Venture Capital – it’s a term you’ve likely heard, but what does it really mean for your startup? Imagine having the funds to transform your innovative ideas into reality to scale your business beyond your wildest dreams. That’s the promise of venture capital.

This guide will paint a clear picture of how it works, providing proof of its potential and pushing you toward the path of financial growth. Get ready to unlock the secrets of venture capital and propel your startup to new heights.

What Is Venture Capital

Venture Capital (VC) is a form of private equity financing that is provided by venture capital firms to startups and early-stage companies that are believed to have high growth potential.

Unlike traditional loans, venture capital financing doesn’t require startups to repay the invested capital, reducing the financial burden on early-stage companies. Instead, Venture Capitalists invest capital in exchange for equity, or partial ownership, in the companies they fund.

This way, VCs share the business’s success if it does well but also risk losing their investment if the startup fails. This form of financing is particularly popular in high-tech industries such as SaaS, Healthcare, AI or Fintech, but it can be found in any industry.

Why Do Startups Seek VC Funding

Venture Capital funding, often regarded as the fuel that propels startups into their growth phase, is highly sought after by entrepreneurs worldwide.

This type of financing is not merely a monetary transaction but a partnership that offers multiple benefits to startups. Yet, it’s crucial for startups to understand why they might want to seek this form of funding. Let’s dig into the main reasons why startups pursue venture capital.

1. Growth Capital

Startups typically need significant amounts of capital to grow and scale, particularly in sectors like technology, where it may take years of development before a product can be sold commercially. VC funding provides this much-needed capital.

2. Market Validation

VC backing can provide a level of validation in the marketplace. Having a reputable venture capital firm investing in your startup can signal to other investors, customers, and potential hires that the startup has significant growth potential.

3. Strategic Guidance

Venture capitalists often provide more than just capital. They can also offer strategic advice, industry connections, mentorship, and operational guidance to help startups navigate their growth.

4. Long-Term Vision

Unlike banks and other lenders, venture capitalists invest with a long-term view. They expect many of their investments to fail but know that those who succeed generate large returns. This allows them to take risks on innovative, disruptive companies that might not qualify for traditional loans.

5. Exit Opportunities

VC firms are experienced in navigating exit strategies, whether through acquisitions, mergers, or initial public offerings (IPOs). This expertise can be invaluable for startups looking to exit.

It’s important to note that VC funding is not suitable for every business, and it comes with its own set of challenges, including the potential loss of control and dilution of ownership. However, the benefits can outweigh the downsides for startups with high-growth aspirations.

Venture Capital Vs. Angel Investors

Startups in need of funding often decide between angel investors and venture capitalists, two significant sources of investment in the startup ecosystem. While both offer capital to help businesses grow, they operate differently, with distinct implications for the startups they fund.

These differences can greatly impact a startup’s direction, from the scale of financial support to the extent of investor involvement in the business. Let’s dig deeper into the comparative aspects of Venture Capital and Angel Investing better to understand these two key forms of startup financing.

1. Investment Stage

Angel investors typically invest at the very early stages of a startup, often in the seed or pre-seed round when the company may only have an idea or a prototype. Venture capitalists usually get involved at later stages when the business has proven its concept and is ready to scale, although some VCs also invest in seed rounds.

However, these are not hard and fast rules. The specific timing for when an angel investor or venture capitalist might invest can be quite fluid, influenced by the unique circumstances of the startup and the strategies of the individual investors.

2. Investment Size

Angel investors usually invest smaller amounts, typically ranging from thousands to a few million dollars. Venture capitalists, on the other hand, can invest from millions to billions of dollars, depending on the funding round and the potential of the startup.

3. Investor Type

Angel investors are usually high-net-worth individuals who invest their own personal funds. Venture capitalists are professional investors managing a fund that pools investments from various sources, such as pension funds, endowment funds, foundations, corporations, and wealthy individuals.

4. Involvement

Angel investors may be less involved in the companies they invest in, often serving as mentors or advisors. Venture capitalists typically take an active role in their portfolio companies, often securing a seat on the board of directors and providing strategic direction to the company.

5. Return Expectations

Venture capitalists, in exchange for their investment, often acquire equity or an ownership stake in the startup. This practice is not just about seeking high returns but also gives them a direct interest in the startup’s success.

While they might aim for a substantial return (often targeted anywhere from 3x to 100x) within a 5-10 year period, this is not guaranteed and greatly depends on the startup’s performance.

On the other hand, Angel investors, investing their own personal funds, typically seek about 27% or 2.5 to 3 times their initial investment within 5 to 7 years.

However, their return expectations may vary greatly, often with more flexibility than venture capitalists, as their investment decisions can be influenced by factors beyond just financial return, such as personal interest or desire to support entrepreneurship.

Both angel investors and venture capitalists play vital roles in the startup ecosystem, providing not just capital but also valuable expertise and networks. The best choice for a startup depends on its stage, funding requirements, and the level of involvement it seeks from its investors.

Venture Capital Mechanics

Venture Capital (VC) is a complex field driven by a set of unique mechanics and stages that guide the process from the initial investment to the final exit. By understanding these mechanisms, entrepreneurs can better navigate the VC landscape, strategically position their startups for funding, and successfully manage the relationship with their investors.

In the upcoming sections, we will look into the VC funding process, explore the structure and key players in a VC fund, discuss the different stages of VC funding, shed light on valuation methods, and finally examine the various exit strategies.

Armed with this knowledge, startup founders can make more informed decisions and potentially increase their chances of securing venture capital.

The Venture Capital Funding Process

Navigating the venture capital funding process can be challenging for entrepreneurs, albeit important. This is because early-stage startups often rely heavily on venture capital investments to help them scale their operations.

With its distinct stages and precise examination, it requires a thorough understanding to maximize the opportunities it provides.

In this section, we will discuss the key steps of this process: Deal sourcing, Due Diligence, Deal Execution, and Post-Investment Management. Understanding each phase will help startups prepare effectively, align their expectations, and build productive relationships with venture capitalists.

1. Deal Sourcing

This is the initial stage of the VC funding process, where venture capitalists search for potential investment opportunities. It includes various activities such as attending startup events, networking, market research, and direct outreach to startups.

At this stage, VCs are looking for startups that align with their investment thesis, which is based on factors such as industry, geography, and startup stage.

2. Due Diligence

Once a potential investment has been identified, the VC firm conducts a thorough investigation into the startup. This includes evaluating the startup’s business model, products or services, market size and potential, competitive landscape, financials, and the team’s expertise.

Legal due diligence is also performed to ensure the company has its legal affairs in order, such as intellectual property rights, contracts, and compliance with relevant laws and regulations.

3. Deal Execution

If the startup passes the due diligence process, the VC firm will propose a term sheet, which outlines the terms and conditions of the investment, including the amount to be invested, the equity stake the VC firm will receive, valuation, governance rights, and exit strategy.

Negotiations take place at this stage to agree on the terms of the deal. Once both parties agree, legal documents are drafted, and the investment is closed.

To test your understanding of term sheets and deal-making, you can test your knowledge with our interactive Term Sheet Quiz.

4. Post-Investment Management

After the investment is made, the VC firm takes on a proactive role in the startup, often securing a seat on the board of directors. The VC firm provides ongoing support through strategic advice, networking opportunities, operational guidance, and further fundraising.

They also monitor the startup’s performance to ensure it is on track to achieve its growth targets.

The specifics of this process can vary based on the VC firm, the startup, and the specifics of the deal, but these stages provide a general framework for how venture capital funding works.

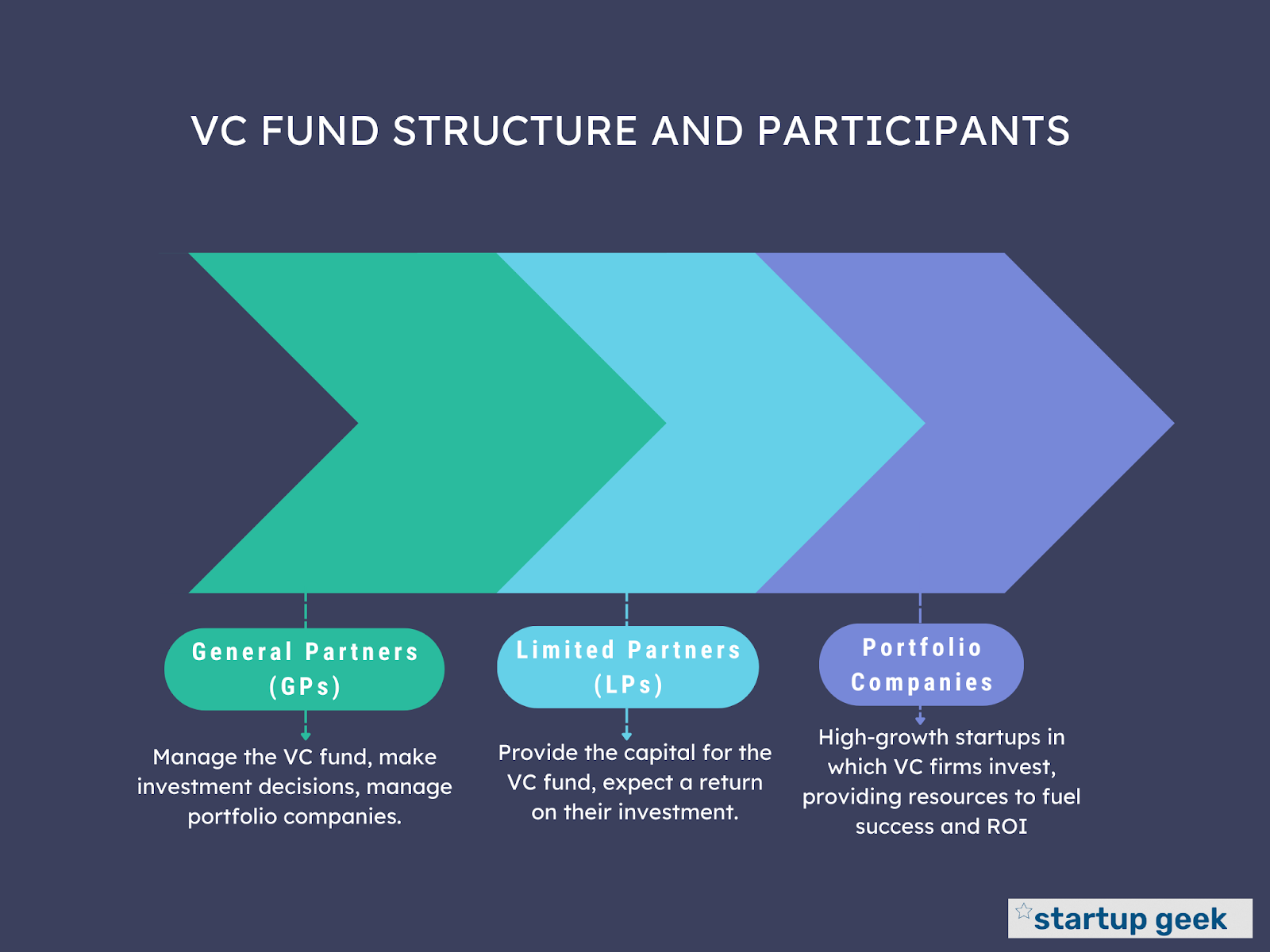

VC Fund Structure And Participants

To understand the dynamics of venture capital, it’s crucial to comprehend its organizational structure and the key participants involved. A venture capital fund is not a massive entity but a complex arrangement of various players with unique roles, responsibilities, and interests.

In this section, we’ll break down the structure of a typical VC fund and discuss the roles of General Partners (GPs), Limited Partners (LPs), and Entrepreneurs. Appreciating the function and objectives of each participant is instrumental in facilitating successful interactions and ensuring a smooth funding process.

1. General Partners (GPs)

General Partners are the individuals who manage the VC fund, with responsibilities spanning from sourcing deals and conducting due diligence to orchestrating exits, and unlike Limited Partners, they are fully liable for the actions of the fund, potentially putting their personal assets at risk.

GPs are active participants in the fund, often serving on the boards of the companies they invest in. They receive a management fee, typically a percentage of the fund’s capital, and a share of the profits from the fund’s investments, known as carried interest.

2. Limited Partners (LPs)

Limited Partners are the investors in the VC fund. They are often institutions like pension funds, university endowments, foundations, insurance companies, and high-net-worth individuals.

LPs provide the capital that GPs use to invest in startups but have limited liability and typically do not participate in the day-to-day operations of the fund. They expect to receive a return on their investment after the VC fund successfully exits its investments.

3. Portfolio Companies

Portfolio companies are startups in which a venture capital (VC) firm has invested. The success of these portfolio companies directly impacts the success of the VC firm; a significant return on investment from a portfolio company can offset losses from other investments and yield a net positive return for the firm and its investors.

In the VC fund structure, these portfolio companies comprise the fund’s ‘assets’ or ‘holdings’, while other participants include the general partners who manage the fund, limited partners who contribute capital, and the management team handling day-to-day operations.

VC Funding Stages

Venture capital funding is not a one-size-fits-all solution; it is a journey that evolves as startups grow and their needs change. Different stages of this journey correspond to different funding rounds, each with its own characteristics and expectations.

In this section, we will walk through the common stages of VC funding: the Pre-Seed Stage, the Seed Stage, Series A, Series B, Series C, and Mezzanine financing. Familiarizing yourself with these stages can help you better understand when and how to engage with venture capitalists and what to anticipate from each funding round.

1. Pre-Seed Stage

This is the stage where entrepreneurs develop their ideas and build prototypes. Funding usually comes from the founders themselves, as well as friends, family, and possibly early-stage funds or micro VCs.

2. Seed Stage

At this stage, the company has some experience and can demonstrate potential. The funds raised are typically used for market research, business plan development, setting up a management team, and product development. The goal is to secure enough funding to prove to future investors that the company has the capacity to grow and scale.

3. Series A

This is typically the first round of venture capital financing. At this stage, the company usually completes its business plan and has a pitch deck emphasizing product-market fit. The company is honing the product and establishing a customer base, ramping up marketing and advertising, and can demonstrate consistent revenue flow.

4. Series B

At this stage, the company is ready to scale. This venture capital stage supports actual product manufacturing, marketing, and sales operations. To expand, the company will likely need a much larger capital investment than earlier ones.

5. Series C And Beyond (Expansion Stage)

When a company reaches the Series C funding stage, it’s on a growth path. The company has achieved success, and incremental funding will help it build new products, reach new markets, and even acquire other startups.

6. Mezzanine Financing

This is a hybrid of debt and equity financing that is typically used to fund the expansion of existing companies. It is often used as a bridge between the venture capital stages and an IPO.

These stages represent the conventional progression, but the actual process can vary greatly. Some startups may skip some stages or proceed through these stages at different rates based on their individual circumstances, industry trends, and market conditions.

Valuation Methods In VC

Determining the value of a startup is a critical aspect of venture capital investing. Unlike established companies with steady revenue streams and assets, startups often lack the traditional metrics used in business valuation.

Therefore, venture capitalists rely on a mix of quantitative and qualitative methods to estimate a startup’s worth. This valuation directly impacts the capital a VC firm will invest and the stake it will receive in the startup.

In this section, we will look into several methods used for valuing startups in the venture capital world, including the venture capital method, comparables method, and discounted cash flow method.

1. First Chicago Technique

The First Chicago technique establishes a company’s valuation based on the anticipated cash flows of the early-stage startup. It takes into consideration the profits that could be gained from investments.

In essence, the First Chicago technique employs a discounted cash flow model. It creates three financial forecasts: an optimistic scenario, a neutral scenario, and a pessimistic scenario.

The startup’s value is then deduced by discounting the net present value of the cash flows for each scenario.

This technique is particularly effective when assessing the value of a startup with a promising future or a vast potential market. It has been adopted by several successful startups, such as Airbnb, Uber, and Pinterest.

2. Rating Card Technique

The Rating Card technique calculates the worth of a pre-revenue startup by comparing it with other businesses in the same geographic area and industry to arrive at a value estimation.

For example, if a similar startup was recently evaluated at $5 million, then the current startup should be valued similarly. Adjustments to this value are then made based on various factors like capital, competition, size, the product or technology, sales and marketing strategies, and the management team, among others.

This technique is typically applied when a startup lacks sufficient data or has few established precedents in the industry.

3. Berkus Technique

The Berkus technique determines a startup’s value through a straightforward estimation process. This is achieved by envisioning the startup generating $20 million in revenue by its fifth year.

An amount of up to $500,000 is assigned to five separate company elements such as its concept, the Minimum Viable Product (MVP), quality management, business connections, and a launch strategy.

This means that the maximum valuation that can be achieved using this method is $2.5 million. The Berkus technique is beneficial for estimating a startup’s value, particularly for tech startups. However, since this method does not consider the market, the valuation may not offer the desired level of precision.

4. Venture Capital Technique

The Venture Capital technique is a vital method for evaluating pre-revenue startups. This is done by forecasting the startup’s revenue for the next five years. This method involves many assumptions, and the formula for the calculation is:

Exit Value / Anticipated Return on Investment = Post-Money Valuation

and

Post-Money Valuation – Investment Amount = Pre-Money Valuation

For instance, if an investor agrees on a value of $10M and expects a 10x return on investment, the post-money valuation would be $10M divided by 10, i.e., $1M.

If an investor contributes $2.5M for a 25% equity stake, the pre-money valuation would then be $7.5M.

5. Risk Factor Summation Technique

The Risk Factor Summation Technique merges elements from both the Rating Card Technique and the Berkus Technique, leading to a more comprehensive valuation that focuses on the investment risks involved.

This method analyzes a total of 12 risk factors, which either increase or decrease the monetary value on a scale from very low risk to very high risk.

For instance, scores of -2 and -1 are considered very high risk, resulting in a reduction of $500,000 and $250,000 respectively.

On the other hand, scores of +1 and +2 are seen as very low risk, leading to an increase of $250,000 and $500,000 respectively.

A score of 0 is considered neutral, implying no increase or decrease.

This method’s main risk factors include the stage of the business, funding, technology, sales and marketing, management, competition, reputation, global risk, legislation, potential exit strategy, and possible litigation.

Exit Strategies

In the venture capital world, an ‘exit’ refers to how a venture capitalist realizes a return on their investment in a startup. The choice of exit strategy is guided by various factors, such as the startup’s performance, market conditions, and the VC firm’s investment timeline.

Here, we will explore the key types of exit strategies that venture capitalists typically consider Initial Public Offerings (IPOs), acquisitions, secondary sales, and buybacks.

1. Initial Public Offering (IPO): An IPO is when a company becomes publicly traded on a stock exchange. This process involves selling a significant portion of the company’s equity to public investors. IPOs can generate substantial returns for venture capitalists and provide startups with access to a large pool of capital.

A good example is HubSpot, with a remarkable IPO in 2014 when they announced its pricing on Oct. 8, 2014, with shares initially priced at $25 each, well above the initial low-end proposed range of $19.

This enthusiastic reception from the market drove the company’s shares up over 20%, setting its market capitalization at just over $900 million. The company managed to raise $125 million from its IPO.

However, going public also comes with significant costs, including underwriting and legal fees, increased reporting requirements, and greater scrutiny from investors and the public.

2. Acquisition: In an acquisition, a larger company purchases the startup. This can be an attractive exit strategy as it often offers a quicker and more predictable return than an IPO. The acquiring company may be interested in the startup’s technology, talent (an “acquihire”), or market share.

However, the success of an acquisition as an exit strategy can depend on the synergies between the acquiring company and the startup and the willingness of the startup’s team to work within the larger organization.

3. Secondary Sales: A secondary sale is when the venture capitalist sells their stake in the startup to another private investor or investment firm. This allows the VC to realize a return without the company needing to go public or be acquired.

Secondary sales can provide a useful exit route if the VC’s investment horizon is shorter than the startup’s time to reach an IPO or acquisition. However, finding a buyer and agreeing on a price can be challenging, especially if the startup’s performance is uncertain.

4. Buybacks: In a buyback, the startup repurchases the VC’s shares. This can be an attractive option if the startup has sufficient cash reserves and wants to retain greater control over its equity. However, a buyback often offers a lower return than an IPO or acquisition, and not all startups have the financial capacity to repurchase shares.

5. Dividend Exit Strategy: The Dividend Exit Strategy is another technique that is often overlooked in the venture capital realm but can be a viable method. This strategy operates based on generating routine income through dividends rather than relying on a liquidity event such as a sale or an Initial Public Offering (IPO).

In this approach, the investor may influence the startup to issue dividends from its net profits as a way to return the capital. This strategy is commonly used in cases where the startup is able to generate steady and substantial profits, but the chances of a successful exit through acquisition or IPO are slim.

However, it’s worth noting that this method is less common in high-growth potential startups, primarily because such businesses tend to reinvest their profits to fuel further growth instead of distributing them as dividends. Yet, in stable, mature, and cash-flow-positive businesses, this can be an effective exit strategy.

Thus, while venture capitalists typically aim for exits by selling their equity stakes at elevated prices, the Dividend Exit Strategy offers an alternative that can be particularly effective under the right circumstances.

Each exit strategy comes with its own pros and cons and implications for both the startup and the venture capitalist. A well-executed exit strategy can result in substantial returns for the VC firm, while a poorly chosen or executed exit could diminish the returns or even result in a loss.

For entrepreneurs, understanding these exit strategies can help them align their goals with those of their investors and potentially influence the trajectory of their startup.

How To Seek VC Funding For Your Startup

Venture capital funding can propel a startup to new heights, offering the financial support needed to develop products, hire talent, enter new markets, and scale operations.

However, securing VC funding is no easy feat; it requires a strong business proposition, strategic preparation, and the ability to effectively pitch your startup to potential investors.

In this section, we’ll explore the process of seeking venture capital funding, from initial preparation to identifying and approaching potential investors to successfully navigating the negotiation and due diligence processes.

1. Initial Preparation:

- Develop a Solid Business Plan: Your business plan should clearly outline your business model, product or service, target market, competitive landscape, growth strategy, and financial projections. This document serves as the roadmap for your business and the first point of reference for investors.

- Build a Strong Team: Venture capitalists often invest in people as much as ideas. A dedicated, skilled, and cohesive team is a valuable asset when seeking VC funding.

- Prepare a Pitch Deck: A pitch deck is a brief presentation that gives investors an overview of your business. It should be concise and engaging and cover key aspects of your business, such as the problem you’re solving, your solution, business model, market size, competitive advantage, and financial projections.

2. Identify Potential Investors:

- Research: Look for VC firms that have experience in your industry, invest in your startup’s stage, and whose investment thesis aligns with your business. Consider factors like the firm’s reputation, past investments, and the value they can add beyond just funding.

- Networking: Leverage your network and industry events to get introductions to potential investors. Warm introductions through mutual connections often yield better results than cold outreach.

3. Approaching Investors And Pitching:

- Initial Contact: Reach out to the investors you’ve identified, ideally through a warm introduction. Share your pitch deck and business plan, and express your interest in exploring potential funding opportunities.

- The Pitch: If investors show interest, you’ll be invited to pitch your startup. This is your chance to tell your story, demonstrate your passion, and convince the investors of your startup’s potential. Be prepared to answer tough questions and receive feedback.

4. Negotiation And Due Diligence:

- Term Sheet Negotiation: If your pitch is successful, you’ll receive a term sheet outlining the terms of the proposed investment. These terms can include the valuation of your startup, the amount of investment, the equity stake the VC firm will get, voting rights, and other conditions. It’s often beneficial to get legal counsel to help

- Due Diligence: Upon agreement on the term sheet, the VC firm will navigate this process. conduct a detailed examination of your startup’s financials, operations, and legal compliance. They do this to validate the information you’ve provided and identify any potential risks. It’s crucial to be transparent and cooperative during this process.

5. Closing The Deal:

- Final Agreement: If the due diligence process is successful, the final investment agreement is drafted. This includes all the terms of the investment and is legally binding.

- Funds Transfer: Once all parties sign the agreement, the VC firm transfers the funds to your startup. After this, the venture capitalist often sits on your board, and you can begin using the funding to grow your business.

The journey to securing VC funding can be challenging and time-consuming, but it can also be a transformative process that helps clarify your business vision, refine your strategies, and lay the groundwork for rapid growth.

Armed with an understanding of how VC funding works, and with careful preparation and persistence, you can increase your chances of securing the funding your startup needs to thrive.

It helps to remember that each VC firm has its own processes and timelines, so patience, perseverance, and flexibility are key to successfully navigating the venture capital funding process.

Importance And Impact Of VC On Startup Ecosystems

Understanding the significant role of venture capital not only provides insights into the workings of the startup landscape but also underlines the importance of building strong relationships between entrepreneurs and investors.

As startups innovate and grow, fostered by the supportive framework of venture capital, they contribute to a cycle of entrepreneurship that drives forward the global economy, encouraging continuous innovation, and stimulating robust, sustainable development.

1. Fueling Startup Growth: Startups often operate in emerging markets with high growth potential and significant risk. Traditional financial institutions may be reluctant to lend to these businesses due to their lack of operating history and collateral.

Venture Capital provides these startups with the necessary capital to develop their products, hire talent, and scale their operations. In return, VCs get equity in the company, betting on the startup’s future success.

2. Supporting Innovation: VC investors are often attracted to disruptive ideas and technologies. The venture capital industry has been instrumental in turning innovative ideas into world-changing businesses. They provide funding to innovators aiming to create new markets or disrupt existing ones.

This financial support is crucial in fostering innovation, driving technological advancements, and shaping the future of various industries. Some of the most well-known companies today, like Apple and Amazon, started with investments from venture capital funds.

3. Creating Jobs: As startups grow, they create new jobs, contributing to employment and economic growth. According to statistics from the national venture capital association (NVCA), employment at U.S. VC-backed companies grew 960% from 1990 to 2020, 8 times more than non-VC-backed companies.

4. Spurring Economic Growth: Successful VC investments can lead to high-return exits, such as Initial Public Offerings (IPOs) or acquisitions, which can generate wealth and stimulate further economic activity.

Moreover, VC firms are highly concentrated in regions where VC investments have been successful before, contributing to developing vibrant innovation hubs and attracting other businesses and services to the area.

5. Facilitating Knowledge Transfer: Venture capitalists often provide more than just financial support. They can offer strategic advice, industry connections, and access to further financing. This mentorship and networking can help startups overcome hurdles, improve their strategies, and accelerate their growth.

6. Promoting Entrepreneurship: By offering a potential source of substantial funding, venture capital can encourage entrepreneurship. Knowing that capital is available, more people might be willing to risk starting a business, leading to a more vibrant and diverse startup ecosystem.

The impact of venture capital on the startup ecosystem is profound, shaping not just the fortunes of individual businesses, but also the broader landscape of innovation and economic activity.

Cons Of Venture Capital For Startups

Venture capital can offer many benefits to startups, but it’s not without its drawbacks. As a startup founder, understanding these potential pitfalls can help you make informed decisions about whether or not to seek venture capital. Here are some of the cons associated with venture capital:

1. Loss of Control: Venture capitalists buy equity in your company, which means they also get a say in major decisions. Depending on the terms of the investment, you may have to give up a significant degree of control over your business.

In some cases, VCs may have the right to appoint board members and make key decisions, which might not align with the founder’s vision for the business.

2. Pressure for High Growth and Quick Returns: VCs seek high returns on their investments, usually via an exit like an IPO or a company sale. This can lead to a high-pressure environment, where the focus is on rapid growth and quick returns, often at the expense of other aspects of the business.

This kind of pressure can lead to decisions that prioritize short-term gains over long-term stability and sustainability.

3. Dilution of Equity: Securing venture capital funding usually means giving up a portion of your company’s equity. This can result in a dilution of the founder’s shares, and if you go through several funding rounds, you may end up with a much smaller stake in the company than you started with.

In many cases, if the company has recently hired new staff, a new lead investor might insist on setting aside additional equity to expand the option pool, further diluting the stakes of the founders and the Series Seed investors.

4. Risk of Losing Everything: If things don’t go as planned, and the company fails, the investors typically have the right to recoup their investments before any remaining assets are distributed to others. This could potentially leave the founders and employees with nothing.

5. Limited or No Profit Sharing: As the focus of venture-backed startups is often growth rather than profitability, the profits, if any, are typically reinvested back into the business rather than being distributed to the shareholders. This means that as a founder, you may not see any monetary returns unless the company is sold or goes public.

6. Potential Strain on Founder-VC Relationships: Relationships between founders and VCs can sometimes be strained due to differing visions for the company, disagreements on strategy, or other factors. This could create a difficult working environment and potentially hinder the company’s progress.

While these cons paint a cautionary picture, it’s essential to remember that not all venture capital relationships result in these scenarios. The key lies in thoroughly understanding the terms of the investment, aligning expectations, and building transparent relationships with your investors.

Conclusion

In the thrilling but demanding world of startups, venture capital can be a key lifeline, fueling your idea from a dream into reality. It’s not just money—it’s a partnership, expert guidance, and a pathway to exponential growth. But it also involves sacrifice, like sharing control and profits.

Before diving in, weigh the potential gain against the stakes. If the scale tilts towards growth and your vision aligns with that of a potential investor, venture capital could be the launchpad that propels your startup into the stratosphere of success. Remember, knowledge is your most valuable asset.