In today’s rapidly evolving business landscape, companies of all sizes face complex financial challenges that require strategic guidance and specific expertise throughout. While large corporations often have the luxury of hiring full-time Chief Financial Officers (CFOs) to perform CFO duties, small to medium-sized businesses often struggle to access the same level of financial leadership. However, a solution has emerged for small businesses to overcome financial challenges in the form of Fractional CFOs.

In this article, we will explore the world of Fractional CFOs, their responsibilities, and the advantages they offer to businesses.

What Is A Fractional CFO

A Fractional CFO, also known as an outsourced or part-time CFO, is a financial professional who provides strategic financial guidance and expertise to companies on a fractional or contractual basis. Several companies are in the fractional CFO business too. Fractional CFOs, often working as independent contractors, are vetted by and associated with these fractional CFO businesses via contract.

Unlike a full-time CFO, a Fractional CFO works part-time, typically dedicating a specific number of hours per week or month to each client or engagement.

Fractional CFOs offer their services to multiple companies, ranging from small to medium-sized businesses, unlocking a clear and comprehensive view of your financial future through forward-facing financial visibility that may not require a full-time CFO but still need high-level of financial analysis and guidance.

These seasoned financial professionals offer a flexible and cost-effective alternative, providing strategic insights, accounting services, and expertise on a fractional or temporary basis.

How Does A Fractional CFO Differ From Full-Time CFOs

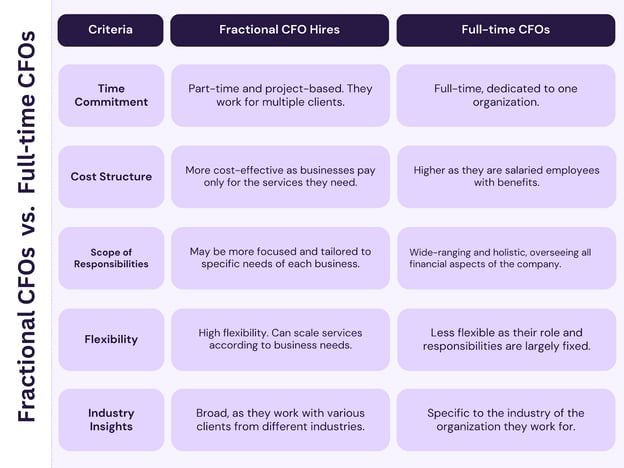

Fractional CFO hires differ from full-time CFOs in terms of time commitment, cost structure, scope of responsibilities, flexibility, and industry insights. The following are some prominent differences between the two:

Benefits Of Fractional CFO Services

1. Cost-Effectiveness

Hiring a fractional CFO for a full time CFO position is more cost-effective than employing a full-time CFO. It eliminates the expenses of a full-time executive salary, benefits, and overhead costs. Fractional CFOs work part-time as contractors (1099), allowing companies to pay for services rendered without a continuous, full time employee commitment. For context, a full-time CFO’s median total compensation ranges from $188,000 to $567,000 per year, while a fractional CFO costs anywhere between $1,500/mo – $10,000/mo offering significant cost savings.

2. Flexible Engagement

Fractional CFOs offer flexibility in engagement and time commitment. They can be hired for specific projects, defined periods, or a set number of hours per week or month. This scalability allows the company to adjust financial support as needed without the constraints of a full-time position.

3. Expert Financial Guidance

Fractional CFOs offer their services to small to medium-sized businesses that may not require a full-time CFO but still need high-level financial guidance. These seasoned financial professionals offer a flexible and cost-effective alternative, providing strategic insights, financial planning, financial analysis, accounting services, and expertise on a fractional basis.

4. Customized Solutions

Fractional CFOs tailor their services to the specific business needs of each company. They collaborate closely with the management team to understand business goals and develop financial strategies aligned with those objectives. Customized solutions address unique challenges and optimize financial operations accordingly to achieve growth together.

5. Access To Networks And Resources

Fractional CFOs generally possess vast networks of finance professionals and industry connections, offering benefits in fundraising, partnership opportunities, and accessing specialized resources. Their broad industry knowledge allows them to bring best practices and insights from various sectors, enriching the financial strategies of the company.

6. Scalability And Adaptability

Fractional CFOs adapt their services to accommodate organizational growth or changes in financial needs. They provide guidance during expansion, mergers and acquisitions, or financial restructuring. Their flexible approach aligns expertise with evolving requirements, supporting sustainable growth.

When To Hire A Fractional CFO

Companies hire a fractional CFO depending on the startup’s stage of growth. Use our short quiz to find out if you need a CFO. Here are some scenarios when it may be advantageous to consider bringing in an experienced fractional CFO:

1. Fundraising And Investor Relations

Startups often need to raise capital to fuel their growth. A fractional CFO with experience in fundraising and raising capital, can provide valuable expertise in creating financial projections, preparing investor materials, and negotiating funding deals.

They can help startups present a compelling financial story to potential investors and navigate the complexities of equity financing or debt arrangements.

2. Financial Strategy And Planning

As startups scale, they require sound financial strategies and plans to guide their growth. A fractional CFO can assist the finance leader in developing financial models, forecasting revenue and expenses, setting budgets, and creating financial roadmaps aligned with the company’s goals.

They provide strategic insights to optimize cash flow, manage burn rates, optimize strategy and make informed decisions about resource allocation and investment priorities.

3. Financial Operations And Controls

Startups need strong financial operations and internal controls to ensure accurate financial reporting and compliance. A fractional CFO can help establish robust financial systems, implement processes for bookkeeping, financial reporting, and expense management, and implement systems to strengthen internal controls.

A chief financial officer can also advise on financial policies and procedures to mitigate financial risks and safeguard company assets.

4. Scaling And Growth Management

Startups experiencing rapid growth face unique financial challenges. A fractional CFO can provide guidance on scaling financial operations, the cash flow position, managing working capital, and optimizing financial processes to support growth while maintaining financial stability.

They can assist in evaluating expansion opportunities, the cash position, assessing financial risks, anticipating future owner compensation, specific financial challenges and developing strategies to ensure sustainable growth.

5. Exit Strategies And M&A

For startups considering exit strategies, such as using equity funding through an acquisition or IPO, a fractional CFO can play a crucial role. They can conduct financial due diligence, analyze valuation scenarios, support negotiations, and help navigate the complexities of the transaction.

Fractional CFOs with M&A experience can be trusted advisors to provide strategic planning and financial insights to maximize the value of the business ready for exit and ensure a smooth transition.

6. Interim Or Transition Periods

During leadership transitions or when a full-time CFO role is vacant, a fractional CFO can fill the gap and provide continuity in financial leadership. They can maintain financial operations, manage financial reporting, and provide stability during the transition period (like an interim or part time CFO would) until a permanent chief financial officer is hired.

What Would It Cost To Hire A Fractional CFO

What it would cost to hire a Fractional CFO depends on how many hours or days they work for depending on the flexible pricing options they offer. They may charge on an hourly basis, daily basis, or get paid a monthly retainer, allowing companies to choose between one-time projects or ongoing advisory services.

When evaluating the cost of hiring a Startup Fractional CFO, consider factors such as your business size and complexity, required services, geographical location, and the CFO’s experience. The extent of services needed, such as financial strategy development, budget planning, M&A consulting, or general financial health evaluation, will also influence the cost.

Location might also sway the price, with certain regions tending to be pricier for Fractional CFO services. Furthermore, a CFO’s expertise and experience have a direct impact on their hourly rates – more seasoned professionals will likely command higher fees. These aspects collectively contribute to your Startup Fractional CFO cost, so due diligence is key in your financial planning.

You can estimate the cost of hiring a Fractional CFO using our startup accounting cost calculator.

How To Find The Right CFO For Your Startup

To find the right fractional CFO for your startup, follow these steps:

1. Assess Your Needs

Determine the specific financial expertise and skills your startup requires in a fractional CFO. Consider factors such as fundraising, general financial strategy, industry knowledge, and growth stage.

2. Seek Referrals And Recommendations

Tap into your professional network and seek recommendations from trusted sources, such as investors, advisors, or fellow entrepreneurs to find your choice CFO. They may be able to refer you to fractional CFOs with relevant experience and a proven track record.

3. Conduct Interviews

Interview potential fractional CFO candidates to assess their expertise, experience working with startups, and cultural fit. Ask about their previous engagements, their approach to financial challenges, and their understanding of the startup ecosystem. Make sure they have enough time to support your startup needs especially in tight schedules like due diligence and annual audit.

4. Check References

Request and check references from past clients to gain insights into the candidate’s performance, communication style, and ability to deliver results and future goals.

5. Evaluate Industry Experience

Consider the fractional CFO’s experience in your industry or similar sectors. Familiarity with the nuances and challenges of your specific industry can greatly benefit your startup. Search social media accounts like LinkedIn profiles and articles published by the candidate to back their experience and knowledge.

6. Assess Communication And Collaboration Skills

Evaluate the candidate’s communication skills and ability to collaborate effectively with your team. A fractional CFO should be able to communicate complex financial concepts in a clear and concise manner.

7. Discuss Engagement Terms

Determine the expected financial forecast, time commitment, fees, and contractual terms with the fractional CFO. Ensure that both parties have a clear understanding of the scope of work, deliverables, and expectations.

By following these steps, you can increase the likelihood of finding the right fractional CFO who possesses the necessary skills, experience, cultural fit, and industry knowledge to support your startup’s financial needs and contribute to its success.

Conclusion

Hiring a fractional CFO can benefit a company, particularly startups. They offer cost-effective access to high-level financial expertise, allowing businesses to receive strategic guidance without the expenses associated with a full-time CFO.

The flexibility in engagement and time commitment can enable a company to scale financial support as needed, whether for specific projects, defined periods, or a set number of hours. The scalability and adaptability of experienced fractional CFOs also make them well-suited to support startups during periods of growth, expansion, or restructuring.

Overall, hiring a fractional, experienced CFO, empowers a company to make informed financial decisions, optimize business operations, and drive sustainable growth. By considering the unique benefits of engaging a fractional CFO, startups can position themselves for financial success and gain a competitive edge in the dynamic business landscape.