For startups, there are unique challenges that come with getting off the ground – and setting the CEO’s compensation is no different. It’s a delicate balance between providing enough incentives to attract and retain top talent while ensuring the financial sustainability of the startup.

In this guide, we’re going to shed light on how to establish an average salary for startup CEOs, utilizing statistics and proven methods to help determine the right compensation package.

The Role Of A CEO In A Startup

Determining the proper pay for a startup CEO requires a deep understanding of their role within the organization. As the driving force behind the company, a CEO’s responsibilities encompass setting strategic direction, managing daily operations, and nurturing the startup’s culture.

Furthermore, they build and lead the team, make pivotal business decisions, and secure funding from investors. Understanding the intricacies of the CEO’s pay becomes even more crucial during the startup’s early stage.

Companies often face a complex balancing act, needing to fairly pay their leaders while also maintaining a lean budget for business operations and growth.

When determining a startup CEO’s salary, having these multifaceted responsibilities at the back of the mind helps. Of course, along with the said responsibilities the industry standards, financial situation of the startup, the CEO’s experience and skills, and the risk and pressure associated with leading a new venture all should be accounted for and will be discussed soon enough.

Factors Influencing Startup CEO Salaries

Navigating the process of determining a startup CEO’s pay can be a complex task. While the desire is to attract and retain top talent with competitive packages, striking a balance with the startup’s financial realities is crucial. There are several key factors that come into play when devising an appropriate compensation strategy. Let’s have a look at them.

1. Performance Metrics

The performance of the CEO often directly correlates with their pay. This can include the company’s growth rate, profitability, or reaching specified milestones.

By tying pay to performance, companies can align the CEO’s incentives with the company’s objectives and motivate the CEO to meet or exceed these goals.

2. Experience And Skill Set

A CEO’s experience and specific skills can significantly impact their pay. CEOs with a proven track record of success, extensive industry knowledge, or specialized skills might command higher pay than those without these attributes. The rarity of the skill set in the market can also drive up pay.

3. Company Size And Stage

The startup’s lifecycle stage can also impact the CEO salary. Early-stage startups, with limited resources, might not afford to pay such high salaries, choosing instead to offer equity in the company. As the company matures and secures more funding, the cash component of the CEO’s compensation often increases.

4. Funding Stage

Speaking of funding, capital raised by a startup and its cash flow situation significantly influences the CEO’s salary. The more capital and funding a startup secures, the more resources it has at its disposal to compensate the CEO.

Startups that have successfully raised substantial funds or those generating steady profits have greater leeway to offer more competitive pay to their CEOs.

5. Industry Norms

The industry in which the startup operates also significantly influences a startup CEO salary. This is due to the disparity in average pay for CEOs in different industries. The CEO salary for biotech companies, for example, is usually higher than for the CEO salary in ecommerce companies.

By comparing what similar companies in the same industry offer, startups can benchmark and guide their CEO’s compensation.

6. Geographical Location

The cost of living and market rates in the company’s location can also affect the CEO’s pay. Typically, the median salary for areas with high living costs, like Silicon Valley, New York City, and other major startup hubs, is higher than in other regions—primarily because these regions are hotbeds for tech companies.

However, the rise of remote work is beginning to shift this dynamic. CEOs working remotely from regions with a lower cost of living might opt for reduced salaries.

7. Company Culture

In some cases, CEOs might intentionally keep the lowest salaries affordable to foster a culture of frugality and efficiency within the startup.

By allocating a larger portion of their own compensation towards equity, CEOs align their personal financial success with the long-term success of the company, thereby incentivizing both themselves and their employees to strive for a lucrative exit.

Understanding these elements can equip you with the knowledge necessary to make informed decisions that can both foster the growth of your startup and satisfy the expectations of your CEO.

The Average Startup CEO Salary

Given that CEOs typically have a considerable influence in setting their salaries, it’s imperative to maintain a balance. The goal is not about indulging in extravagance nor about surviving on a shoestring budget.

It’s about ensuring fair pay that supports a sustainable lifestyle while acknowledging the inherent risks and challenges of leading a startup. A recent report by Kruze Consulting, a startup accounting firm, provides some insights into this topic.

In 2022, Kruze Consulting collected data on CEO salaries at over 250 venture capitalist-backed companies and found that salaries increased by 2.7% compared to 2021, a figure below the national inflation rate.

This reflects a 7.9% increase in median startup CEO salary from 2020 when the average CEO salary in several industries saw a considerable decline due to the covid crisis.

Kruze’s Average Startup CEO Salary

Venture Funding Impact

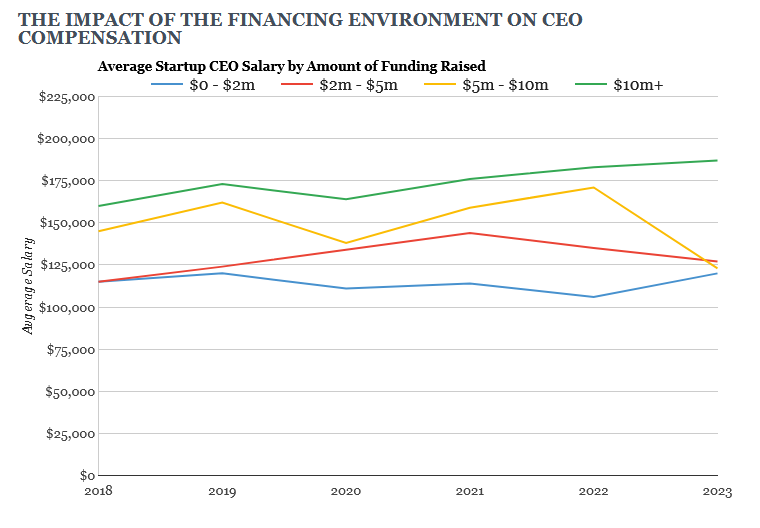

The report reveals a correlation between the amount of venture or seed funding a startup has raised and its CEO’s salary. For instance, companies that have raised less than $2 million in total funding at the seed stage tend to pay their CEOs the lowest salaries with an average annual salary of $106,000.

Conversely, firms that have raised money over $10 million in total funding at the seed stage typically offer an average CEO salary of almost $200,000.

Kruze’s Average Startup CEO Salary

Healy Jones, VP of Financial Planning & Analysis for Kruze, attributes this trend to three main factors. Firstly, companies with more funding are naturally better equipped to provide higher CEO salaries.

Secondly, higher CEO salaries might reflect the executive’s fundraising capabilities, mirroring the way mature companies compensate CEOs who generate substantial profits.

Lastly, in the startup ecosystem, particularly in the tech sector, there’s often pressure to keep salaries low to minimize expenses and make the company more appealing to investors. Some well-known founders like Jeff Bezos and Mark Zuckerberg have famously prioritized company equity over their own pay.

When examining the data by industry, Kruze Consulting found notable differences. For instance, hardware company CEOs earn on average $112,000 per year, placing them towards the lower end of the scale.

Industry Impact

On the other hand, biotech and pharma CEOs, who are often medical doctors with considerable educational and opportunity costs, draw an average median salary of $161,000.

For the ecommerce companies, CEOs saw a significant median salary increase, averaging $141,000, likely due to the industry’s recent success, driven in part by a decrease in retail and a shift towards online shopping.

Kruze’s Average Startup CEO Salary

It’s important to remember that these levels of payout are broad estimates, and actual salaries can differ significantly. It helps to always consult with financial advisors or compensation experts when determining CEO pay.

Also, a significant portion of CEO salaries often comes in the form of equity in the company, which can be worth far more than the cash salary if the company is successful. This aligns the CEO’s incentives with the long-term success of the company.

Typical CEO Equity In A Startup

In the realm of startups, a CEO’s total compensation package goes beyond just their salary. Equity stakes play a pivotal role in the remuneration of startup CEOs. But how much equity do CEOs typically get in startups?

Key Determinant Of A CEO’s Equity

A key determinant of a CEO’s equity is their relationship with the startup at an early stage. Companies, where the founder is the CEO of their own company, can take a pay cut and reduced salary for more equity.

Essentially, it boils down to whether the CEO is also a co-founder of the startup, or if they’ve been brought on board after the establishment of the early stages of the company.

Financial advisor for startups, David Ehrenberg, proposes that a reasonable equity stake for CEOs who join the company at a later stage ranges from 5 to 10 percent.

This assertion is supported by data collected from SaaStr, indicating that at the time of a company’s IPO, founder-CEOs hold around 14 percent equity, whereas non-founding CEOs typically possess between 6 and 8 percent equity.

The reason for this discrepancy lies in the fact that startup founders initially hold the majority, if not all, of their own company’s equity. However, these holdings get diluted over time as more employees come on board and as the startup raises more venture capital funding.

Therefore, founders who also serve as CEOs of venture-backed companies usually retain a larger equity stake compared to CEOs of venture backed companies who were not part of the original startup controller founding team.

Balancing Act: Equity Stakes And Salary In A CEO’s Compensation

Typically, a CEO’s equity stake and annual salary might share an inverse relationship in startups. That is, CEOs who draw larger salaries might opt for a smaller equity stake and vice versa.

Moreover, additional equity stakes might form part of the CEO’s remuneration package. For instance, a CEO could potentially receive an extra 1 percent equity for each year they serve in that role.

However, it’s important to note that there isn’t a universal rule to follow when it comes to equity and salary in startups. Most startups are flexible and open to negotiation on both fronts.

Therefore, CEOs who are contemplating joining a startup should equip themselves with the skills necessary to assess a stock option grant, along with other components of their prospective compensation package. This will help them make an informed decision about what fair and satisfactory pay looks like in their unique situation.

Risks Of Over-Compensation And Under-Compensation

Balancing startup CEO salaries is a delicate process with potential risks on both ends of the scale. But it helps to know the risks that come with not getting it right and why it is so important to take all we’ve gone over into serious consideration. Let’s go over some of those risks.

Over-Compensation Risks

1. Resource Drain: Over-compensating the CEO can strain the startup’s limited financial resources. This might leave less capital available for crucial areas such as product development, marketing, or hiring other key team members.

2. Equity Dilution: If the compensation involves a significant equity portion, it could lead to substantial dilution of the company’s shares. This situation could potentially limit the company’s ability to use equity to attract other top talents or to raise future funding.

3. Misaligned Incentives: A CEO who is over-compensated might focus more on maintaining their high pay than on growing the company. This scenario can lead to short-term decision-making at the expense of long-term success.

4. Culture and Morale Issues: If the CEO is paid a much higher salary than that of other employees, it can lead to a sense of unfairness, breeding resentment, and negatively affecting the company culture and overall morale.

Under-Compensation Risks

1. Attraction and Retention: If the pay is too low, the startup may struggle to attract or retain high-quality CEOs. Talented executives might be lured away by better offers from other companies.

2. Motivation and Performance: Under-compensation can lead to low motivation, potentially affecting the CEO’s performance. If they don’t feel adequately rewarded for their work, their drive to push the company forward may diminish.

3. Perception of Value: Pay is often associated with market value too. Underpaying a CEO could signal to the market that the CEO or the company is undervalued as the CEO’s salary sets a cap for everybody else, which could affect the startup’s reputation and ability to raise money in the future.

4. Personal Stress: Under-compensating can put personal financial stress on the CEO, which could impact their focus and decision-making.

Balancing these risks to achieve fair and motivating compensation is essential for the success of the startup and its CEO.

How To Evaluate The Average Salary For CEOs In A Startup

1. Survey Comparable Companies

Conduct thorough research to comprehend the overall pay structure for CEOs in similar startups, taking into account other factors, like size, development stage, industry, and geographic location. This information will serve as a reference point for determining pay.

2. Harmonize Salary And Equity

The compensation package of a startup CEO should ideally balance immediate cash income and long-term stock options and equity incentives. More mature startups might afford larger cash salaries, while those in their initial stages might offer more equity.

3. Account For The CEO’s Position And Expertise

A CEO who also happens to be a founder, or who possesses substantial industry experience, may expect a larger equity share. On the other hand, a CEO with less experience or who is hired after the startup’s launch may receive a higher salary but less equity.

4. Link Pay To Performance

Incorporating performance-based elements into the CEO’s pay, tied to specific goals or key performance indicators, can align the CEO’s motivations with the company’s objectives and serve as a powerful incentive.

5. Regular Evaluations

As the startup grows and changes, so should the CEO salary range. Regular assessments of levels pay will allow necessary salary adjustments based on factors like the company’s growth, funding status, and current market trends.

6. Transparency And Equity

Clearly communicate the determinants of the CEO’s compensation. This helps avoid potential disputes and maintains a healthy, motivating work environment.

7. Consult Professionals

Engage with a legal or financial advisor with experience in startup compensation, specializing in everything from founder pay to financial modeling to interim CFO consulting.

They can provide critical insights and assistance in navigating the complexities of seed-stage salaries, firm handles, startup CFO consulting, and all things accounting.

8. Adaptability

Keep in mind that there is no universally applicable solution. What suits one startup may not be appropriate for another. Remain open and flexible for negotiations to find a compensation package that mutually benefits both the CEO and the company.

In sum, establishing a fair CEO pay is about balance. The goal of increasing compensation is to incentivize the CEO to guide the startup toward success while simultaneously ensuring the financial sustainability of the company.

Questions To Consider When Determining A Startup CEO Salary

Determining a startup CEO salary requires careful thought and consideration. Framing the criteria for fair compensation as questions can help to make a better evaluation of how to go about things.

Here are some key questions that can guide this decision-making process:

Remember, there’s no one-size-fits-all answer. The key is to strike a balance between offering a competitive package to the CEO and ensuring the financial sustainability of the startup.

Conclusion

In the dynamic world of startups, determining the appropriate compensation for a CEO requires careful consideration and strategic planning. Multiple factors come into play, such as the company’s stage and financial standing, the CEO’s experience and skill set, industry standards, and geographical location. Equally important is the mix of cash compensation and equity that balances immediate financial reward with a stake in the company’s future.

Over-compensation and under-compensation carry their unique risks and should be avoided to ensure the long-term success of the startup. Ultimately, it’s about finding a balance – a package that is fair, competitive, and motivates the CEO to lead the company toward success. This can be a delicate process, but with careful consideration and informed decisions, startups can set a fair and effective CEO salary structure.