It’s been a minute since the Silicon Valley Bank disaster. And while a lot of us may have moved on, there are founders still suffering from the direct consequences of that collapse, and others still traumatized about the reality of what can become of their money in certain unfortunate circumstances.

While we may not be totally able to alleviate those fears, or the impact of that collapse, the least we can do is to inform you about the new development, as regards other guys (and by that I mean banks) that still back startups and can also help your startup achieve its goals.

In the article, we are going to be reviewing 10 banks that are best for startups in the current climate, how they got on the list, and how best they help startups.

Let’s get to it!

10 Best Banks For Startups

1. Chase

Chase stands as the largest bank in the US. And by market cap, the largest in the world. Yes, they have the prestige, but what really makes them one of the best banks for startups is their commitment to the growth of startups, especially regarding IPOs.

Born from the 2000 merger of Chase Manhattan Corporation and J.P. Morgan & Co., this financial powerhouse has spent decades building trust with business owners.

Chase became a household name for small businesses when it launched its Ink business credit card series, which revolutionized how entrepreneurs earn rewards on everyday expenses. Today, Chase serves more than 4 million small businesses across America.

Major Features:

- Business checking accounts with multiple tiers

- Business savings accounts

- Merchant services and payment processing tools

- Business credit cards, including the popular Ink series

- SBA loans, term loans, and lines of credit

- Integrated QuickBooks support

- Extensive network of 4,700+ branches nationwide

- Robust fraud protection systems

Cons:

- Monthly maintenance fees of $15 (though waivable with minimum balances)

- Low APY of just 0.01-0.02% on checking and savings accounts

- Reputation for prioritizing larger corporate clients over small startups

- Lengthy loan application process

- Difficulty getting approved without an established credit history or substantial collateral

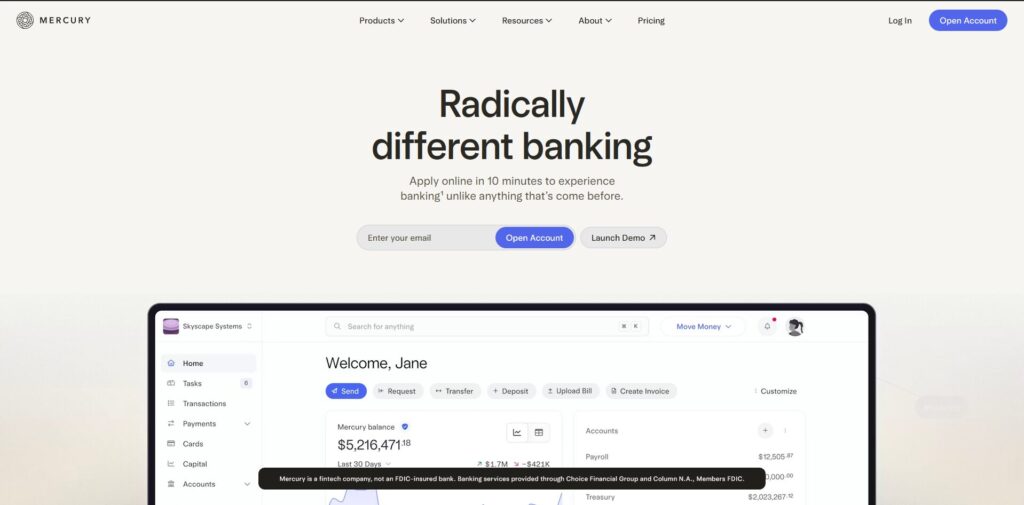

2. Mercury

Full disclosure, Mercury here isn’t exactly a bank, but a fintech that provides virtual banking services. But that doesn’t matter as much as the intent behind founding the bank which is: “making banking better for ambitious endeavors”.

Since its inception in 2017, Mercury has gone ahead to gain the love and trust of over 200,000 customers, consisting of both companies and individuals. Roughly one in three U.S. startups use the platform, which processed $156 billion in transaction volume in 2024.

Mercury eliminated everything entrepreneurs hated about traditional banking: branch visits, paperwork, monthly fees, and clunky interfaces. The bank has made waves in Silicon Valley by offering accounts that could be opened in minutes, not weeks, with sleek dashboards that made founders actually want to check their finances.

So, despite not being a traditional bank, their commitment to startups has made us include them as one of the best banks for startups.

Major Features:

- Free FDIC-insured checking accounts

- High-yield savings through Mercury Treasury (up to 4.47% APY)

- Virtual and physical debit cards with customizable controls

- International wire transfers

- Multi-account management for cash flow organization

- Bill pay automation

- Seamless integrations with Stripe, QuickBooks, Xero, and other startup tools

- IO Credit Card for qualified businesses

- Accounts can be opened in minutes online

Cons:

- Zero physical branches means no cash deposits or in-person help

- Limited lending products (only the IO Credit Card, no traditional business loans or lines of credit)

- Services focused primarily on the U.S. market

- Savings accounts earn 0% APY

- Customer support is entirely remote and can feel less personal

3. U.S. Bank

US Bank has been around for a minute. Serving American businesses since 1863, making it one of the oldest continuous banking operations in the country.

As the fifth-largest commercial bank in the United States, US Bank built its reputation in the Midwest before expanding nationwide. The bank carved out its small business niche in the 1980s and 90s by focusing on Main Street businesses rather than just Wall Street corporations. US Bank became particularly known among entrepreneurs for its strong SBA loan portfolio and willingness to work with businesses that other national banks might overlook.

Major Features:

- Business checking and savings accounts

- Money market accounts

- SBA 7(a) loans with competitive rates

- Term loans and lines of credit

- Equipment financing

- Business credit cards

- Merchant services

- Payroll processing

- Business payment solutions

- Specialized accounts for different business types

- Robust cash management tools

Cons:

- Monthly fees ranging from $0-$20 depending on account type

- Difficult-to-meet fee waiver requirements

- Low savings account APY of up to 0.05%

- Limited presence in some U.S. regions (particularly the coasts)

- Slower digital innovation compared to fintech competitors

- Online platform lacks modern feel and advanced features that digital-native startups expect

4. Citi Bank

Citibank’s business banking division grew from its international roots, having established itself as a global banking leader since the early 1900s. While Citi serves businesses of all sizes, it truly shines for startups with international reach.

Citi made its mark with tech startups in the 2000s by offering specialized services for companies doing business across borders and has since leveraged its worldwide presence to build what many consider the gold standard for multi-currency banking and international transactions.

Major Features:

- Multi-currency business accounts

- International wire transfers with competitive rates

- Trade finance services

- Treasury services for cash management

- Business checking and savings accounts

- Business credit cards

- Merchant services

- Foreign exchange services with access to major global currencies

- Dedicated relationship managers for business clients

- Specialized solutions for different industries

Cons:

- Higher minimum balance requirements (often $5,000-$25,000 depending on account type)

- Substantial monthly fees for early-stage startups

- Complex account structures that can overwhelm new business owners

- Reputation for being less attentive to small businesses compared to enterprise clients

- Digital tools have a steeper learning curve

- Less startup-focused features compared to neobanks

5. Bluevine

Bluevine started in 2013 as a fintech disruptor focused on solving the cash flow problems that keep small business owners up at night. Founded by Eyal Lifshitz, the company originally offered invoice factoring and lines of credit before launching its game-changing Business Checking account in 2020.

Bluevine made headlines by offering what was then the highest interest rate on business checking accounts. This radical move challenged the industry standard of paying businesses virtually nothing on their operating cash. The company has since established itself as one of the best “banks” for free business checking and business lines of credit.

Major Features:

- Business checking account with 1.5% APY on balances up to $250,000 (if qualified)

- Business savings accounts

- No monthly fees on standard checking

- Mobile deposits

- Bill pay functionality

- Unlimited transactions

- Debit cards

- Integrations with QuickBooks and other accounting software

- Invoice factoring services

- Lines of credit up to $250K

Cons:

- No physical branches whatsoever (no cash deposits or in-person service)

- APY requirements can be restrictive (must maintain qualifying activities)

- Relatively new player with a limited track record compared to established banks

- No traditional business loans or SBA lending products

- Customer service response times can be slower during high-volume periods

6. Brex

Brex exploded onto the startup scene in 2017 with a bold approach: corporate credit cards that don’t require personal guarantees or credit checks.

Founded by Brazilian immigrants Henrique Dubugras and Pedro Franceschi, both of whom dropped out of Stanford to build the company, Brex understood the frustration of startup founders who couldn’t access business credit despite raising millions in venture capital.

The company’s breakthrough came from underwriting based on cash in the bank and revenue rather than personal credit scores; a revolutionary approach that resonated with venture-backed startups. Brex quickly became the default card for Y Combinator companies, serving 80% of Y Combinator startups, and has since spread throughout Silicon Valley.

Major Features:

- Corporate credit cards with no personal guarantee required

- Cash management accounts with high yields

- Automated expense tracking and categorization

- Real-time spending controls and customizable limits

- Rewards programs optimized for startup spending patterns

- Travel perks and benefits

- Virtual cards for employee spending

- Integrations with accounting software like QuickBooks and NetSuite

- Higher credit limits compared to traditional business cards

- Instant approval decisions for qualified startups

Cons:

- Limited traditional banking services beyond cards and cash management (no business loans or full-service checking)

- No physical branches for in-person support

- Some features require minimum account balances or subscription plans ($12-$49/month for premium tiers)

- Strict eligibility requirements that exclude bootstrapped or slower-growth startups

- Underwriting focus on venture-backed companies means traditional small businesses may not qualify

7. Rho

Rho launched in 2018 as the “finance platform for who’s next,” targeting high-growth startups and small businesses that are drowning in financial and administrative work.

Founded by Everett Cook and Nik Milanovic, Rho was born from the realization that modern businesses needed more than just a bank account; they needed a complete financial operating system. The company made waves by offering completely free business banking with powerful automation tools that typically required expensive treasury management services. Rho distinguished itself largely by its impressive use of automation—letting businesses set up complex approval chains, automate bill payments, and manage cash across multiple accounts without manual intervention.

Major Features:

- Customizable business checking accounts with zero fees

- Automated bill pay and invoice management

- Expense management with virtual cards

- Multi-account cash management tools

- Integrations with QuickBooks, Xero, Slack, and other business software

- Real-time spend tracking and reporting

- API access for custom integrations

- Corporate cards with spending controls

- Automated approval workflows

- Cash flow forecasting tools

Cons:

- Relatively new player (founded in 2018) with a limited long-term track record

- $25,000 minimum balance requirement to open an account (prohibitive for early-stage startups)

- No physical branches or in-person banking services

- Advanced features may require additional fees or higher account balances

- No traditional lending products like business loans or lines of credit

8. Bank of America

Bank of America has been in business since 1904 and serves more small businesses than any other U.S. bank (over 4 million at last count). The bank earned its reputation among entrepreneurs through its Business Advantage programs, launched in the 1990s, which offered tiered banking with real perks for keeping higher balances or using multiple products.

Bank of America has since made a strategic push into small business digital banking in the 2010s, investing billions in mobile and online platforms. The bank’s relationship rewards program became particularly popular, offering significant fee discounts for businesses that maintain multiple accounts or use their credit cards regularly.

Major Features:

- Multiple tiers of business checking accounts

- Business savings and money market accounts

- Business Advantage Relationship Rewards program

- Merchant services

- SBA loans with competitive rates

- Business credit cards

- Lines of credit

- Equipment financing

- Payroll services

- Seamless integrations with QuickBooks and Zelle for instant payments

- Extensive branch network nationwide

Cons:

- Monthly maintenance fees of $16 (waivable but with high balance requirements of $5,000-$10,000)

- Very low APY of 0.01% on most accounts

- Fees can be difficult to waive without maintaining high balances or using multiple products

- Small business owners report feeling like small fish in a very large pond

- Better service reserved for high-value commercial clients

9. Capital One

Capital One is yet another bank that understands startups and small businesses. Its checking accounts have unlimited in-person and electronic transactions with zero fees.

Capital One launched its Spark Business brand in 2009 to carve out a distinct identity in small business banking, separate from its consumer credit card empire. The bank has made its name by offering some of the most rewarding business credit cards in the industry, with generous cash back rates and simple redemption options.

Capital One Spark revolutionized business credit by treating small businesses more like consumers—with faster online applications, instant decisions, and straightforward rewards instead of complicated points systems. The bank later expanded into business checking and savings, bringing the same digital-first philosophy that made its credit cards popular.

Major Features:

- Business checking accounts with online-focused features

- Business savings accounts (0.20% APY)

- Excellent business credit cards with rewards (including the Spark Cash card with 2% cash back)

- Mobile banking with robust features

- Virtual assistant support

- Merchant services

- Business loans

- Fast online application process

- Simple, transparent rewards programs

- Instant approval decisions on credit cards

Cons:

- Limited physical branch locations (in-person service mostly unavailable)

- Monthly fees range from $0-$35 depending on account tier, and can be hard to waive

- Relatively basic banking features compared to full-service banks

- No SBA loan programs

- International banking capabilities are limited compared to global banks

10. Silicon Valley Bank (now First Citizens Bank)

Yes, we know what you are thinking. The first thing that comes to mind when anyone sees Silicon Valley Bank is that 2023 disaster. So, why have they still somehow made this list?

Well, Silicon Valley Bank was acquired by First Citizens Bank the same month the 2023 failure occurred, and they’ve since bounced back to serving startups like they used to. SVB claims that since the incident, a number of startups have returned, and they even added over a thousand clients in the first 6 months of 2025.

They still have some of the best debt offerings in the market, reportedly quick, flexible, and generous.

Major Features:

- Business checking and savings accounts

- Venture debt and growth capital loans

- Lines of credit based on venture backing

- Term loans

- Equipment financing

- International banking services

- Foreign exchange services

- Cash management services

- Access to extensive network of venture capital firms

- Specialized teams focused on technology and life sciences sectors

- Startup resources and networking events

Cons:

- The 2023 collapse and FDIC takeover raised serious concerns about stability and risk management

- Higher minimum balance requirements (often $5,000-$25,000)

- Premium fees compared to digital banks

- Services primarily focused on venture-backed companies (bootstrapped startups may not qualify)

- Primarily U.S.-focused with limited international reach

- Transition to First Citizens has created uncertainty about future product offerings and service levels

Wrap Up

What we have done here is create not just a list of the banks that serve Startups best, but a list of a variety of banks that serve the various types and needs of startups. Choosing one of these banks or multiple banks (depending on your needs) will eventually come down to personal preference and what your startup needs.