a valuation cap. The discount allows SAFE note holders to convert their investment into equity at a rate lower than the price offered to new investors in the next funding round. However, without a cap, if the company’s valuation rises dramatically, the investor may receive a smaller portion of the company than they might have anticipated.

SAFE: Cap And Discount

This SAFE note includes both a valuation cap and a discount rate. During the conversion to equity, the SAFE note holder benefits whether the company’s valuation at the next financing round is above or below the cap, the investor benefits by gaining a potentially larger share of the company than they would have without these terms.

SAFE: MFN, No Cap, No Discount (Most Favored Nation)

MFN stands for “Most Favored Nation.” This type of SAFE note doesn’t have a valuation cap or a discount rate. However, it includes a clause that gives the investor the right to adopt any more favorable terms that the company might offer to other investors in the future.

It protects the investor by ensuring they are treated as favorably as the most favorably treated investor in any subsequent SAFE notes or other convertible securities issued by the startup.

Whether this is your initial experience with SAFEs or you are already familiar with it, we recommend going through Y Combinator’s SAFE User Guide.

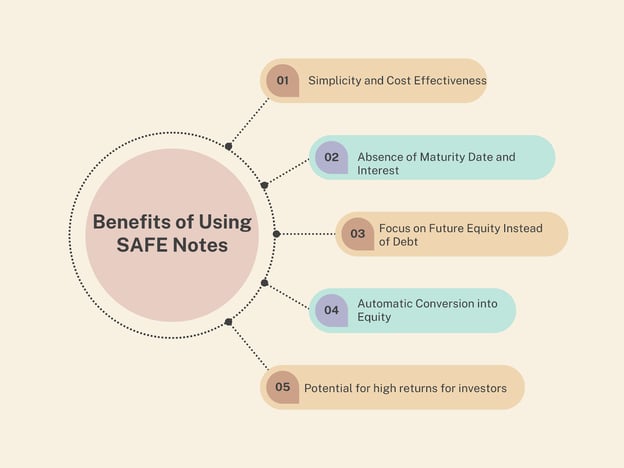

Benefits Of Using SAFE Notes

Convertible notes have long been a staple in startup financing, but recently, SAFE notes have gained traction among Silicon Valley investors. For new businesses, SAFE notes address challenges with traditional financing methods with a more efficient, flexible instrument that benefits both startups and investors.

By understanding these benefits, stakeholders can facilitate a more streamlined and successful fundraising process.

A. Simplicity And Cost Effectiveness

- SAFE notes simplify startup financing, eliminating elements like interest accrual, maturity dates, or loan repayments.

- Standardization of SAFE notes minimizes negotiation time, reducing legal fees and overall fundraising costs.

B. Absence Of Maturity Date And Interest

- SAFE notes do not have a maturity date or interest rates, providing startups with financial flexibility.

- Conversion into equity occurs during pre-specified triggering events, allowing startups more control over financial strategies.

C. Focus On Future Equity Instead Of Debt

- SAFE notes focus on future equity, not current debt, relieving startups from debt servicing.

- This structure aligns investor returns with startup success, fostering collaboration and focus on long-term growth.

D. Automatic Conversion Into Equity

- SAFE notes automatically convert into equity at predetermined triggering events, simplifying the transition from early-stage funding to later-stage equity financing.

- Automatic conversion provides a clear path from investment to equity ownership, reducing administrative complexities.

E. Potential For High Returns For Investors

- Investing in startups through SAFE notes offers significant potential for high returns due to the risk-reward dynamics of early-stage companies.

- The valuation cap and discount rate terms can provide early investors with more substantial equity stakes, potentially yielding significant returns.

Challenges And Criticisms Of SAFE Notes

While SAFE notes have transformed startup financing by providing a simpler and more adaptable alternative to traditional equity and debt financing, they also come with potential drawbacks and challenges. Below are a few key criticisms associated with SAFE notes:

1. Lack Of Investor Protection

Critics argue that SAFE notes might leave investors less protected compared to traditional investment instruments as they don’t come with the same obligations and safeguards. Also, SAFE note holders, unlike equity holders, do not have voting rights or entitlement to dividends.

2. Valuation Uncertainty

Since SAFE notes postpone valuation until a priced equity round, this creates a level of uncertainty for both founders and investors. This uncertainty can potentially cause difficulties in predicting dilution effects and truly understanding the cost of capital.

3. Complexity In Conversion

Although SAFE notes are simple, the conversion process can be complex, especially when multiple SAFE notes with different terms have been issued. The complexity is further increased when determining the conversion price per share, applying discount rates, and valuation caps.

4. Risk Of Overuse

There’s a risk of over-reliance on SAFE notes by startups, leading to challenges in relation to dilution. When a large number of SAFE notes convert into equity, substantial dilution for existing shareholders can occur, impacting the startup’s founders and early-stage investors.

5. Potential For Misuse

The simplicity of SAFE notes could lead to their misuse due to a lack of full understanding of their implications. Both founders and investors must ensure they fully comprehend the terms and conditions of a SAFE note before proceeding.

Despite these challenges, many believe the benefits of SAFE notes, including their simplicity, cost-effectiveness, and flexibility, outweigh the potential drawbacks. Nonetheless, startups and investors should familiarize themselves with SAFE notes’ intricacies and seek legal and financial advice when dealing with such instruments to mitigate potential risks.

Understanding The Functionality Of SAFE Notes In Successful And Unsuccessful Business Scenarios

1. If The Startup Flourishes

Let’s assume that Investor A has invested $100,000 in Startup X via a SAFE note, with a $1 million valuation cap.

Scenario: Startup X flourishes and conducts its next equity financing round, where it’s valued at $5 million (post-money).

In this case, Investor A’s SAFE note would convert into equity, and the valuation cap would come into effect. Instead of owning a 2% share ($100,000/$5 million), Investor A would get a 10% share ($100,000/$1 million), as the lower cap provides a greater proportion of equity. Thus, if the company continues to grow and eventually goes public or is sold, Investor A stands to make a significant return on its investment.

2. If The Startup Bankrupts

Now, let’s consider that Investor A has also invested $100,000 in Startup Y via a SAFE note.

Scenario: Unfortunately, Startup Y struggles to generate revenue and eventually declares bankruptcy.

In this scenario, the SAFE note does not offer the same protections as debt financing. As an equity-like instrument, the SAFE note would not entitle Investor A to any debt repayment in the event of bankruptcy.

In a typical bankruptcy proceeding, assets are sold off to repay debts, but equity holders (which is what Investor A effectively is) are at the end of the line and usually don’t receive anything unless all debts have been paid off. In most cases, this means that Investor A would lose their entire investment.

Comparison With Traditional Financing Methods

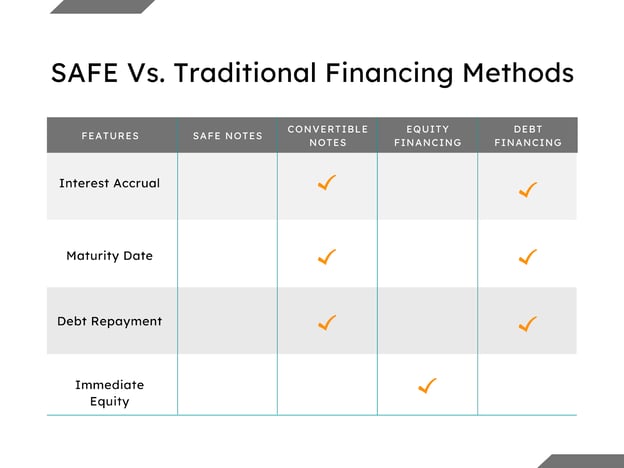

1. Convertible Notes

One financing method that SAFE note is usually compared with is convertible note or CLA (convertible Loan Agreement). And while SAFE notes share some similarities with convertible notes (as both instruments convert to equity in the future), they have their differences.

SAFE notes are not considered debt, do not accrue interest, and do not have a maturity date. In contrast, convertible notes carry interest , are considered debt, and have a maturity date.

2. Equity Financing

Unlike traditional equity financing, where investors receive shares immediately upon investing, a SAFE note does not provide immediate equity. Instead, the investor gets the right to purchase equity in a future financing event. This eliminates the need to negotiate valuation at the time of investment, making the process quicker and simpler.

3. Debt Financing

Unlike traditional debt financing, SAFE notes do not involve repayment of principal or even interest payments. Instead, the investor’s return is contingent on a future equity financing event. This means startups don’t carry the liability of a loan and don’t face the pressure of regular repayments.

Convertible Notes: When To Use One Instead Of A SAFE Note

You might consider using a convertible note instead of a SAFE note in the following instances:

Interest Accrual Preference

If accruing interest on the investment until it converts into equity is acceptable to you, then a convertible note may be a better fit.

Investor Protections

If your investors prefer a debt instrument because of the protections it offers (for example, they’ll be paid back before equity holders in a liquidation event), a convertible note may be more suitable.

Tax Considerations

In some jurisdictions, interest accrued on convertible notes may be tax-deductible. If this is the case, it might be an appealing feature for your investors.

Negotiation Flexibility

If you and your investors desire more flexibility to customize your agreement’s terms, a convertible note might be better as SAFE notes are typically standardized. However, note that this could potentially require more legal assistance due to complex terms.

While these factors might tilt the balance towards convertible notes in certain situations, it’s important to note that neither instrument is universally superior. The choice between SAFE notes and convertible notes depends heavily on the specific circumstances and needs of the startup and its potential investors, emphasizing the importance of proper legal and financial advice.

Conclusion

SAFE notes represent a significant innovation in the field of startup financing. They also have a lot with other convertible securities, like being included in the company’s capitalization table. They provide a simpler, more flexible way for early-stage companies to raise capital compared to traditional methods like equity or convertible notes.

However, it’s important to recognize that SAFE notes also have their challenges and criticisms. Issues like lack of investor protection, valuation uncertainty, complexity in conversion, risk of overuse, and the potential for misuse can create difficulties for both parties involved.

Ultimately, while SAFE notes offer a unique approach to early-stage financing, their use should be carefully considered and implemented with the guidance of financial and legal advisors. With proper understanding and appropriate usage, SAFE notes can be a valuable tool in the world of startup financing.