With finance management being such a crucial aspect of any business, startups must be well-informed and in control of basic accounting terms to ensure the business runs smoothly.

Accounting is the metaphorical house of cards at the heart of any company. If the balance sheets are not managed correctly, there is a real potential for the walls to come crashing down.

On the other hand, if the accounting framework is managed diligently, with a sharp eye on assets, liabilities, revenues, and expenses, the company has a far better chance of enjoying growth.

Here are 15 important accounting terms every startup founder should be aware of.

BASIC ACCOUNTING QUIZ – CHECK YOUR KNOWLEDGE NOW >>

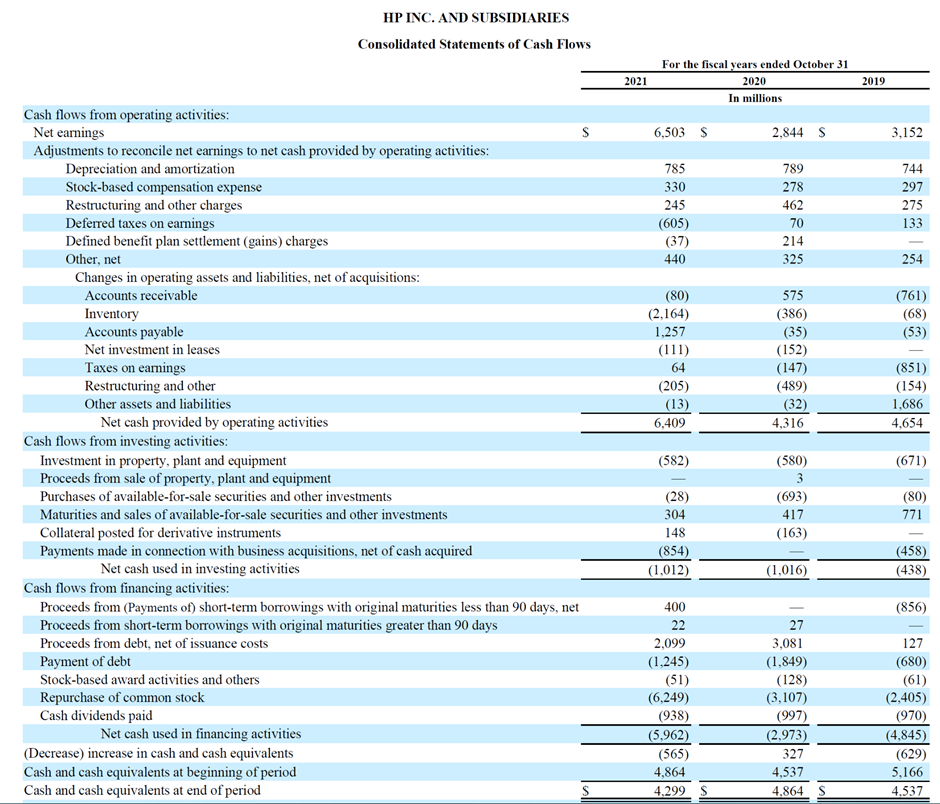

1. Cash Flow Report

Also known as the statement of cash flows, the cash flow report is a financial document outlining the amount of money flowing in and out of an organization. It shows how balance sheet accounts and income changes affect cash and cash equivalents.

These changes in the balance sheet help break down the analysis into operating, investing, and financing activities. This helps understand the business’s cash position at any point in time.

The cash flow is structured from the US Generally Accepted Accounting Principles (GAAP). The principles provide a framework for reporting cash flows and help keep records consistent across different companies.

Structure Of The Cash Flow Statement

For startups to understand the cash flow statement, they must first recognize its three main components:

Operating Activities

This includes all activities that involve generating revenue and spending to produce goods and services. It is the primary source of cash for any business. According to Financial Accounting Standards Board (FASB) Statement 95, operating activities include the following:

- Sales of goods and services

- Payment for the purchase of goods and services

- Expenses related to taxes, salaries, and other operating costs

- Changes in accounts receivable, inventory, prepaid expenses, and other current assets and liabilities.

Investing Activities

This section of the cash flow statement deals with investments that a business makes, such as the purchase or sale of property, equipment, and investments in other companies. It also includes cash to buy intangible assets such as patents or copyrights.

Generally, changes in cash from investing are considered cash-out items on the balance sheet. This is because these financial investments are not expected to generate any cash in the short term. They may, however, generate income in the long run and help the company grow.

Conversely, when a company decides to divest an investment, the proceeds from the sale would be considered cash-in on the balance sheet.

Financing Activities

Financing activities involve obtaining funds from external sources to meet the business’ financial needs. They include borrowing money from banks, issuing debt or equity to investors, and repaying these debts over time. Other sources may include taking out a loan, issuing new debt securities, or repurchasing any existing ones.

Financing activities are listed separately from investing activities since they are unrelated to investments. Any cash obtained from these activities is classified as cash-in on the balance sheet. Another thing to note is that changes in cash from financing activities do not affect the net income of a business. The cash flows from financing activities are non-operating and can be found on the statement of cash flows.

How To Calculate The Cash Flow

There are two methods of calculating cash flow: the direct method and the indirect method.

Direct Method

The direct method involves adding up all cash payments. These cash payments include cash collected from the sales of goods and services and cash payments such as salaries and taxes. The figures in this method are calculated by the beginning and ending balances of various assets and liabilities.

The direct method is ideal for startups as it provides a more accurate picture of the cash position in the business. It is also an excellent way to track the business’s ability to generate cash from operations.

Indirect Method

The method involves calculating net income and adding non-cash depreciation costs. It is also used to adjust working capital items by subtracting current liabilities and increasing current assets on the balance sheet from one period to another.

The account will automatically detect increases and decreases in assets and liabilities and account for them. This ensures an accurate cash flow statement.

Overall, the cash flow statement provides valuable information to startups and can be used to gauge the financial health of a business.

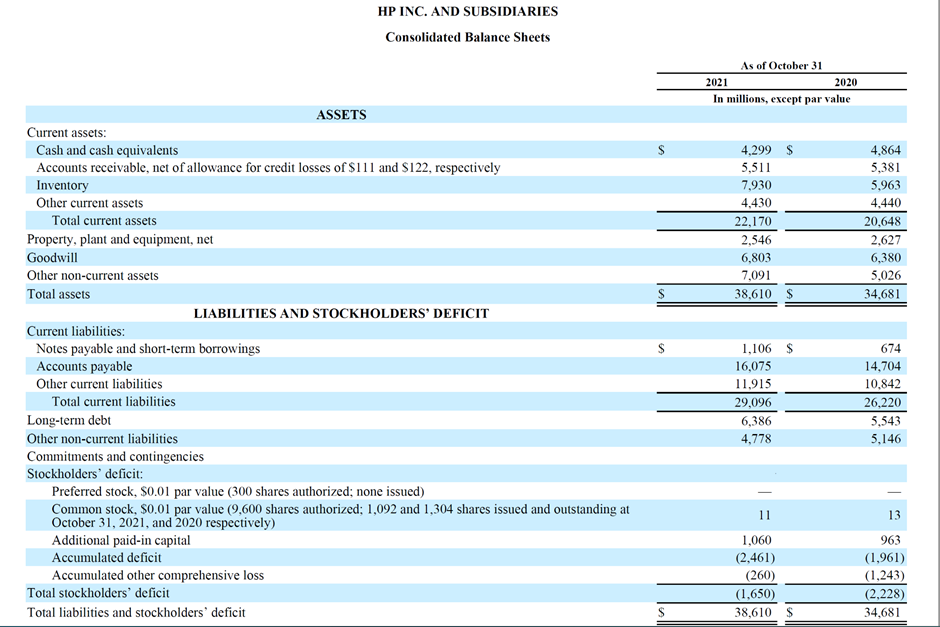

2. Balance Sheet Report

Also known as the statement of financial position, the balance sheet report is used to give an overview of a business’s assets, liabilities, and equity for a particular period. It is an important tool for startups, providing a snapshot of the company’s financial statements.

Startups can use the balance sheet to get an overview of their financial position and make informed decisions. The document also helps investors understand the true value of a business and can be used for tax purposes.

Components Of A Balance Sheet

For a balance sheet to be accurate, it must include all the necessary components. These components help the reader to get a better understanding of the company’s financial position. Here are some of the components:

Assets

The asset section of a balance sheet includes all the resources owned by the business. They are the resources that can be converted into cash if need be. The asset section is further broken into subsets listed on the balance sheet in order of liquidity. The following are some of the common assets listed:

- Cash: The cash section includes all the cash owned by the business, such as cash in bank accounts, investments, and reserves.

- Accounts receivable: This is the money owed to a business from customers who have purchased goods or services on credit.

- Inventory: This section includes any stock or items in production that are not yet sold but can be sold for cash.

- Fixed assets: Fixed assets are resources owned by the business that has an expected life of more than one year, such as land, buildings, and equipment.

Assets are further categorized into current and long-term assets. Current assets include cash, accounts receivable, inventory, and other items that a company can easily convert to cash. Long-term assets are those that have a life of more than one year and cannot be readily converted to cash. Examples of such items are property, plant, and equipment.

Liabilities

The liabilities section of the balance sheet includes all the debts and dues of a company. It is further divided into current liabilities and long-term liabilities.

- Current liabilities are debts and dues the company must repay in one year. Examples include accounts payable, salaries payable, rent payable, taxes owed, and other short-term obligations.

- Long-term liabilities are those debts and obligations due beyond one year from the date of the balance sheet. Examples of such items include long-term loans, mortgage payments, and bonds.

Equity

The equity section includes the shareholder’s funds and retained earnings. It is used to calculate the net worth of a company by subtracting total liabilities from total assets. Positive net worth means that the company has more assets than liabilities and vice versa.

Assets – Liabilities = Equity (reflect the net worth of the company)

A point worth noting is that we have two different types of equity:

- Shareholders’ funds, which include the money shareholders have invested in the company. These funds sit under Share Capital and Additional Paid-In Capital accounts.

- Retained earnings, which represent the net profits or losses that a company has retained to date and which were not distributed as dividends.

3. Profit And Loss Report

A profit and loss report is a financial statement that shows a company’s performance for a given period, typically a quarter or a year. The statement summarizes revenue, expenses, and other income or losses that a business has incurred over the period.

The records give information about a company’s sales, costs of goods sold, and other expenses. They also provide a look at a company’s business model, as well as how profitable the business is. Startups can use this information to track their performance in terms of revenue growth and their bottom line.

Types Of Profit And Loss (P&L) Statements

Companies use two methods to track and report their P&L statements. Here are the two:

1. Accrual Method

The accrual accounting method is based on the matching principle. This means that expenses and revenues are recorded in the same period they are incurred or earned, regardless of when cash is received or paid.

For example, a company that buys a product on credit during the year will record the purchase as an expense even if they have not paid for it by the end of the period. The liabilities are also recorded in the balance sheet to make it easier to track payments.

2. Cash Method

The cash accounting method is based on bank account transactions. It records income and expenses as they are paid or received in cash. Transactions that involve future credits and payments will not be recorded until the cash is exchanged.

A business will always record transactions as revenue when cash is received from clients, even if the goods or services have not been delivered yet. Similarly, they will record transactions as expenses when cash is paid out to service providers, regardless of when the service was provided.

Comparing Profit And Loss Statements

Comparing and analyzing P&L statements from different periods help entrepreneurs make better business decisions. It also helps them identify revenues, operating costs, research and development (R&D), and other operating expenses changes year over year. This way, they can track their finances and make the necessary adjustments to improve their financial position going forward.

Furthermore, comparing P&L statements from different companies in the same industry provides insight into what is going on in the market. This can help make strategic decisions and benchmark your performance against competitors.

Profit and loss statements can also be referred to as:

- Statement of operations

- Income statements

- Statement of comprehensive income

- Profit and loss statement

4. Working Capital

Working capital is the amount of available capital a business has to fund current operations. It represents the difference between current assets, such as cash and accounts receivable, and current liabilities, such as accounts payable.

To calculate working capital, subtract current liabilities from current assets. If the result is positive, the business has sufficient working capital. If it is negative, the company may need to improve its cash flow. You can hire a CFO to help you analyze your working capital situation.

5. Profitability Terms

The profitability of a business is a measure of how much profit it makes on every sale it generates. And it is an important metric for all entrepreneurs to track. The most common profitability terms are gross profit, operating income, net income, and return on investment (ROI).

- Gross Profit: Gross profit is the difference between sales and the cost of goods sold (COGS). It measures the efficiency with which a business can produce and sell its products. When analyzing the gross profit of a business, startups should look for trends in their sales and COGS such as seasonality or price changes. This will give them an indication of whether their pricing is competitive and their operations are efficient.

- Operating profit: Operating profit is the ratio of operating income to revenue. Operating expenses include wages, rent, hosting, research, sales and marketing expenses, depreciation, and other general and administrative expenses. A positive operating income reflects a healthy business that produces profits from the total operation but is still subject to tax payments.

- Net Income: Net income is the difference between a business’s total revenue and expenses. It is the most important profitability measure because it indicates how much money the business makes for its owners or shareholders.

- Return on Investment (ROI): ROI measures how much money a business can make for each dollar it invests. It is calculated by dividing net income by total investments. One should expect to receive a higher ROI than the interest he could get from bank deposits to cover the risk he is taking while operating a business. For example, if I invested $1M in a business that generates $100K in net income, that means that the ROI is 10%, which is very good compared to the 2%-4% I could get from my bank for a long-term deposit.

6. Financial Runway

In the financial world, the term “runway” measures the amount of time a business has before it runs out of money. It is an important metric for startups because they need to ensure they have enough cash to continue operations until they become cash flow positive.

A business may tell investors how many months of cash runway it has. This gives investors an indication of how long the business can operate until it needs more funding. It is also a good way for startups to measure their financial health.

Importance Of Financial Runway

The financial runway has become increasingly important for startups, as venture capitalists and investors tend to favor longer-run businesses. Startups should aim to maximize their financial runway through efficient operations and sound financial decision-making.

The following are some tips for improving a business’s financial runway:

- Monitor cash flow closely and identify any areas of inefficiency

- Analyze profitability metrics to identify ways to improve revenue and reduce costs

- Secure additional funding from investors or lenders if necessary

- Implement a disciplined budgeting process

- Leverage available financial technology tools to improve efficiency

- Make sure to keep 12+ months of financial runway

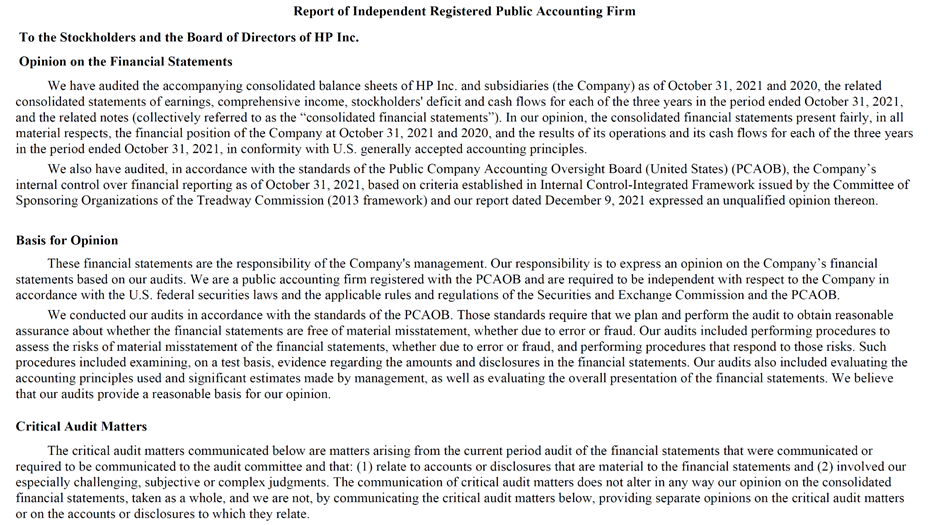

7. Audited Financial Statements

An audited financial statement is a document prepared by a certified public accountant (CPA) following generally accepted accounting principles (GAAP). The CPA reviews and verifies the accuracy of the financial statements and provides a written opinion on their reliability.

After the CPA has completed the audit, the financial statements are distributed to investors and other stakeholders for review. Audited financial statements provide a more accurate picture of a business’s financial health than unaudited statements.

Structure Of Audited Financial Statements

Structure Of Audited Financial Statements

The financial statement is typically divided into other parts that include:

- Balance Sheet – This shows the company’s assets, liabilities, and net worth at a given point in time. It is used to measure a company’s financial health and liquidity.

- Income Statement – This shows the company’s revenue, expenses, and net income over a specified period of time. It is used to measure profitability and growth.

- Cash Flow Statement – This shows the company’s cash inflows and outflows over a specified period of time. It is used to measure liquidity and sustainability.

- Income Report- This contains information about a company’s income, expenses, and profits over a given period of time. It is used to assess performance over time and compare financial results with industry averages.

Statement Of Equity

A statement of equity shows the changes in a company’s owners’ equity over a period of time. It is used to understand the impact of transactions on owners’ equity and to calculate the return on investment (ROI).

Here, the shareholders may benefit from additional company performance information, such as dividends paid out and share repurchases.

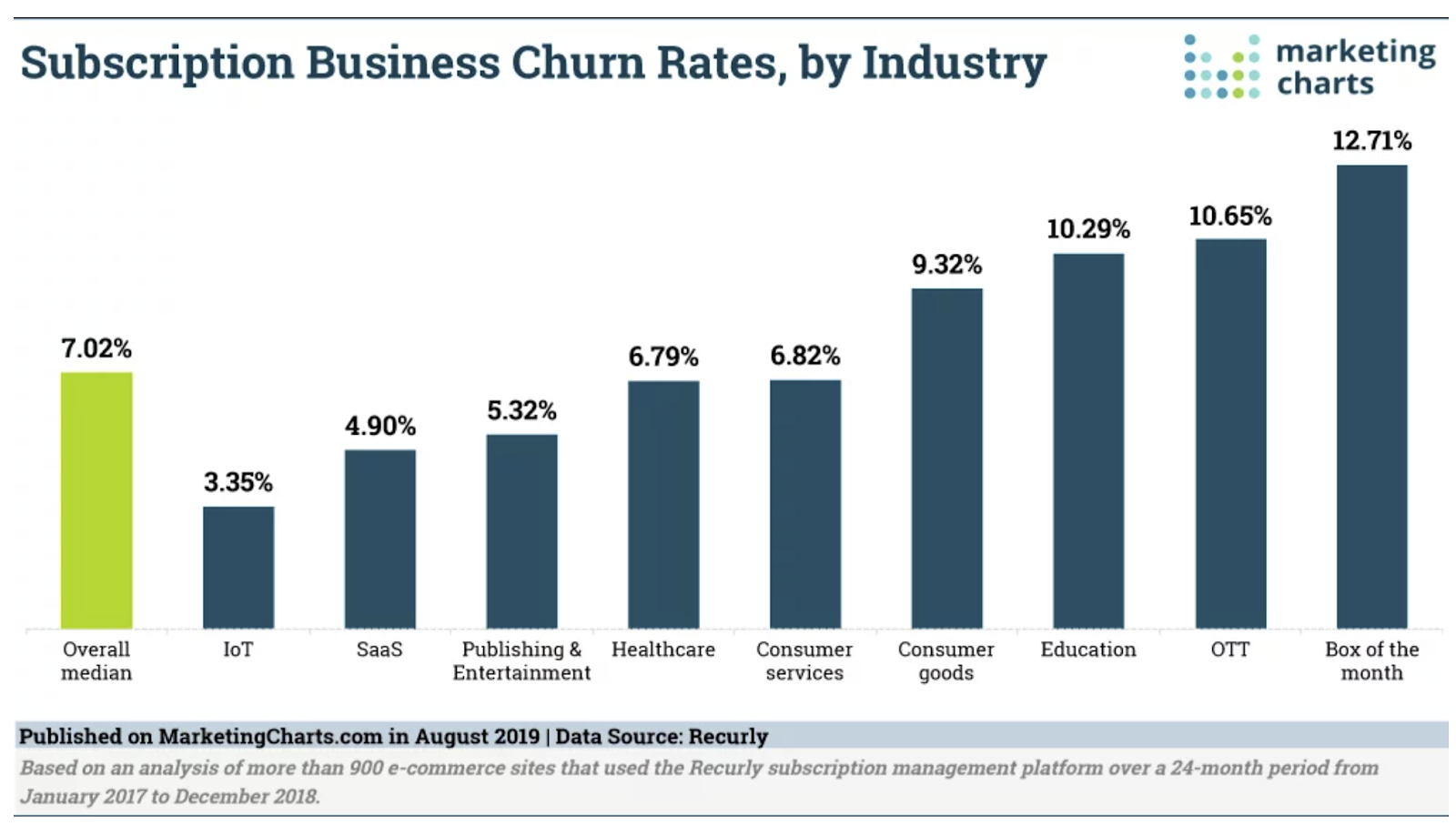

8. Churn Rate

Also known as customer attrition, the churn rate is the rate at which customers stop doing business with a company for any given period of time. It is an important metric for startups, as it helps them measure customer loyalty and determine if their product or service offerings meet customer needs.

The higher the churn rate, the more likely customers will not be satisfied with a business’s product or service. This can lead to decreased revenue and profitability. Customers who have subscribed to a service may churn if they are unhappy with the quality or price of the product.

To reduce customer attrition, startups should improve customer satisfaction, increase customer loyalty, and provide better value for money. They should also focus on developing strategies to retain existing customers while at the same time acquiring new ones. Monitoring churn rate and understanding why customers are leaving can help a business identify areas that need improvement.

9. Tax Return

A tax return is a document that is filed with the Internal Revenue Service (IRS) to report a company’s income and expenses for a given tax year. It is used to calculate the amount of taxes that the company owes for that tax year.

It is the obligation of a business to file an accurate and timely tax return. This will help the business to comply with its tax obligations and remain in good standing with the IRS. Any business not filing a tax return may be subject to an audit, fines, or criminal charges. So, as a business owner, it is important to be aware of the tax filing requirements and deadlines and to have an experienced CPA prepare your company’s tax return.

10. Annual Recurring Revenue(AAR) And Monthly Recurring Revenue(MRR)

MRR and ARR are two key metrics for subscription-based businesses. MRR is the total revenue from subscriptions that are invoiced on a monthly basis. This figure includes both new subscriptions and renewals. ARR, on the other hand, is the total revenue from all subscriptions over a 12-month period- this figure includes one-time charges, such as setup fees or early termination fees. Both MRR and ARR are important metrics to track, as they can give insights into the health of a subscription business. MRR is a good metric to track month-over-month growth, while ARR can give insights into long-term trends.

11. Earnings Before Interest, Taxes, Depreciation, And Amortization(EBITDA)

EBITDA is a financial metric that measures a company’s earnings before interest, taxes, depreciation, and amortization. EBITDA is a popular metric because it provides a clear picture of a company’s operating performance. By stripping out these non-operating expenses, EBITDA gives investors a better idea of how much cash flow a company is generating. EBITDA is also used as a measure of a company’s valuation.

Because EBITDA excludes non-operating expenses, it can be used to compare companies with different capital structures. EBITDA is not without its critics, however. Some argue that EBITDA is too easily manipulated and that it doesn’t give a true picture of a company’s financial health. Nonetheless, EBITDA remains a popular metric among investors and analysts.

12. Compound Annual Growth Rate(CAGR)

CAGR is the rate of return on an investment or portfolio over a certain period of time. It is expressed as a percentage and represents an investment or portfolio’s annual growth rate over time.

For instance, if an investor invests $100 in a company and the company doubles its value by the end of the year, its CAGR would be 100%.

CAGR measures a company’s performance and compares it with other companies. It is also used to measure a company’s growth over time.

13. Customer Acquisition Cost(CAC)

CAC is the cost of acquiring a new customer. It measures the money spent on sales and marketing to attract and convert customers. For instance, advertising campaigns, sales incentives, and other promotional costs.

CAC is a crucial metric for startups as it helps to evaluate the efficiency of the sales and marketing efforts. It can also help to evaluate the return on investment (ROI) of a business’s marketing efforts and decide whether or not they are worth the cost.

14. Customer Lifetime Value (CLV)

Customer lifetime value is the total income a business can expect to bring in from a single customer over the course of their relationship. It measures how much value a customer brings to a business, as long as the client’s account remains open.

The CLV of a customer can be determined by analyzing past revenue and expenses related to that customer, as well as the length of their relationship with the business. Most of these customers are corporate and large customers. They always have an account with the company and make purchases over a period of time.

When measuring the CLV, the startups should look at the total average revenue generated by the customer, their average purchase frequency, and the average amount spent per transaction. This will give them a better idea of the customer’s value to the company.

15. Burn Rate

Burn rate is a term used to describe the rate at which a company is spending money. Burn rate is typically expressed in terms of cash burn, which is the amount of cash that a company is spending each month. Burn rate is important because it can give investors an indication of how quickly a company is burning through its working capital.

If a company has a high burn rate, it may need to raise additional funds in order to continue operating. Burn rate can also be used as a measure of efficiency, as it can show how quickly a company is able to bring in revenue and convert it into cash. Burn rate is therefore an important metric for both investors and founders.

Conclusion

The terminology and phrasing used in finance and accounting are really quite vast. Your energy and efforts are probably better spent in other areas of the business, and not hitting the books to learn every practice, procedure, and general underbelly of accounting.

That said, there are some essential terms you need to be aware of, and through this post, we have covered the main nuts and bolts of your financial and accounting engine. While it might not be the most engrossing topic, it is very important and will only serve to improve your company’s growth if you embrace this side of the business.

Additionally, investors will have a better grasp of the financial health of your business if you ensure a thorough understanding of these 15 most crucial points.