For startup founders, managing payroll can feel like a big task. You want it to be easy, fast, and correct every time. Choosing the right payroll system can streamline this critical process, freeing you to focus on what truly matters: scaling your business. That’s where we come in. Imagine a payroll system that does all the hard work for you, from paying your team to handling taxes, so you can focus on growing your business.

This article dives into the top 8 payroll systems specifically tailored for startups, highlighting their ease of use, pricing plans, and integration capabilities. Whether you’re a solopreneur or a growing team, we’ll help you find the perfect solution to simplify your payroll and empower you to focus on what you do best – building your dream.

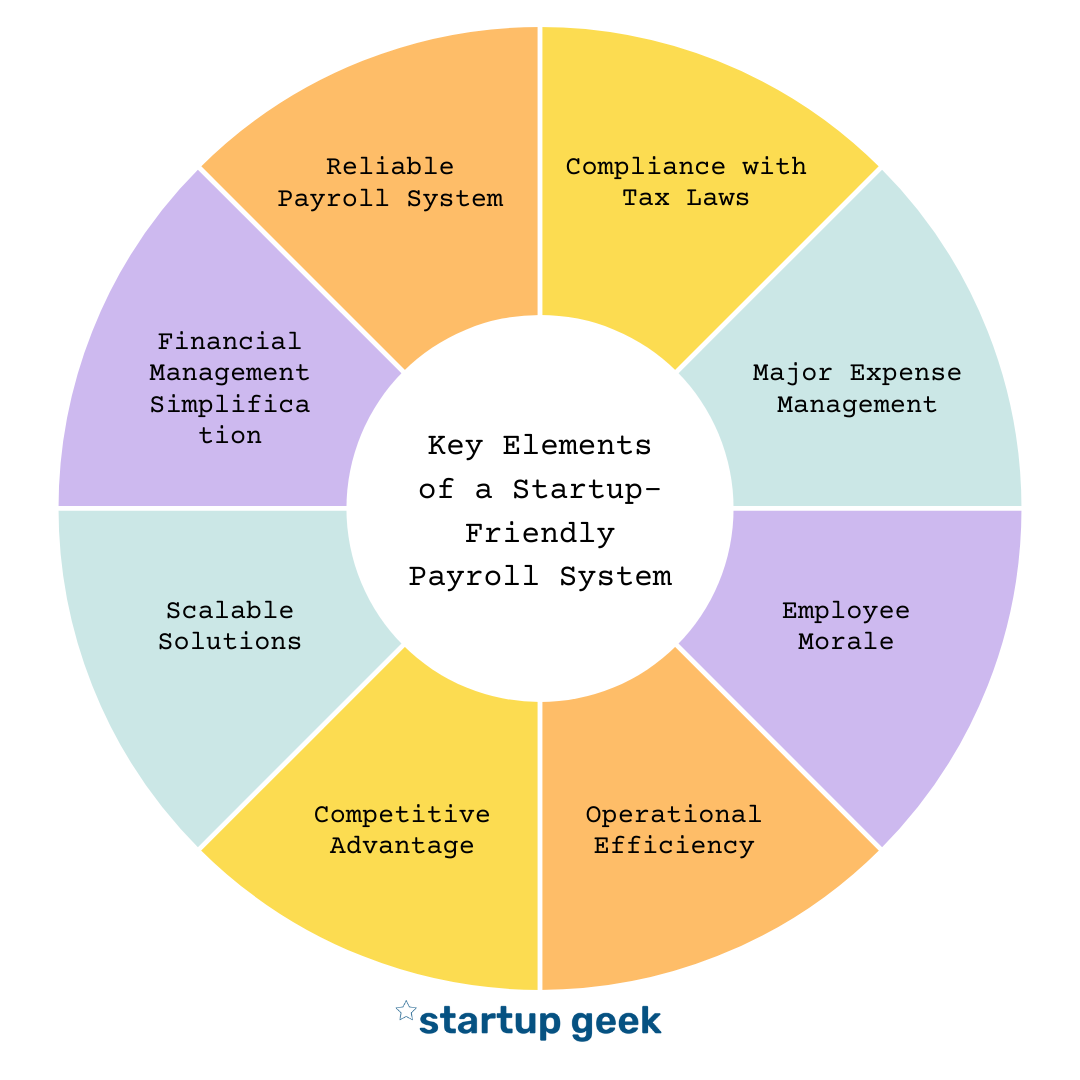

Importance of Payroll Systems for Startup

Establishing a reliable and efficient payroll system goes beyond just ensuring employees are paid on time; it’s fundamental to the health of a startup and the satisfaction of its employees. For a startup, navigating the intricate web of tax laws and employment regulations is paramount. Any misstep in payroll can lead to significant fines and tangled legal issues, draining resources and tarnishing the startup’s reputation.

Moreover, payroll represents one of the most substantial expenses for any business. Effective payroll management is crucial for accurate budgeting and financial planning, ensuring the business’s sustainability and growth potential. It’s also directly tied to employee morale; timely and accurate payments demonstrate the company’s appreciation for its workforce, fostering a positive workplace culture and high retention rates.

Additionally, streamlining payroll processes through automation can dramatically reduce the time spent on administrative tasks, freeing up the startup team to concentrate on core business objectives. This operational efficiency can become a significant competitive edge, allowing the startup to navigate more smoothly through its growth phases.

In essence, the challenge for startups lies in identifying a payroll solution that is scalable, cost-effective, and capable of supporting the company’s evolving needs. The right payroll system can simplify complex financial management tasks, ensure regulatory compliance, and strengthen employee relationships—all of which are critical components for laying the groundwork for sustained growth and success.

Factors to Consider when Choosing a Payroll System

Choosing the right payroll system for your startup involves a thorough assessment of various factors that impact both your immediate needs and your long-term operational efficiency. Given the pivotal role of payroll in employee satisfaction and regulatory compliance, selecting a system that aligns with your business requirements is essential. Here are key factors to consider:

- Business Size and Scalability

Your startup’s size and growth projections play a crucial role in determining the most suitable payroll system. Small startups might need a simple, straightforward solution, whereas rapidly growing or mid-sized startups may require a system with more advanced features like automated tax filings, benefits management, and scalability to support an increasing number of employees, including international staff. A cloud-based solution can offer the flexibility and scalability crucial for startups.

- Ease of Use

The user interface and ease of use of the payroll system are critical, especially for startups with limited HR or accounting resources. A system that is intuitive and easy to navigate can significantly reduce the time and effort spent on payroll processing, allowing your teams to focus on core business activities.

- Integration Capabilities

Integration with existing business systems (e.g., HR management, time tracking, accounting software) is crucial for streamlining operations and ensuring accuracy across all platforms. The ability to seamlessly connect your payroll system with other tools can automate data flow, reduce manual entry errors, and provide more comprehensive insights into your business finances and operations.

- Compliance Features

Given the complexities of tax laws and employment regulations, which can vary widely by location and change over time, it’s important to choose a payroll system that offers strong compliance features. This includes automatic updates to tax tables, support for different tax jurisdictions, and the ability to handle various types of employee contracts and benefits in compliance with local laws.

- Payroll Features

Assess the specific payroll features offered, such as support for different pay schedules (e.g., weekly, bi-weekly, monthly), direct deposits, tax filing and payment services, end-of-year tax forms preparation, and handling of bonuses, expense reimbursements, and other types of compensation.

- Customer Support

The availability and quality of customer support can greatly affect your experience with a payroll system. Consider providers that offer timely, responsive support through multiple channels (e.g., phone, email, chat) and possibly 24/7 assistance, to ensure you can quickly resolve any questions that arise.

- Security Measures

Data security is paramount when handling sensitive employee information. Look for payroll systems with robust security measures, including data encryption, secure data storage practices, and compliance with data protection regulations (e.g.,GDPR for European employees).

- Cost

Evaluate the pricing structure of the payroll system, including any initial setup fees, monthly or per-employee costs, and additional charges for extra features or services. It’s important to balance affordability with the range and quality of features offered, ensuring you get value for your investment without compromising on essential functionalities.

- Reviews and Recommendations

Finally, consider feedback from other startups or businesses similar to yours. Reviews and recommendations can provide valuable insights into the reliability, performance, and customer satisfaction associated with different payroll systems.

Top 8 Payroll Systems for Startups

Following is the list of top 8 payroll systems for startups:

1. Rippling

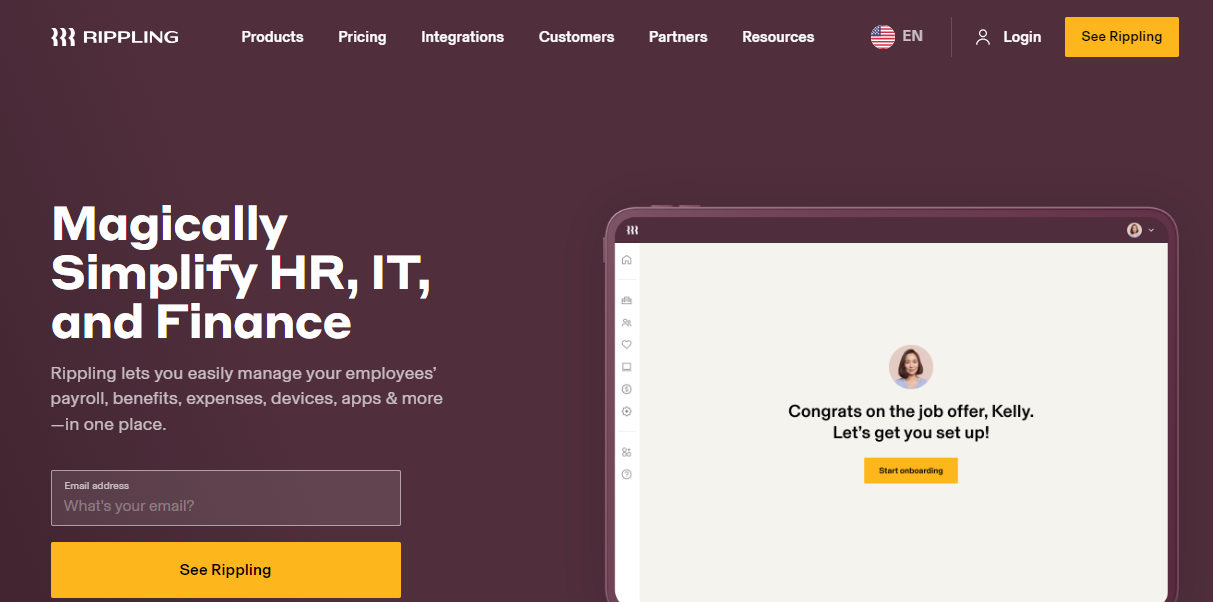

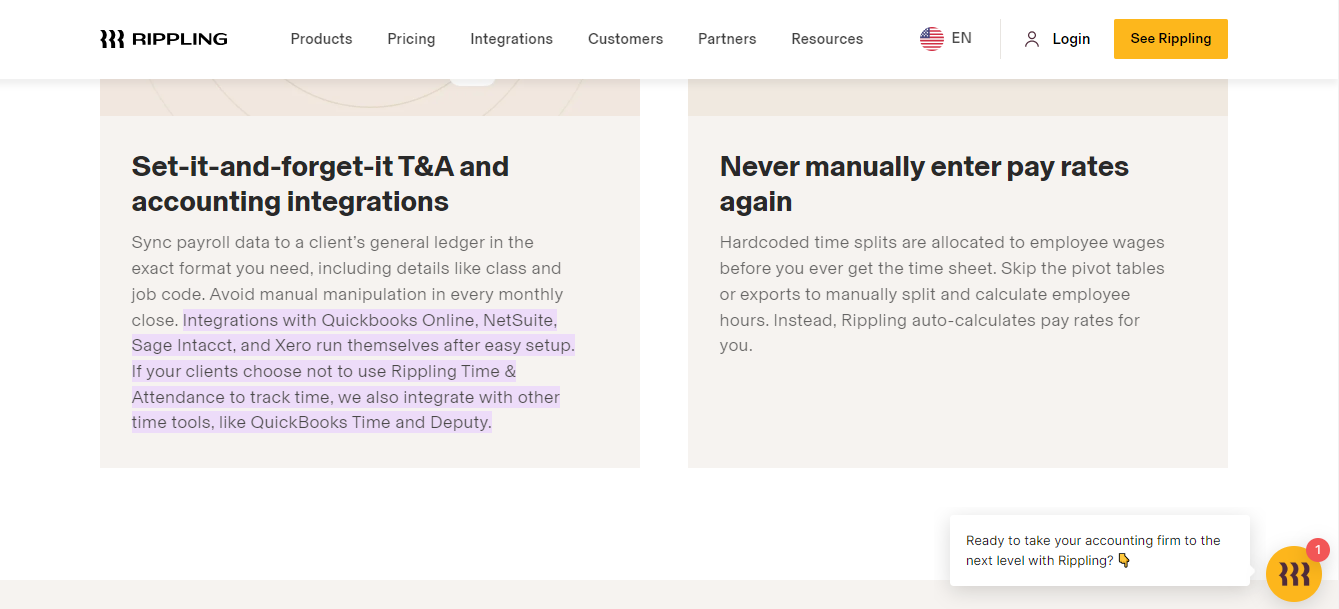

Rippling is a unified platform managing the entire employee lifecycle, from onboarding and offboarding to payroll, benefits, and compliance. Features like automated workflows, self-service options, and integrations with various HR and financial tools streamline tasks and minimize manual effort for HR professionals. While Rippling caters to businesses of all sizes, its focus lies on core functionalities and might not offer the advanced features of dedicated HR systems.

Source: Rippling

Pros:

- User-friendly interface: Easy to navigate even for non-HR professionals.

- Automated workflows: Streamlines tasks like onboarding, benefits enrollment, and payroll processing.

- Strong compliance management: Ensures your company stays up-to-date with tax regulations.

- Scalability: Grows with your business, eliminating the need to switch platforms.

- Integrations: Connects with various third-party tools for a holistic HR experience.

Cons:

- Limited customization options: May not be suitable for companies with complex needs.

- Pricing not publicly available: Requires a quote, which can be a turnoff for some.

- Limited reporting capabilities: May not offer all the reporting features some businesses require.

- Annual commitment – you must commit to a 12 months plan which can be paid monthly or yearly.

- No dedicated payroll accountant– you’ll get a customer support email or chat.

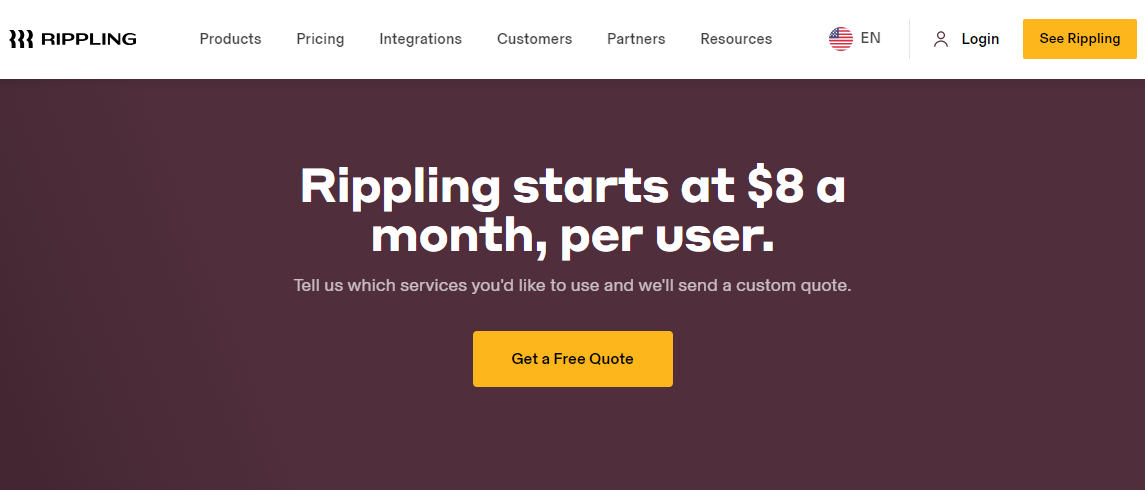

Pricing: $35 plus $8 per user, per month if you pay annually in advance. Requires contacting Rippling for a custom quote.

Source: Rippling

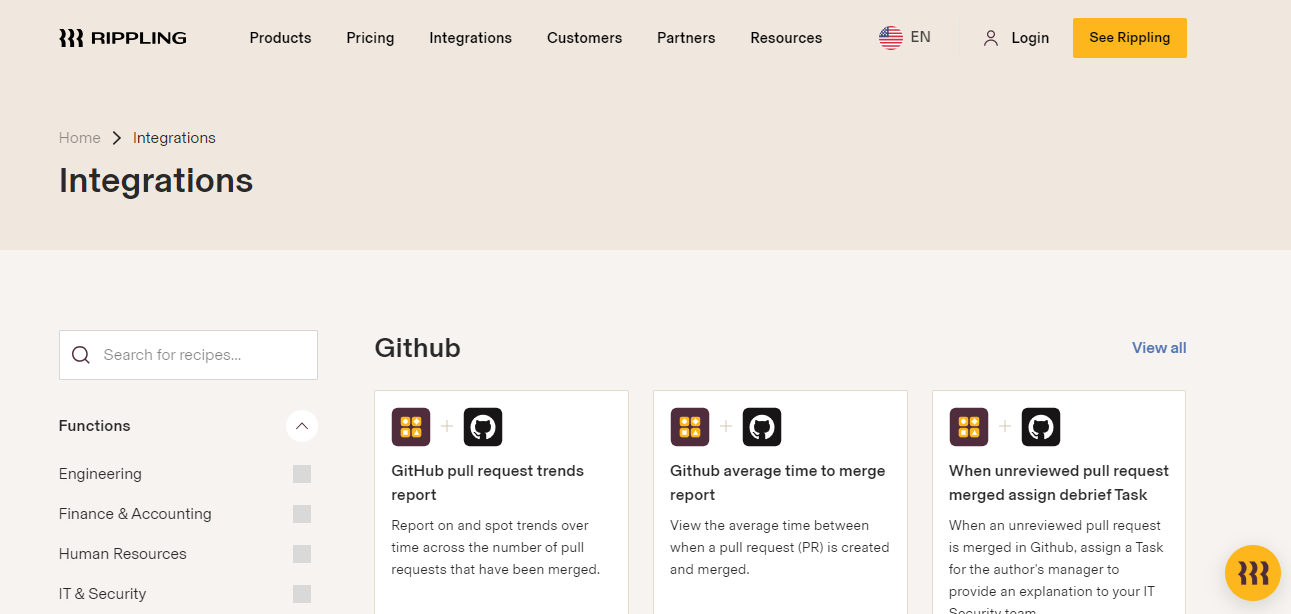

Integrations: Rippling offers a wide range of integrations with popular third-party applications, including:

Source: Rippling

- Accounting software: NetSuite, QuickBooks Online, Xero, and more.

Source: Rippling

- Time tracking: Clockify, Time Doctor, OnPoint, Google Sheets, and more.

- Benefits administration: Zenefits, Namely, ADP TotalSource, and more.

- Communication and collaboration: Slack, Microsoft Teams, Google Workspace, Zoom, and more.

- IT tools: Okta, Azure Active Directory, Google Workspace Marketplace, and more.

- Security and compliance: DocuSign, OneLogin, Ping Identity, and more.

Customer Support: Rippling offers multiple customer support channels, including:

- 24/7 phone support: Access to live representatives anytime.

- Chat support: Available during business hours for quick inquiries.

- Email support: Dedicated email address for comprehensive inquiries.

Summary:

Ease of Use: ★★★★★

(Highly user-friendly interface)

Pricing: ★★★☆☆

(Competitive for small businesses, part-time employee pricing can impact costs)

Integrations: ★★★★★

(Extensive range of integrations)

2. Gusto

Gusto is a user-friendly online platform that modernizes HR and payroll processes for businesses of all sizes, with a special focus on startups and small businesses. Its comprehensive feature set includes automated payroll processing with tax filing and direct deposit, streamlined benefits administration for health insurance and retirement plans, and efficient HR tools for onboarding, compliance, and employee self-service. Gusto also offers time tracking integration and insightful reporting and analytics on workforce metrics. Designed as an all-in-one solution, Gusto combines payroll, benefits, and HR functionalities, eliminating the need for multiple systems and enhancing the employee experience with a self-service portal for managing pay, personal details, and benefits. This makes Gusto particularly appealing to businesses seeking affordability, ease of use, and a holistic approach to employee management.

Source: Gusto

Pros:

- Easy to use and intuitive interface: Streamlines tasks and reduces complexities for businesses without dedicated HR personnel.

- Streamlined payroll and HR tasks: Automates payroll processing, tax filings, and simplifies HR tasks like onboarding, offboarding, and benefits administration.

- Comprehensive benefits administration: Offers a comprehensive platform to manage and administer various employee benefits like health insurance, retirement plans, and paid time off.

- Employee self-service options: Empowers employees to access pay stubs, update personal information, and manage benefits through a self-service portal, reducing administrative burden for HR teams.

- Strong customer support: Offers various support channels and readily available resources for assistance.

Cons:

- May not be suitable for large, complex organizations: While offering a robust suite of features, Gusto might not cater to the extensive needs of large enterprises requiring highly customizable HR systems.

- Limited customization options compared to some competitors: Compared to some HR-focused systems, Gusto offers less customization flexibility tailored to specific business needs.

- Self service– it is built as a self service solution at it’s core offering, so you’ll need to learn how to operate the software, not ideal for a busy founder

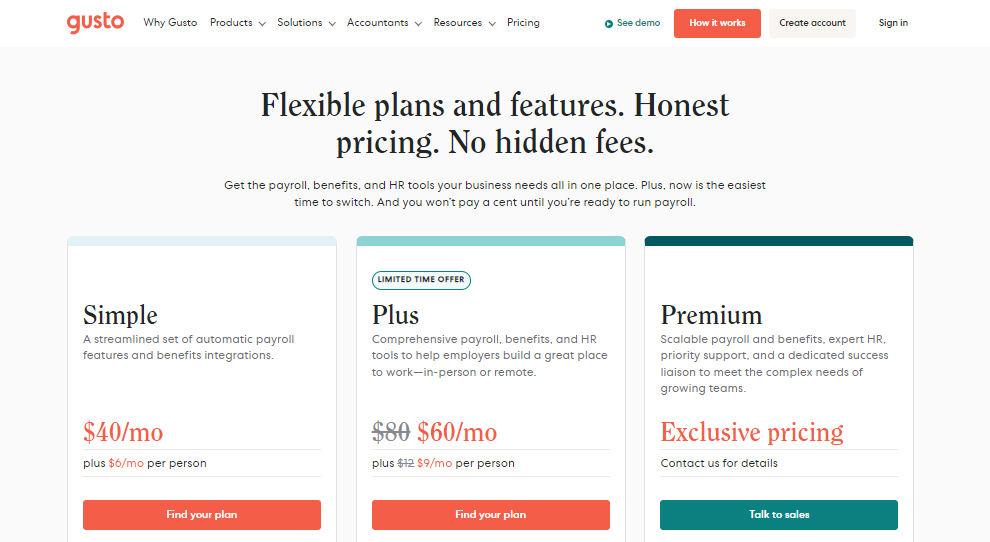

Pricing:

- Simple Plan: $40/month plus $6 per employee/month

- Plus Plan: $80/month plus $12 per employee/month

- Premium Plan: Exclusive Pricing, Contact for Quote

Source: Gusto

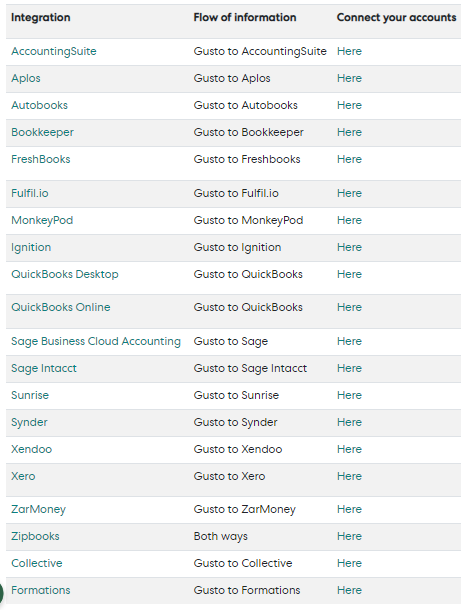

Integrations: Gusto offers a wide range of integrations with various third-party applications, including:

Source: Gusto

- Accounting software: QuickBooks Online, Xero, Sage Business Cloud Accounting, and more.

- Time tracking: Clockify, Time Doctor, Hubstaff, TSheets, and more.

- Benefits administration: Zenefits, Namely, UnitedHealthcare, and more.

- Communication and collaboration: Slack, Microsoft Teams, and Google Workspace.

- Other: DocuSign, ADP Marketplace, and more.

Customer Support: Gusto offers 24/7 support through various channels:

- Phone: 24/7 access to live representatives.

- Chat: Available during business hours for quick inquiries.

- Email: Dedicated email address for comprehensive inquiries.

Summary:

Ease of Use: ★★★★★

(Highly user-friendly interface)

Pricing: ★★★★☆

(Reasonable for small businesses, might be expensive for larger companies)

Integrations: ★★★★★

(Extensive range of integrations)

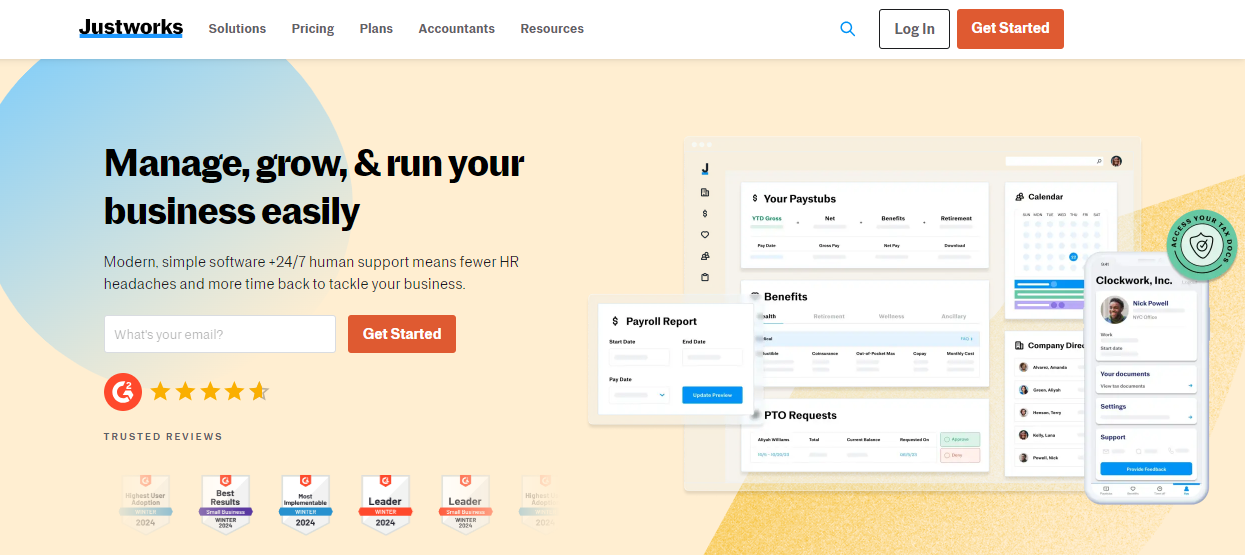

3. Justworks

Justworks is a PEO (Professional Employer Organization) that offers an all-in-one payroll and HR solution tailored specifically for small businesses. It simplifies processes beyond basic payroll by providing features like automated payroll processing with tax & filings, benefits administration, HR tools for onboarding, offboarding, and compliance, time & attendance tracking integrations, and reporting & analytics. This comprehensive platform empowers small businesses to streamline HR and payroll tasks while ensuring compliance and gaining valuable workforce insights.

Source: Justworks

Pros:

- All-in-one solution: Streamlines payroll and HR processes within a single platform.

- Designed for small businesses: Caters to the specific needs and complexities of small businesses.

- Affordable pricing: Offers competitive pricing compared to some competitors.

- Dedicated HR support: Provides access to HR professionals for assistance and guidance.

Cons:

- Limited features compared to some competitors: May not offer advanced features needed by larger companies or those with complex HR requirements.

- Limited customization options: Offers less customization flexibility compared to some HRIS solutions.

- Part-time employee pricing: Separate pricing structure for part-time employees, which may impact overall costs.

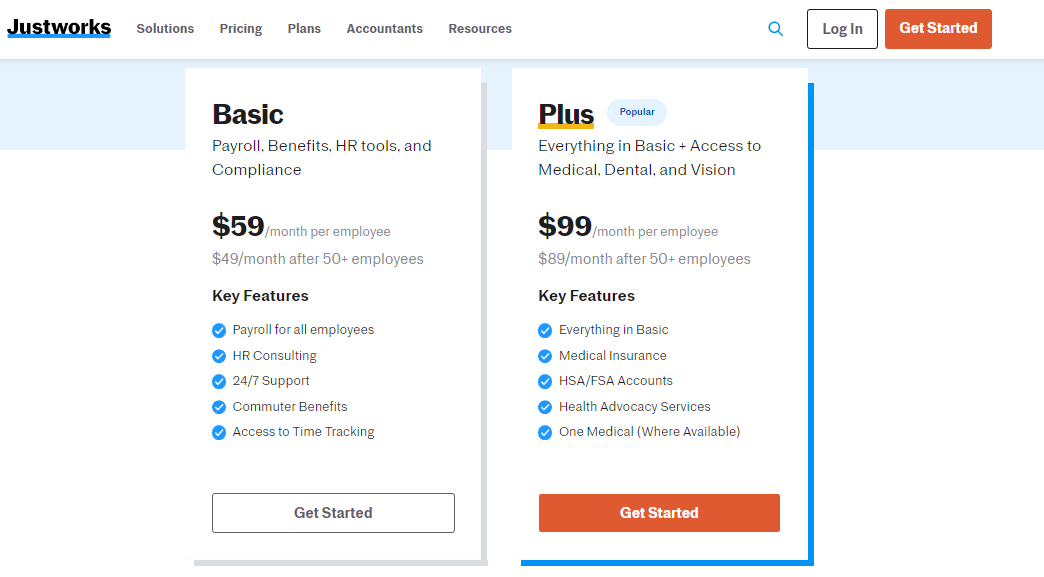

Pricing:

- Basic: $59 per employee per month + 49$ per month after 50+ employees.

- Plus: $99 per employee per month + 89$ per month after 50+ employees.

Source: Justworks

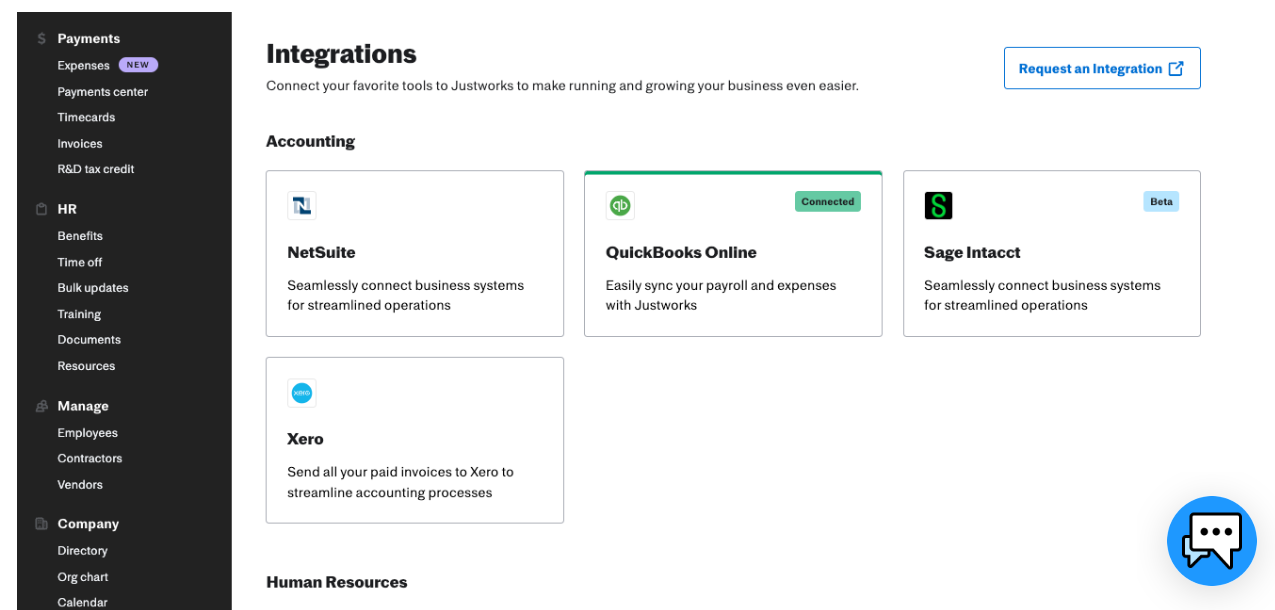

Integrations: To enhance its functionality, Justworks integrates with various third-party applications:

Source: Justworks

- Accounting Software: QuickBooks Online, Xero, NetSuite

- Time Tracking: Buddy Punch, QuickBooks Time

- Benefits Administration: Zenefits, Namely

- Other: Checkr (background checks), EasyLlama (expense management), Brex (corporate cards), WeThrive (employee engagement), TeamSense (performance management)

Customer Support:

Justworks offers support through various channels:

- Phone: Available during business hours.

- Email: Dedicated email address for inquiries.

- Onboarding and ongoing support: Dedicated specialists assist with setup and ongoing questions.

Summary:

Ease of Use: ★★★★

(User-friendly interface, but might require training for complex features)

Pricing: ★★★☆☆

(Competitive for small businesses, part-time employee pricing can impact costs)

Integrations: ★★★☆☆

(Offers key integrations, but may not cover all needs)

4. TriNet

TriNet offers more than just basic payroll services, including a range of features designed to simplify HR tasks and boost employee engagement. With three main options available, TriNet addresses the varied needs of businesses. The Full-Service PEO option acts as the employer of record, taking care of payroll, taxes, benefits, and HR expertise, helping businesses to focus more on their core activities. The HR Plus option is customizable, offering payroll, tax compliance, benefits administration, and dedicated HR consulting for those wanting more control over HR functions with expert support. The HR Platform is a self-service option that gives businesses the tools to manage payroll, taxes, benefits, and other HR activities on their own. TriNet’s flexible offerings allow small and mid-sized businesses to select the level of HR support and control that fits their specific needs best.

Source: TriNet

Pros:

- Comprehensive HR solutions: TriNet offers a wide range of HR solutions to meet the needs of SMBs of all sizes and industries.

- Expertise and experience: TriNet has over 30 years of experience in the HR industry and a team of experts who can help SMBs with all aspects of HR.

- Technology and innovation: TriNet invests heavily in technology and innovation to provide SMBs with the latest HR tools and resources.

- Customer service and support: TriNet offers excellent customer service and support to SMBs.

Cons:

- Cost: TriNet’s HR solutions can be expensive for some SMBs.

- Complexity: TriNet’s HR solutions can be complex for some SMBs to manage.

- Customization: TriNet’s HR solutions may not be customizable enough for some SMBs.

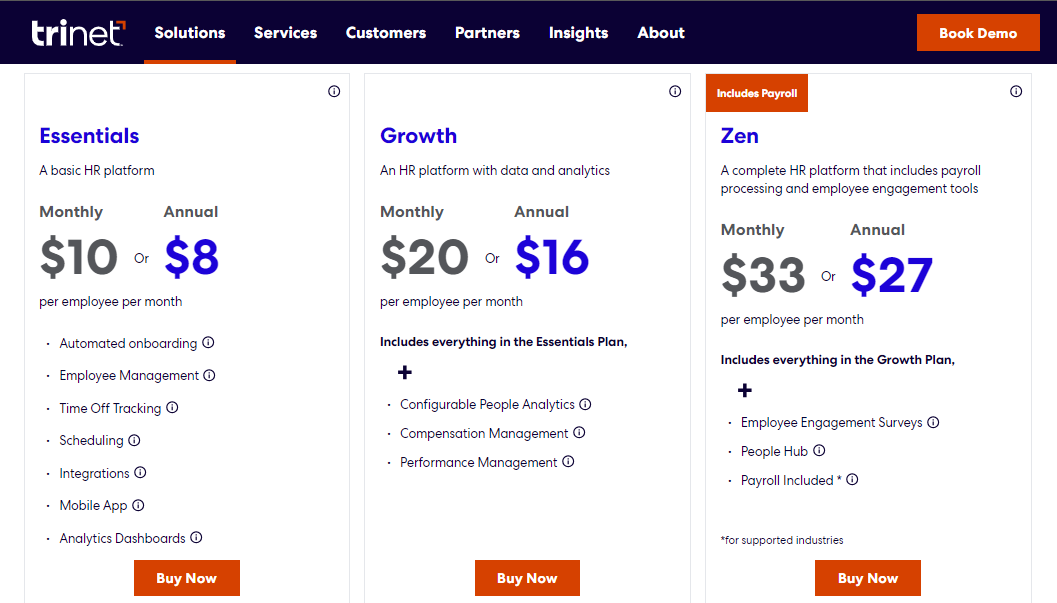

Pricing:

- Essentials Plan: $8/month per employee

- Growth Plan: $16/month per employee

- Zen Plan: $27/month per employee

Source: Trinet

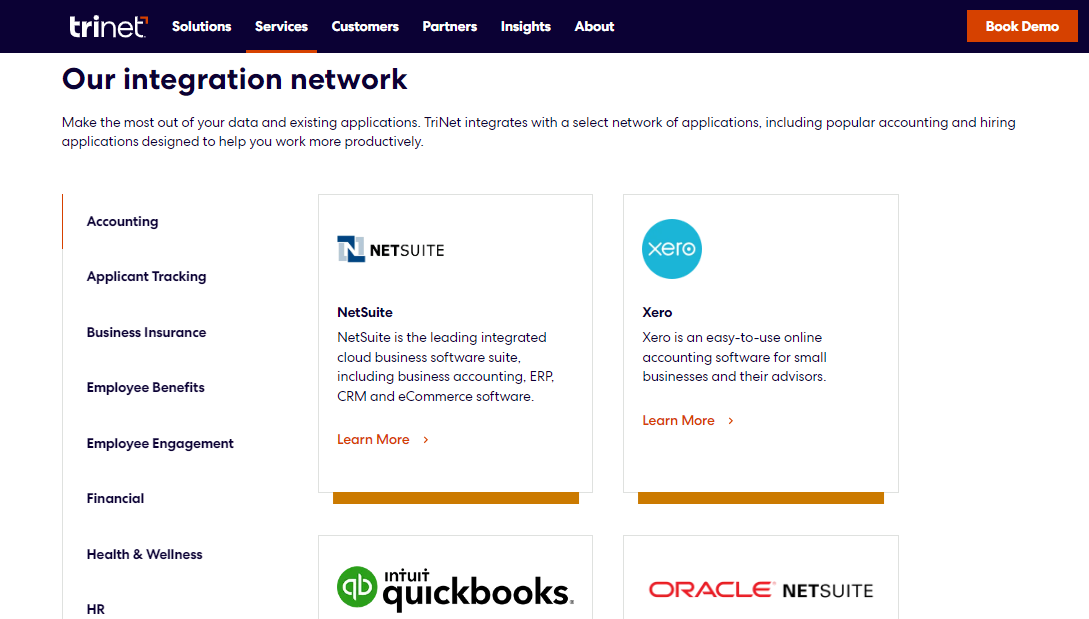

Integrations: TriNet offers integrations with various third-party applications, including:

Source: Trinet

- Accounting software: QuickBooks, Xero, NetSuite, etc.

- Time tracking: Clockify, Time Doctor, OnPoint, etc.

- Benefits administration: Zenefits, Namely, ADP TotalSource, etc.

- Communication and collaboration: Slack, Microsoft Teams, Google Workspace, etc.

- Other: DocuSign, Dropbox, Google Drive, Zoom, Zapier, etc.

Customer Support:

TriNet offers 24/7 support through various channels:

- Phone: 24/7 access to live representatives.

- Chat: Available during business hours for quick inquiries.

- Email: Dedicated email address for comprehensive inquiries.

- Online resources: TriNet offers a comprehensive online knowledge base with articles, FAQs, and other resources.

Summary:

Ease of Use: ★★★☆☆

(User-friendly interface, but complex features might require training)

Pricing: ★★★☆☆

(Competitive for small businesses, part-time employee pricing can impact costs)

Integrations: ★★★☆☆

(Offers key integrations, but may not cover all needs)

5. Paychex

Paychex offerings include automated payroll processing equipped with tax calculation and filing capabilities, direct deposit, and the ability to handle international payments. Paychex also simplifies benefits administration by allowing businesses to offer and manage various employee benefits, such as health insurance, retirement plans, and paid time off, all through an integrated platform. Additionally, they provide comprehensive HR tools to streamline tasks like onboarding, offboarding, compliance management, and offer employee self-service options. The integration with time tracking systems enables accurate tracking of employee hours, overtime, and paid time off, ensuring the company remains compliant with all state and federal payroll taxes, including unemployment insurance.

Source: Paychex

Pros:

- Scalable solutions: Offers a range of plans to cater to the needs of businesses of all sizes, from startups to large enterprises.

- Comprehensive features: Provides a wide range of features beyond basic payroll to streamline HR processes.

- Strong reputation: Established company with a long history of providing reliable payroll and HR solutions.

- Customer support: Offers various channels for customer support, including phone, chat, and email.

- Dedicate support and CS manager: One of the core advantages of this provider is having you work closely with a single POC from the get go.

Cons:

- User interface: The user interface can be complex for some users, especially beginners.

- Cost: Pricing can be higher compared to some competitors, especially for smaller businesses.

- Customization: May not offer the same level of customization options as some HR-focused systems.

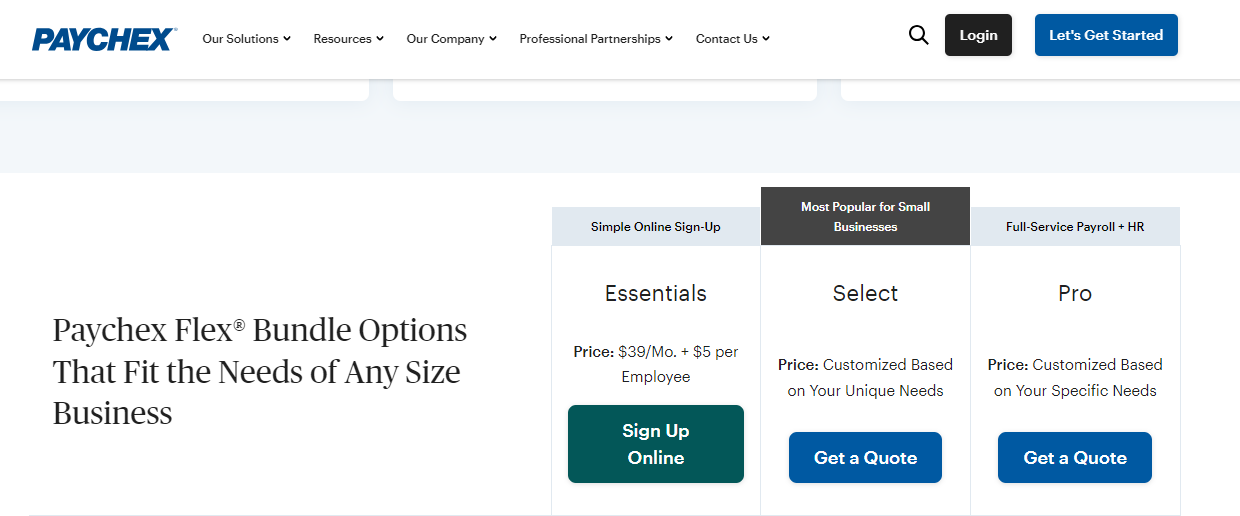

Pricing:

- Paychex Flex Essentials: $39/month plus $5 per employee/month

- Paychex Flex Select: Custom pricing with quotes available upon request

- Paychex Flex Pro: Custom pricing with quotes available upon request

Source: Paychex

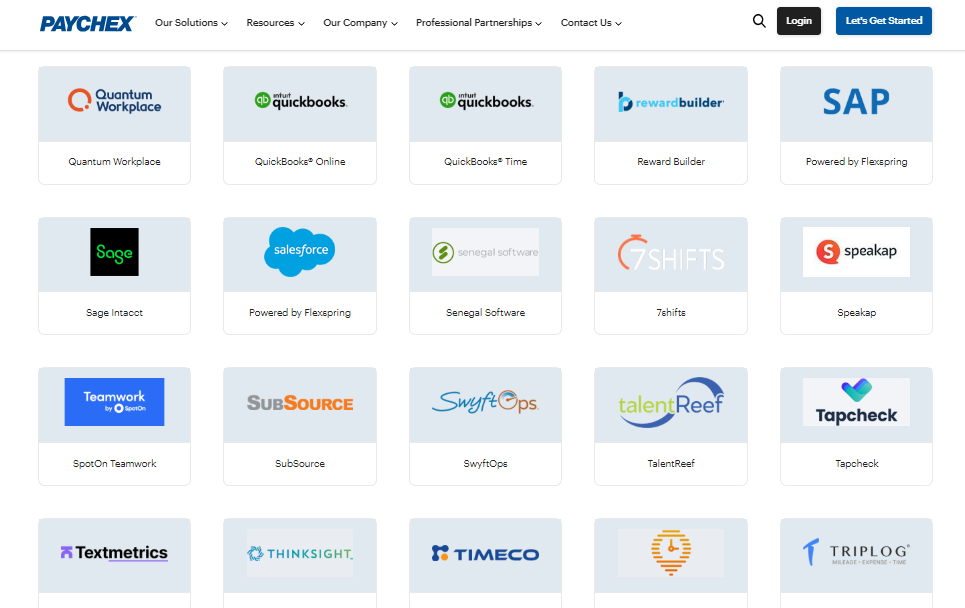

Integrations: Paychex offers integrations with a wide range of third-party applications, including:

Source: Paychex

- Accounting software: QuickBooks, Xero, NetSuite, etc.

- Time tracking: Clockify, Time Doctor, OnPoint, etc.

- Benefits administration: Zenefits, Namely, ADP TotalSource, etc.

- Communication and collaboration: Slack, Microsoft Teams, Google Workspace, etc.

- Other: DocuSign, Dropbox, Google Drive, Zoom, Zapier, etc.

Customer Support: Paychex offers 24/7 support through various channels:

- Phone: 24/7 access to live representatives.

- Chat: Available during business hours for quick inquiries.

- Email: Dedicated email address for comprehensive inquiries.

- Self-service knowledge base: Provides access to articles, FAQs, and other resources.

Summary:

Ease of Use: ★★★☆☆

(User-friendly interface, but might require training for complex features)

Pricing: ★★☆☆☆

(Scalable solutions, but pricing not publicly available and can be higher than some competitors)

Integrations: ★★★★★

(Wide range of integrations)

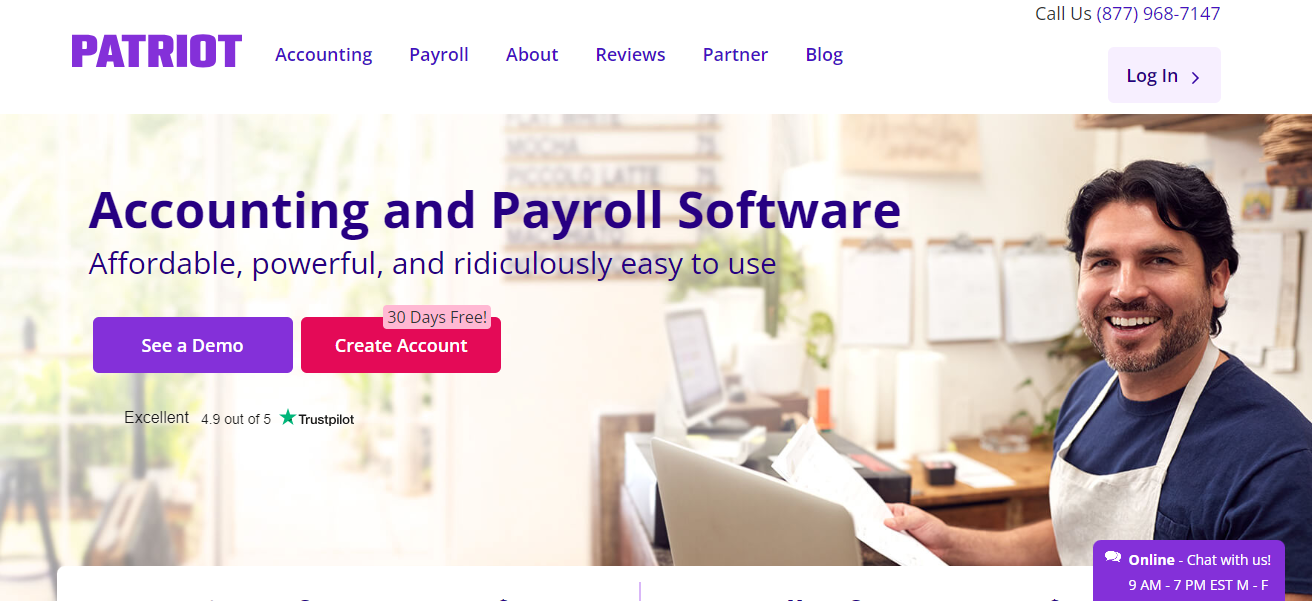

6. Patriot Software

Patriot Software enhances financial management and HR tasks with its comprehensive suite of features. This includes accounting software for managing accounts payable and receivable, creating invoices, tracking expenses, and generating financial reports. Its payroll processing automates calculations, tax filings, and enables direct deposit, while also offering benefits administration for managing health insurance, retirement plans, and paid time off. Additionally, its integration with time tracking systems ensures accurate employee hour logging. An employee self-service portal further empowers staff to view pay stubs, update personal details, and manage their benefits, streamlining operations and fostering a more engaged workforce.

Source: PatriotSoftware

Pros:

- Easy to use: Intuitive interface and user-friendly design make it accessible even for businesses with limited accounting experience.

- Affordable pricing: Offers tiered pricing plans based on features and number of employees, making it budget-friendly for small businesses.

- Integrated solutions: Seamless integration between accounting and payroll software simplifies financial management.

- Excellent customer support: Offers 24/7 support through various channels and boasts highly-rated customer satisfaction.

Cons:

- Limited features: Compared to some competitors, it might lack advanced features like inventory management or complex reporting capabilities.

- Scalability limitations: May not be suitable for larger businesses or businesses with complex accounting needs.

- Limited mobile app functionality: The mobile app may not offer all the functionalities as the desktop software.

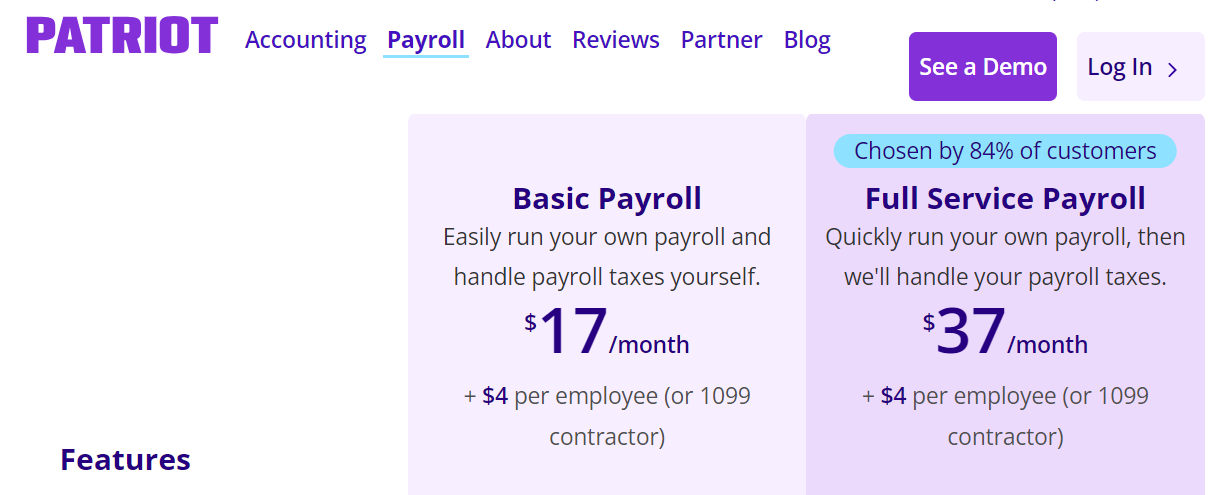

Pricing:

- Basic Payroll: Starts at $17 per month + $4 per employee per month.

- Full Service Payroll: $37 per month + $4 per employee per month.

Source: Patriot

Integrations: Patriot Software offers integrations with a limited range of third-party applications, including:

Source: Patriot Software

- Accounting software: QuickBooks

- Payment processing: Stripe

Note: Patriot Software prioritizes core payroll functionalities, so their website might not showcase a vast array of integrations. While platforms like Zapier or IFTTT offer the potential to connect Patriot Software with tools like Zenefits or Namely, these indirect connections often require additional setup complexity and potentially high fees. To navigate this, consider contacting Patriot Software support to confirm any direct integrations or explore third-party options, keeping in mind the potential for increased setup effort and costs.

Customer Support: Patriot Software offers 24/7 support through various channels:

- Phone: 24/7 access to live representatives in the US.

- Chat: Available during business hours.

- Email: Dedicated email address for inquiries.

- Online resources: Comprehensive knowledge base with articles, FAQs, and tutorials.

Summary:

Ease of Use: ★★★★★

(Highly user-friendly interface)

Pricing: ★★★★★

(Affordable and transparent pricing structure)

Integrations: ★★★☆☆

(Limited integrations, may not cover all needs)

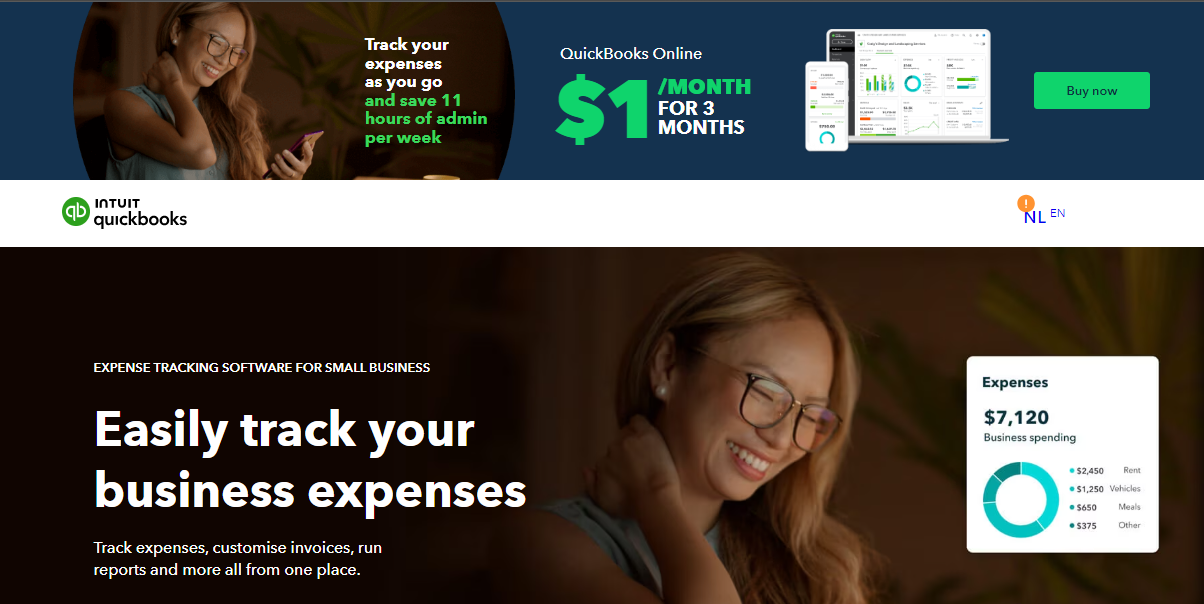

7. Intuit QuickBooks Payroll

Intuit QuickBooks Payroll, seamlessly integrated with the widely used QuickBooks accounting software, delivers a user-friendly payroll solution catering to the diverse needs of businesses, regardless of size. This advanced system transcends basic payroll processing functionalities by introducing automated payroll processing, which simplifies payroll tasks through automatic calculations, tax filings, and enabling direct deposit. It further empowers employees by providing a self-service portal where they can view their pay stubs, access W-2s, and update their personal details, fostering a sense of independence and engagement. The platform is equipped with tax and compliance tools including federal and state as well as local tax calculations and filings, ensuring businesses stay compliant with regulatory requirements.

Source: Quickbooks

Pros:

- Easy to use: Intuitive interface simplifies payroll tasks for users with limited accounting knowledge.

- Integration with QuickBooks: Seamless integration with QuickBooks accounting software for streamlined financial management.

- Affordable pricing: Offers tiered pricing plans based on features and number of employees, making it suitable for various business sizes.

- Strong customer support: Offers 24/7 support through various channels.

Cons:

- Limited features: Compared to some competitors, it might lack advanced features like HR modules or extensive customization options.

- Payroll errors: Occasional reports of payroll errors encountered by some users.

- Limited international support: May not be suitable for businesses with international operations.

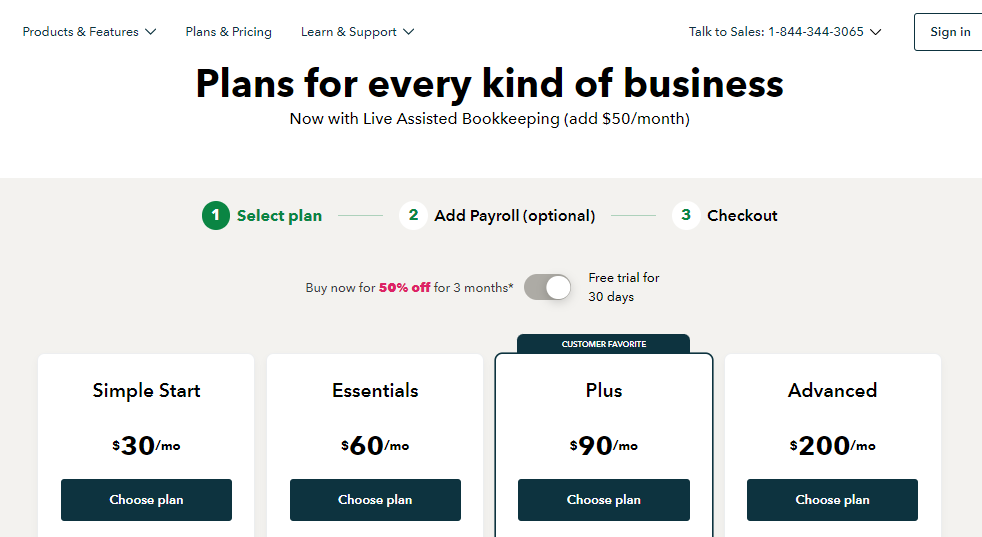

Pricing:

- Simple start: 30$ per month

- Essentials: 60$ per month

- Plus: 90$ per month

- Advanced: 200$ per month

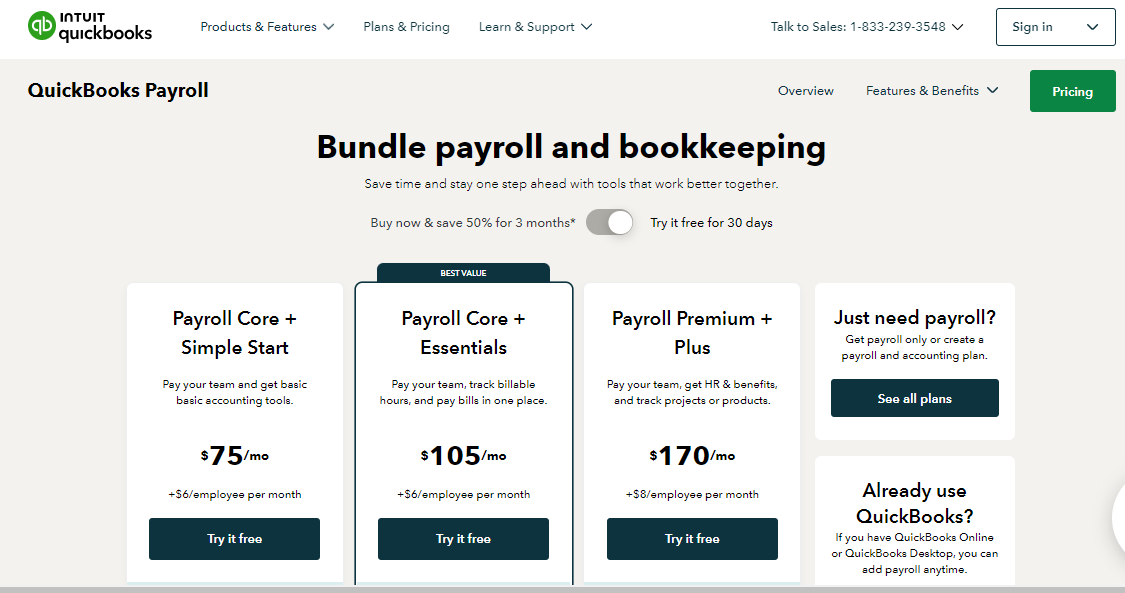

You can also choose to bundle payroll and bookkeeping with the following plans:

- Payroll Core + Simple Start: $75/month plus $6 per employee/month

- Payroll Core + Essentials: $105/month plus $6 per employee/month

- Payroll Premium + Plus: $170/month plus $8 per employee/month

Source: QuickBooks

Source: QuickBooks

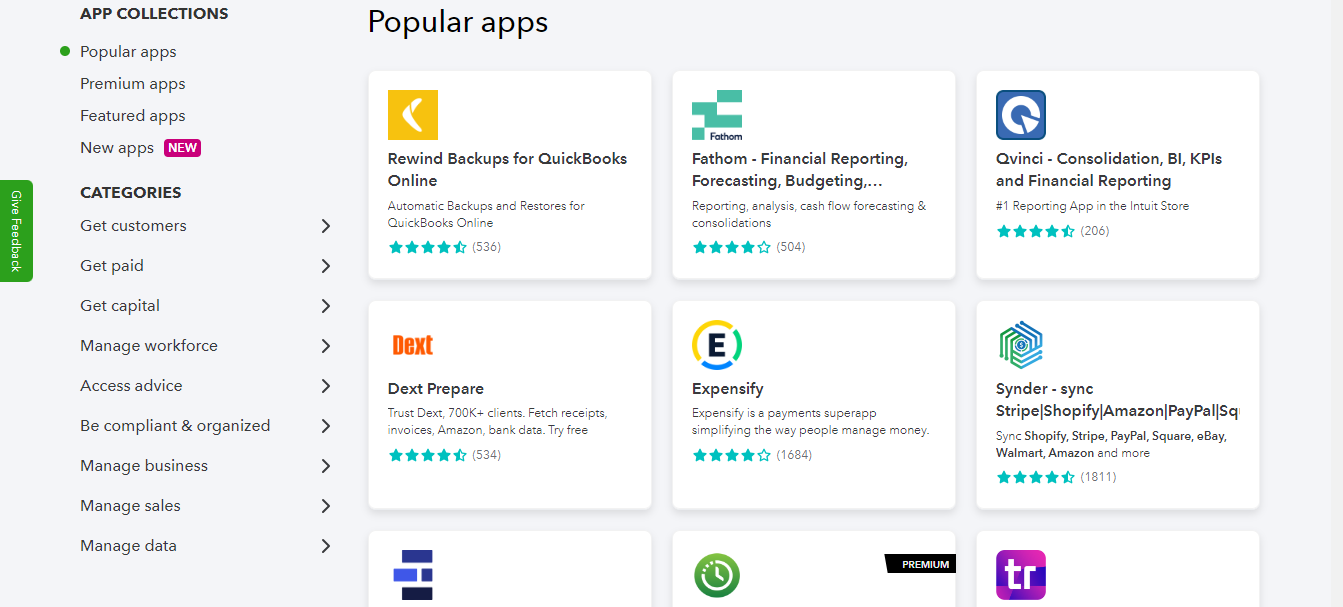

Integrations: QuickBooks Payroll integrates with a wide range of third-party applications, including:

Source: Quickbooks

- Accounting software: Seamless integration with all QuickBooks editions.

- Time tracking: Clockify, Time Doctor, OnPoint, etc.

- Benefits administration: Zenefits, Namely, ADP TotalSource, etc.

- Other: DocuSign, Google Drive, Gusto, etc.

Customer Support:

QuickBooks Payroll offers 24/7 support through various channels:

- Phone: 24/7 access to live representatives.

- Chat: Available during business hours for quick inquiries.

- Email: Dedicated email address for inquiries.

- Online resources: Comprehensive online knowledge base with articles, FAQs, and tutorials.

Summary:

Ease of Use: ★★★★★

(Highly user-friendly interface)

Pricing: ★★★★☆☆

(Affordable for most businesses, competitive pricing)

Integrations: ★★★★☆☆

(Wide range of integrations, but might not cover all needs)

8. ADP Run

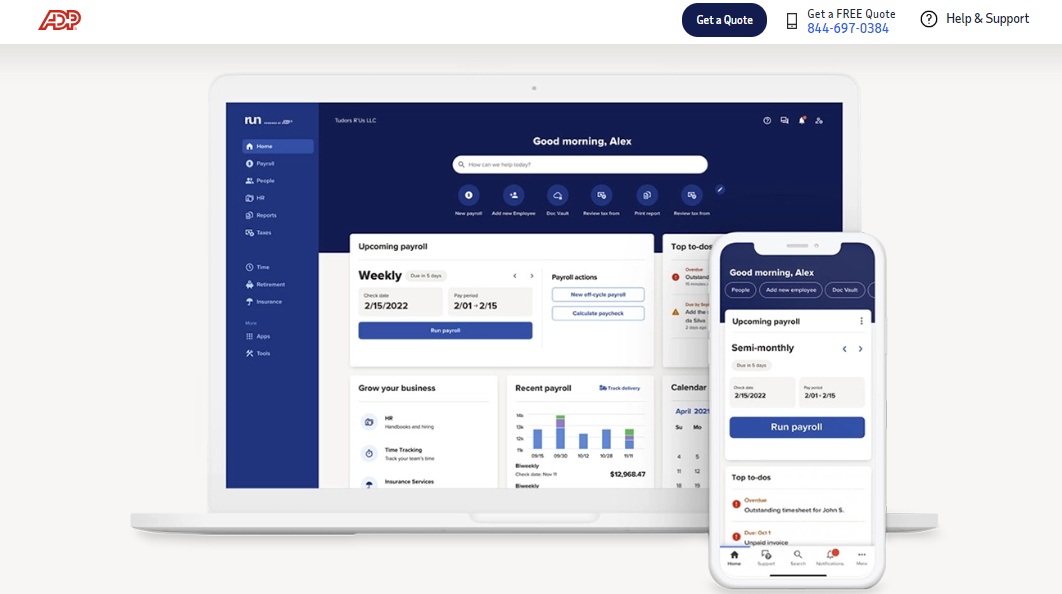

ADP RUN, powered by the global leader in human capital management (HCM) solutions, ADP, delivers an all-encompassing payroll and HR platform suitable for businesses of any size. This robust system enhances payroll processing with automation for calculations, tax filings, and direct deposit, alongside efficient management of benefits like health insurance and retirement plans. It includes essential HR tools for onboarding, compliance, and an employee self-service portal, plus integrates with time tracking systems for accurate work hours and overtime monitoring. ADP RUN ensures regulatory compliance with automated tax calculations and offers detailed reporting and analytics to provide insights into payroll costs and workforce demographics. Additionally, it leverages AI for error detection, ensuring accuracy in payroll data processing, making it a comprehensive solution for modern business payroll and HR needs.

Source: ADP RUN

Pros:

- Scalability: Caters to businesses of all sizes, from small businesses to large enterprises.

- Comprehensive features: Offers a wide range of features beyond basic payroll, including HR tools and AI-powered error detection.

- Strong reputation: Backed by the expertise and experience of ADP, a market leader in HCM solutions.

- Security and reliability: Employs robust security measures and ensures data reliability.

Cons:

- Cost: Can be expensive compared to some competitors, especially for smaller businesses.

- Complexity: Implementing and utilizing all features might require training and support.

- Limited customization options: Might not offer the same level of customization as some HR-focused systems.

Pricing: ADP provides four tailored payroll service plans, with specific pricing not listed publicly and varying based on employee count and service complexity. For precise rates, businesses must request a quote through ADP’s online form or by contacting a sales rep. User reports suggest the Essential plan begins at $79 monthly, plus $4 per employee. The customizable RUN Powered By ADP plans start similarly, designed to scale with business growth.

Source: ADP

Integrations: ADP RUN offers integrations with a wide range of third-party applications, including:

Source: ADP RUN

- Accounting software: QuickBooks, Xero, NetSuite, etc.

- Time tracking: Clockify, Time Doctor, OnPoint, etc.

- Benefits administration: Zenefits, Namely, ADP TotalSource, etc.

- Communication and collaboration: Slack, Microsoft Teams, Google Workspace, etc.

- Other: DocuSign, Dropbox, Google Drive, Zoom, Zapier, etc.

Customer Support:

ADP RUN offers customer support through various channels:

- Phone: Dedicated phone support during business hours.

- Email: Dedicated email address for inquiries.

- Online resources: Comprehensive knowledge base with articles, FAQs, and tutorials.

- Dedicated customer service representatives: Assigned to each client for personalized support.

Summary:

Ease of Use: ★★★☆☆

(User-friendly interface, but complex features may require training)

Pricing: ★★☆☆☆

(Scalable solutions, but pricing not publicly available and can be expensive for smaller businesses)

Integrations: ★★★★★

(Wide range of integrations)

Tips for Setting Up a Small Business Payroll

Setting up payroll for a small business is a critical step to ensure that employees are paid accurately and on time, and that the business complies with all tax laws and regulations. Here are detailed tips to guide you through the process:

- Obtain an Employer Identification Number (EIN)

Before setting up your payroll, you must get an EIN from the IRS. This number is used to identify your business for tax purposes. You can apply for an EIN online through the IRS website, by fax, or by mail.

- Understand Your Obligations Under Local and Federal Laws

Familiarize yourself with the Fair Labor Standards Act (FLSA) for federal wage and hour laws, including minimum wage, overtime, and record-keeping requirements. Also, understand state and local employment laws, which can vary significantly. Government websites like the Department of Labor offer guidelines and resources.

- Choose the Right Payroll System

Decide whether you’ll manage payroll in-house or outsource to a payroll service provider. Consider factors like cost, the complexity of payroll needs, and the size of your business. Software solutions like QuickBooks Payroll, Gusto, or ADP Run offer various features that cater to small businesses, including tax filing services and integration with existing HR systems.

- Collect Employee Tax Information

Have each employee fill out a W-4 form (Employee’s Withholding Certificate) to determine the amount of federal income tax to withhold from their wages. Some states have their own version of the W-4 form, so be sure to check your state’s requirements.

- Determine Pay Periods

Decide how often you will pay your employees: weekly, bi-weekly, semi-monthly, or monthly. This decision may be influenced by state laws and the nature of your business. Regular, consistent pay periods help manage cash flow and ensure employee satisfaction.

- Set Up a System for Tracking Time and Attendance

Accurately tracking hours worked is essential for calculating pay and complying with labor laws, especially for hourly employees. Consider using digital time-tracking tools that integrate with your payroll system to streamline the process and reduce errors.

- Process Payroll Taxes Accurately

You are responsible for withholding the correct amount of taxes from employees’ paychecks and paying employer taxes. This includes federal income tax, Social Security and Medicare taxes, and possibly state and local taxes. You’ll also need to file tax returns regularly with the IRS and your state’s tax agency.

- Keep Detailed Records

Maintain accurate records of wages, deductions, tax payments, and employee information for at least three years, as required by the FLSA. Good record-keeping is crucial for compliance, resolving disputes, and preparing for audits.

- Stay Informed on Changes in Tax Laws

Tax laws and employment regulations can change, so it’s important to stay updated to remain compliant. Use resources like the IRS website, professional accountants, or your payroll provider’s advisory services to keep informed.

- Consider Professional Help

If payroll seems daunting, consider hiring an accountant or a payroll service provider. They can help ensure that your payroll is set up correctly and that you comply with all legal requirements. This can save you time and protect you from costly errors or legal issues.

Conclusion

Selecting the right payroll platform transcends mere money management; it’s about ensuring a seamless onboarding process for hires and contractors, facilitating efficient payroll runs, and providing a user-friendly employee portal. For business owners, a startup-friendly, cost-effective, and customizable system that simplifies payroll processes and tax filings is key. The ideal tool offers analytics for strategic planning and supports employee onboarding with ease. In this fast-paced world, choosing a system that integrates smoothly with your operations can significantly impact how you manage work and care for your people. The right payroll providers act not just as services but as partners, ensuring your business thrives in an ever-evolving landscape.