One of the first problems I had with SaaS revenue modeling was pronouncing the word “SaaS” itself. You’ve probably had that dilemma too, but I’m sure you are here for a different reason this time—to understand the concept of Saas Revenue Modeling. If you are more interested in learning about the different types of models and how they can be applied to a business to help it grow and retain its customer base, you are in the right place.

Let’s get to it!

What Is SAAS Revenue Modeling?

Before the internet became a thing, you’d sell software the old way: This meant you’d build it, price it, sell it once, and collect your money. Done. The customer owns a license, installs it on their computer, and what happens after that isn’t really your problem. You got paid up front.

Enter SaaS!

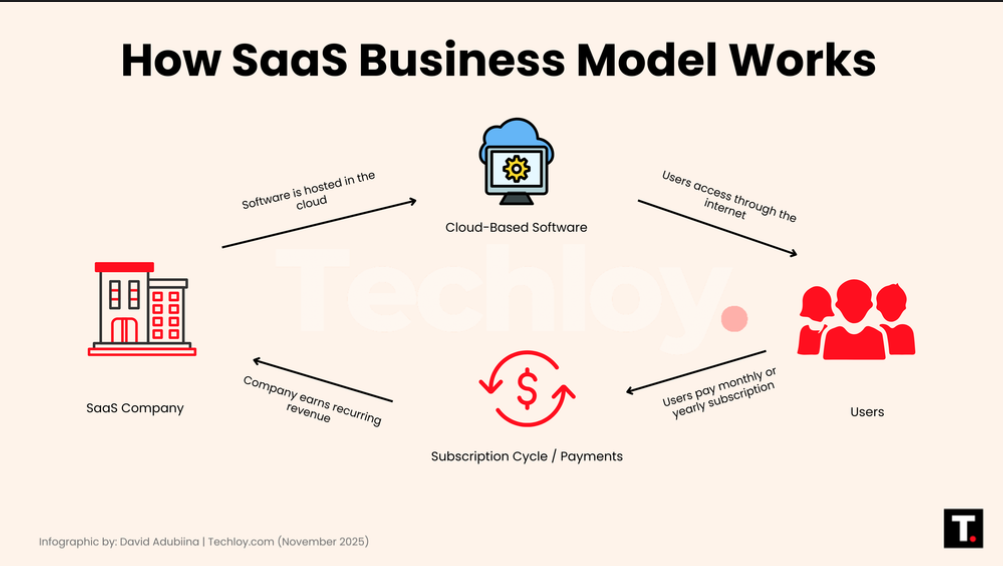

SaaS stands for Software as a Service. The “service” part means you’re not selling software that customers can just install and own. This model means you are providing access to software that lives on your servers, that you maintain and update, and that customers use, for as long as they keep paying you.

A more useful way to think about it as a business owner is Subscription as a Service. Because you are not just delivering software—you’re running a subscription business where customers pay regularly for ongoing access and value.

Netflix doesn’t sell you movies. Spotify doesn’t sell you songs. It doesn’t matter if you’ve seen the movie before on the same Netflix or listened to that same album on Spotify—every time you want to see the movie again or put the album on repeat for the umpteenth time, you have to have a running subscription. This highlights the concept of ongoing access and value.

Why Does Your Revenue Model Matter?

Because how you approach your revenue model makes or breaks your business. It shapes everything from pricing to customer acquisition to investor valuation. Here are some key reasons to pay close attention to your SaaS revenue model.

1. It Determines Whether You Survive.

Say you are spending money to acquire customers before those customers have paid you back. If you spend $600 to acquire a customer paying $50/month, you’re cash-flow negative for 12 months. Multiply that across hundreds of customers, and you’re burning through your runway fast.

But bill annually instead? That customer pays $600 upfront. You’re immediately cash-flow positive, and that money can fund the next customer acquisition right now, not in a year from now. For startups with limited runway, this difference can mean 6-12 extra months to find product-market fit—or running out of money before you get there.

2. It Dictates What Kind of Company You’re Building.

A $10/month consumer subscription and a $10,000/year enterprise subscription aren’t just different price points—they’re different businesses. At $10/month, you need thousands of customers and can’t afford sales calls or onboarding sessions.

Your product must sell itself through frictionless signup and instant value. At $10,000/year, you need salespeople, demos, security reviews, and implementation support. Your revenue model forces you to choose one path, and that decision builds an organizational DNA that’s hard to change later.

3. It Shapes How Long Customers Stay.

In subscription businesses, customer lifetime is everything. A customer who stays six months is worth half as much as one who stays a year, who’s worth a fraction of one who stays five years. Your revenue model directly impacts this. For example, usage-based pricing feels fair but can be unpredictable.

Flat-rate pricing may feel stable, but customers might also feel they’re overpaying. Annual contracts mechanically reduce churn but create renewal cliffs. Monthly subscriptions let unhappy customers leave immediately, but also let satisfied ones stay indefinitely. All these factors contribute to the retention rate of your customers, which is intrinsically connected to your revenue model.

4. It Determines Whether Revenue Compounds.

The best subscription businesses have Net Revenue Retention above 100%—existing customers spend more this year than last year, even accounting for churn. This means revenue compounds. You don’t need new customers just to maintain revenue; every new customer is pure growth. Your revenue model either enables or prevents this.

5. It Affects Your Valuation.

Investors don’t just look at revenue—they analyze the quality of that revenue. $1M in ARR from enterprise customers on annual contracts with 5% annual churn might get valued at 15x ($15M valuation). $1M in ARR from month-to-month consumers with 5% monthly churn (46% annually) might be valued at 5x ($5M valuation). Same revenue, 3x valuation difference, all driven by how your revenue model shapes subscription economics.

Essential SaaS Metrics Every Founder Should Track

Running a subscription business means you need to track different things than a traditional company. You need to understand whether customers are staying, whether you’re spending too much to acquire them, and whether your business model actually works.

Here are the metrics that matter:

1. Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR)

MRR is your predictable subscription revenue each month. If you have 100 customers paying $50/month, your MRR is $5,000. ARR is just MRR multiplied by 12—so $60,000 in this case.

This is your core metric. It tells you the size of your subscription base and whether it’s growing. The keyword is “recurring”—one-time fees and variable charges don’t count. You’re measuring the predictable revenue that shows up month after month.

Most founders break MRR into categories: New MRR from new customers, Expansion MRR from existing customers upgrading, Churned MRR from customers who left, and Contraction MRR from downgrades. These metrics measure whether growth comes from new customers or expansion, and how much churn is holding you back.

2. Customer Acquisition Cost (CAC)

CAC is what you spend to acquire one customer. Add up your total sales and marketing costs—salaries, ads, tools, everything—and divide by the number of customers you acquired.

If you spent $10,000 last month and acquired 20 customers, your CAC is $500. This tells you how expensive your growth is. A $500 CAC might be great or terrible, depending on what those customers are worth to you.

3. Lifetime Value (LTV)

LTV estimates the total revenue you’ll earn from a customer over their entire relationship with you.

Simple Formula For Calculating LTV: monthly revenue per customer × how many months they typically stay.

If customers pay $100/month and stay for 30 months, your LTV is $3,000. This is the ceiling for what you can afford to spend on acquisition. If customers are worth $3,000, spending $500 to acquire them makes sense. If they’re only worth $600, you’re in trouble.

4. LTV to CAC Ratio

Divide your LTV by your CAC. For example, with $3,000 LTV and $500 CAC, your ratio is 6:1.

You want at least 3:1. Below that means you’re not generating enough value from customers relative to acquisition costs. Above 10:1 might mean you’re under-investing in growth.

This ratio tells you whether your business model fundamentally works.

5. Churn Rate

Churn is the percentage of customers who cancel each period. If you started the month with 100 customers and 5 canceled, your monthly churn is 5%. You can also track revenue churn—the percentage of MRR you lost—which might differ from customer churn if bigger or smaller customers are leaving.

Churn is critical because it compounds. 5% monthly churn sounds small, but that’s 46% annually—you’re losing nearly half your customers every year. Great SaaS companies keep monthly churn rate under 2%. Above 5% and you likely have serious problems.

6. Net Revenue Retention (NRR)

NRR answers the question “If you stopped acquiring new customers today, would your revenue grow or shrink?”

Take a group of customers from a year ago. Some left, some downgraded, some upgraded. What percentage of that original revenue do you still have? If you started with $100K and now have $120K from that same group (after all churn and expansion), your NRR is 120%.

NRR above 100% means your revenue compounds—existing customers spend more over time. Below 100% means you’re leaking revenue and need new customers just to stay level.

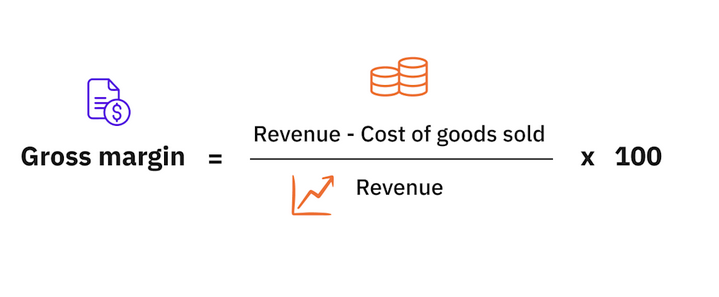

7. Gross Margin

Your revenue minus the direct costs of delivering your service—hosting, infrastructure, support staff tied to serving customers. If you have $100K revenue and $20K in these costs, your gross margin is 80%. SaaS businesses should have high gross margins, typically 70-85%.

Lower margins mean you have expensive infrastructure or you’re running a services business disguised as software.

8. Burn Rate and Runway

Burn rate is how much cash you’re losing each month. If you have $50K revenue and $150K expenses, you’re burning $100K/month.

Runway is how long you can survive: $1M in the bank with $100K monthly burn gives you 10 months. This is existential. Most founders raise money with 6-9 months of runway left because fundraising takes months. You need to know your countdown timer; that way, you can better learn how to extend your runway and reduce burn rate.

9. Time to Value and Activation Metrics

Time to value is how long it takes new customers to get meaningful results from your product.

Activation metrics track whether customers complete key actions that predict they’ll stick around—connecting an integration, inviting teammates, completing setup, and creating their first project. Customers who never activate churn quickly. The faster you get them to their “aha moment,” the better your retention will be.

SaaS Go-to-Market Motions

Your go-to-market motion is how customers actually find, try, and buy your product. It’s the entire journey from “never heard of you” to “paying customer,” and in SaaS, there are really three main paths you can take.

1. Product-Led Growth (PLG)

The first is product-led growth, where the product sells itself. You’ve experienced this if you’ve ever signed up for Slack, Dropbox, or Notion. You visit the website, click a button, enter your email, and boom—you’re using the product. No phone calls, no demo requests, no waiting around. The product is right there for you to explore, and if you like it, you pull out your credit card and start paying. The whole experience is designed so you can get value immediately without talking to anyone.

This works brilliantly when your product is intuitive enough that people can figure it out on their own. It typically makes sense for lower price points—say $10 to $500 per month—where individuals or small teams can make buying decisions without going through procurement.

The magic of product-led growth is when your product has natural viral elements built in. Slack gets better when you invite your team. Dropbox gets better when you share folders. Each user you bring on can potentially bring more users, and suddenly, you’re growing without spending much on sales and marketing.

The catch is that you need massive volume to make it work. If only 3% of your free users convert to paid customers, you need thousands of signups to build meaningful revenue. But when it clicks, your customer acquisition costs can be incredibly low because the product is doing all the heavy lifting.

2. Sales-Led Growth

On the opposite end is sales-led growth, where customers talk to a salesperson before they buy. This is the world of enterprise software—Salesforce, SAP, Oracle, etc. You fill out a “Request Demo” form, a sales rep reaches out, you schedule a call, they walk you through the product, understand your specific needs, send a proposal, you negotiate back and forth, and eventually, you sign a contract. This process can take weeks or months.

Sales-led makes sense when you’re dealing with complex products that require explanation, when you’re selling large contracts worth $50,000 or more annually, or when you’re targeting enterprises where purchasing decisions involve multiple stakeholders and procurement departments. The value proposition might not be immediately obvious, or the product might need configuration for each customer’s unique situation. Sometimes buyers just need to be convinced through relationship-building and consultative selling.

The tradeoff is cost. You’d be paying your sales reps, both in salary and in commission, and each rep can only handle so many deals per year. All these add to the customer acquisition cost, but that’s fine if each customer is worth $50,000 to $500,000 over their lifetime.

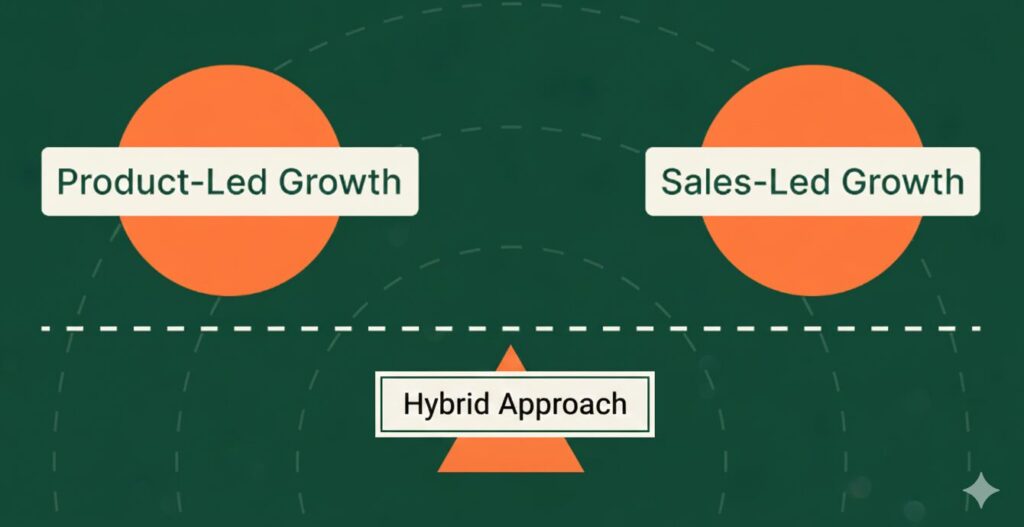

3. Hybrid Approach

The hybrid approach is exactly what it sounds like—letting smaller customers self-serve while providing sales support for bigger deals. A lot of businesses do this beautifully. Small teams can sign up and pay with a credit card for Jira or Confluence, but large enterprises work with sales reps who help with deployment, security reviews, and company-wide contracts. HubSpot offers free tools that anyone can use, but it has sales teams selling premium packages to larger companies.

Hybrid is powerful because it lets you capture both ends of the market. You get efficient growth from self-service customers at the low end, and you can go after high-value enterprise deals at the top. It’s particularly effective for moving upmarket—you start product-led to acquire lots of users cheaply, then layer in sales to capture the big fish who discovered your product because their employees were already using it.

The challenge is that you’re essentially running two businesses at once. Product-led requires obsessing over signup conversion rates and onboarding flows. Sales-led requires relationship skills, pipeline management, and deal negotiation. The cultures and skillsets are different, and managing both simultaneously is tricky.

How to Choose Your Go-To-Market Motion

So how do you choose? It comes down to your product, your market, and your stage.

1. Ask yourself: Can a motivated stranger figure out how to use your product and see value without talking to anyone? If yes, you can go product-led. If your product is complex and needs explanation, you need sales.

2. Think about your customers: Are you selling to individual contributors who can swipe a credit card, or to IT departments with formal procurement processes? Small businesses move fast and self-serve naturally. Enterprises move slowly and expect dedicated support.

3. Consider your stage. Early on, the sales-led approach lets you learn directly from customer conversations, and this is a good thing as you are still figuring out your messaging and positioning. The product-led approach, however, requires having all that dialed in already because the product must do the selling.

But sales-led is expensive and doesn’t scale efficiently, so many companies start with sales to learn, then gradually shift toward product-led as they mature and understand their market better.

SaaS Pricing Models Explained

Once you’ve figured out how customers will buy from you, you need to decide how to charge them. Here are the pricing models you can use:

1. Flat-Rate Subscription

The simplest approach is flat-rate pricing, where everyone pays the same amount for the same thing. Basecamp famously does this with one of their plans—$299 per month, unlimited users, unlimited projects, everyone gets everything. It’s beautifully simple. Customers know exactly what they’ll pay, there’s no negotiation, no surprises, no complexity.

2. Tiered Pricing

You’ve seen this everywhere—Starter at $29 per month with basic features, Professional at $99 with advanced capabilities, Enterprise at $299 with everything plus priority support. This lets you capture different customer segments. Startups pay less and get what they need. Growing companies upgrade as they need more. Enterprises pay premium prices for premium features and support.

Tiers create natural expansion paths. Customers start small and grow with you, and you capture that growth as revenue when they upgrade. The challenge is deciding which features belong in which tier. Sometimes it feels arbitrary—why is this particular feature locked behind the $299 tier when all I need is that one thing? It can be frustrating at times, but when done well, tiered pricing works for almost everyone.

3. Usage-Based (Consumption) Pricing

Usage-based pricing flips the model entirely—you pay for what you actually use. AWS charges for server hours. Twilio charges per API call. Mailchimp charges based on how many subscribers you have and how many emails you send.

The appeal is that it feels fair. You’re not paying for capacity you’re not using. If you’re a small startup using very little, you pay very little. As you grow and use more, you pay more, and that feels natural because you’re presumably getting more value.

4. Per-User Pricing

Per-user pricing is incredibly common, especially for collaboration tools. Slack charges per active user. Zoom charges per host license. You pay $10 per user per month, or whatever the rate is, and as your team grows, your bill grows. It’s simple and intuitive, and revenue naturally expands as organizations scale.

The problem is that it can discourage adoption. If every new user costs money, companies start thinking carefully about who really needs access. Some teams create shared logins to game the system. And per-user pricing only works when the value is actually proportional to the number of users. For some products, one person might get the same value as ten people, and charging per user doesn’t reflect that reality.

5. Freemium and Free Trial Models

Then there’s freemium and free trials, which are really about how customers get into your product rather than how you charge them long-term. Freemium gives you a limited version forever—think Spotify with ads or Notion’s generous free plan. Free trials give you full access for a limited time, usually 14 or 30 days.

The advantage is removing all friction to try your product. People can experience value before committing money, and if your product is good, free users become your marketing engine—they tell others, they invite teammates, they create viral growth.

The harsh reality is that most free users never convert. Typical conversion rates are 2% to 5%, which means you need enormous volume to build a business. And free users still create costs—support, infrastructure, attention—without contributing revenue.

6. Hybrid Pricing Approaches

Finally, there are hybrid approaches that combine multiple models. Slack charges per user, but has free and paid tiers. GitHub charges per user with different feature tiers. Snowflake has usage-based pricing within tiered packages. This lets you capture value from multiple dimensions—you’re not leaving money on the table by only pricing on one axis.

How to Choose the Right Revenue Model for Your Startup

Choosing your revenue model isn’t something you do once and forget about. It’s one of the most important strategic decisions you’ll make, and getting it right requires understanding your customers, your product, your market, and honestly assessing where you are as a company.

1. Assessing Your Target Customer Segment

Start with who you’re selling to, because that decision cascades into everything else. Individual consumers and very small businesses expect self-service. They want to sign up with a credit card, start using your product immediately, and pay small amounts—maybe $10 to $50 per month. They won’t sit through sales calls. This pushes you toward product-led growth with simple pricing, probably freemium or a free trial.

Small to mid-market businesses—say 10 to 500 employees—sit in the middle. They might self-serve for lower price points, but they’re willing to talk to sales for bigger commitments. They can pay $500 to $5,000 per month. This is where hybrid models shine—let them start self-service but have sales ready for expansion.

Large enterprises are different animals entirely. They have procurement processes, security requirements, and compliance needs. They expect sales conversations, custom contracts, and negotiated pricing. They’ll pay $50,000 to $500,000+ annually, but the sales cycle might take six months. If enterprises are your target, you need a sales-led motion with tiered or custom pricing.

2. Product Complexity and Value Delivery

How complicated is your product, and how quickly can customers see value? If someone can sign up, complete onboarding, and see clear value in 15 minutes, you can be product-led. Think Calendly—you set your availability, send someone a link, and they book time. Instant value, no explanation needed.

Ask yourself: Can a motivated stranger figure out your product without talking to anyone? If the honest answer is no, you need sales or at least a heavy investment in onboarding.

Value delivery timing matters too. If customers see value within their first session, you can charge quickly—maybe a 7-day trial. If it takes weeks or months for value to accumulate, you need longer trial periods or freemium models.

3. Market Expectations and Competition

What you want to charge matters less than what your market expects. If every competitor offers a free tier, you’ll struggle to charge from day one. If everyone does annual contracts, trying to sell monthly might feel weird. If the standard is per-user pricing, introducing usage-based pricing requires education.

Look at how your direct competitors price. You don’t have to copy them, but understand why they made those choices and what customer expectations have formed. If you’re going to diverge, you need a clear reason that resonates—”we’re simpler,” “we’re more aligned with your usage,” “we don’t nickel and dime you.”

4. Your Current Stage and Resources

Early stage—pre-revenue to $1M ARR—is about learning. Sales-led makes sense here, even if you’ll eventually go product-led, because sales conversations teach you about customer pain points and what messaging resonates.

The growth stage—$1M to $10M ARR—is when your model needs to be efficient. If you’ve been sales-led, you’re thinking about reducing CAC through better marketing or adding self-service. If you’ve been product-led, you might add sales to move upmarket. Your model needs to support predictable, repeatable growth.

Scale stage—$10M+ ARR—is optimization. You’re refining pricing, reducing churn through better onboarding, and increasing expansion revenue. Your model is established at this stage, and changes are simply incremental improvements.

5. Testing and Iterating Your Model

Start with something simple. Don’t overthink packaging or try to optimize for every segment. Just pick a model that makes sense for your initial customers and bank on the real feedback you get from it.

Test pricing with actual customers. Try different price points with different customers—structured experiments, not random discounting. See where customers say yes easily, where they hesitate, and where they reject you.

Watch your metrics obsessively. Track conversion rates, churn patterns, and expansion behavior. Which customer segments have the best unit economics? Which pricing tiers do customers choose? Your data tells you what’s working.

Be willing to pivot, but not constantly. If CAC is too high, churn is killing you, or nobody’s converting, change it. But don’t change pricing every quarter—you’ll confuse customers and destroy trust. Give each iteration time to generate meaningful data.

When you change your model, grandfather existing customers when possible. New pricing for new customers is fine, but forcing existing customers onto new terms damages relationships.

Wrap Up

If you are anything like me, one of the first things you check whenever you want to try a new tool is the pricing structure. And even though a lot of thought and tweaking usually go into those pricings, you can decide in less than a minute. This is why developing a good SaaS revenue model is very critical. It could make or break your business. And that’s why we’ve thoroughly discussed what you need to create the best revenue model for your business. You’re welcome.

FAQs

When Should I Change My Pricing Model?

Change your pricing when it’s clearly holding you back, not just because you think there might be something better. The signals are obvious: CAC is too high relative to what customers pay, churn is killing you because customers don’t see enough value for the price, and you’re consistently losing deals to competitors with better pricing.

How Do I Know if My Cac Is Too High?

Your CAC is too high when your LTV:CAC ratio falls below 3:1, or when the payback period threatens your cash flow. If you’re spending $600 to acquire customers paying $50/month, you’re waiting 12 months to break even. With limited runway, that’s unsustainable.

Below 3:1 LTV:CAC means your business model doesn’t work. Between 3:1 and 5:1 is okay, but not great. Above 5:1 is healthy. Context matters though. Early-stage companies often have terrible CAC because they’re still learning. Enterprise companies can sustain higher CAC because lifetime value is enormous.

If your CAC is high, diagnose why. Is your sales process inefficient? Are you targeting the wrong customers? Is your messaging unclear? Fix the root cause.

Should I Offer Discounts to Enterprise Customers?

Enterprise customers will ask for discounts—it’s their negotiation playbook. Whether you offer them depends on what you’re getting in return.

Discounts for annual prepayment make sense. You’re getting cash now instead of over 12 months—that’s worth 10-20% off. Annual commitments also reduce churn risk. Multi-year contracts can work for the same reason.

Never discount just because someone asks. Get something valuable in return—longer commitment, case study rights, referrals, prepayment, faster decision timeline. Discounting without getting value back trains customers that your pricing isn’t real.

What’s a Good Churn Rate for Early-Stage SAAS?

For B2B SaaS selling to businesses, a monthly churn below 2% (under 22% annually) is excellent. Between 2-5% monthly is acceptable, especially early on. Above 5% monthly (46% annually) is a red flag—you’re losing nearly half your customers every year.

The more important question is why customers are leaving. Talk to churned customers and find out why. Different reasons require different fixes.