Picture this: You’re a first-time founder who just closed your seed round. Champagne bottles are popped, congratulations are flowing in, and your team is ready to change the world. Six months later, you’re sitting across from an investor who asks a simple question: “Where exactly did that first $100,000 go?” You freeze.

A lot of startups realize far too late that proper bookkeeping isn’t just about compliance or keeping the IRS happy—It’s the foundation that determines whether your startup survives its first year or becomes another cautionary tale. That’s why we are going to discuss the importance of bookkeeping for startups and how to go about it.

What is Bookkeeping?

Bookkeeping is the systematic recording of your company’s financial transactions. It’s the daily work of documenting every dollar that comes in and goes out of your business— from recording sales and revenue to tracking business expenses and purchases.

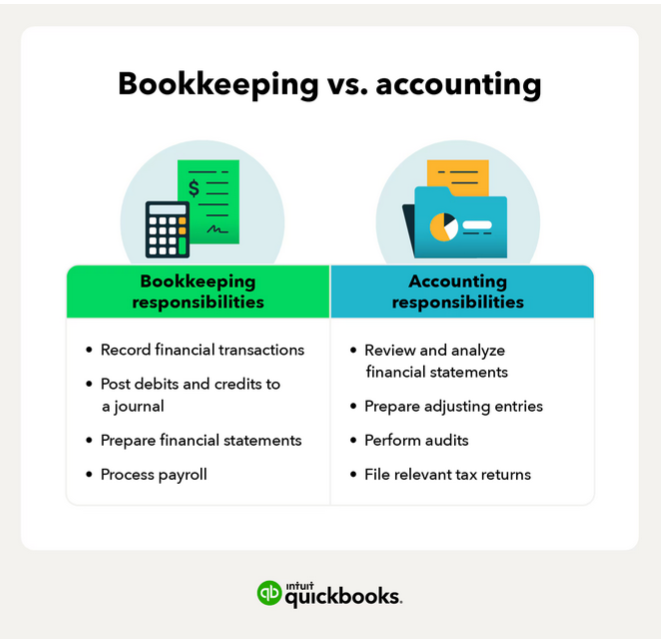

Many founders confuse bookkeeping with accounting, but they’re distinct functions that serve different purposes. Bookkeeping is the data entry and organization layer. It’s about accurately recording what happened financially in your business. Accounting, on the other hand, is the analysis and interpretation layer. Accountants take the clean data your bookkeeper provides and use it to prepare financial statements, file taxes, provide strategic financial advice, and help with financial planning and forecasting.

Think of it this way: bookkeeping tells you what happened, while accounting tells you what it means and what you should do about it.

Why Startups Need Good Bookkeeping

Good bookkeeping isn’t optional for startups; it’s fundamental to survival and growth. Let’s explore the ‘why?’

Why Bookkeeping Matters

1. Maintaining Cash Flow Visibility

Cash is oxygen for startups. Unlike established businesses with predictable revenue streams, startups often operate with limited runway and irregular income. Without clear bookkeeping, you’re flying blind. You might think you have three months of runway when you actually have six weeks, or worse, you might be spending money you don’t have because you haven’t accounted for upcoming expenses.

Good bookkeeping gives you real-time visibility into your burn rate, helps you forecast when you’ll need additional funding, and allows you to make strategic decisions about when to hire, when to invest in growth, and when to conserve cash.

2. Tax Compliance and Preparation

The IRS doesn’t care that you were busy disrupting an industry. Come tax time, you need accurate records of all income and deductible expenses.

Poor bookkeeping can cost you in two ways: You’ll overpay taxes because you can’t document legitimate deductions, or you’ll underpay and face penalties, interest, and potential audits. Startups have unique tax savings and considerations (ranging from R&D credits to stock option accounting), and these require proper record-keeping to make the most of.

3. Attracting Investors and Securing Funding

When investors consider funding your startup, they conduct financial due diligence. They want to see clean, organized books that demonstrate you’re a responsible steward of capital. Messy financials send a clear message: if you can’t manage your books, how can you manage their investment?

Investors ask fewer questions and move faster when they can clearly see where money has gone and how efficiently you’ve deployed capital.

4. Making Informed Business Decisions

Should you hire that new developer or invest in marketing? Is your current pricing sustainable? Which customer segments are actually profitable? These questions can’t be answered with gut feeling alone.

Accurate bookkeeping provides the data you need to make evidence-based decisions. It helps you identify your most and least profitable products or services, understand true customer acquisition costs, spot trends before they become problems, and allocate resources strategically rather than reactively.

5. Avoiding Costly Errors and Penalties

Mistakes in bookkeeping compound over time. A small error in month one becomes a major discrepancy by month twelve. The costs go beyond just time spent fixing errors. Apart from the possibility of penalties for late tax filings and interest on unpaid taxes you didn’t know you owed, there’s also the risk of legal issues from misreported financials to investors or lenders, damaged relationships with vendors due to lost or incorrect payments, and the opportunity cost of the time spent fixing preventable problems.

When Founders Should Handle Bookkeeping Themselves

In the earliest stages of your startup, doing your own bookkeeping can actually be valuable. When you’re pre-revenue or generating minimal income, have a simple business model with straightforward transactions, are extremely cash-constrained and need to preserve every dollar, and want to develop an intimate understanding of your financial operations, it makes sense to handle it yourself.

There are genuine benefits to founder-led bookkeeping in these early days. You’ll gain financial literacy that serves you throughout your entrepreneurial journey, maintain complete control and visibility over every transaction, develop a gut feel for your burn rate and unit economics, and save cash that can be deployed toward product development or customer acquisition. Some of the most successful founders, like Ben Chestnut, credit their early bookkeeping experience with giving them financial intuition that later informed critical strategic decisions.

When It’s Time to Hire Professional Help

The DIY approach has a shelf life, and recognizing when you need to know when you’ve outgrown it.

As a rule of thumb, you should consider bringing in professional help when you realize that your time is better spent on activities that actually grow the business.

In terms of complexity, you should consider hiring professional help once you start having requirements like investors asking for regular financial reports, hired employees on payroll, multiple revenue streams, or complex transactions, making errors, or falling behind on reconciliation, etc.

The Consequences of Getting the Timing Wrong

The timing of transitioning from DIY bookkeeping to professional outsourcing is an important decision for founders, as it is also a time-sensitive decision. Mistiming it may carry significant costs.

DIY-ing for too long, for example, may lead to a plethora of problems, like missed tax deductions, inability to produce accurate reports for investors, or, even costlier, a high opportunity cost as founders trade high-value strategic work for low-value administrative tasks.

This also goes for premature outsourcing, as that could deprive founders of the invaluable, hands-on experience of building financial intuition by understanding their early finances at a granular level, or the extra cost that level of expertise incurs when it is not yet needed. The sweet spot involves starting with DIY using good software, then transitioning to professional help once the transaction volume or complexity justifies the cost.

Types of Bookkeeping Services Available

Once you’ve decided it’s time to get professional help, you’ll find several options available, each suited to different startup stages and needs.

1. Freelance Bookkeepers

Freelance bookkeepers are independent professionals who typically work with multiple small business clients. They operate on their own, often working remotely, and usually charge by the hour or offer monthly packages based on transaction volume.

A freelance bookkeeper will typically log into your accounting software remotely, process transactions on a weekly or monthly basis, reconcile your accounts, and provide you with basic financial reports. Most freelancers have expertise in specific accounting software platforms like QuickBooks Online or Xero.

Best For: Freelance bookkeepers are ideal for early-stage startups that have outgrown DIY bookkeeping but don’t yet have the volume or complexity to justify a full bookkeeping firm. They’re perfect when you have 50-200 monthly transactions, need someone who can be flexible with hours and availability, want a personal relationship with your bookkeeper who understands your specific business, and are looking for cost-effective solutions in the $300-800 per month range.

The main advantage is the personal touch and flexibility. You’ll work directly with the same person who gets to know your business intimately. The downside is that you’re dependent on a single individual, so if they get sick, go on vacation, or quit, you’re left scrambling. There’s also typically no backup support or second set of eyes reviewing their work for errors.

2. Bookkeeping Firms

Bookkeeping firms are established companies that employ multiple bookkeepers and often serve dozens or hundreds of clients. They provide more structured, systematic services with built-in redundancy.

When you hire a bookkeeping firm, you’re typically assigned a primary bookkeeper, but their work is reviewed by senior staff or managers. The firm uses standardized processes and quality control measures. They often have dedicated teams for different functions like accounts payable, accounts receivable, and reconciliation.

Best For: Bookkeeping firms make sense for startups that are scaling and need reliability and consistency, have 200-1,000+ monthly transactions, and require multiple services like invoicing, bill pay, and financial reporting. You also get the plan B of backup support, so work continues even if your primary bookkeeper is unavailable, or if you want more sophisticated reporting and financial analysis.

3. Virtual/Online Bookkeeping Services

Virtual bookkeeping services are technology-forward companies that combine software automation with human bookkeepers. Think Bench, Pilot, or inDinero. These services have emerged specifically to serve startups and small businesses.

You connect your bank accounts, credit cards, and other financial accounts to their platform. Their software automatically imports and categorizes transactions using machine learning and AI. Human bookkeepers then review and correct the automated work, ensuring accuracy. You access your financial information through their dashboard, which provides real-time reports and insights. Communication typically happens through the platform, with support available via chat or email.

Best For: Virtual services are excellent for tech-savvy startups that are comfortable with app-based solutions, want the efficiency of automation combined with human oversight, need scalable pricing that grows with transaction volume, value real-time access to financial dashboards and reports, and appreciate integration with other startup tools.

4. Full-Service Accounting Firms

Full-service accounting firms offer comprehensive financial services that go beyond basic bookkeeping to include tax preparation, tax planning, CFO services, financial forecasting, and strategic advisory. Think Startup Geek.

These firms assign you a team that typically includes a bookkeeper for day-to-day transaction recording, a staff accountant for monthly close and financial statements, a CPA for tax preparation and planning, and potentially a fractional CFO for strategic guidance. They often work on a retainer basis and become deeply embedded in your financial operations.

Best For: Full-service firms are appropriate for well-funded startups that have raised Series A or beyond, have complex financial situations involving multiple entities, investors, or international operations, need comprehensive tax planning strategies to optimize their tax position, require CFO-level strategic financial guidance, and are preparing for potential exit events.

The advantage is having a complete financial team without the cost of hiring full-time employees. You get proactive tax planning that can save significant money, strategic guidance on fundraising, financial modeling, and business decisions, and a team that scales with you and can handle increasingly complex needs. The downside is the high cost, which may not be justified until your startup reaches a certain scale and complexity level.

What to Look for in a Bookkeeping Service

Here are things to consider when choosing the right bookkeeping service:

1. Industry Experience with Startups

Startup accounting has unique quirks that general small business bookkeepers may not understand. Look for services with specific startup experience who understand equity and stock options, convertible notes and SAFEs, multi-currency transactions (if you operate internationally), R&D tax credits and other startup-specific tax strategies, venture capital reporting requirements, and the metrics investors care about like burn rate and runway. Ask potential bookkeepers how many startup clients they serve and request references from companies at similar stages to yours.

2. Software Compatibility

Your bookkeeping service should work with software that fits your needs. Most startups use QuickBooks Online or Xero as their core accounting platform. Ensure your bookkeeper is proficient in your chosen software or can recommend the best option for your situation.

Also consider integrations with other tools you use, such as payment processors like Stripe or PayPal, expense management tools like Expensify or Divvy, invoicing systems, payroll platforms, and banking platforms. The more seamless the integration, the less manual data entry required and the fewer opportunities for errors.

3. Pricing Models and What’s Included

Understand exactly what you’re paying for. Make sure you understand what’s included in the base price versus what costs extra. Ask about monthly reconciliation and financial statements, accounts payable and receivable management, receipt and invoice management, financial reporting and dashboard access, tax preparation (often separate), payroll processing (usually separate), and advisory or consulting time.

Get clear answers about how pricing changes as your business grows and what triggers price increases. Which takes us to the next one.

4. Scalability as Your Business Grows

Choose a service that can grow with you. Starting over with a new bookkeeper because you’ve outgrown your current one is painful and messy. It requires transitioning all your financial data, teaching a new person about your business, and often cleaning up problems that accumulated under the previous system.

Ask potential services about their largest clients, what services they can add as you scale, how they handle increasing transaction volumes, and whether they’ve successfully supported clients through fundraising, acquisitions, or IPOs if those are in your future.

Setting Up Your Bookkeeping System

1. Start by opening a dedicated business bank account and credit card separate from personal finances. This is non-negotiable and makes everything else exponentially easier.

2. Choose accounting software appropriate for your stage. Set up your chart of accounts properly from the beginning. While software comes with default categories, customize them to match your business model and the metrics you want to track.

3. Next, establish a routine for recording transactions, whether that’s daily, weekly, or monthly, depending on your volume.

4. Implement a system for capturing and organizing receipts and invoices, whether digital or physical.

5. Remember to also set up regular bank reconciliation to ensure your books match reality.

Red Flags to Avoid

Certain warning signs should make you think twice.

- If their offer sounds too enticing (like them promising they can save you tons of money on taxes through aggressive strategies), it’s probably risky to work with them.

- Run away from anyone who is vague about their qualifications, experience, or process.

- Avoid bookkeepers who are slow to respond to your initial inquiries, since communication will only get worse once you’re a client.

- Question services with no verifiable reviews, testimonials, or references.

- Be cautious if they’re unwilling to explain their process or let you talk to the actual bookkeeper who will handle your account. Likewise, if they don’t ask questions about your business, suggesting they use a one-size-fits-all approach, steer clear.

- Avoid those who want you to give them complete control without providing transparency into what they’re doing.

Conclusion

Good bookkeeping isn’t glamorous. It won’t land you on the cover of a magazine or win you startup pitch competitions. But it’s the unglamorous foundation upon which successful companies are built. It is the financial infrastructure of your business, just as important as your code base or your product roadmap. Start now. Start simple if you must, but start. Your future self—and your future investors—will thank you.