Navigating the business world can often seem like an intimidating task, especially when it comes to securing the funds needed to grow your venture. One of the most accessible and flexible options available to small business owners is an SBA (Small Business Administration) loan.

However, the process can appear complex and intricate for newcomers. This article aims to simplify it for you, guiding you through the step-by-step process of applying for a small business administration loan.

What Is A Small Business Administration (SBA) Loan?

A Small Business Administration loan is a type of financial assistance that is provided by the federal government in order to help small businesses overcome certain challenges and create stronger, more successful companies.

They are an important source of working capital for many small business owners and can provide the needed financial resources to build and expand a business. In fact, the business loans guaranteed through traditional SBA lending programs exceeded $43 billion, in 2022 alone.

The most appealing feature of an SBA loan is that it typically provides financing with lower interest rates than other types of business loans. This makes them desirable for entrepreneurs who need extra financial support to get their businesses up and running.

How Can An SBA Loan Help Me Start A Business?

An SBA loan can be a great source of funding for entrepreneurs looking to start a business in any area, whether for purchasing supplies or meeting other financial needs. With this loan program, you can access large loan amounts of capital from investors and other sources who wouldn’t lend money otherwise.

The SBA also provides alternative financing options, such as lines of credit, in times when the traditional lenders—such as banks and credit unions—are not willing to take on additional risks at or below the prime rate, acting as a safety net and essential tool for small business owners.

Furthermore, SBA loans can provide relief for businesses unable to secure traditional loans, such as disaster loans, mortgages, or equity-based financing.

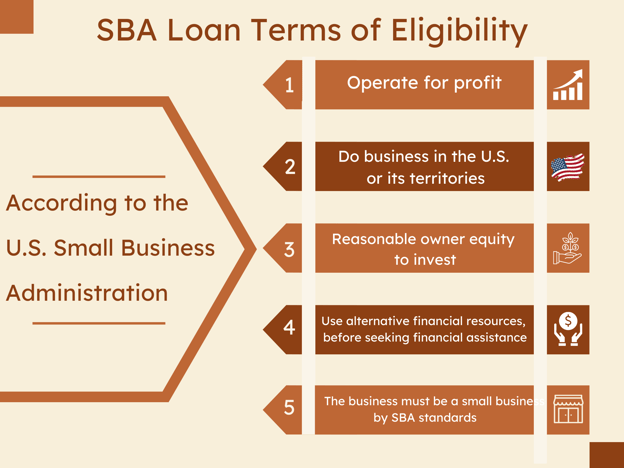

Types Of Eligibility Requirements For An SBA Loan

When applying for SBA loans, you must meet certain eligibility requirements. First off, your startup must meet SBA’s definition of what a small business is.

You must be a US citizen or permanent resident, have a viable business plan, and have sufficient experience in the team or industry related to the funded business. Additionally, you must show that you have enough collateral to secure the loan, such as a mortgage stake in the business you fund, as well as suitable creditworthiness.

While meeting SBA loan eligibility requirements can sometimes be challenging and restrictive, understanding these criteria is essential for entrepreneurs seeking capital investments and can improve their chances of receiving an SBA loan and setting up their business ventures successfully.

How Does An SBA Loan Work?

An SBA loan operates by disbursing the entire loan amount in increments, rather than as a lump sum like a down payment, such as those from a bank. This way, small business owners can receive the money they need, for example, $2 million, in a few installments, without taking out much money all at once.

The loan proceeds received from an SBA loan program may be used for practically any business-related purpose such as purchasing equipment or inventory, paying employees, expanding your business into new markets, or even refinancing existing debt.

Exploring The Different Types And Amounts Of Loans Available

The most common type of small business loan is the 7(a) Loan Program which offers a maximum loan amount of $5 million for financing eligible small businesses. However, the SBA also provides 504 Loans, Microloans, Community Advantage Loans, and more, depending on your business needs.

The amount you qualify for will depend on the type of loan program you apply for, as well as your current financial situation and how well you manage your finances.

For instance, if your business meets certain criteria, such as having a low net worth or a limited operating history, you may be eligible for an SBA Express Loan, which offers funding of up to $350,000 in working capital.

However, applying for an SBA Export Loan could provide up to $5 million in working capital specifically for export sales for those looking to increase their product exports from the United States. You might also want to consider applying for a certificate of approval for a refinance, term loan, or other finance alternatives that best suit your business needs.

New Development And Improvements In SBA Loan 2023 (Expand Access To Capital For Small Businesses)

On May 11, the United States SBA (Small Business Administration) published new updates to the SBA 7(a) and 504 programs. Based on the information provided, here are the key updates to the SBA 7(a) and 504 programs:

- Streamlined Eligibility Determination: Starting August 1, 2023, the SBA will determine eligibility for SBA loans in-house through new technology. This aims to reduce the burden on SBA lenders and streamline operations, allowing more lenders to focus on their customers and increase lending capacity, especially for small-dollar lending.

- New Fraud Review: The SBA will implement advanced data analytics, third-party data checks, and artificial intelligence tools for fraud review on all loans in the 7(a) and 504 Loan Programs before approval, starting August 1, 2023. This is a significant change as loan approval in these programs has largely been delegated to lenders, who approve loans based on SBA rules without the agency checking for fraud indicators upfront.

- Simplified Guidelines for Lenders: The SBA has published new, simplified guidelines for lenders on how to make SBA loans. Under the new rules, SBA lenders can now use their existing credit policies for similarly sized non-SBA loans up to $500,000. This aims to expand the number of credit-worthy business owners accessing SBA loans, especially small-dollar loans.

- Cutting Red Tape: The SBA has outlined new procedures in a Procedural Notice that removes the requirement for a Loan Authorization, a set of forms that have become duplicative and unnecessary for lenders.

- Clarified Affiliation Standards: The SBA has published details simplifying and clarifying affiliation standards to ease the burden on small business owners and lenders and make clear who qualifies for an SBA loan.

- Accepting New Lender Applications: The SBA will accept new lender applications in the Small Business Lending Company (SBLC) program from June 1 until July 31. This will allow the existing program to provide loans to an expanded number of small businesses. SBA will name up to three new SBLCs.

- Simplified Lender Guidelines: The SBA will continue to post updates, including simplified lender guidelines on lender participation, servicing, and liquidation.

These updates aim to modernize the loan programs, increase access to capital for small businesses, and ensure the integrity of the loan approval process.

Advantages And Disadvantages Of Taking Out SBA Loans

Before taking out an SBA loan, it’s important for startups to understand the advantages and disadvantages of taking out such a loan.

To begin with, the biggest advantage of getting SBA loans is that your business may be more likely to qualify for an SBA loan relative to other types of (non-SBA) loans due to the guarantee from the Small Business Administration. This can particularly benefit family-owned businesses, veterans, or those amid expansion.

Rates of SBA loans are typically much lower than those found in alternative sources because the government takes on part of the loan amount risk of default, which can save you in expenses related to loan purchases.

Additionally, SBA loan terms are often easier to manage than other loan options, where repayment periods can extend for up to 25 years in some cases, providing more flexible and manageable loan terms.

On the flip side, SBA loans usually come with longer terms and more complex paperwork than other types of financing. Approval and funding times are also longer than credit cards or merchant cash advances due to the need for detailed reviews by multiple lenders.

Moreover, SBA lenders can come with higher qualification criteria than other financing options which can make them harder for borrowers to qualify for.

Applying For SBA Loans

1. Make sure you are eligible by researching the requirements on the U.S. Small Business Administration’s website.

2. Gather all required documents: tax returns; financial statements such as balance sheets and income statements for your business; business plan with details about employees, industry prospects, and competitive landscape; cash flow projections; collateral such as fixed assets such as real estate or equipment; personal financial history including credit reports and other documents deemed necessary by lenders.

3. You could also find lending partners – banks, credit unions, or non-bank lenders – specializing in providing financial assistance loans backed by the SBA. Check their website to compare terms and qualifications before deciding on a partner.

For more information on finding an SBA-approved lender that caters to your specific needs, such as those for family-owned businesses or veterans, check out their resource page here.

4. Once you submit your application to a lender of your choice, they will review it and then send it to the SBA for further review (but note that only certain loans require SBA approval – like the CDC/504 loan and the 7(a) loan).

During this process, the lender may interview you about any details included in your loan request and contact any third-party references you provided in your application forms.

The amount of time it takes from start to finish varies but generally takes between four weeks to three months if all necessary documents are provided in full after initial submission. If everything is in order, you should get the SBA-guaranteed loan distributed within a week of final approval!

Frequently Asked Questions Answered

What Type Of Loan Best Suit Startups?

For startups, SBA 7(a) loans are often a suitable option. These loans, backed by the U.S. Small Business Administration, are designed to cater to small businesses that may face difficulties qualifying for traditional business loans due to their newer status or risk factors.

They offer competitive interest rates and flexible terms, making them a beneficial choice for startups seeking funding.

A Business Line of Credit is another type of loan suitable for startups. It is a flexible borrowing option for startups and other businesses. Instead of receiving a lump sum of funds like a traditional loan, a business line of credit allows the company to draw from a set amount of funds whenever needed.

The borrower only pays interest on the money they’ve withdrawn, not the entire credit limit. This is particularly beneficial for managing cash flow, dealing with unexpected expenses, or financing short-term business needs. However, business lines of credit often require a solid credit history, and the interest rates may be higher than those of more traditional loans.

What Documents Are Needed To Apply For An SBA Loan?

To apply for an SBA loan, you will need to provide certain documents which may include your business plan, financial statements (such as income statements, balance sheets, and cash flow statements), personal tax returns, credit reports, and a list of collateral against which the loan is being secured.

Depending on the type of loan you are applying for, you may need additional documentation, such as leases or contracts.

What Fees Are Associated With SBA Loans?

- Taking out an SBA loan can come with certain fees, many of which are semi-optional. These fees include application fees, closing costs, servicing fees, early discharge fees, and prepayment penalties.

- Application fees are generally required to cover the costs of processing the loan application. This fee is usually not refundable and typically ranges from 1% to 4% of the maximum loan amount.

- Closing costs consist of legal fees, title search fees, filing charges, and appraisal fees. Again, these costs vary depending on the size of your loan. But it usually costs anywhere from $11,752 to $48,0000.

- Both the lender and the SBA charge servicing fees to ensure that the loan is running smoothly. They are often charged as either a fixed fee or a percentage of the maximum amount. Loan service fees typically range from 0.25% to 0.75% of the remaining balance on your loan at each billing cycle.

- Early discharge fees may be levied if you decide to pay off your loan ahead of schedule and before its maturity date. Prepayment penalties may also be applied if you decide to pay off a guaranteed portion of your loan too soon. Typically, they can range from 1% to 5% of your total loan balance.

Conclusion

And there we have it – the roadmap to applying for an SBA loan. It’s not just about the application process, it’s about the preparation and clarity on how those funds will be used in your startup. You’ve got to remember, the SBA wants to see your business succeed as much as you do!

From determining the right kind of loan and assembling your documents to drafting a solid business plan, each step is a crucial rung on the ladder toward securing your funding. And don’t forget, patience is key. The process can be time-consuming, but it’s all part of ensuring that the loan is the right fit for you and the lender.

And remember, you’re not alone in this journey. You could still contact resources like loan experts, SBA district offices, or Small Business Development Centers. They can also provide invaluable guidance and help you navigate the process.

So, don’t wait around. If your startup needs that financial boost to take it to the next level, apply for an SBA loan. Secure the funds you need and make your business dreams a reality. Best of luck!