Technological innovations drive the most economic growth over time and raise living standards. Without investment in technology development, it is difficult to have continuous tech innovations. Over time, U.S. research budgets have evolved. Compared to the 1980s, private-sector research and development investment has risen steadily while public-sector investment declined. More than 2/3 of U.S. research and development are now funded by businesses. Public research and technology development play a key role in creating new technology.

In order to encourage the private sector to keep investing in R&D, the US government came up with the research and development credit that allows paying fewer taxes thus saving hundreds of thousands of dollars each year.

In essence, we are talking about general business tax credit for companies that incur R&D expenses. The tax credits can be used to offset payroll taxes, income taxes, or alternative minimum taxes.

It’s a valuable tool that can help reduce your payroll tax liability by up to $250,000 per year. If you are an early-stage startup that incurs mainly expenses, you may be eligible for tax credits. This guide will discuss the eligibility requirements for the tax credits program and how to claim it successfully. We will also provide tips and advice on how to make the most of these valuable tax credits.

What Is The R&D Tax Credit?

The R&D tax credit is a federal program available to businesses that incur expenses related to the research and development of new products or services. The program was created in 1981 to encourage companies to invest in R&D activities. It has been extended and expanded several times since its inception. The most recent extension was enacted in 2015 and made the program permanent.

To be eligible for the tax credits, your company must have qualified research expenses. Qualified research expenditures are defined as activities that seek to discover information that is technological in nature and that results in a new or improved function, performance, or reliability of a product or process. The tax credits can be used to offset payroll taxes, income taxes, or alternative minimum taxes.

Click Here To Calculate Your Potential Tax Credit

5 Interesting Statistics About Tax Credit In The US

(Source: OECD Study Published in 2021)

- In 2018, tax incentives accounted for 48% of total government support for BERD in the United States (BERD stands for Business Enterprise R&D)

- The cost of government tax support for R&D rose (in 2015 prices) from USD 9.5 billion in 2000 to USD 22.1 billion in 2018.

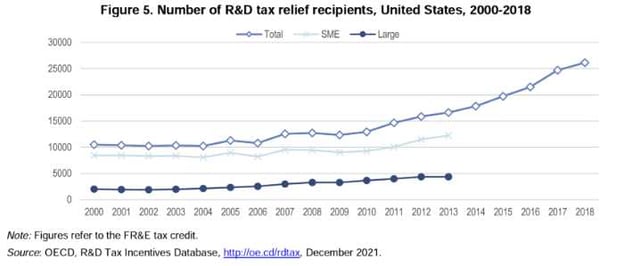

- Between 2000 and 2018, the number of R&D tax relief recipients effectively more than doubled in the United States, from around 10,500 R&D tax relief recipients in 2000 to over 26,000 R&D tax relief recipients in 2018.

- Over the period 2000-2013 period (for which relevant data are available), SMEs, defined as enterprises with gross receipts of less than USD 50 million, accounted for the majority of R&D tax relief recipients in the United States, with a share of around 70-75% in more recent years.

- In 2018, firms in services represented around 68% of R&D tax relief recipients in the United States, followed by firms in manufacturing with a share of 29%. The share of R&D tax benefits accounted for by firms in manufacturing and services amounted to 49% in that year.

What Are The Benefits Of The Tax Credit?

The tax credit can provide several benefits for businesses. Some of the key benefits include:

– Tax savings: It can help businesses save money on their taxes. The credit can be used to offset payroll tax liabilities, income tax liabilities, and alternative minimum tax liability.

– Increased cash flow: It can help businesses increase their cash flow by reducing their tax liabilities. This can help businesses manage their finances more effectively and invest in new R&D activities.

– Improved financial stability: It can help businesses improve their financial stability by encouraging investment in R&D activities. This can help companies to stay competitive and expand their operations.

-Cost recovery and R&D expenses: In addition to a re-investment tax credit, the ability to fully refund costs is a crucial component of the Tax Code for companies engaging in innovation. According to new legislation, companies may opt to partially deduct R&D costs from their taxable income in tax-exempt years. This tax treatment makes sure that companies pay the appropriate amount for their net income because removing the deduction for R&D expenses overstates revenues as inflation is a major factor. Ideally, all business expenses such as investments could be deducted immediately.

This program is a valuable tool that can help businesses reduce their tax liabilities and improve their financial stability. If you are an early-stage startup that incurs mainly expenses, you may be eligible for the R&D tax credit.

Who Is Eligible For The R&D Tax Credit?

To be eligible for the R&D tax credit, your business must meet the following criteria set by the Internal Revenue Code (IRC) and Treasury Regulations:

– You must be engaged in R&D activities within the United States.

– Your R&D activities must be related to developing a new or improved product or service.

– You must have incurred expenses related to your R&D activities, such as salaries, supplies, and contract research.

– Your R&D activities must meet the requirements for technical uncertainty or process of experimentation.

To be eligible for the tax credit, your company must also meet the following criteria:

– Have gross receipts of less than $5 million for the tax year

– Have no more than five years of gross receipts or interest income

– Be engaged in an active trade or business within the United States

If your business meets the criteria for the program, you may be able to claim a credit of up to $250,000 against your payroll tax.

Important note: You can claim up to five years back, so the total potential claim could get to an amount of $1.25M.

The tax credits are non-refundable and can be used only to offset payroll taxes, and income tax liability. If you have no tax liability, you will not be able to receive a refund.

Qualified R&D Industries

Several industries are eligible for the tax credit program. Some of them are:

– Agriculture

– Biotech

– Manufacturing

– Information Technology

– Pharmaceuticals

– and more

Qualified Expenses You Can Claim

The research and development tax credit can be applied to a wide range of expenses, including:

– Salaries and wages paid to employees engaged in R&D activities

– Supplies used in R&D activities

– Contract research expenses

– Prototypes developed during the R&D process

– R&D software costs

– R&D equipment costs

Please note that there are expenses that are not qualified for a tax return, such as:

– Research expenses post product launch

– Activities with no real innovation such as reverse engineering

– Surveys & studies

– software licenses for general use

– Research expenses outside of the US

– and more

In Which State Could You Claim Your Tax Credits?

The program varies by state. Some states offer a refundable R&D tax credit, while others provide a non-refundable R&D tax credit. A few states, such as Kentucky and Oklahoma, have both refundable and non-refundable R&D tax credits.

Some, like Connecticut and California, have their own termination of Qualified Research Expenses (QREs) which you can use in your claim. In these cases, there are different requirements for how much money can be spent to qualify as research spending under section 174 of IRS code – depending upon which state you live within!

Choose your state to find out whether or not it supports the R&D Tax Credit program.

How To Claim Your Credit?

The credit is claimed on your business’s annual tax return. To claim it, you must complete Form 6765 and attach it to your tax return (Form 1120 – US Corporation Income Tax Return).

On the payroll tax form 941 (Employer’s Quarterly Federal Tax Return), claim your tax credits; to make it easier for you, talk to your payroll processor and they will help you to submit the claim.

What Are The Documents You Need For The Claim?

To support your tax credits claim, you will need to provide documentation of your R&D expenses. This may include:

– Receipts

– Invoices

– Contracts

– Payroll reports

– Trial Balance and General Ledger reports

– Detailed records of R&D activities and costs

If you are claiming the R&D tax credit for the first time, it is advisable to seek professional help from an accountant or tax credit experts who are familiar with the claim process. They can help you to gather the required documentation and ensure that you meet the IRC guidelines.

How To Maximize Your Tax Credit Claim

There are several ways you can maximize your R&D tax credit. Some tips to consider include:

– Hiring qualified personnel: One of the best ways to maximize your R&D tax credit is to hire qualified personnel in R&D activities. This will ensure that your R&D activities are eligible for the credit and help you maximize your tax savings.

– Documentation: Keeping detailed records of your R&D activities and expenses is crucial to claiming the R&D tax credit. Make sure to keep receipts, invoices, and contracts for all R&D expenses. This will make it easier to claim the credit and maximize your tax savings.

– Planning: Planning is key to maximizing your R&D tax credit. Make sure to plan your R&D activities to take advantage of the credit. By planning ahead, you can ensure that your R&D activities are eligible for the credit and maximize your tax savings.

When Should You File The R&D Tax Credit?

The R&D tax credit form should be filed with your business’s annual tax return. However, you may also file the form on a quarterly basis if you are claiming the credit against your payroll taxes.

Each year after you closed the previous year books, determine what your tax credit amount will be (you can use a professional to help you with that), and then add it to your annual tax return. 3 months following your tax return submission you can start claiming your tax return against your payroll taxes.

If you file your annual tax return by March 15th, for example, the first payroll tax offset you would receive is for the following April – June.

6 Reasons Companies Don’t Think They Qualify

Despite the R&D tax credit being available for over 35 years, there are still many misconceptions about the credit. As a result, many companies that could benefit from the credit do not claim it. Below we dispel some of the most common misconceptions about the R&D tax credit:

– Misconception #1: R&D Must Be Conducted in a Laboratory

– Misconception #2: The Product or Service Must be New or Innovative

– Misconception #3: Only Manufacturing Companies Qualify

– Misconception #4: Results of R&D Activities Must be Successful

– Misconception #5: Small Companies Cannot Claim the Credit

– Misconception #6: Only Companies with High R&D Expenditures Qualify

Is The R&D Tax Credit Worth It?

Using tax credit can help reduce federal and some states’ tax income. It allows firms to pay for research and development expenses which could amount to about 10 to 15 % of the return. These tax credits are a dollar-for-dollar reduction of your taxes so they can save your business significant money.

Have you considered taking advantage of the tax credit program? This valuable tax credit can help reduce your federal and some state income taxes, and it

Final Words

The R&D tax credit may be useful for firms investing in research and development. You can use the advice in this article to ensure that you are qualified for the program and can claim it successfully. Please contact us with any queries regarding the claim or how to apply it. We’d be delighted to help you through the R&D tax credit claim process.

Did you find this guide helpful? Let us know in the comments below! Don’t forget to share this guide with your friends and followers on social media! Until next time, Happy Claiming! 🙂