As a startup founder, taxes can be a real headache. Between tracking expenses, collecting receipts, and filing returns, it’s easy to get overwhelmed. But what if I told you there was a tool that could make tax season a breeze?

Enter Track1099, the all-in-one tax filing solution that can save you both time and money. With Track1099, you can easily file 1099 forms online, track contractor payments, and even handle state e-filing, all in one place. And the best part?

You can do it all for a fraction of the cost of hiring a tax professional. So, if you’re tired of stressing over taxes every year, read on to learn how Track1099 can help streamline your tax filing process and save you money in the long run.

A Brief Overview

Track1099 was founded in 2010 by Lindsey West, the idea for this company came from his experience working in the finance industry and noticing that many businesses and independent contractors – particularly those who get nonemployee compensation – needed help to prepare and file their tax forms accurately and on time.

Initially, the company was started as a side project, a platform to help small businesses and contractors generate and file 1099 tax forms online. Over the years, Track1099 has created additional features and services to its platform, including support for W2 and 1095 forms and integrations with popular accounting software.

Track1099 is an IRS-approved software tool to help startups and small businesses manage their 1099 forms efficiently. By streamlining the process of creating, distributing, and filing 1099 forms, Track1099 saves startups time and money while ensuring compliance with IRS regulations.

In addition, the software seamlessly integrates with popular accounting software, making it easy to import data and reducing the need for manual data entry. Track1099 also provides a secure platform for managing sensitive financial data, giving startups peace of mind.

User Guide: How To Use TRACK1099 For Startup Tax Management

Online software platforms like Track1099 simplify the process of filing tax forms as they are time-saving, affordable, and secure. If you need to file 1099 forms, Track1099 can make the process much easier and more efficient for you. Here is a step-by-step guide on how to set up and use Track1099.

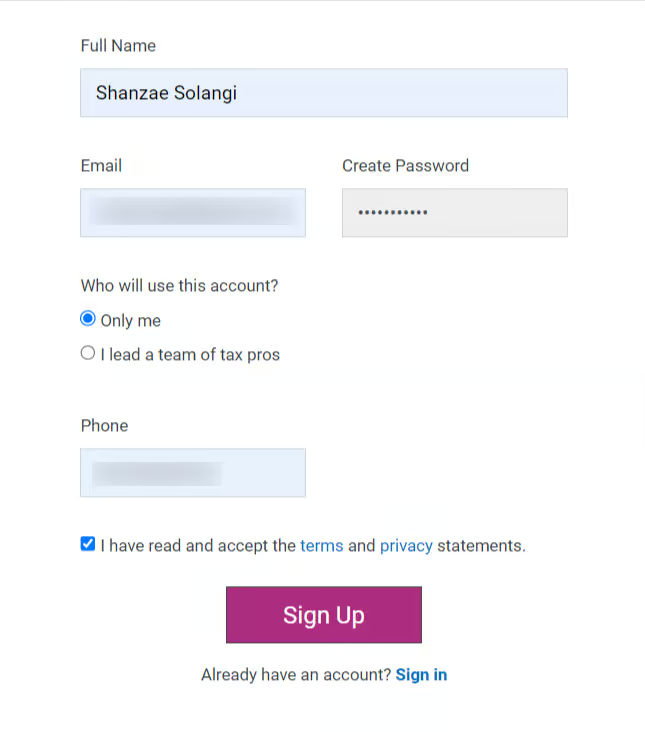

Step 1: Setting Up Your Account

To start using Track1099, visit their website at www.track1099.com and create an account.

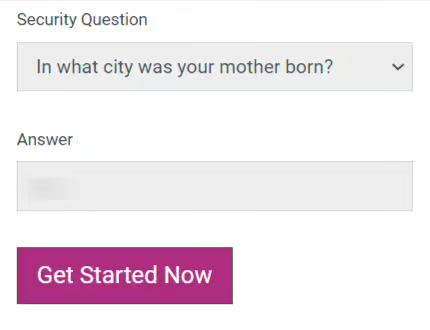

After creating an account on the website you’ll be redirected to the next screen for an additional security check.

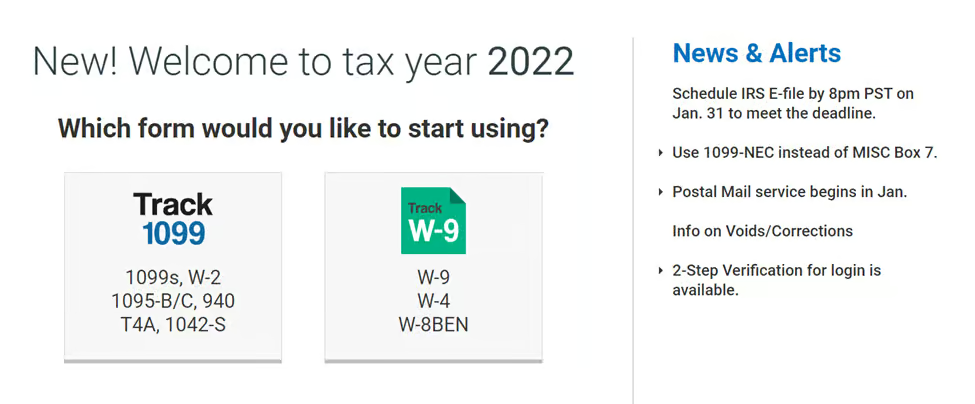

After completing the whole sign-up process, a screen will appear asking you, “Which form you’d like to start using?” You can use any of the following formats based on your requirements.

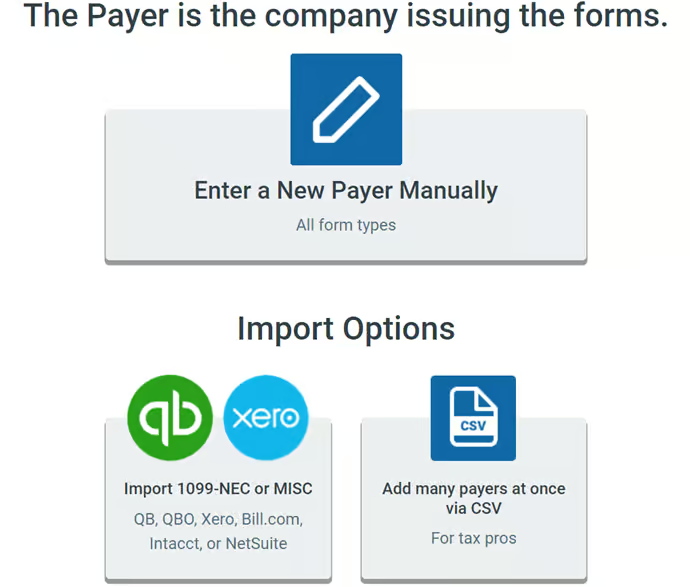

Step 2: Add Payer

On the next screen, enter the name of the company issuing the forms under ‘Payer’. You can either add contractors individually as a Payer or upload a CSV file containing all of your contractor’s information. You can also use the option to import from other software like QuickBooks Online, Bill.com and Xero.

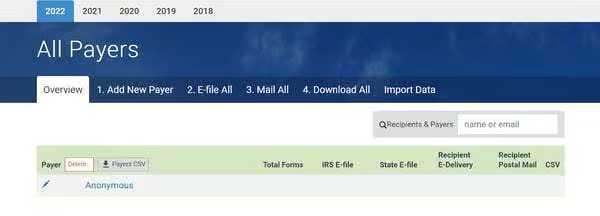

Importing the information may take a while. On completion of importing the information or saving information manually, you’ll see the All Payers screen, showing all the Payers.

The All Payers Overview tab will provide you with the following information about your Payers:

- Total number of Forms of each Payer

- IRS E-file

- State files

- Recipient E-Delivery

- Recipient Postal Mail

- CSV

Step 3: Review And Edit Payer Information

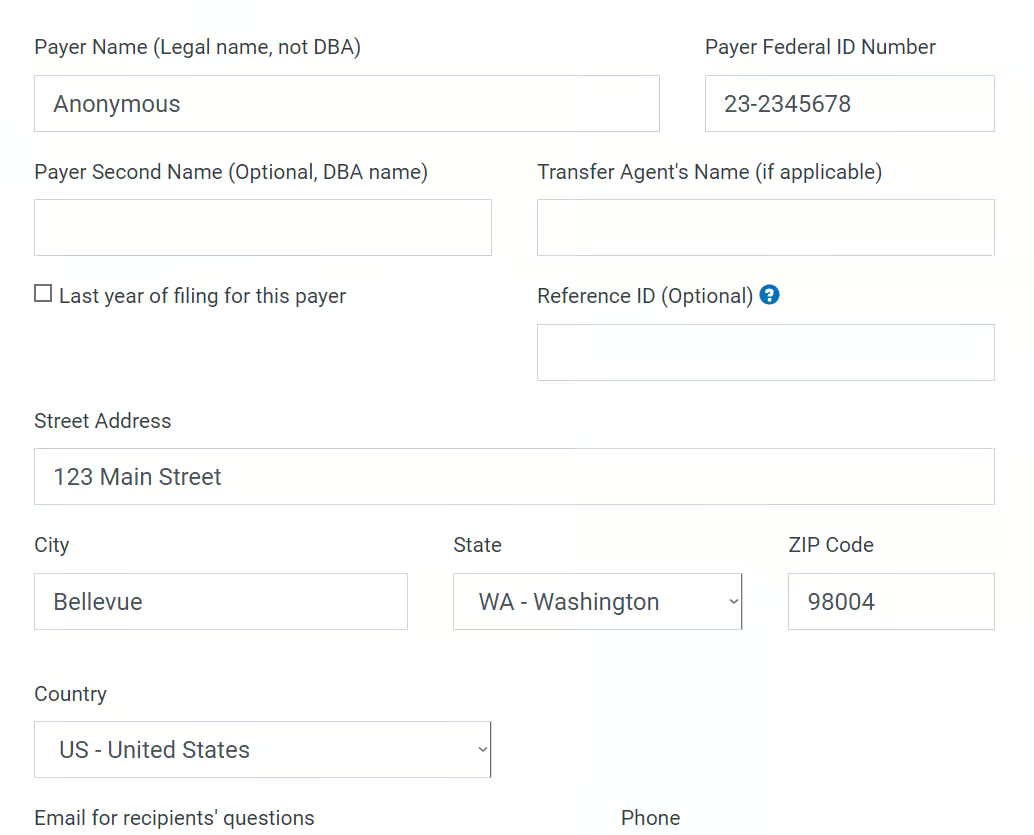

Once you add the Payers, you can view or edit information in the “All Payers Overview Tab”. On clicking the Payer, the screen will open having fields auto-filled, allowing you to review that all the information is correct.

- You’ll have to enter the following information about your Payer:

- Payer Name

- Payer Federal ID number (federal ID number (EIN) is a legal identifier required by the IRS for tax purposes)

- Payer Second Name (optional)

- Complete Address along with Email and Phone

- Reference ID Number (a reference ID is an internal tracking number used by a company or organization)

Click the Save button once you’re done reviewing and editing the information.

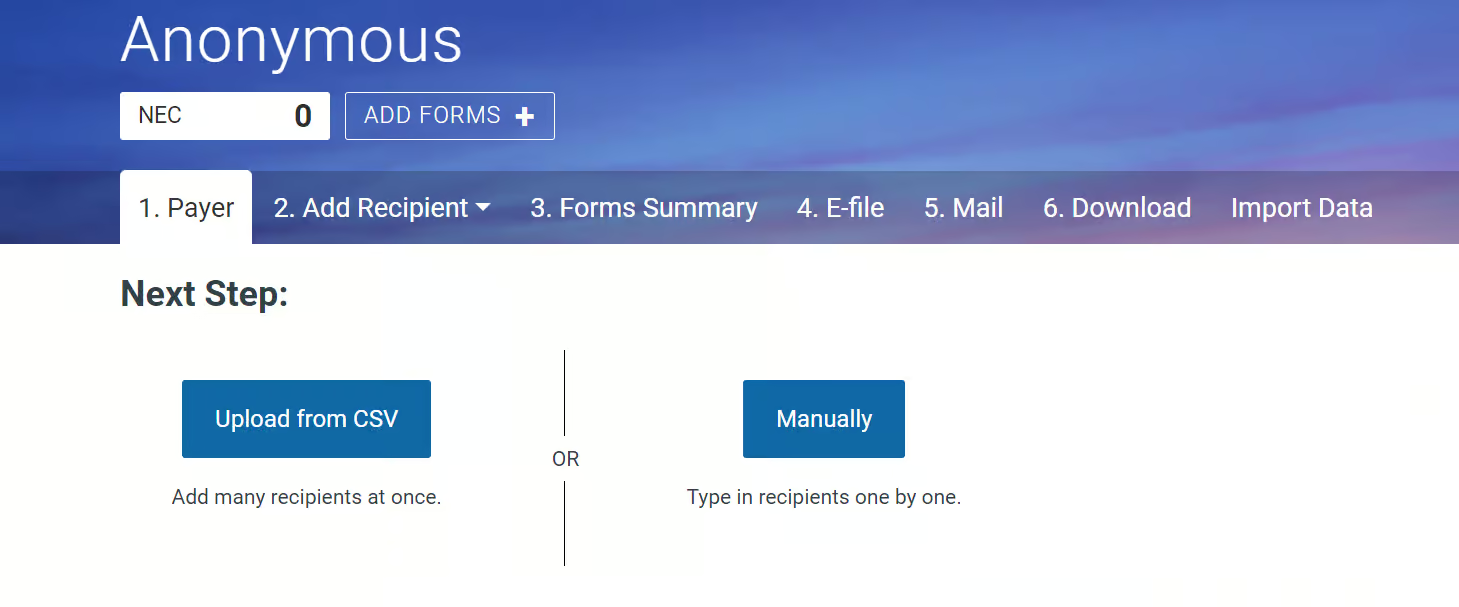

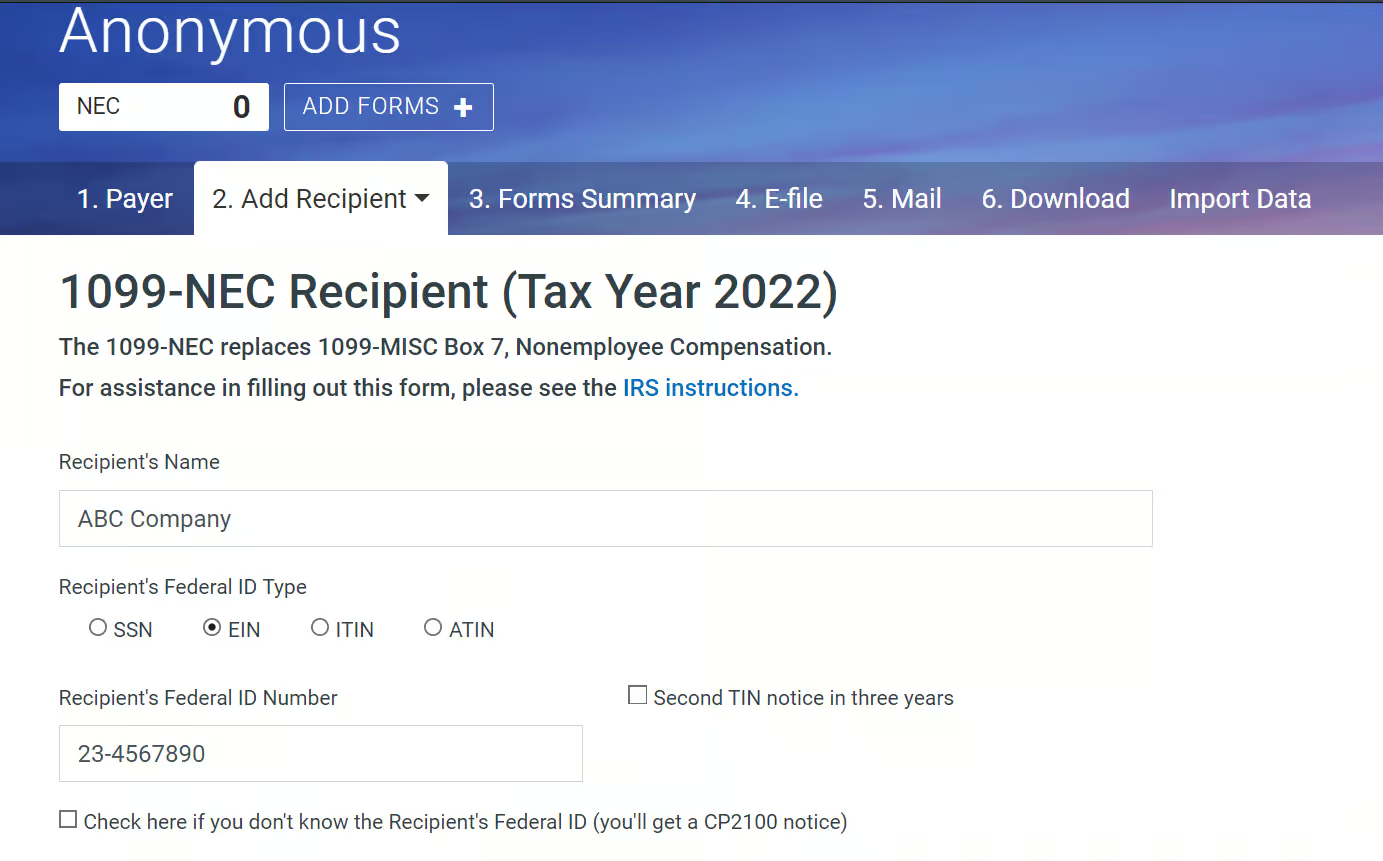

Step 4: Add Your Recipients

Now you can start adding your recipients. You can add recipients manually or upload a CSV file containing all of your recipient information.

You will need to provide their name, address, Social Security number or EIN, and the amount you paid them. After filling in all the required information, click the Save button.

After saving, you will be redirected to a blank page where you can add another recipient.

Step 5: Choose Your Form And E-File Option

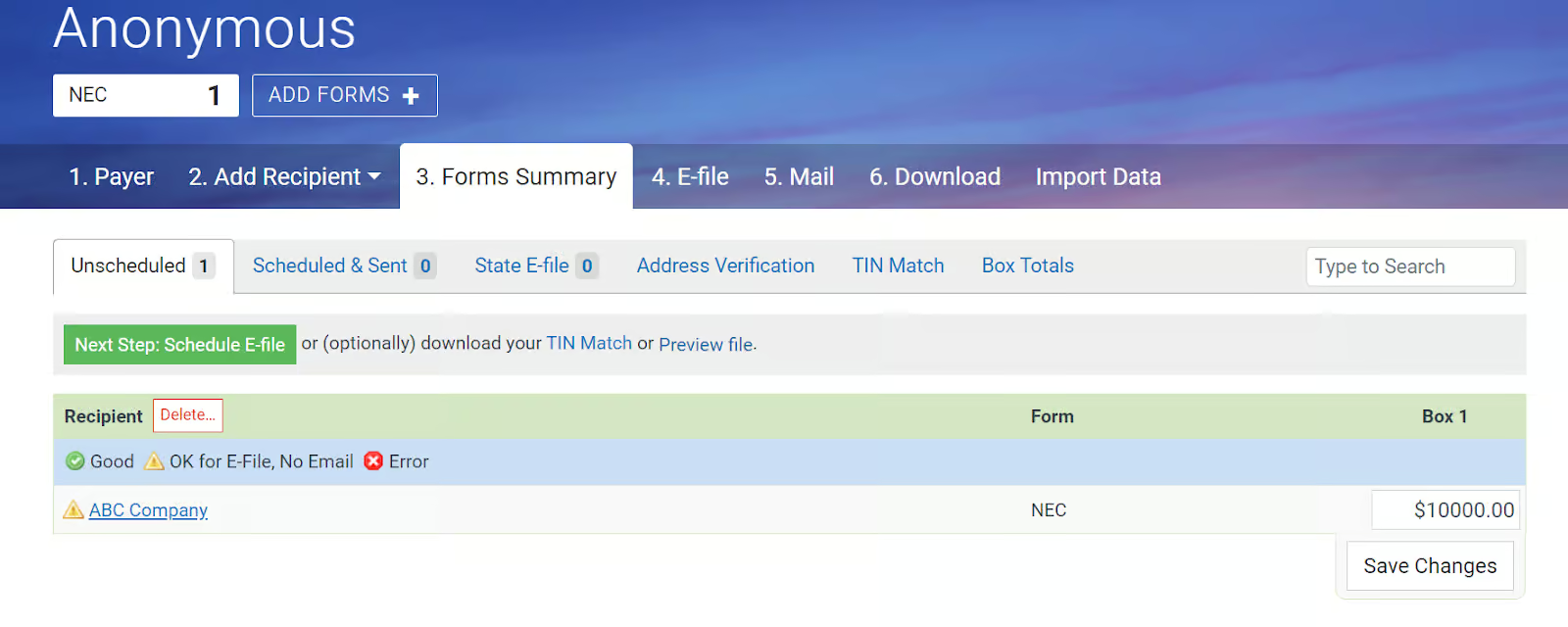

When you’ve completed inputting all of the recipients, go to the Forms Summary tab. This tab shows a list of all the forms that you’ve generated. If a little yellow warning symbol appears with your form, it indicates that E-File is OK, but there’s no email address.

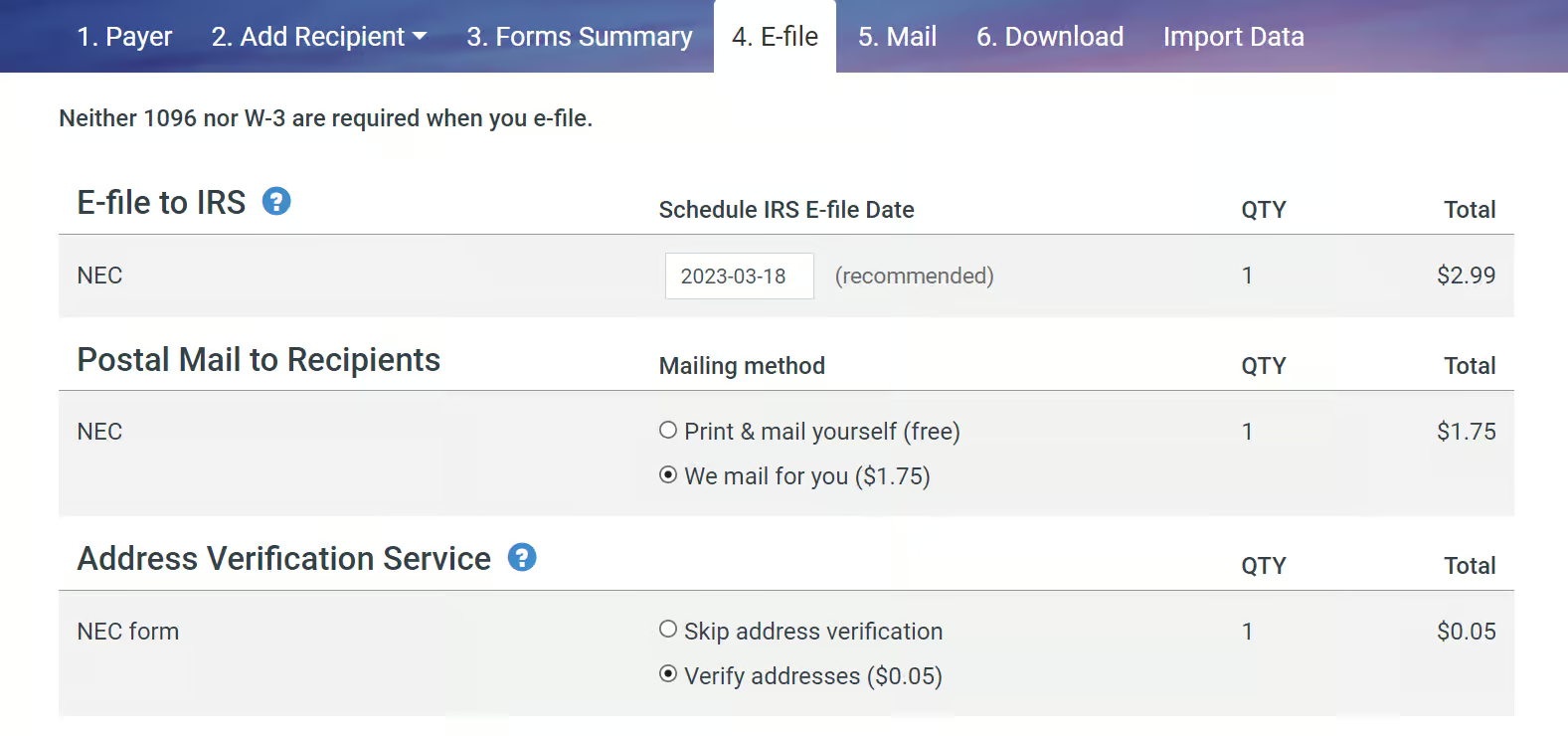

Click on the E-file tab to continue to the final step. You may print and mail the files yourself or have Track1099 mail them for you on the E-file page by paying a minimal fee of $1.75.

Once you select the services in the E-file Tab, you will be asked to pay for those services. The fee varies depending on the number of forms you need to file. Once you have paid, you can file your forms directly from Track1099.

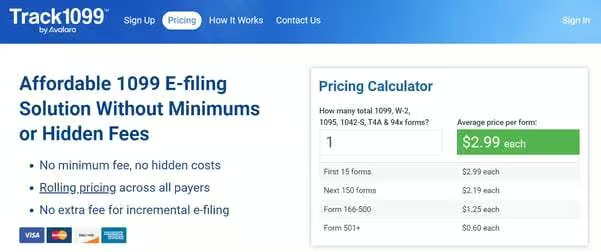

Pricing

The average price for one form is $2.99. The first 15 forms will cost you $44.85, taking up to 165 forms will cost $373.35, 500 forms will cost $790.85 and for more than 500, each additional form costs an extra $0.60.

Top Features Of Track1099

Track1099 is an essential software tool for startups and entrepreneurs because it simplifies the process of managing 1099 forms required for tax reporting purposes.

The software automates many of the data entry and compliance-related tasks, making it easy to import data and reducing the need for duplicate data entry. Additionally, it provides a secure platform for managing sensitive financial data, which is crucial for startups.

Track1099 is a software tool that can help startups in a variety of following ways:

Streamlined 1099 Form Management

The streamlined 1099 form management provided by Track1099 is incredibly helpful for startups. By simplifying the process of managing 1099 forms, Track1099 saves time and reduces the likelihood of errors in tax reporting.

Startups can easily create, distribute, and file 1099 forms all in one place without the need for manual data entry or multiple software applications.

With Track1099, startups can focus on their core business operations rather than getting bogged down in time-consuming administrative tasks. This saves extra effort and ensures that the forms are accurately filled out and filed on time.

Ensure IRS Compliance

Ensuring IRS compliance is crucial for startups, as non-compliance with 1099 form regulations can result in significant penalties. With Track1099, startups can automate many of the compliance-related tasks, reducing the likelihood of non-compliance and the risk of costly penalties.

Track1099 sends out reminders and alerts when forms are due, ensuring that startups stay on top of their tax reporting obligations.

Startups should avoid being buried in administrative work by automating these compliance-related tasks so they can concentrate on their key business operations. This feature of Track1099 helps startups to stay compliant with IRS regulations, avoid penalties, and maintain their financial health.

Integrates With Accounting Software

Integrating with popular accounting software is incredibly helpful for startups, as it reduces the need for duplicate data entry and saves time.

With Track1099’s integration with accounting software such as QuickBooks, Xero, and Billcom, startups can easily import data and populate the 1099 forms automatically, reducing the risk of errors and inconsistencies.

This feature eliminates the need for manual data entry, which can be time-consuming and prone to errors which ultimately helps startups focus on growing their business. Integrating Track1099 with popular accounting software helps startups increase efficiency and maintain accurate financial records.

Automated Data Entry And Electronic Delivery Option

Automated data entry and electronic delivery options offered by Track1099 are incredibly helpful for startups. With automated data entry, the software can automatically populate tax forms with accounting software data, reducing the likelihood of errors and inconsistencies.

The software also checks for errors and provides suggestions for correcting them, ensuring the forms are accurate and complete.

Furthermore, with the electronic delivery option, startups can choose to deliver 1099 forms electronically to recipients, eliminating the need for printing and mailing. This not only saves time but also lowers printing and postal expenses.

Provides A Secure Platform

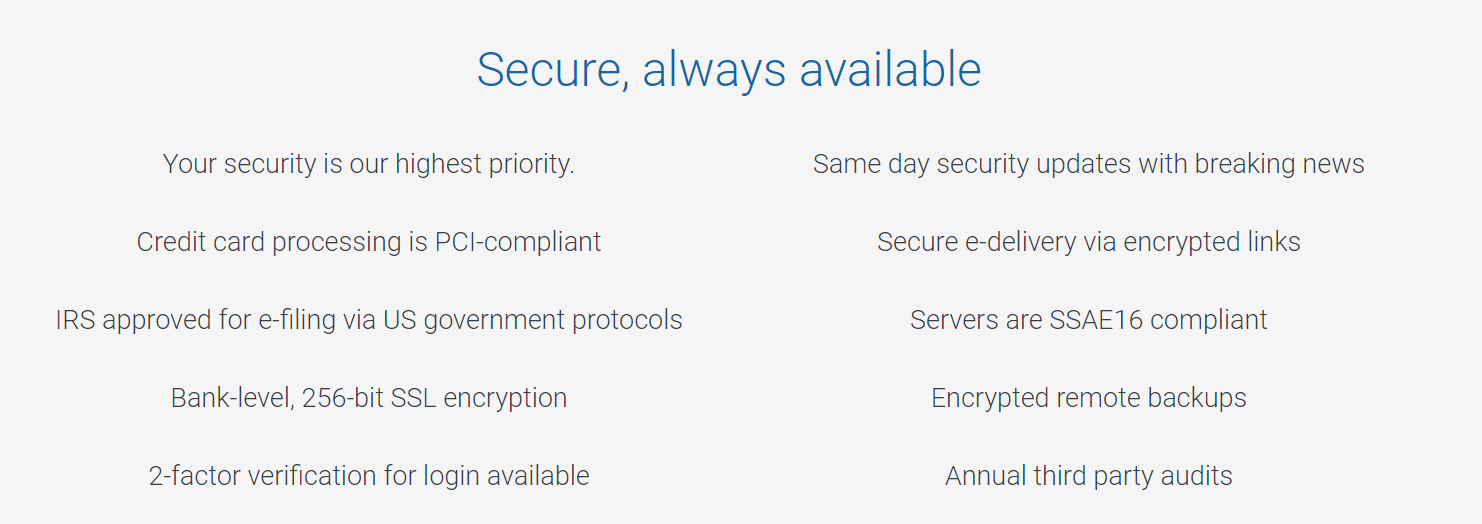

The secure platform provided by Track1099 is highly beneficial for startups. The security of sensitive financial data is critical for startups, and the software provides a secure platform for managing such data with industry-standard encryption and other security measures.

Credit card processing is PCI-compliant, and the software is IRS-approved for e-filing via US government protocols. With bank-level, 256-bit SSL encryption, users can rest assured that their data is protected. Two-factor verification for login is also available for added security.

To ensure the security of your data on Track1099, they provide same-day security updates in response to breaking news, secure e-delivery via encrypted links, servers that are SSAE16 compliant and encrypted, and remote backups.

Overall, the secure platform provided by Track1099 ensures that startups can manage their sensitive financial data in a safe and secure manner.

Track1099 Supported Forms

Track1099 is a cloud-based service that supports various tax forms and makes it easy for businesses and individuals to prepare and file their taxes. Here are some details on the supported forms on Track1099:

| 1099 Series | Report taxpayer’s non-employment income received during the tax year | 1099-A, 1099-B, 1099-C, 1099-DIV, 1099-G, 1099-H, 1099-INT, 1099-K, 1099-LS, 1099-LTC, 1099-MISC, 1099-OID, 1099-PATR, 1099-Q, 1099-R, 1099-S |

| 940 Series | Report the amount of unemployment taxes owed by the employer to the federal government | 940, 941, 943, 944 |

| W-2 Series | Report wages and salaries paid to employees by an employer | W-2, W-2C, W-2G |

| Others | W-9, W-4, W-8BEN, W-8BEN-E |

Pros

- Incorporated with well-known accounting software like Bill.com, Xero, and QuickBooks

- Integrated with widespread accounting software, such as QuickBooks, Xero, and Bill.com

- User-friendly interface that makes it simple for users to generate and maintain forms

- Time and cost savings

- Secure platform for managing sensitive financial data with industry-standard encryption

- Excellent client support, including live chat, phone, and email support

Cons

- Does not support 480-series and form-8809

- The interface is very straight-forward, but no step-by-step guided tours are available

Frequently Asked Questions (FAQs)

Is Track1099 Legitimate?

Track1099 is a legitimate platform for filing 1099 forms. Although it does not provide tax advice it is an IRS-approved e-filing provider that allows businesses and individuals to file and send 1099 forms to their contractors, vendors, and service providers.

When Do Startups Need To File 1099?

For startups, it’s important to be aware of when they need to file Form 1099. This form is required when a startup has paid an amount to an independent contractor or vendor during the year. Essentially, it’s used to report payments made to non-employees, such as freelancers, consultants, or other service providers.

To ensure compliance, startups must keep accurate records of payments made to independent contractors and vendors throughout the year. This will help them determine who meets the threshold for reporting and enable them to issue 1099s accordingly.

It’s worth noting that the deadline for issuing 1099s is January 31st of the year following the reporting year, and the deadline for filing them with the IRS is typically February 28th (or March 31st if filing electronically).

Failing to adhere to these deadlines can result in penalties and other legal consequences, which is why startups should take their record-keeping and 1099 filing obligations seriously. By staying on top of these requirements, startups can help ensure smooth operations and avoid any unnecessary headaches.

How Do I Correct A 1099 In Track 1099?

To correct a 1099 form in Track1099, you need to log in to your account and locate the form that needs to be updated. Once you have selected the form, you can make the necessary corrections and refile it with the IRS.

If the form has already been sent to the recipient, you will also need to send them a corrected copy.

Where Can I Find My 1099 Online?

To find your 1099 form online in Track1099, log in to your account and go to the Forms Summary section. You should be able to see all the 1099 forms that you have filed through the platform.

How Can I Locate A 1099 That Was Submitted To The IRS?

To locate 1099 submitted to the IRS using Track1099, Click on the “Forms Summary” tab and Select the tax year for the form you are looking for. Scroll down and locate the form you are looking for.

Click on the form to view the details, including the date it was submitted to the IRS. You can also download a duplicate copy of the form from your Track1099 account by clicking on the form to view the details, and then click on the “Download PDF” button to save a copy of the form to your system.

If you are unable to find the form in your Track1099 account, you may also contact the IRS directly to request a transcript of your tax return, which should include all of the 1099 forms that were filed on your behalf.

Conclusion

Track1099 is a powerful tool that can help startups and small businesses streamline and simplify the process of managing 1099 forms. With its automated data entry, compliance checks, electronic delivery options, and integration with popular accounting software, the software can help businesses save time and money while ensuring compliance with IRS regulations.

With over 300,000 companies already using Track1099, startups can trust that the software is a reliable and trusted solution for their tax form needs. Overall, for businesses looking to simplify the process of managing 1099 forms, Track1099 offers a user-friendly, affordable, and secure solution.