Are you looking to maximize your tax savings and enhance your startup’s financial health? In today’s competitive business landscape, strategic tax planning is crucial for long-term success. However, navigating the complex world of tax regulations can be daunting. That’s why we’re here to help. In this informative guide, we will provide you with effective tax planning strategies specifically tailored for startups. By implementing these proven techniques, you can optimize your tax savings, minimize liabilities, and channel those resources back into growing your business.

What Is Tax Planning?

Tax planning is an essential part of your financial toolkit, especially when running a startup. It’s all about understanding, strategizing, and aligning your tax obligations with your business goals to minimize liabilities and maximize efficiency. By employing effective tax planning strategies, you not only ensure compliance with the law but also optimize your tax benefits. This way, you can use your hard-earned money to invest in your business, nurturing growth and stability.

Remember, tax planning is not a one-off exercise, it’s a continuous process that evolves with your business. So, whether you’re navigating through the complexities of deductions and credits or understanding new tax regulations, a proactive approach to tax planning will keep your startup financially healthy. Take charge of your taxes, and let them be a tool for your business success rather than a hindrance.

The Debate Surrounding Tax Planning Services

Now, not everyone agrees on the value of hiring a guide for this journey. Some skeptics feel like tax planning services are a bit like hiring a guide for a stroll in your local park. They say that the cost of the service may not always justify the benefits, especially when you consider it as part of a larger budget. They point out that the tax landscape is riddled with complexities and hidden costs that can make the final bill more than you bargained for.

Proactive Tax Planning Strategies

However, on the other side of the coin, supporters argue that a guide can be invaluable. They claim that proactive tax planning can be the key to unlocking substantial savings. Think of it as a treasure map and you need to find all the potential deductions and credits. By managing expenses strategically and maximizing deductions, you can turn every stone and discover all the saving opportunities that the law provides. Plus, having an expert at your side makes you less likely to overlook those hidden gems.

At the end of the day, it’s about weighing the potential benefits against the possible pitfalls. Should you take the plunge into the world of tax planning? That’s a decision that individuals and firms have to make for themselves. But remember, with a well-thought-out strategy and an understanding of the tax landscape, you can make informed decisions that could lead to a more favorable financial future. After all, a penny saved is a penny earned.

Benefits Of Tax Planning

Tax planning can feel like a difficult task, especially for startup owners juggling multiple responsibilities. However, the benefits far outweigh the initial effort required. Here’s a quick rundown of why you should start considering tax planning seriously.

- Save Tax

The most obvious benefit of tax planning is the potential to reduce your tax liability. Through deductions, credits, exemptions, and various strategies, it’s possible to significantly lower your tax bill. Planning ensures that you take full advantage of these tax-saving provisions.

- More To Invest

With effective tax planning, the money you save can be used for reinvestment in your startup. This could mean improving your product, expanding your team, or scaling your marketing efforts, all of which contribute to business growth. Always have a reinvestment strategy in place for the money you save from taxes.

- Strategize

Tax planning is not a one-time event, but a strategic process that runs parallel to your business operations. It provides a structured approach to financial management, assisting you in making better business decisions.

Treat tax planning as an integral part of your overall business strategy.

- Start Early

Tax planning isn’t something to leave until the last minute. Starting early gives you more options and the time to evaluate them carefully, ensuring you make the most informed decisions possible. Mark important tax deadlines in your calendar to avoid the end-of-year rush.

Streamlining your month-end close process is one way to keep track of all important deadlines and meet them at the right time, which can help save tons of time in tax planning and other aspects.

- Get A Head Start

Early tax planning also allows you to anticipate future tax obligations and prepare for them, giving your startup a head start. You’ll be better equipped to manage cash flow and avoid potential financial obstacles.

Use financial forecasting tools to predict your tax liabilities.

- Becoming Confident

Understanding and implementing tax planning strategies boost your financial literacy, leading to more confidence in managing your startup’s finances. You’ll be better equipped to navigate the often complex world of business finance.

Use online resources and consult with a tax professional to deepen your understanding.

- See The Big Picture

Tax planning helps you see the broader financial landscape of your business. You’ll gain a holistic view of your income, expenses, and financial health, enabling you to plan and strategize better.

Combine tax planning with financial analysis for a comprehensive overview.

- Defined-Contributions Optimization

Defined contributions are retirement plans that are typically tax-deferred, leading to significant tax benefits while ensuring you’re building a solid nest egg for retirement.

Defined-contribution optimization strategies continually evolve. Regularly review your defined contribution plan and consult with a financial advisor. They can provide crucial insight into how legislative changes or market conditions might influence your strategy, helping you to make informed decisions.

- Peace Of Mind

Knowing that you’ve minimized your tax liability and are prepared for future tax obligations provides peace of mind. This lets you focus more on growing your business rather than worrying about your tax situation.

Regularly reviewing your tax plan can help maintain this peace of mind.

- Utilize Recent Budget Changes

Tax laws and regulations are constantly changing. Effective tax planning ensures that you’re up-to-date and taking advantage of any new provisions that may benefit your business.

Keep an eye on legislative changes and understand how they affect your business or ensure an expert keeps you up to date.

- Insight Into Income And Tax Liability

Tax planning can provide clear insight into your income and tax liability, helping you understand where your money is going and how to better manage it.

Regularly monitor your income and tax liability for more accurate planning.

- Management Of Large Monetary Transactions

Selling a business, acquiring another, or even launching a new product can have significant tax implications. Effective tax planning helps you navigate these large transactions smoothly.

Involve a tax professional when making major financial decisions to avoid potential pitfalls.

- Caution Against Over-Planning

While tax planning is essential, overdoing it can lead to unnecessary complexity and potential issues. It’s crucial to find a balance that works for your specific business situation.

Aim for simplicity and efficiency in your tax planning strategies.

- Preventing Fines And Penalties

Proper tax planning helps ensure that you’re compliant with tax laws and regulations, helping to prevent costly fines and penalties. A minor oversight can lead to a major financial setback if not caught in time.

Regular audits and checks can help catch any discrepancies in your tax filings.

This introduction serves as a primer to the myriad benefits of tax planning, but it’s just the start. Each section offers a glimpse into the profound impact tax planning can have on your startup’s financial health. We hope these insights and pro tips will encourage you to dive deeper into tax planning and explore its potential to enhance your startup’s growth and success.

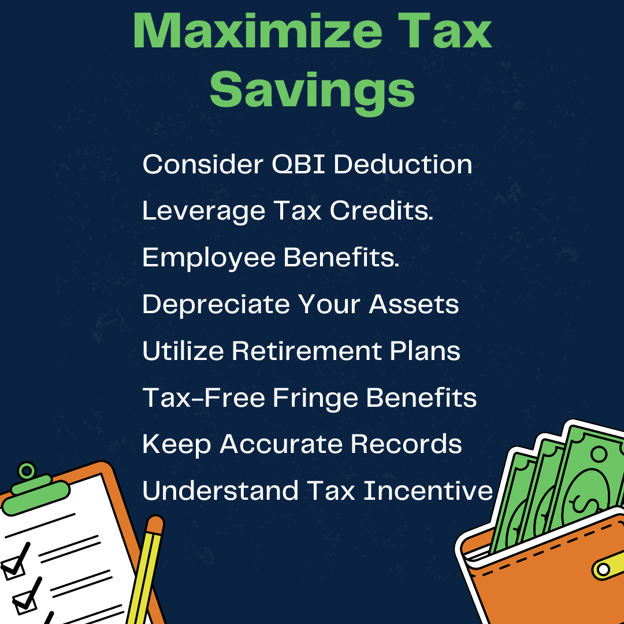

How To Maximize Your Tax Savings

When you’re an entrepreneur, your focus naturally falls on developing your startup and making it successful. However, you can’t overlook the importance of understanding your tax situation and planning accordingly. In this regard, maximizing tax savings is one potential way to funnel more resources back into your business. Here’s a guide to help you navigate this financial labyrinth.

- Understand Your Business Structure

Your startup’s business structure can greatly impact your tax liability. It’s essential to understand whether you’re operating as a sole proprietorship, partnership, LLC, S corporation, or C corporation because each structure carries its own set of tax rules and rates. Consulting with a tax professional or business attorney can provide valuable insights into the optimal structure for your business based on your specific situation.

- Leverage Tax Credits And Deductions

Tax credits and deductions can significantly reduce your tax liability. Familiarize yourself with the tax credits available for small businesses, like the Work Opportunity Tax Credit or the Research & Development Tax Credit. Keep a close eye on your expenses. Many routine business costs can be deducted, from office supplies to business travel expenses.

- Invest In Employee Benefits

Offering robust employee benefits can attract and retain talent, and some can offer tax advantages too. For example, contributions to employee health plans are often tax-deductible. Consider setting up a 401(k) or similar retirement plan. Not only does this benefit your employees, but employer contributions are also tax-deductible.

- Depreciate Your Assets

The IRS allows businesses to take a tax deduction for the wear and tear, decay, or obsolescence of physical assets like equipment, buildings, and vehicles. Consider Section 179 of the IRS tax code, which allows businesses to deduct the full purchase price of qualifying equipment bought during a tax year.

- Claim Home Office Deductions

If you’re running your startup from home, you might be eligible to deduct some of your home’s costs such as mortgage interest, insurance, utilities, and repairs. Keep precise records of your home office expenses. Accuracy is key to successfully claiming this deduction.

- Utilize Tax-Deferred Retirement Plans

Contributions to tax-deferred retirement plans lower your taxable income now and allow the investment to grow tax-free until retirement. A Simplified Employee Pension (SEP) IRA or a Solo 401(k) can be a good choice for small business owners.

- Opt For Tax-Free Fringe Benefits

Some fringe benefits are exempt from taxation. They include benefits like health savings accounts, tuition assistance, and on-premise athletic facilities. Use these benefits as part of a competitive compensation package to attract high-quality employees.

- Hire Independent Contractors

Independent contractors are not employees, so the employer avoids many taxes and benefits associated with employees. Be careful with classification. The IRS has strict rules about who can be classified as an independent contractor.

- Keep Accurate Records

Accurate record-keeping is crucial for any business. It not only helps in managing your business but also makes it easier during the tax filing process. Consider investing in accounting software. It can help you track income and expenses, making tax time less stressful.

- Leverage Tax-Exempt Financing Options

Certain types of financing options provide tax benefits, like tax-exempt bonds or New Market Tax Credits. Talk to a financial advisor who can guide you through the process and help determine if these options are a good fit for your business.

- Understand State And Local Tax Incentives

Remember, not all treasures are found in the same place. Many states and localities offer their own set of tax incentives and credits, like a local guide offering you a map of hidden treasure. You might find property tax abatements, job creation tax credits, or sales tax exemptions. So, do your homework and research your state and local tax laws.

Consider the full range of incentives, from credits for creating jobs to breaks for rehabilitating historic properties.

- Consider A Qualified Business Income (QBI) Deduction

The QBI deduction is a magic amulet for eligible businesses. It allows you to deduct up to 20% of your qualified business income. This tax benefit is especially useful for pass-through entities. Seek out a tax professional to see if your startup qualifies for this deduction.

Work with a tax advisor to determine if your business is eligible for the QBI deduction and to understand its potential impact.

- Keep Up With Tax Law Changes

In this world of taxes, the only constant is change. Staying informed about these changes is like having a spy in the king’s court. It can help you spot new tax-saving opportunities. Consider subscribing to relevant newsletters, consulting with a tax professional, or attending tax seminars to stay current.

Consider establishing a relationship with a tax professional who can update you on tax law changes and their potential impact on your business.

Armed with this knowledge, you’re better prepared to take steps toward maximizing your tax savings. However, every business is unique, and what works for one may not work for another. It’s essential to consult with tax professionals and advisors who understand your business and can provide tailored advice. When done right, tax planning is a strategic tool that can lead to significant cost savings and contribute to your startup’s growth and success.

Strategies For Effective Tax Planning

Every entrepreneur dreams of launching their startup into the stratosphere. But in the midst of raising funds, honing the product, and building a team, one aspect often slips under the radar: effective tax planning. A well-devised tax plan can maximize your earnings and minimize your liabilities. In this guide, we’ll unravel the most effective tax planning strategies that can streamline your finances and bolster your startup’s bottom line.

1. Be Strategic With Your Income

How you draw your income from your startup can significantly impact your tax liabilities. Choosing between salary, dividends, and bonuses can be a complex decision, as each has a different tax treatment. Consulting a tax advisor or CPA can help identify the most tax-efficient method for your unique situation. Defer income to the next year if you anticipate being in a lower tax bracket. This could help you save significantly on taxes.

2. Review Your Entities

Your startup’s legal structure – whether it’s an LLC, S Corporation, C Corporation, or sole proprietorship – affects your tax obligations. It’s crucial to periodically review your business entity to ensure it aligns with your financial growth and evolving business needs. As your startup grows, it might make sense to transition from an LLC to an S Corporation to save on self-employment taxes.

3. Review Your Accounting Method

Your choice of accounting method – cash or accrual – can impact your taxable income. With the cash method, income is recognized when received, and expenses when paid. The accrual method, however, recognizes income when it’s earned and expenses when incurred. For startups with fluctuating income, the cash method offers more control over tax liabilities.

4. Practice Good Bookkeeping

Keeping your financial records in order is not only good practice but also a significant part of tax planning. Regular reconciliation of your books can help prevent costly errors during tax filing and also help you identify tax-saving opportunities. Use accounting software to automate your bookkeeping process. It can help you stay organized and save time for more strategic tasks.

5. Keep Documentation Current

Maintaining detailed records of all business-related transactions is essential for accurate tax reporting. This includes receipts, invoices, mileage logs, and any other documents pertaining to your business expenses or income. Utilize cloud storage to keep your financial documents safe, organized, and easily accessible.

6. Evaluate Personal Loans And Expenses Related To Your Business

If you’ve taken a personal loan for business purposes or use personal assets for your startup, you can claim these as deductions. Ensure you track these expenses diligently and consult a tax professional to maximize your deductions. Keep your personal and business expenses separate to avoid confusion and potential scrutiny from tax authorities. Use a tax expert when considering these deductions.

7. Don’t Miss Out On Deductions

Many business expenses, from office supplies to business travel, can qualify for tax deductions. Regularly review your expenses to identify all potential deductions and maximize your tax savings. Stay updated with the latest tax laws. Some deductions may change annually, and new ones may be introduced.

8. Review Your Giving

If your startup makes charitable contributions, these can often be deducted from your taxable income. Ensure to document these gifts meticulously and comply with IRS guidelines to claim these deductions. Donating appreciated stock instead of cash can provide additional tax benefits.

9. Understand How Property Purchases And Sales Impact Your Taxes

Buying or selling business property can have significant tax implications. Understanding how depreciation, capital gains, and 1031 exchanges work can help you strategize your property transactions for tax efficiency. Consider conducting a cost segregation study for large property purchases. It can accelerate depreciation and boost your deductions.

10. Consider Hiring Your Minor Children

Have you ever thought of bringing your kids into the family business? It’s like hitting a tax trifecta! You create a tax deduction for the business, their income is taxed at a lower rate, and you get to teach them the ins and outs of entrepreneurship. It’s a brilliant strategy, but make sure to have a heart-to-heart with your tax advisor to see if it’s a good fit for your family.

Mistakes To Avoid While Tax Planning

Tax planning is essential to financial management, particularly for startup owners. The tax system can be complex, and it is crucial to avoid mistakes that may lead to overpayment, penalties, or missed opportunities. Here we will discuss some common tax planning mistakes to be aware of, ensuring you maximize your potential benefits and minimize tax liabilities.

- Ignoring The Alternative Minimum Tax (AMT)

Charitable contributions, home-office deductions, out-of-pocket expenses for charitable work – they’re all clues often left untouched. Don’t play hide and seek with these tax breaks. Keep your detective’s notebook – or your tax records – accurate and updated to make your case solid.

- Not Accounting For Mutual Fund Dividend Reinvestments

When you’re reinvesting dividends in mutual funds, you’ve got to keep your eyes on the prize: tracking the cost of those additional shares that you acquired through the dividend reinvestment. Because the cost of these additional shares becomes the new cost basis for tax purposes. If you don’t, you might end up treating the IRS as your charity of choice, and overpaying them.

- Failure To Track Year-to-year Carryover Items

Think of carryover items – like excess capital losses, state and local taxes paid, and unused charitable contributions – as money seeds. If you track them and plant them into your tax garden in subsequent years, they can sprout into beautiful tax breaks. Don’t let them slip away unnoticed.

- Failing To Name (Or Naming The Wrong) Beneficiary To Your Retirement Plan

Picking a beneficiary for your retirement plan is like writing a will for your hard-earned savings. It ensures that your wealth goes into the right hands, sidestepping accelerated taxes and pesky penalties. Keep your beneficiary list as updated as your Netflix watchlist.

- Not Maximizing Your 401(K) Contributions

Here’s a little secret: every dollar you toss into your 401(k) plan is a dollar less you’ll be taxed on, plus it grows tax-free. Missing out on maximizing your contributions is like leaving a match-winning goal on the field. Don’t forget about employer matching funds – that’s free money!

- Missing Quarterly Estimated Tax Payments

Let’s talk about quarterly estimated tax payments. It’s like getting small annual check-ups instead of one major surgery. This can help you avoid those annoying underpayment penalties. Be the early bird that gets the worm and make those payments on time.

- Not Planning Correctly For Exercising And Selling Stock Options

When it comes to exercising and selling stock options, it’s a bit like playing chess. You’ve got to think about the potential impact on your tax filing status and plan your moves carefully to avoid a checkmate when tax season rolls around.

- Not Adjusting Withholding When You Change Jobs

Changing jobs is like changing gears – you need to review your withholding allowances to ensure you don’t overpay or underpay taxes throughout the year. It’s all about keeping your ride smooth and free of bumps.

- Contributing To A Roth IRA When Your Income Is Too High

Beware of the Roth IRA income trap. If your income is above a certain threshold and you still contribute, it’s like crossing the speed limit – you’ll get a 6% penalty ticket. So, stay within the limits!

- Making An Estimated Tax Payment Right After A Big Income Event

After hitting the jackpot with a big income event, you might feel compelled to make an additional estimated tax payment. But sometimes, it’s better to let that money marinate and earn interest until it’s time to pay taxes. Make sure you check your underpayment penalties protection before moving ahead. It’s like having a shield in a battle; if you’re well-protected, why rush?

How To Choose A Tax Planner

Choosing the right tax planner is crucial for startups navigating the complexities of tax laws and regulations. The right professional can help you make informed decisions tailored to your financial situation, ensuring that you maximize savings and comply with tax requirements.

- Experience Matters

Imagine yourself standing on a tightrope. Beneath you is the complex web of your startup finances – it’s a long way down, right? Now, who would you trust to guide you across? Someone with a solid background in accounting, finance, and individual tax law, right? That’s precisely the kind of seasoned professional you need to handle your tax planning. It’s not just about their technical skills; it’s about their capacity to navigate the nuanced landscape of your unique financial situation.

- Personalized Approach

Think of tax planning as a dance. To glide through it smoothly, you need a partner who moves in sync with you, one who understands your rhythm and goals. Picture sitting down for coffee with your tax planner – do you feel at ease spilling your financial beans to them? Do their explanations of various options ring clear as a bell? If yes, you’ve found a match. If not, keep searching – there’s a dance partner out there who’s just right for you.

- CPA Involvement

Ever heard the phrase, ‘knowledge is power’? Well, when it comes to tax laws and regulations, Certified Public Accountants (CPAs) are practically superheroes. They’re always in the loop about the latest changes, armed with insights that could sway your tax situation for the better. They can even pull creative solutions out of their hats to tackle problems you might not have seen coming!

- Weighing Costs

While a CPA might be a superhero, your startup might not need one. Sometimes, a sidekick can get the job done just as well. Depending on your specific needs, a less experienced tax planner or an attorney could be a more cost-efficient choice. It’s all about finding the right balance for your startup’s needs.

- Trust Is Key

Whether you choose a superhero CPA or a sidekick tax planner, one thing is clear – trust is the golden key. You need to feel confident opening up your financial playbook to them. So, don’t rush the process. Take your time to build a relationship where trust is the foundation.

- Filing Opportunities

Think of tax season as a game. To score big, you need to understand the different plays at your disposal. From tax forms and refundable tax credits to itemized deductions – these are your power moves. Knowing them can help you maximize savings and make the most of your tax planning strategy. Remember, knowledge isn’t just power – it’s potential savings too!

Frequently Asked Questions

Q1. What Are Some Effective Tax Planning Strategies For Startups To Minimize Tax Liability And Optimize Cash Flow?

A robust tax planning strategy for startups involves utilizing various tax deductions, credits, and deferrals. One key aspect to consider is maximizing the use of refundable tax credits, which can provide a cash refund even if your tax liability is zero. Properly leveraging these credits can help to improve cash flow and invest in business growth.

Q2. How Can Startups Benefit From Refundable Tax Credits As A Tax Planning Strategy?

A refundable tax credit is an advantageous tax planning tool, as it reduces a startup’s tax liability and results in cash refunds. By identifying and claiming relevant refundable tax credits, startups can optimize their tax position and reinvest the excess funds into business expansion or other essential expenses.

Final Words

In conclusion, tax planning is vital in achieving financial success, particularly for startups. You can maximize tax savings by carefully assessing your unique situation, leveraging applicable credits and deductions, and understanding regional tax laws.

However, a holistic approach is essential, considering liquidity, tax efficiency, and risk management. Collaborate with a certified financial planner or CPA to optimize your tax strategy and ensure long-term financial growth. Their expertise will help you navigate complex tax laws and create a balanced plan supporting your immediate and future objectives.