Why is a cap table management software so important? Well, one of the downsides (if you can call it that) of the rapid growth of your startup is managing your startup’s equity. Without the right cap table management software, things can get really messy, really fast. If you are already facing that dilemma or you can foresee it, then you are in the right place.

In this guide, we’ll show you the best cap table management software and the features that have landed their spots in this list. We’ll also show you the pricing and show you everything you need to know about choosing the best cap table software for your startup, on your way out.

Let’s dive in!

What is Cap Table Software?

A cap table, or capitalization table, is a document that shows a company’s equity ownership structure. It lists the types of securities (like common stock, preferred stock, or options), the number of shares each shareholder owns, and their corresponding ownership percentages.

This helps track who owns what in the company, including founders, investors, and employees with stock options. As the company grows and issues new shares or raises funding, the cap table evolves to reflect changes in ownership and dilution.

Cap table management software is a tool that simplifies creating, updating, and maintaining this information. It automates complex calculations, such as how new funding rounds or employee stock options affect ownership percentages. This software ensures accuracy, saves time, and helps companies make informed decisions about equity distribution, fundraising, and compliance.

Cap table management software helps companies efficiently track and manage their equity structure. It records changes like share issuance, option grants, and transfers, ensuring accurate and up-to-date ownership details.

This is important for compliance with securities laws and tax regulations, as well as for generating reports on ownership percentages, dilution, and vesting schedules (the process by which an individual earns the right to fully own their equity or stock options over time, typically through continued service with the company).

Why Is It Important for Startups?

- Provides transparency and eliminates disputes – Gives everyone (employees, investors, founders) clear visibility into the company’s ownership structure, voting power, and decision-making control while keeping all cap table information organized in one accessible place. This also means it is easy to share up-to-date ownership structures with potential investors.

- Simplifies equity planning – Tracks available option pools for future employee grants.

- Reduces legal costs – Automates equity agreements and share issuance, cutting down on paperwork and legal fees.

When Is the Best Time to Start Using Cap Table Management Tools?

The best time to start using cap table management tools is as early as possible, ideally when you incorporate your startup or issue your first shares.

- From the Start: Even if your cap table is simple at the beginning (e.g., just founders), using software ensures accuracy and organization from day one. This prevents errors and complications as your company grows.

- Before Issuing Equity: If you plan to grant equity to employees, advisors, or investors, having a tool in place ensures proper tracking of ownership percentages, vesting schedules, and dilution.

- Before Fundraising: Investors will want to see a clean, accurate cap table. Starting early ensures your ownership structure is well-documented and ready to share, making fundraising smoother and more professional.

- When Complexity Grows: As you add more shareholders, issue stock options, or go through funding rounds, manual tracking becomes error-prone and time-consuming. Implementing software early avoids messy corrections later.

In short, the earlier you start, the easier it is to maintain an accurate, organized cap table, saving time, reducing risks, and building trust with stakeholders.

The Best Cap Table Management Software For Startups in 2025

1. Carta

Carta, founded in 2012 by Henry Ward and Manu Kumar (originally as eShares), is a leading equity management platform designed to help companies manage electronic securities and cap tables. With over 40,000 customers, including prominent companies like Calendly, Plum, and Trustpilot, Carta is widely recognized for its robust features and expertise in the venture ecosystem. It supports more than 30,000 companies and manages over $2.2 trillion in private assets, making it a trusted choice for startups and established businesses alike.

So how has Carta achieved all this? Well, they offer a comprehensive digital cap table management system that simplifies tracking, managing, and updating equity distribution among stakeholders. These features allow companies to efficiently handle share issuance, ownership adjustments, and equity optimization during fundraising rounds.

Carta supports employee equity plans by providing customizable templates and region-specific compliance documents, making it easier to grant equity to employees through Enterprise Management Incentives (EMIs) and other plans. The recently launched Total Comp platform further enhances Carta’s offerings by providing robust compensation management tools, including benchmarks, leveling, scorecards, and rewards, to help companies effectively manage employee compensation.

Carta also offers advanced scenario modeling tools that generate detailed reports on financing rounds, exit scenarios, waterfall tiers, liquidation charts, stakeholder proceeds, and dilution impacts—essential for making informed strategic decisions. Carta’s SPV (Special Purpose Vehicle) administration feature streamlines the creation of subsidiaries to mitigate financial risk, enabling SPV deployment within 48 hours.

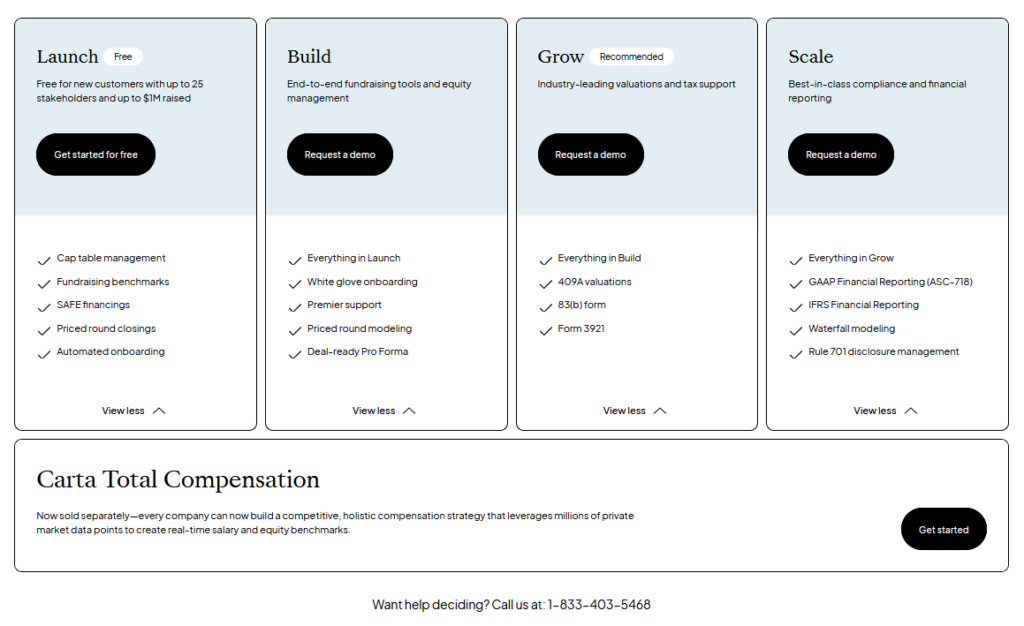

Carta offers four pricing tiers designed to scale with your company’s growth.

The Launch plan is free for startups with up to 25 stakeholders and $1M raised, providing essential tools like cap table management, fundraising benchmarks, and automated onboarding.

The Build plan adds advanced fundraising features, white-glove onboarding, and deal-ready Pro Forma modeling.

For companies needing valuations and tax support, the Grow plan includes 409A valuations, 83(b) forms, and Form 3921.

Finally, the Scale plan is ideal for larger companies, offering best-in-class compliance tools like GAAP/IFRS financial reporting, waterfall modeling, and Rule 701 disclosure management. Each tier builds on the previous one, ensuring Carta grows alongside your business.

2. Eqvista

Founded in 2018 by Tomas Milar, Eqvista is a comprehensive cap table management platform trusted by over 20,000 clients, from pre-seed startups to unicorns and SMEs. One of its major selling points is its intuitive interface that simplifies equity tracking, securities management, and financial modeling, helping businesses maintain accurate, real-time cap tables with clear visualizations.

Another comforting thing to know is that the platform supports all types of equity instruments, including stock options, employee stock option plans (ESOPs), restricted stock units and awards (RSUs and RSAs), warrants, convertible notes, and SAFEs, while enabling electronic stock issuance to eliminate paperwork.

Eqvista stands out with its powerful financial modeling capabilities, allowing companies to create detailed projections for funding rounds, dilution analysis, and exit scenarios. It also offers automated 409A valuations to ensure compliance with fair market value requirements. Startups also get a free cap table setup (worth $350), reducing initial costs. The platform allows customizable access for investors, legal teams, and shareholders, improving transparency and collaboration. Eqvista also has built-in compliance features to keep equity management aligned with the latest securities regulations.

For companies that wish to switch from another cap management tool, Eqvista also offers a quick and easy onboarding process and assists in transferring data from other platforms.

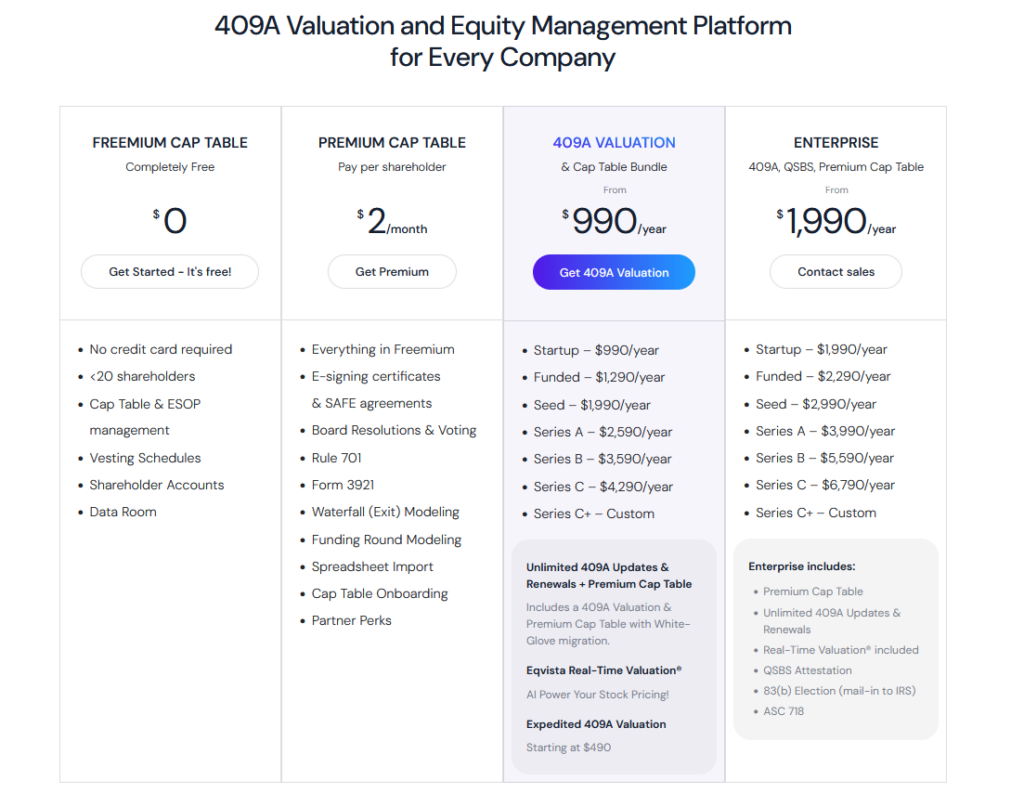

Eqvista offers flexible pricing plans designed to support companies at every growth stage.

The Freemium Plan is free forever with no credit card required and includes essential features like cap table and ESOP management, vesting schedules, shareholder accounts, and a data room for companies with fewer than 20 shareholders.

For growing teams, the Premium Plan costs just $2/month per shareholder and adds powerful tools like e-signing for stock certificates and SAFE agreements, board resolutions and voting, Rule 701 compliance, Form 3921 filings, waterfall (exit) modeling, funding round simulations, spreadsheet imports, and partner perks.

For established companies, Eqvista provides a 409A Valuation Plan with annual pricing starting at $990/year for startups and scaling up to custom pricing for Series C+ companies. These plans include all Premium features with add-ons like unlimited 409A updates and renewals, real-time valuation, and an expedited 409A valuation.

Then there is the Enterprise Plan, which starts at $1,990/year and goes up to Series C+ custom pricing with unlimited 409A renewals for material events, QSBS attestation, IRS mail-in 83(b) elections, and ASC 718 compliance, making it ideal for high-growth companies needing advanced equity management and reporting.

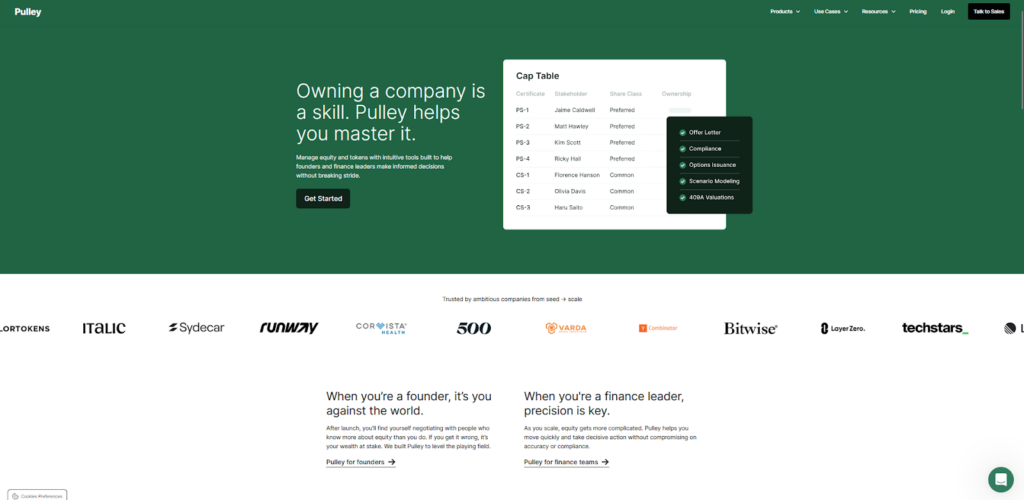

3. Pulley

Pulley stands out with its digital cap table, offering real-time visibility into ownership structures through a customizable dashboard, ensuring transparency for employees and investors. Its fundraising modeling tool simplifies complex funding rounds, showing the impact on ownership percentages and dilution, helping founders make strategic decisions.

For startups needing frequent valuations, Pulley provides fast 409A valuations in five days or less. The platform also excels in employee equity management, enabling offer letters, precise equity calculations, and electronic option exercises via ACH, ensuring a smooth and transparent process.

Additionally, Pulley’s seamless onboarding includes an account manager and AI-powered tools to streamline document uploads, while HRIS integration ensures accurate, automated cap table updates, reducing manual effort and errors. These features make Pulley a powerful, user-friendly choice for startups.

Additionally, Pulley has a feature that lets you transfer your data on a free trial if you are switching from Carta.

Pulley offers three pricing tiers to meet the needs of startups at different stages.

The Startup plan costs $1,200/year and includes cap table management, share certificates, fundraising modeling, and tools for electronically sending and signing option grants and SAFEs. It also provides concierge onboarding, equity templates, offer letters, and a communications hub for up to 25 stakeholders.

The Growth plan, at $3,500/year, expands on the Startup plan with 409A valuations, electronic option exercises, Rule 701 compliance, Form 3921, board approvals, and HRIS integration for up to 40 stakeholders.

For larger or more complex needs, the Custom plan offers tailored solutions, including ASC 718 compliance and priority onboarding, in addition to all Growth features.

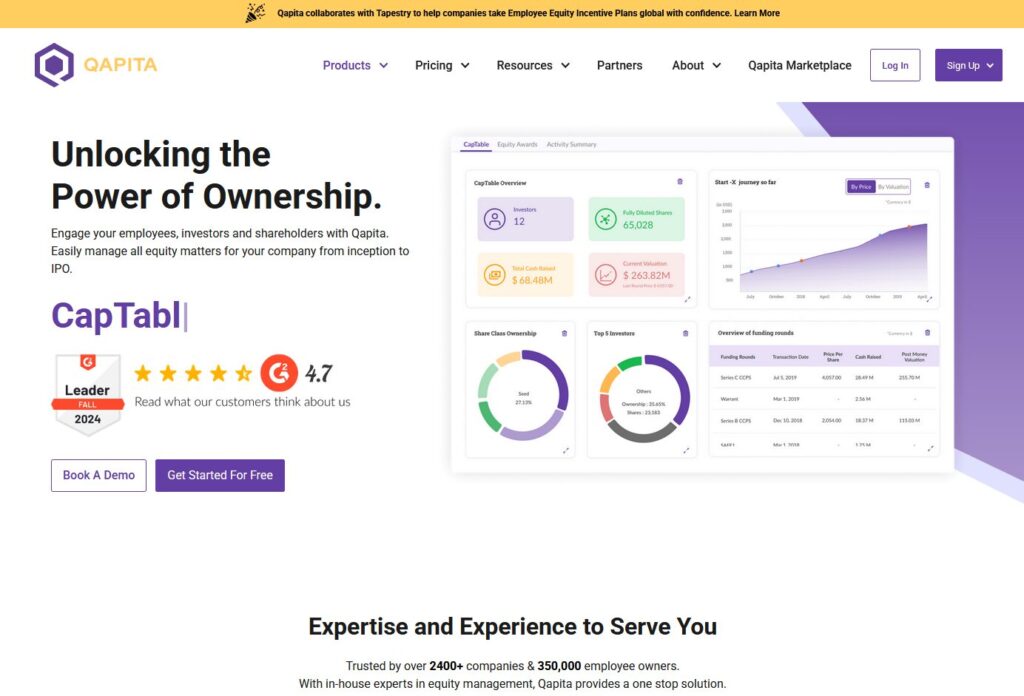

4. Qapita

Qapita is a Singapore-based equity management platform designed to simplify and digitize equity ownership and liquidity for startups, founders, and investors. Founded by Ravi, Lakshman, and Vamsee, Qapita serves over 2,200 rapidly growing companies with a focus on transparency, efficiency, and user-friendliness. Its digital ESOP and cap table management feature streamlines equity processes, reducing paperwork and automating tasks to save time. The platform provides employee visibility, allowing employees to easily access their equity information, fostering transparency and understanding.

Qapita’s user-friendly interface ensures smooth navigation for both company admins and employees, while its onboarding support team ensures a seamless transition to the platform. Additionally, Qapita emphasizes growth and mentorship, with founders actively involved in fostering a culture of learning.

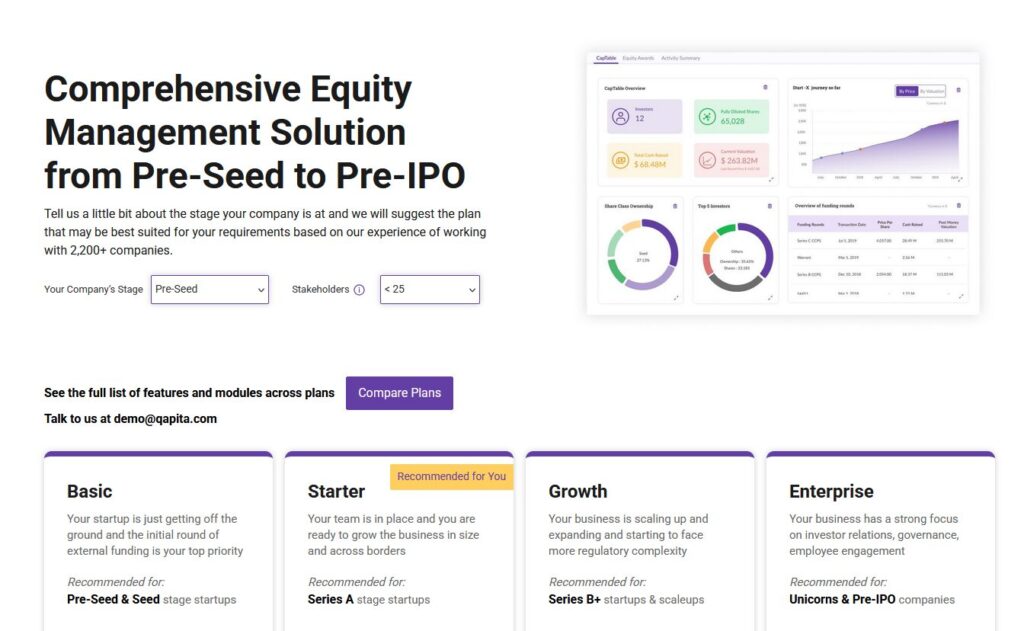

Qapita offers tailored pricing plans for both Unlisted Companies (from startups to pre-IPO) and Listed Companies (public equity solutions for domestic and global firms).

For Unlisted Companies, the Basic plan is free for pre-seed and seed-stage startups, supporting up to 5 stakeholders with cap table management, ESOP tracking, funding round modeling, and a self-onboarding process.

The Starter plan, ideal for Series A startups, costs $654/year (plus a one-time onboarding fee) and adds e-signatures, reporting modules, and email support for up to 50 stakeholders. The

Growth plan, designed for Series B+ startups, includes custom pricing, exercise workflows, valuation reports, and a dedicated customer success manager.

The Enterprise plan, for unicorns and pre-IPO companies, offers full-service equity administration, custom reporting, and HRIS integration.

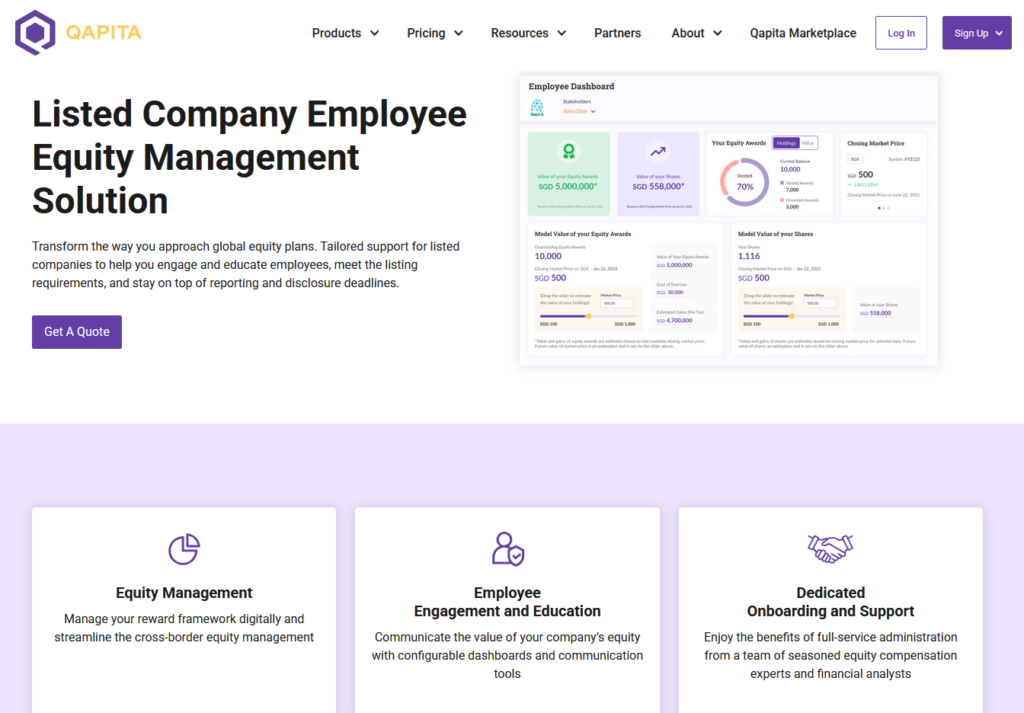

For Listed Companies, Qapita provides a comprehensive solution for global equity plans, including cap table management, employee engagement tools, cross-border equity administration, and financial reporting support. Features like equity fair value reports, audit-ready disclosures, and dedicated onboarding ensure compliance and streamline operations. Custom pricing is available, and interested companies have to contact Qapita for a demo or quote.

5. EquityList

EquityList is a modern equity management platform designed to align HR, Legal, and Finance departments with an intuitive user experience. Known for its top-tier customer support and swift onboarding (some companies onboard in under 24 hours), EquityList caters to businesses across India, Southeast Asia, MENA, and the U.S., managing over 400 companies, 25,000 stakeholders, and approximately $2 billion in equity.

The platform offers region-specific features to comply with local regulations, such as electronic share registers and dematerialization for Indian companies, audit-ready 409A reports and federal exemption tagging for the U.S., and multi-entity management for emerging markets. Other key functionalities include secure storage of share classes and digital certificates, fundraising scenario simulations, and administration of ESOPs, SARs, RSUs, or RSAs.

Notably, it offers a free version for smaller companies with fewer than 25 stakeholders and less than $1 million raised, removing budget barriers and encouraging growth. This approach ensures startups can transition from spreadsheets to a robust equity management platform and upgrade to the paid version when ready.

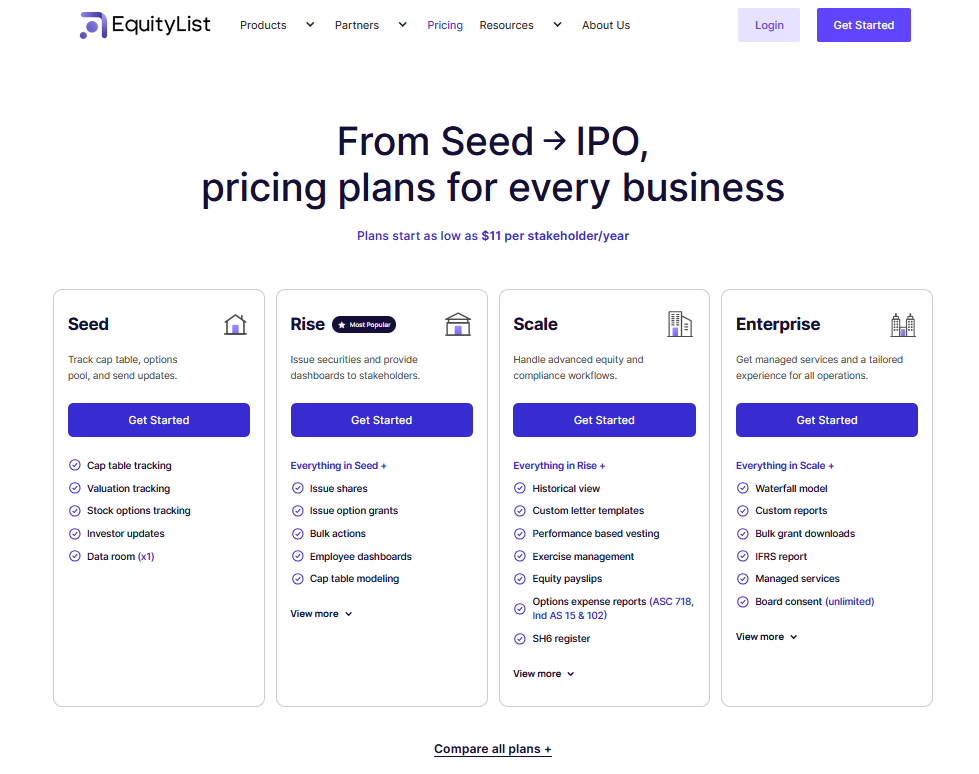

EquityList offers four pricing tiers designed to support companies from Seed to IPO, with plans starting as low as $11 per stakeholder/year.

The Seed plan is ideal for early-stage startups, providing cap table tracking, stock options management, valuation tracking, and investor updates.

The Rise plan, the most popular, adds features like issuing shares and option grants, employee and investor dashboards, e-signatures, and 409A/HMRC valuations.

For more advanced needs, the Scale plan offers exercise management, equity payslips, compliance reports (ASC 718, Ind AS 15 & 102), and HRIS integration.

Finally, the Enterprise plan offers tailored solutions, including waterfall modeling, custom reports, IFRS reporting, and managed services for large or complex operations. Each tier builds on the previous one, ensuring EquityList grows with your business.

6. Cake Equity

Cake is a global cap table and equity management platform designed to simplify the process for ambitious startup founders, no matter where they are in the world. It claims its mission is to provide the tools needed to help startups grow efficiently and compliantly. How does it do that?

Well, for starters, Cake Equity has a user-friendly platform. It’s clean, easy-to-navigate dashboard combines cap table management, document storage, and e-signing in one place, serving as a single source of truth in the cloud. This ensures that all stakeholders, no matter where they are, have access to the most accurate and up-to-date equity information, all in one place.

With Cake, you can set up your cap table and send your first offer letter in just a few clicks. If you already have a cap table in another software or spreadsheet, Cake allows you to import it seamlessly—and offers free setup assistance to ensure accuracy.

Unlike many enterprise-focused tools, Cake is truly global, handling legal, compliance, and tax matters for any country or region. This flexibility ensures that equity plans remain compliant with local laws, whether your company or employees are based in one location or spread across the globe.

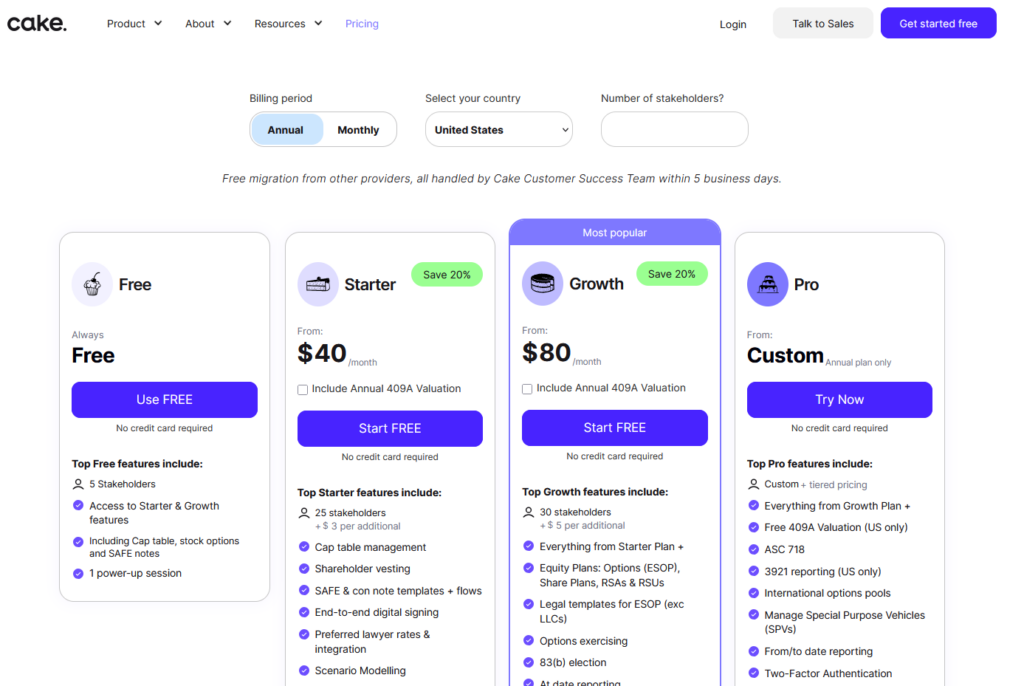

Cake simplifies equity management for startups with four flexible pricing tiers.

The Free plan supports up to 5 stakeholders and includes cap table management, stock options, SAFE notes, and one power-up session.

The Starter plan, starting at $50/month (with a 20% annual discount), supporting 25 stakeholders, offering cap table management, shareholder vesting, end-to-end digital signing, etc.

The Growth plan, at $100/month (also with a 20% annual discount) supports 30 shareholders and includes everything in Starter, plus equity plans (ESOP, RSAs, RSUs), options exercising, and 83(b) election support.

For advanced needs, the Pro plan offers custom pricing, ASC 718 compliance, SPV management, international options pools, and priority migration, among other things.

How to Choose the Best Cap Table Software for Your Startup

When choosing cap table software, consider the following:

- Ease of Use: Look for a platform with an intuitive interface and simple navigation.

- Scalability: Choose software that grows with your business as you raise funds and expand your team.

- Integrations: Ensure the software integrates well with other tools you use, like accounting software or HR systems.

- Lawyer Compatibility: Most early-stage companies rely on law firms for cap table management. Confirm that your law firm supports the software.

- Compliance: Make sure the platform adheres to legal requirements in your jurisdiction.

- Pricing: Compare pricing plans to find a solution that fits your budget.

Wrap Up

Cap table management software is a critical tool for startups aiming to scale efficiently and maintain compliance as they grow. It simplifies equity tracking, ensures accuracy in ownership records, and supports global expansion by adhering to regional regulations. When selecting the right platform, prioritize factors like ease of use, robust reporting features, scalability, and cost-effectiveness. By investing in the right cap table software, you can streamline equity management, reduce administrative burdens, and focus on what truly matters—building and growing your business.