Staying afloat requires more than a brilliant business idea; it’s all about managing money, right? It’s easy to feel overwhelmed by endless invoices, receipts, and financial reports, not to mention tax obligations.

Fortunately, mastering a few crucial accounting practices can turn this tide, giving you clear financial insight, ensuring compliance, and driving informed business decisions. This piece will guide you through these essential accounting tips that are easy to understand, even for beginners.

Understanding The Significance Of Accounting For Startups

Business owners dream of a thriving enterprise, and the key to this is having a handle on the numbers. Accounting, especially small business accounting, isn’t just about crunching numbers; it’s the backbone of your business. It tells the financial story of your enterprise, showing where you stand, guiding your future decisions, and gathering funding.

- Firstly, small business accounting provides clarity. Knowing how much money is coming in, where it’s going, and how much is left is vital as a small business owner. This information helps you plan your business operations and strategize for growth.

- Secondly, accounting ensures compliance. Businesses have to abide by various laws and regulations, including tax obligations. Proper accounting ensures you comply, avoiding costly fines and potential legal problems.

- Next, it aids in securing loans or investments. Any investor or lender will want to see your financial records before investing money in your business. Proper accounting will present a transparent and attractive picture to them.

A significant aspect of small business accounting is managing the business bank account. Keeping business and personal finances separate is essential to avoid confusion and legal issues. Furthermore, maintaining a business bank account provides a clear record of all business transactions, making it easier to track income and expenses.

Accounting is crucial for the success of a small business. It provides clarity, ensures compliance, aids in securing funds, and helps manage a business bank account. Therefore, every small business owner should give it the attention it deserves.

Understanding Basic Accounting Terms

Accounting might seem like a language of its own to new entrepreneurs, but it’s crucial to understand its basic terms to effectively run your business. Let’s break down these essential accounting terms in easy-to-understand language.

Revenue And Expenses

Revenue is the money your business earns from selling its products or services. If you own a bakery, every loaf of bread you sell contributes to your revenue. On the other hand, expenses are the costs your business incurs to generate this revenue. These could be raw materials, rent, utilities, salaries, or advertising costs. The aim is to have your revenue exceed your expenses to make a profit.

Assets And Liabilities

Assets are everything that your business owns that has value. They can be tangible, like machinery, inventory, or cash in the bank, or intangible, like patented technology. Liabilities, contrastingly, are what your business owes to others. This could be money owed to suppliers, bank loans, or unpaid bills. Your business’s financial health depends on having more assets than liabilities.

Equity

Equity, or owner’s equity, represents the ownership interest in the business. It’s what’s left over when you subtract your business’s liabilities from its assets. It’s essentially the ‘net worth’ of your business. As your business earns profit, your equity grows.

Financial Statements

Lastly, understanding financial statements is key. These documents tell your business’s financial story. The three primary ones are:

- Balance Sheet: Shows your business’s assets, liabilities, and equity at a particular moment.

- Income Statement (or Profit and Loss Statement): Displays your business’s revenue, expenses, and profits over a certain period.

- Cash Flow Statement: Details how cash flows in and out of your business.

By understanding these basic accounting terms, you’re already on your way to becoming a more savvy and informed business owner. The language of accounting is vital to speaking the language of business.

Take our basic accounting quiz

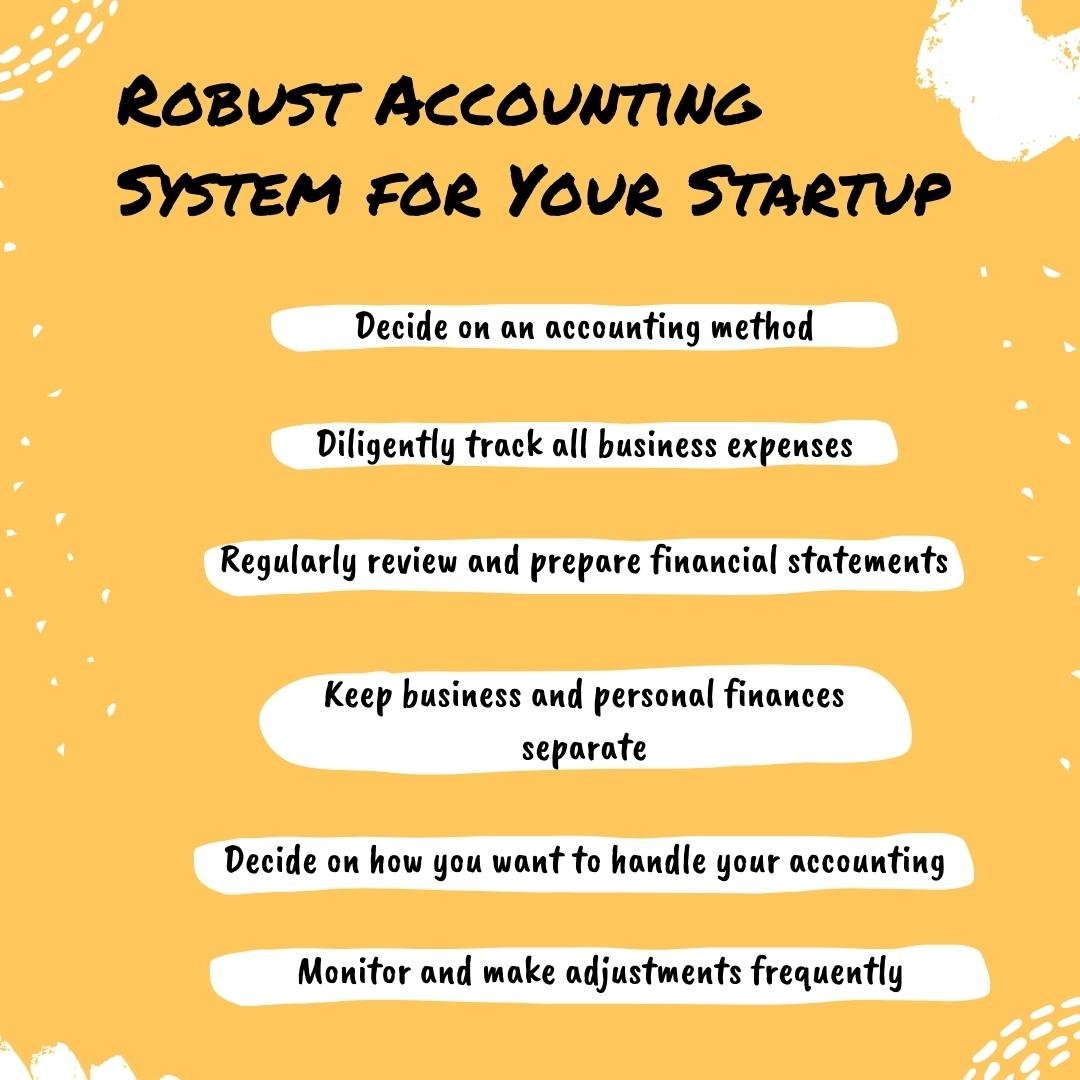

Establishing A Robust Accounting System For Your Startup

When it comes to managing your business’s finances, having an effective accounting system in place is like having a reliable navigation system for a ship—it steers you in the right direction. Here’s how to implement a robust accounting system for your small business.

Choosing The Right Method

Firstly, decide on an accounting method: cash or accrual.

- Cash accounting recognizes revenue when cash is received and expenses when they are paid. It’s simpler and gives a clear picture of the cash in hand.

- Accrual accounting, however, records revenue when it’s earned and expenses when they’re incurred, regardless of cash movement. It gives a more comprehensive view of business finances over the long term.

The choice depends on the nature and scale of your business.

Tracking Business Expenses

Diligently track all business expenses. Keep all receipts and document all purchases—no matter how small. This habit is crucial not only for maintaining accurate financial statements but also for tax deductions. The more business expenses you can prove, the less taxable income you report, which could lead to significant savings.

Maintaining Separate Bank Accounts

Regarding business bank accounts, keep business and personal finances separate. Comming funds (mixing funds) can lead to tax complications and skewed financial records. Opening a separate bank account for your business makes it easier to track income and expenses, simplifying your accounting process.

Understanding And Preparing Financial Statements

Understanding business financial statements is another essential step. These documents—balance sheets, income statements, and cash flow statements—offer vital insights into your business’s financial health.

They show you where your money is coming from, where it’s going, and how much is left. Regularly reviewing and preparing these statements will help you make informed business decisions and identify potential issues before they escalate.

Selecting Accounting Software Or Hiring A Professional

Finally, decide on how you want to handle your accounting. Many small businesses can manage with accounting software. These tools automate processes, generate financial statements, and even handle tax calculations. They can be a cost-effective way to manage your accounting.

Alternatively, hiring an accountant or bookkeeper might be the right choice for businesses with more complex finances. These professionals not only handle the numbers but also offer strategic financial advice. However, their services come at a higher cost compared to operating the software by yourself.

Ongoing Monitoring And Adjustment

Implementing an accounting system isn’t a one-time task. It requires ongoing monitoring and adjustments. As your business evolves, so will its financial needs. Regularly review your accounting practices to ensure they still serve your business effectively.

Mastering Cash Flow Management

The lifeblood of any business, big or small, is its cash flow. Simply put, cash flow is the movement of money in and out of your business. Managing this flow effectively is crucial for business stability and growth. Here’s how to do it in simple terms.

Understanding Cash Flow

First, understand what cash flow means. When your business sells products or gets paid for services, money flows in – this is a cash inflow. When you pay for business expenses like salaries, rent, supplies, or taxes, money flows out – this is a cash outflow.

Positive cash flow means your inflows exceed your outflows. Conversely, negative cash flow indicates your outflows are more than your inflows.

Forecasting Cash Flow

A critical step in managing cash flow is forecasting. It means predicting your future cash inflows and outflows based on your past data and future plans. A cash flow forecast will help you anticipate periods of negative cash flow and take proactive measures.

For your convenience, we have created this cash flow template.

Speeding Up Inflows And Slowing Down Outflows

Next, try to speed up cash inflows. Invoice promptly and encourage quicker payments from customers by offering incentives like discounts. On the flip side, it slows down cash outflows. Negotiate longer payment terms with suppliers or stagger payments to spread out your outflows.

Keeping A Cash Reserve

Lastly, always keep a cash reserve. It’s like an emergency fund for your business to cushion unexpected costs or slower-than-expected inflows. Having a cash reserve provides financial security and allows your business to operate smoothly, even in challenging times.

Cash Is King

Remember, “Cash is King” in business. Profit is essential, but positive cash flow is what keeps your business afloat and drives growth. Regularly monitor your cash flow and adapt your strategies as needed. With effective cash flow management, you’re on your way to building a financially healthy and sustainable business.

Top Tips For Efficient Bookkeeping For Startups

Bookkeeping, the process of recording all your business’s financial transactions, is an integral part of small business accounting. It might not be the most exciting part of running a business, but it’s essential. Here are some simple and effective bookkeeping practices for your startup.

Maintain Regular Records

The key to successful bookkeeping is consistency. Don’t let receipts and invoices pile up. Record transactions regularly, preferably daily. This habit ensures accuracy, saves time, and reduces stress during tax season.

Go Digital

Invest in a good accounting software or app that suits your business needs. Digital tools automate data entry, reduce human error, generate reports, and make the entire bookkeeping process smoother and quicker.

Separate Personal And Business Expenses

Always keep business and personal finances separate. Mixing them can lead to confusion and potential tax issues. Use a separate business bank account and credit card for all business transactions.

Categorize Expenses

Categorizing your expenses makes it easier to analyze your spending patterns and can help maximize tax deductions. Common categories include rent, utilities, office supplies, travel, and marketing expenses.

Monitor Receivables

Late or unpaid invoices can wreak havoc on your cash flow. Keep a close eye on your accounts receivable, follow up promptly on overdue invoices, and have a plan in place to deal with non-payment.

Seek Professional Help

When in doubt, seek help. A professional bookkeeper or accountant can set up your bookkeeping system, provide advice, and help ensure you comply with tax laws.

Effective Management Of Accounts Receivable And Payable

Managing accounts receivable and payable efficiently is crucial to maintaining healthy cash flow and business relationships. Here’s a simple guide to do it effectively.

Accounts Receivable: Get Paid On Time

Accounts receivable is the money owed to you by your customers. To manage this:

- Invoice Promptly: As soon as you’ve delivered a product or service, send an invoice. The sooner you invoice, the sooner you get paid.

- Clear Payment Terms: Ensure your payment terms are clear, reasonable, and communicated to customers upfront.

- Follow-up: Regularly review your receivables and follow up on overdue payments. Consider automated reminders to save time.

Accounts Payable: Pay Smart

- Accounts payable is what you owe to your suppliers. To manage this:

- Track Expenses: Keep a clear record of all purchases and expenses.

- Schedule Payments: Avoid late fees and maintain good supplier relationships by scheduling payments.

- Leverage Payment Terms: If suppliers offer payment terms like “net 30” or “net 60”, use this to your advantage to hold onto your cash longer.

Remember, the goal is to get paid as soon as possible and pay others just in time. This balance ensures the maximum cash stays in your business, boosting your financial health.

Simplifying Payroll Administration For Your Business

Payroll administration, the process of managing the payment of wages to employees, is a critical task for any business owner. Done right, it ensures happy employees and complies with legal requirements. Here’s a simple guide to managing it efficiently.

Understanding Payroll Basics

First, understand the basics. Payroll isn’t just salaries. It includes wages, bonuses, deductions, and net pay. Also, you need to account for taxes, social security, and other statutory contributions.

Automate Your Payroll

Consider using payroll software. These tools automate calculations, manage deductions, and generate pay slips, saving you significant time and reducing errors.

Keep Accurate Records

Record keeping is crucial for payroll. You must accurately track employees’ work hours, leaves, overtime, and bonuses.

Stay Updated With Laws

Stay informed about labor laws, tax regulations, and minimum wage requirements. Laws change, and non-compliance can lead to penalties.

Outsource If Needed

If payroll administration becomes too complex, consider outsourcing it. Payroll service providers can handle everything for you and ensure compliance.

Tax Planning And Compliance For Small Businesses

For small business owners, tax planning and compliance may seem complex, but they don’t have to be. Understanding the basics and following some simple practices can make the process smoother.

Understanding Tax Obligations

Every business has different tax obligations depending on its structure, location, and operations. Familiarize yourself with the relevant income tax, sales tax, and payroll tax laws in your area. Also, be aware of any industry-specific taxes.

Effective Tax Planning

Tax planning involves taking strategic steps to minimize tax liabilities while complying with the law. Here are some tips:

- Deduct Business Expenses: Keep records of all business expenses. Many are tax-deductible, reducing your taxable income.

- Utilize Tax Credits: Tax credits are like coupons for tax bills. They’re available for various activities like hiring, training, or green initiatives. Research what’s available for your business.

- Plan for Major Expenses: Timing can affect your taxes if you plan to make significant purchases or investments. Consult a tax professional to understand the best timing.

If you want more details on tax planning strategies, you can check our article on Tax Planning.

Compliance Is Key

Compliance means adhering to all tax laws and regulations. Ensure you file your tax returns accurately and on time to avoid penalties.

Use Professional Help

Consider hiring a tax professional or accountant. They can guide you through tax planning and ensure compliance. They’ll keep up with changes in tax laws so you can focus on running your business.

Financial Analysis And Decision Making

For small business owners, making informed decisions is critical. That’s where financial analysis comes in. By examining your business’s financial data, you can make smarter choices that fuel growth. Here’s how to get started.

Understand Your Financial Statements

Financial statements are your go-to resource for financial analysis. The balance sheet shows what you own and owe, the income statement reveals profitability, and the cash flow statement shows your cash movement. Understand these statements and review them regularly.

Calculate Key Financial Ratios

Financial ratios give you quick insights into your business’s financial health. Ratios like profit margin, debt-to-equity, and current ratio can indicate profitability, financial stability, and liquidity. Learning to calculate and interpret these ratios is beneficial.

Use Data For Decision Making

Use financial data when making decisions. Financial analysis can guide you, whether you’re considering a new investment, adjusting prices, or planning for growth. For example, if your profit margin is low, you might decide to increase prices or reduce costs.

Consider Professional Advice

If financial analysis seems complex, consider consulting a financial advisor. They can help interpret financial data and advise on strategic decisions.

FAQs

1. Is Small Business Accounting Software A Game-Changer For Many Businesses?

Firstly, it automates tasks, saving you time and reducing the risk of errors. Secondly, it provides real-time financial data, allowing you to monitor your business’s financial health at a glance. The software can generate various reports, like profit and loss statements, balance sheets, and cash flow statements, providing valuable insights. Plus, come tax season, having all your financial data organized and accessible can be a big relief. Finally, many accounting software options are scalable, growing with your business and meeting your evolving needs.

2. When Should Startups Consider Hiring Accounting Professionals?

While small business accounting software can handle much of the day-to-day accounting tasks, there are situations where you may need the expertise of accounting professionals. These situations include setting up your initial accounting system, dealing with complex financial transactions, navigating tax planning and compliance, and needing financial advice for growth or investment decisions. Additionally, if your business is rapidly growing or if financial management is taking up too much of your time, it might be worth hiring a professional to handle the accounting so you can focus on other aspects of your business.

Final Words

Effective small business accounting is fundamental to your startup’s success. It goes beyond just numbers and finances, helping you make informed decisions, comply with tax laws, and ensure business sustainability. While accounting software can automate much of the work, small business accounting professionals can provide invaluable expertise, especially in complex situations.

Ultimately, mastering your business’s accounting is not just about staying organized or meeting legal obligations—it’s about gaining insights, controlling cash flow, and driving your business toward growth and success.