When it comes to the financial management of any business, it’s often said that Cash Is King! Whether your startup is experiencing rapid growth or facing challenges, effective cash flow management is crucial and can be the key to business survival.

In fact, a recent study by Intuit revealed that 61% of small businesses worldwide struggle with cash flow, with almost one-third unable to meet financial obligations due to cash flow issues.

Proper cash flow management is a fundamental strategy that every startup owner must master for long-term financial success. However, it can also be one of the most significant challenges business owners face.

In this comprehensive guide, we aim to equip startup founders with a deeper understanding of cash flow management and its impact on decision-making. You’ll learn why cash flow is vitally important, how to calculate and project it, techniques to improve it, and common pitfalls to avoid.

What Is Cash Flow Management?

Cash flow management is the procedure of tracking, evaluating, and adjusting your company’s cash inflows and outflows. This financial strategy is analogous to balancing your personal checkbook, but on a larger and often more complex scale.

Cash flow can be simplified as comparing the sources and uses of funds. The money a startup receives is considered a cash inflow, whereas the money leaving the business is categorized as a cash outflow.

Cash inflows are generated from various sources, such as revenue from product and service sales, loan proceeds, investment capital, and grant money.

On the other hand, cash outflows result from funds being used for different purposes, including purchases of materials, operational expenses, salary payments, interest payments, asset acquisitions, and dividend distributions.

The aim of cash flow management is to ensure that your startup maintains adequate cash reserves to cover day-to-day operational expenses and to invest in business growth, while also keeping a buffer for potential emergencies.

Without sufficient cash flow management, even a profitable business can find itself in trouble if it cannot meet its short-term liabilities.

In the financial context, there are two distinct types of cash flow that a business can experience – positive cash flow and negative cash flow. It’s crucial to comprehend the implications of both to manage your business finances effectively.

3 Major Categories Of Cash Flow

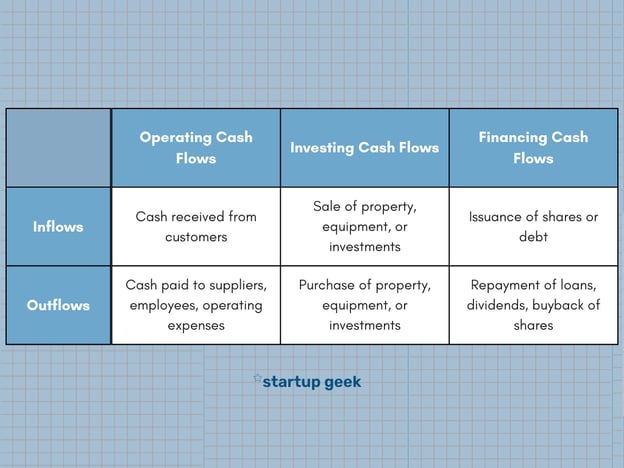

Cash can flow from and through several elements of a business, including:

1. Operating Cash Flow

Operating Cash Flows essentially represent the cash that your company brings in and spends as part of its daily business activities. This metric excludes income and expenses from investments and financing activities, focusing solely on operational efficiency.

For example, when a customer purchases a product or service from your company, this cash inflow is considered part of your operating cash flow.

Similarly, when you pay your employees, buy supplies, or pay your monthly utility bills, these expenses are part of your operating cash outflow. These day-to-day cash transactions reflect your company’s ability to generate a consistent cash flow from its core business activities.

To compute operating cash flows, companies typically start with net income and then adjust for non-cash items like depreciation and changes in working capital. Changes in accounts receivable, accounts payable, inventory, and other current assets and liabilities can significantly impact operating cash flow.

By looking at a company’s operating cash flows, one can gain a clearer understanding of its financial health and stability, beyond what net income alone can reveal.

You can easily calculate your startup’s operating cash flow, through the following operating cash flow formula:

Operating Cash Flow (OCF) = Net Income + Non-cash Expenses (such as depreciation and amortization) – Changes in Working Capital

2. Investing Cash Flow

Investing Cash Flows, on the other hand, are tied to your company’s investments in long-term assets. These could be physical assets like a company building or machinery, or financial assets like stocks or bonds.

For instance, let’s say you run a bakery and decide to purchase a new oven to increase your production capacity. The cash spent on this oven is an example of an investing cash outflow.

On the flip side, if your bakery were to sell an old delivery van, the cash received from this sale would be considered an investing cash inflow. Such transactions reflect how your company is investing in its future growth and development.

Here’s how you can calculate your startup’s investing cash flow:

Investing Cash Flow (ICF) = Cash Inflows from Investments – Cash Outflows for Investments

3. Financing Cash Flow

Lastly, Financing Cash Flows pertain to transactions involving your company’s capital. These cash flows can come from debt, such as bank loans, or equity, and funds raised from issuing shares.

For example, if your company decides to issue new shares to raise capital for expansion, the cash received from this issuance would be a financing cash inflow.

Similarly, when your company repays a loan or pays dividends to shareholders, these represent financing cash outflows. These kinds of cash flows provide insights into your company’s strategy for managing its finances and capital structure.

Analyzing a company’s financing cash flows can reveal insights into its financial strategy and stability. For example, a company that continually relies on debt or equity issuance for its financing may struggle to generate sufficient cash from its operations.

At the same time, a company that frequently repays debt, repurchases shares, or pays dividends might demonstrate strong financial health, as these actions often indicate the company has excess cash it can return to shareholders or use to reduce liabilities.

Here’s how you can calculate your startup’s Financing cash flow:

Financing Cash Flow (FCF) = Cash Inflows from Financing – Cash Outflows for Financing

Summary

Cash Flow Vs. Profit

If you’re a business owner, you need to know your numbers – particularly, cash flow and profit. While these terms may seem interchangeable, they play distinct roles in your startup, each indispensable in its own way. Consider them as two gears in the fine-tuned machine that is your company’s cash flow and profit management.

Profit: The Fuel Of Success

Profit is, in the simplest terms, your income minus your expenses. It’s the surplus left after you’ve paid all your bills. Now, it’s natural to think that the higher your profit margin, the better your business is doing. But it’s not always that straightforward. Profit is an important indicator of financial health, indeed.

However, it doesn’t necessarily mean you have the liquidity to meet your short-term obligations or invest in growth opportunities. And this is where the concept of managing cash flow enters the picture.

Cash Flow: The Lifeblood Of Your Business

Think of cash flow as your business’s bloodstream. It’s the money that moves in and out of your business. When you have positive cash flow, it means you’ve got more cash coming in from sales, investments, and other revenue sources than going out in expenses, purchases, and debts. It’s about timing, really.

Can you pay your bills on time? Can you manage your inventory efficiently? Can you meet your payroll? And how much cash do you have in reserves? Ensuring an accurate cash flow statement is pivotal for all these operations to run smoothly.

Here’s a crucial point: you can be profitable and still have poor cash flow management. Suppose you’ve made many sales this month, but your customers haven’t paid their invoices yet.

Your expenses are due, bills need to be paid, maybe payroll is coming up, and your bank account is dwindling. Your business appears profitable on paper, but in reality, you’re cash poor.

On the flip side, you could have great cash flow but not be turning a profit. Perhaps you’ve taken on significant debt, which has increased your cash reserves but put a strain on your profit margins due to hefty interest payments.

Cash Flow And Profit: A Balancing Act

Understanding the difference between cash flow and profit is essential. Profit might be the fuel for your success, but without a positive cash flow—the lifeblood of your operations—your business could sputter and stall. It’s all about balance.

With proper cash flow management alongside achieving a healthy profit, you can meet your current obligations, plan for future growth, and build a sustainable and successful business.

Remember, in the broader business landscape, maintaining a healthy cash flow and realizing a decent profit can be the difference between a thriving business and one that merely survives.

Why Is Cash Flow Management Important To Startups?

For startup founders, understanding and managing cash flow is a critical aspect of ensuring the ongoing success of the business. In order to appreciate the importance of cash flow management in small businesses, it’s essential to grasp three key financial concepts: liquidity, solvency, and viability.

- ‘Liquidity’ refers to a startup’s capacity to meet its short-term financial obligations at any given time. Put simply, it’s the business’s ability to quickly convert assets into cash. Cash is considered the most liquid asset, followed by short-term receivables. Conversely, an illiquid asset could be a piece of equipment or a building, which cannot be quickly converted into cash.

- ‘Solvency’ signifies a state in which a company’s assets (such as inventory, receivables, equipment, and more) are adequate to cover its long-term liabilities (including term loans, taxes, due interest, and so forth). The cash inflow and outflow cycle over time, and the gap between them, essentially determine a small business’s solvency. If a business’s assets become illiquid, it may fail to generate sufficient cash to meet its long-term financial commitments. This can make it difficult to borrow or raise funds for future operations and responsibilities, potentially leading to insolvency and rendering the business non-viable.

- ‘Viability’ denotes the long-term financial health and sustainability of a startup. It’s a measure of whether the business can continue to operate and grow over an extended period of time. Viability is largely determined by the company’s ability to generate consistent positive cash flows. If the company has a negative cash flow it would not be able to meet its financial obligations, invest in growth, or even continue operations, thereby threatening its viability.

Given these points, it’s crucial for startup founders to constantly be aware of their business’s liquidity. They should know how many months of cash flow their business can comfortably generate before it exhausts its cash reserves and becomes insolvent (also known as a financial runway).

Efficient cash flow management enables you to operate your business viably, meaning that it generates sufficient cash flows on a yearly basis.

1. Strategically Discount Slow-Moving Inventory

One significant strategy for improving your cash flow is to offer discounts on inventory that has been sitting idle for too long. The capital tied up in unsold inventory can harm your business’s liquidity and future cash flow. By offering a discounted rate, you can accelerate the sales cycle, freeing up cash for other operational expenses.

Pro-tip: Don’t discount your inventory too steeply or too frequently. It’s essential to strike a balance. Over-discounting can sometimes lead to a perception of low quality among your customers.

2. Streamline Your Accounts Receivable

Receivables constitute the money owed to your business. If left unchecked, these can create considerable drag on your cash flow projections. The faster you can collect your accounts receivable, the shorter your cash flow conversion period will be.

Consider implementing policies like early payment discounts or stricter credit requirements to speed up the collection process.

Pro-tip: Communication is key. Regularly communicating with your clients about payment terms can help streamline the receivable collection.

3. Efficient Management Of Accounts Payable

Managing your accounts payable – the money you owe to suppliers – is a vital part of cash flow management. The aim is to hold onto your cash as long as possible without souring relationships with your suppliers. One way to achieve this is to negotiate better payment terms or take advantage of any discounts offered for early payments.

Pro-tip: Leverage technology. There are numerous tools and platforms like, QuickBooks, Oracle Netsuite, Bill.com and Tipalti, that can help you manage your payables efficiently.

4. Adopt Accounting And Budgeting Software Solutions

Efficient cash flow management requires a comprehensive understanding of your financial position. This is where accounting and budgeting software comes in. These tools offer real-time insights into your financial health and can help you manage cash flow more efficiently, making it easier to plan and make informed decisions.

Some of the top-rated accounting software for small businesses include QuickBooks, Xero, FreshBooks, and Wave.

Pro-tip: Select software that aligns with your startup needs and is scalable as your business grows. And make sure you and your team understand how to use your chosen software to its fullest potential.

5. Grasp Your Short-Term Financing Options

Even with the best cash flow management practices, there may come a time when your business requires short-term financing. It could be for a sudden growth opportunity or a temporary cash flow crunch.

Understanding the variety of options available to you—from business credit cards to short-term loans—can make the difference between survival and closure.

Pro-tip: Explore all your options. Each type of short-term financing comes with its own set of pros and cons. Carefully consider which option best fits your business needs before making a decision.

6. Lease Vs. Purchase: Deciding For Fixed Assets

When it comes to acquiring fixed assets like equipment or vehicles for your business, leasing can be an attractive alternative to purchasing. This approach can free up capital otherwise spent on expensive assets, thereby improving your cash flow.

Pro-tip: Do a cost-benefit analysis to decide whether leasing or buying would be more beneficial in the long term. This can depend on factors like the nature of the asset, its depreciation rate, and your business’s specific needs.

7. Bootstrapping: A Self-Sustaining Approach To Business

Bootstrapping involves funding your startup through personal savings or the business’s revenue without external help. It encourages frugality, keeping overhead costs low, and reinvesting profits back into the business. While it may slow down your growth initially, bootstrapping can lead to more cash in hand and less financial risk.

Pro-tip: Maintain a strict budget. It’s crucial to control expenses and maximize efficiency when bootstrapping to ensure you use every dollar wisely.

8. Embrace Automation For Efficiency And Cost Savings

In today’s AI era, automation is a powerful tool to improve your business’s efficiency, saving both time and money. Automating routine tasks like invoicing, payrolls, or customer follow-ups can streamline processes, reducing the likelihood of errors and freeing up resources for other critical activities. There are a plethora of startup tools that you can use depending on your business needs.

Pro-tip: Prioritize automation based on your business’s needs. Start with tasks that consume the most time or are prone to human error.

9. Reevaluate Your Pricing Strategy

As costs increase, it may be necessary to revisit your pricing structure. This could mean adjusting prices or rates to reflect the value of your goods or services better. While this might worry some business owners about potentially losing customers, it’s worth noting that most customers are willing to pay for quality.

Pro-tip: Before implementing a price increase, communicate openly with your customers and explain the reasons behind the change. A well-justified price rise can often be accepted without much resistance.

10. Strategic Credit Card Usage: A Double-Edged Sword

Credit cards can be a convenient tool for managing cash flow, allowing you to make purchases now and pay later. However, they need to be used wisely. Mismanagement can lead to mounting debt and negatively impact your cash flow in the long term.

Pro-tip: Opt for a business credit card that offers rewards or cash back. This way, you can benefit from your regular expenses. Remember, always pay off your balance in full each month to avoid interest charges.

Five Cash Flow Management Pitfalls To Avoid

1. Accumulating Excessive Cash Reserves

While it may seem prudent to hoard as much cash as possible, this can lead to missed opportunities for investment and growth. Having a hefty cash reserve might give you a sense of security, but money lying idle isn’t working for your business.

Consider diversifying your funds into different growth-oriented areas, such as marketing or innovation, instead of keeping everything in your savings account. Still, do ensure you have an adequate safety net for unforeseen contingencies.

2. Overcommitting Capital In Early Stages

In the initial excitement of starting a business, it’s easy to get carried away and put too much money into it upfront. However, this could leave you with little flexibility in adjusting your strategy or coping with unforeseen expenses.

To avoid this, create a detailed business plan that accurately estimates your startup costs and earmarks funds for each phase of your business journey. It’s also crucial to account for unexpected costs; a contingency fund can be a lifesaver.

3. Misconstruing Growth As Positive Cash Flow

Rapid growth can be thrilling, but it isn’t synonymous with positive cash flow. It’s possible for your business to be growing in terms of sales or customers, yet still experience cash flow problems.

High growth often demands increased spending on inventory, employees, and infrastructure. A keen eye on your finances will ensure that the spending rate doesn’t outpace the incoming cash, thereby preventing any potential cash flow crisis.

4. Relying Excessively On Fundraising To Resolve Cash Shortfalls

Raising funds is part and parcel of the startup journey, but it’s not a magic bullet for cash flow issues. Fundraising takes time, effort, and resources, and there’s always a risk that it may not come through when you need it most. Instead of viewing fundraising as a quick fix, build a sustainable business model that generates reliable cash flow.

5. Mistaking The Role Of An Accountant For Comprehensive Cash Flow Management

An accountant or bookkeeper is critical in maintaining your financial records, but cash flow management extends beyond their purview. It involves strategic decision-making, such as when to invest, how much to save, and how to maintain a steady cash flow amidst growth or downturns.

Hence, it’s important to adopt a hands-on approach to your cash flow management, even if you have a finance professional on your team.

Get A Free Cash Flow Projection Template For Your Startup

Effective cash flow management is essential for the survival of startups. However, anyone can master this skill with the right approach. Invest time in organizing your finances now, and maintaining control will become effortless. Take advantage of this free cash flow template to efficiently manage your startup’s cash flow.

Wrap Up

In conclusion, effective cash flow management is crucial for startup survival and profitability. It demands astute forecasting, careful expense control, and optimized revenue strategies. Leveraging technology and embracing financial education can empower startups to maximize cash flow, enhance financial stability, and propel business growth.

Remember, in the ever-changing landscape of business, adaptability is key. Constantly reevaluating and adjusting your strategies will keep you ahead of the game and ensure a robust cash flow for your startup.