While a term sheet is pretty much non-legally binding, make no mistake about it; this might be the most important document you sign as a business owner – or at least one of them – and you need to get it right.

Get any aspect of this wrong, and the implications could be quite severe further down the line. If that isn’t enough pressure on your shoulders, let me remind you of something: This is probably your first term sheet, while your backers might have done hundreds already. In short, they are a dab hand at this, and you are not.

Despite those rather harsh words, do not fear! This is definitely not an intimidating process and is easy enough to create, provided you exercise caution and diligence and follow a few basic procedures and principles.

Through this article, we aim to hold your hand through those procedures and generally ensure all of your ducks are in a row for this pretty key document.

What Is A Term Sheet?

A term sheet, also known as a memorandum of understanding (MoU), is a non-binding agreement outlining an investment’s fundamental terms and conditions. The term sheet is a basic template and framework for creating more elaborate, legally enforceable contracts.

When the parties agree on the terms outlined in the term sheet and follow due diligence, a legally binding agreement or arrangement is drafted, such as SPA (Share Purchase Agreement) and IRA (Investor Rights Agreement).

The agreements adhere to the terms outlined in the term sheet. Term sheets mainly include financing, corporate governance, and liquidation.

The most important aspects of the term sheet are:

- The amount of money the investor will provide

- The valuation of the company

- The percentage of equity the investor will receive

- The liquidation preferences

It’s a simple enough concept, really. The term sheet is basically a jumping-off point for outlining the parameters of an investment in your startup. Got it? With that understood, let’s move forward with our six tips and outsmart those VCs.

Disclaimer: The information on this website is not meant to be legal or professional advice, and the readers should consult with their lawyer for any legal matter. All of this site’s information, content, and resources are just for informational purposes.

1. Understand Startup Valuation & Dilution

While negotiating with a lead investor, understanding your company’s valuation and dilution is arguably one of the most crucial, albeit non-legal, factors to remember.

Before you finalize the term sheet details, determine how the option pool will affect the fully diluted pre-money valuation. Always consider valuation in relation to the specific investor. A lower valuation by an excellent investor may be preferable to a greater valuation by a poor investor.

Be aware that a high valuation may not necessarily result in the greatest possible outcomes for your startup. Try and keep a forward-thinking mindset while creating the term sheet – imagine how the valuation will affect your future business.

For many startups, stock plans are the most effective method for retaining top talent; devaluing or diluting them can discourage and have a negative effect on employees.

2. Liquidation Preference

Make sure to calculate the estimated exit values to understand the actual dollar differences across liquidation preference calculations. Remember that the terms of one fundraising round frequently continue to the next round and beyond, so be cautious about what you agree to here, even if it sounds relatively harmless.

In an ideal situation, startups should ask for a non-participating liquidation preference. This means that, in the case of a liquidation, more liquidation funds are allocated to the investor and less to the common stockholders. Investors, on the other hand, desire the exact opposite.

3. Examine The Protective Provisions

Venture investors often have a set of “protective provisions” (usually known as “veto rights”) over particular corporate acts. Some of them are less controversial than others, especially in the early phases of a startup’s growth and funding, such as veto rights on future financings or the company’s exit (liquidation).

As the term sheets often include pitfalls for the unwary, it is prudent to study them carefully and discuss them with your attorney or other counsel. A veto right on future financings is one example.

4. Get Assistance From A Lawyer

When engaging in term sheet negotiations with a venture capitalist, remember that you are negotiating a contract. Typically, when focused on startup development and commercial strategy, founders lack adequate time to understand the legal provisions and conditions of the term sheet.

Consider seeking the assistance of legal and financial specialists to walk you through the negotiation process. It will also ensure you are completely informed when assessing a term sheet.

Apart from getting assistance from corporate lawyers, you can also look for dedicated Facebook groups to get assistance from experienced colleagues. Some of the law firms and Facebook groups are mentioned below:

Law Firms/ Legal Advisors

Dedicated Facebook Groups

- Entrepreneurs Only

- Entrepreneurs and Start-Ups

- Entrepreneurs Worldwide

- Millionaire Mindset | Entrepreneurs Club

- Women Helping Women Entrepreneurs

5. Antidilution Protection

Nearly all U.S. VC agreements include anti-dilution protection against the future exit of a down round.

Variations in anti-dilution protection types determine the degree to which the VC is protected. Proceed further if it is “broad-based anti-dilution protection.” If you encounter the term “full ratchet,” talk to your lawyer.

6. Look At Your Leverage

In any negotiation, you must evaluate your leverage. Getting the attention of several venture capitalists can assist you in securing the best term sheet from your selected investor.

Although you should avoid pressuring long-term partners for every last dollar, leverage your options to battle for conditions that are vital to your startup. Once the agreement has been signed, rejected alternatives will have little weight, and you will need to find leverage elsewhere.

Important Terms Every Startup Founder Needs To Know

You are not alone – most new founders will encounter unfamiliar, sometimes confusing terminology in even the most basic of term sheets. Here are some of the more common terms and phrases, along with a brief explanation.

Valuation

You presumably already know your company’s valuation, especially if you’ve reached the point where you need investors. Still, you may encounter the terms pre-money valuation and post-money valuation mentioned in a startup term sheet.

The pre-money valuation is the startup’s worth before receiving the new investment amount. The post-money valuation is the startup’s value after receiving the investment dollars.

The valuation is one of the most essential terms sheet components. Depending on your startup’s valuation, venture investors may receive preferred stock equal to 10% to 35% of your startup’s shares.

Option Pools

A stock option pool is an allotment of shares held for current or future employees (ESOP – Employee Stock Option Plan). On a term sheet, you might need to create an option pool or add the existing one. It will have a direct impact on how shareholders will be diluted when more shares are issued.

Investors will typically ask to adjust the option pool percentage before their investment to avoid getting diluted immediately.

Right Of First Refusal (ROFR)

A right of first refusal gives the startup’s current investors the option to participate in future funding rounds. For example, if you receive an offer from another venture capitalist for a Series B investment round, your current Series A investors have the first opportunity to match that offer.

If you do not want your current investors to have this privilege, you may want to negotiate for a full or partial waiver of the right of first refusal.

Rights Of Co-Sale

A right of co-sale gives investors the ability to participate in future sales of shares by the founders or other shareholders. For example, if one of the startup’s founders wants to sell his or her shares, the investor has the right to sell a proportionate number of shares simultaneously and under the same conditions.

This clause is included in a term sheet to protect the investor’s interests and to prevent founders from selling their shares without allowing the investor to do so as well.

Typically, co-sale rights are coupled with the right of first refusal. Co-sale rights will presume that ROFR has not been exercised and will only take effect after ROFR has been waived.

Veto Rights

Veto rights allow investors to block certain decisions made by the startup’s board of directors. For example, an investor may have veto rights over the sale of the company or the issuance of new shares.

While veto rights are often seen as a negative for founders, they can also be used to protect the interests of all shareholders. For example, if most shareholders want to sell the company but a minority do not, the veto rights could be used to block the sale.

Veto rights are typically granted to investors in a term sheet to protect their interests in the company. They may be granted on certain major decisions, such as the sale of the company, the issuance of new shares, or the incurrence of debt.

Liquidation Preferences

A liquidation preference gives investors the right to be paid first in the event of a sale or liquidation of the company.

There are a few sub-terms you need to familiarize yourself with:

The Multiple

A 1x liquidation preference means investors will get their money back before anyone else gets paid. A 2x liquidation preference means that investors will get twice their investment back before anyone else gets paid, and so on.

Participating Vs. Non-Participating

There are two additional terms that determine the outcome of a liquidation, “participating” and “non-participating.” A participating liquidation preference means investors will participate in the sale pro rata with the other shareholders.

For example, let’s assume you got $10 million from investors for 25% of the company. So if there’s a 2x participating liquidation preference and the company is sold for $100 million, the investors will get $20 million back first, and then they will participate pro rata in the remaining $80 million (i.e. they will receive an additional $20 million, and total compensation of $40 million).

A non-participating term means that investors will have 2 options: (1) get their money back first and will not participate in the sale pro rata with the other shareholders, or (2) waive their liquidation preference and get their share of the total sale based on a pro-rata calculation.

So if there’s a 2x liquidation preference and the company is sold for $100 million, the investors can get either $20 million back or 25% of the total sale amount, which is $25 million. They will obviously choose the latter option.

Capped Vs. Un-Capped

A “capped” liquidation preference means that investors will get their money back up to a certain amount and then participate pro rata with the other shareholders. So if there’s a 2x participating liquidation preference up to 3x cap and the company is sold for $100 million, the liquidation preference is capped at $30 million as total compensation for the investors.

An “un-capped” liquidation preference means that investors will get their money back first and participate pro rata in the remaining amount without any limitation (which is bad for founders).

Full Ratchet

A full ratchet is an anti-dilution provision that adjusts the option price or conversion ratio for current investors based on the lowest selling price. It safeguards early investors by compensating them for any ownership dilution caused by subsequent fundraising rounds.

Full ratchet provisions can be expensive for founders and can hinder efforts to acquire capital in subsequent fundraising rounds.

To understand, consider a company that sells 1 million convertible preferred shares at $1 per share with a full ratchet provision. The company then sells 1 million common shares at $0.50 each in a second financing round.

Due to the complete ratchet provision, the corporation would have to reduce the preferred shareholders’ conversion price to $0.50. This implies preferred shareholders would require fresh shares (at no additional expense) to guarantee their overall ownership isn’t lowered by the sale of new common shares.

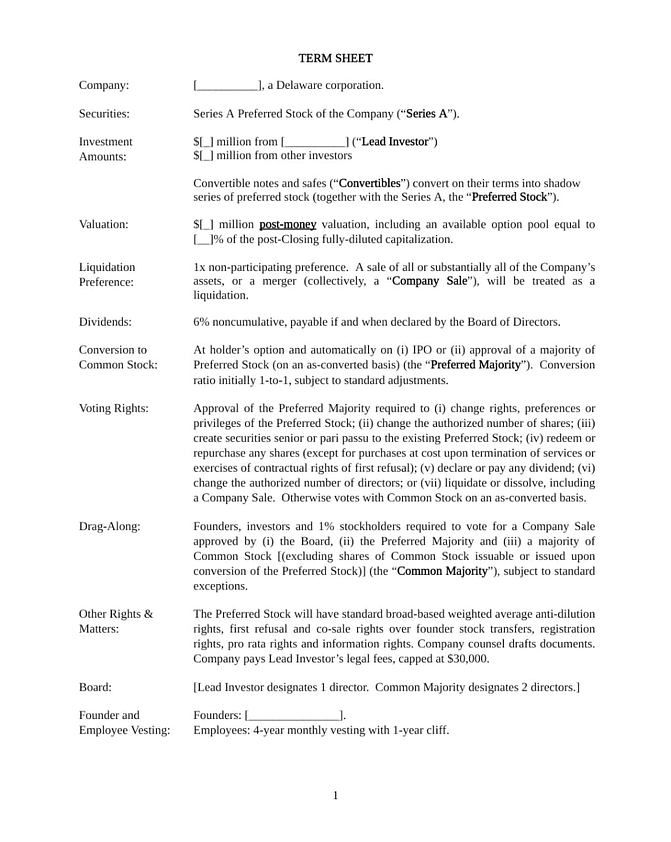

VC Term Sheet Example

Here is an excellent one-page example term sheet template from Y Combinator, focusing on Series A, that any founder can use. The Y Combinator Term Sheet template is an excellent starting point for familiarizing yourself with the subject. However, your actual term sheet may differ in appearance.

Best Term Sheet Templates To Download

Term sheets are essential to every fundraising event. Hundreds of templates and samples were created by investors, entrepreneurs, and attorneys who have been in your position before. Check out the following notable templates:

- Term Sheet Template By NVCA: The Enhanced Model Term Sheet enables investors to design term sheets while benchmarking terms to market standards. Version 2.0 is supported by a database containing over 1,000,000 venture transactions. It represents over 40,000 investors with over $1 trillion in assets under administration.

- Term Sheet Template By Ben Milne: Ben Milne, Dwolla’s founder, has spent a considerable amount of time deciphering term sheets. Ben created a one-page term sheet template in order to provide assistance to both startup founders and investors. The template includes all the key terms like liquidation preference, dividends, voting rights, and closing conditions.

- Term Sheet Template By CFI: CFI’s term sheet template is the all-inclusive template for the legal counsel term sheets. The sample comprises the term sheet’s basic terms like preferential liquidation rights, conversion rights, anti-dilution, and voting rights.

- VC Term Sheet Template By REVV: The venture capital term sheet template by REVV is comprehensively detailed, including all the significant aspects of the investment agreement. It includes valuation, stock options and vesting, drag-along rights, and a no-shop clause.

Wrap Up

To the uninitiated, a term sheet can seem a little daunting, but there is nothing to fear. Consider it as your ally – a precursor to great things. Be careful and patient, brush up on some of the terminologies, do your diligence, and all will be fine.

We hope this article helped you with the basic facets of a standard term sheet. We would advise, however, to seek assistance from a lawyer to double down and ensure you and your company are protected and in a great position to move forward.

As always – good luck!