One of the greatest hurdles that any startup faces is financial management. You may have a fantastic bookkeeping team that absolutely nails your taxes and compliance needs, but they don’t have the experience needed to take a small business into the next growth stage. You may want to consider CFO services.

We’re taking the time to look into the what, when, and how of CFO services to help every small business owner meet their financial management needs and achieve positive financial health.

Read on to learn all about CFO services, including whether your startup should use them and some of our personal favorite firms.

What Are CFO Services?

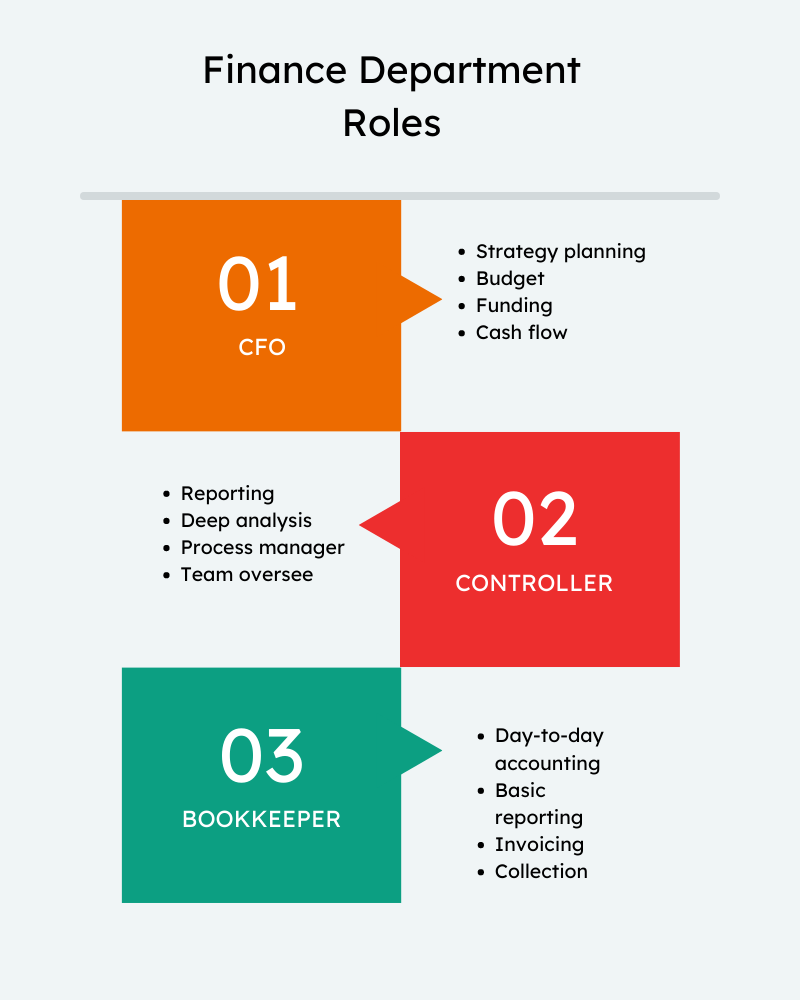

CFO services oversee the work of your bookkeepers and controller staff, ensuring that every finance department runs perfectly while giving you a competitive advantage with financial projections and the latest in financial software. Check out the infographic above for more details about the hierarchy of CFO services, controllers, and bookkeepers.

Outsourced CFO services, meaning CFO services that come from outside your company, monitor your accounting team’s procedures and provide you with feedback and safeguards to keep your growing business in the green.

Most Common Outsourced CFO Services

Most outsourced CFO services provide temporary services when needed, such as when a business needs help getting through an audit or resolving unsustainable growth issues.

Here’s a list of the most common outsourced CFO services:

Long-Term & Short-Term Forecasting

A financial forecast involves analyzing the capabilities of your business and the expected short- or long-term financial trends of your competitors and marketing niche, then providing a detailed guide for how best to navigate toward your business goals. An experienced CFO can provide you with such a forecast to ensure the future growth of your startup.

Financial Strategy

While your typical bookkeeper uses past and current financial records to maintain your business, outsourced CFO services use a future-based financial strategy. The chief financial officer provides you with the best financial strategy to achieve your future goals while keeping your finances in a sustainable range, meaning they will push the startup toward your end goal at the best pace possible without taking huge financial risks.

Budgeting

The budget plan includes the data necessary to keep track of your expected annual capabilities. Good CFO services will utilize the budget plan to adjust your financial strategy, so your startup remains on target for long-term goals while also managing short-term sustainability.

Financial Reports & Financial Management

If you already have a financial report system, your CFO will take that report and help you, the startup founder, understand the key takeaways of that report. The goal is for you to be able to ask questions and make informed decisions regarding day-to-day financial business decisions.

If you do not have a financial report system in place, your CFO will also help you incorporate one into the business.

Raising Capital

Another advantage of utilizing experienced CFO services involves accessing their financial network. The CFO can introduce you to potential investors and set up your financial statements and reports to further impress said investors.

Cash Flow Analyses

Outsourced CFO services will also look into your cash flow and attempt to maximize your bottom line. The CFO may suggest specific changes to improve your cash flow, including the following:

- Renegotiating/Altering contracts with vendors

- Renegotiating client contracts

- Utilizing industry trends to improve prices

- Checking and restructuring commission plans

- Improving supply cost and availability

- Etc.

Making Cost Cuts

Cost cuts are a service greatly improved by using outsourced CFO services as they are impartial, making them more likely to make objective decisions. Their primary goal will be to cut costs while keeping both staff and customers as happy as possible in the process.

How Much Does It Cost?

A full time CFO makes an annual salary between $318,600 to $535,500 in the US, meaning hiring one would cost approximately $26,550 to $44,625 every month. Most startups and other small businesses can’t afford such high fees, so part-time outsourced CFO services tend to be a better fit, coming in as low as $1,000 and up to $12,000 per month, depending on the scope of service and level of involvement.

What Is The Difference Between Bookkeeping And Accounting

Your bookkeeping team records your finances and organizes them into simplified sheets of data, whereas the accounting team takes that data and interprets it for the sake of the business owner and any investors they might have.

You may find bookkeepers doing some basic accounting work in a small business, but it is generally best to have two separate teams to prevent overlap. Here’s a basic list of the duties put forth between bookkeeping and accounting:

Bookkeeping

- Invoices

- Accounts reconciliation

- Business transaction records

- Bills and receipts

Accounting

- Budgeting

- Tax returns

- Financial statements

- Business performance analysis

When Your Startup Needs CFO Services?

Now that we know exactly what outsourced CFO services can do for your startup, how do we determine if your startup needs one? Let’s take a look at three common startup factors that could mean you need to hire a CFO service for your upcoming accounting solutions:

Your Business Is Getting More Complicated

Growing businesses, especially startups, can get complicated very quickly as you start to build a client base and make sales. Keeping track of your financial management needs during this early stage is vital for creating a sustainable budgeting plan.

You might want an interim CFO to pop in and explain the financial projections for your startup to keep you on track. Using an interim CFO is more cost-efficient than hiring a full-time CFO if you are still in the early growth stage of your startup business.

You’ve Noticed A Few Financial Errors Or Inefficient Cash Management

An efficient in-house bookkeeping team wouldn’t have much trouble with the finance function of a startup at first. However, as the business expands and new investors and return customers start pouring in, they might start to feel a bit overwhelmed.

This stage of your startup might be the time to get an outsourced CFO service started. If your business has grown to the point that your books are getting complicated, there’s a good chance your potential profits would be high enough to invest in a CFO who can then improve on them, making your money back and then some.

The CFO would focus on your budget and financial records, leaving you ample time to work on continuing to expand the startup until you reach full-grown business status and really start to skyrocket!

You’re Unsure About Your Financial Status Due To A Lack Of Detailed Data

Outsourcing CFO services is vital for those of you who don’t have much experience with business finances. If you’re unsure how to keep track of your financials or you feel that the data coming from your bookkeeping team is confusing or inadequate, you need some help from a CFO.

This would be a situation where you could even try hiring a virtual CFO just to get you on track and help you make sense of what your bookkeepers have given to you.

Still Unsure?

If you’re still not 100% certain if you need CFO services, try this helpful quiz to confirm your thoughts.

How To Pick The Best CFO For Your Startup

There are a variety of factors to consider when choosing the best CFO for your startup. For starters, consider looking into the CFO service’s business niche if they have a specific one. Getting a CFO who has worked in businesses similar to your startup would be a strong advantage from the get-go.

Here are some other factors to consider:

- Education/Certified Training – You want to be sure that your CFO knows what they’re doing.

- References From Previous Clients – If most previous clients were happy with their results, chances are you will be too.

- Communication Skills – You need to be able to converse with your CFO in such a way that you understand everything they’re suggesting you do.

- Mutually Beneficial Agreements – The contract you agree on must benefit you as much as the CFO.

3 Recommended CFO Services Firms

Let’s take a look at some CFO services firms that we find quite helpful:

Zeni – Best For Budget

Zeni uses AI technology to automate many accounting services, from basic bookkeeping to financial reports and invoicing. The aim is to reduce the costs you have from your financial team while still providing you with ample service. This option may not be as ideal for a startup owner who needs a bit more of an explanation from the reports they receive.

SG Accounting – Best For Tech And SaaS Startups

At Startup Geek we handle everything you need for your startup business, including budgeting, revenue models, investor relations, cash flow projection, due diligence processes, and more. They will take all the financial strain off of your shoulders and handle your bookkeeping, accounting, and taxes, leaving you relaxed and able to focus on your business goals. Apply here

Fully Accountable – Best For ECommerce Businesses

Fully Accountable function as a back office for mainly eCommerce and online businesses. They handle your finances, including your bookkeeping and accounting, aiming to produce the best plan for increasing your profit margins.

Final Thoughts

Even if your startup is still small, CFO services can be a big help when bringing your long-term business goals to fruition while helping you keep a level head in the early stages of your business’s development.

We hope this guide has helped you learn the what, when, and how of hiring the best CFO service for your startup. We wish you all the best in your future business endeavors!