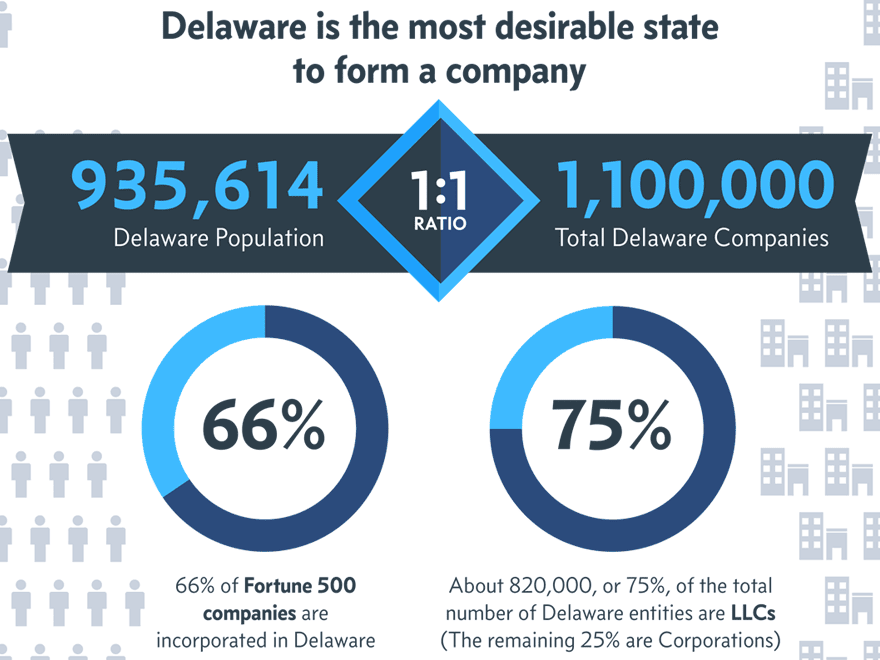

Delaware is consistently ranked as one of the most business-friendly states in the U.S., attracting hundreds of thousands of companies annually. Its popularity stems from favorable tax conditions, robust privacy protections, and the esteemed Court of Chancery, known for how it handles corporate law, with a long history of cases to draw from.

Given some of the things you’ve learned about Delaware capitalism, if you are willing to open and register a business there, you are in the right place to learn how to go about that. In this article, we will give you an in-depth look at everything you need to know regarding registering and establishing a business in Delaware.

1. Decide Your Business Legal Structure

Selecting the right business entity structure is critical, as it significantly impacts your legal responsibilities, taxation, and operational flexibility. Below is an explanation of each business structure, including its legal implications:

Sole Proprietorship

A sole proprietorship is the simplest and most direct form of business organization. It’s owned and operated by one individual, providing full control and ease of setup. However, it does not create a separate legal entity; thus, the owner is personally liable for all business debts and obligations. Creditors can pursue the owner’s assets, such as a home or savings, to settle business debts.

Partnership

A partnership involves two or more people jointly owning and operating a business. There are two primary types:

- General Partnership (GP): Partners equally share management responsibilities and have unlimited personal liability for business debts. Each partner can be held responsible for the full debts and obligations of the business.

- Limited Partnership (LP): Includes both general and limited partners. General partners handle daily management and carry unlimited personal liability, while limited partners have liability only up to their investment amount.

Partnerships require clearly outlined agreements to manage roles, responsibilities, and profit-sharing to avoid legal disputes.

Limited Liability Company (LLC)

An LLC combines characteristics of partnerships and corporations, making it highly popular among small to medium-sized businesses. It provides liability protection, meaning members are not personally liable for business debts or liabilities beyond their investment.

LLCs also offer flexible management structures and pass-through taxation, meaning profits and losses are reported directly on owners’ individual tax returns, avoiding corporate-level taxation.

Corporation

Corporations are separate legal entities owned by shareholders, providing the strongest liability protection. Shareholders are generally not personally liable for corporate debts or liabilities.

- C Corporation: Subject to double taxation, where corporate profits are taxed at the entity level, and again at the shareholder level upon distribution as dividends. Despite this, C Corporations benefit from easier capital raising opportunities, structured management, and potential tax advantages on retained earnings.

- S Corporation: Designed to avoid double taxation, S corporations offer pass-through taxation similar to LLCs. However, S corporations have stricter eligibility criteria, including limits on the number and type of shareholders.

Given the complexity of these structures and significant legal implications, it’s strongly advised to consult with an attorney or CPA familiar with Delaware laws to ensure the selected entity aligns appropriately with your business objectives. Or, at the very least, you can check Delaware’s Legal Business Structure Table to get more information on it.

2. Reserve Your Business Name

While not mandatory, reserving a business name can be a beneficial step, protecting your chosen name for 120 days. Delaware has specific naming conventions based on entity types—LLCs must include “LLC” or “Limited Liability Company,” while corporations require “Inc.,” “Corp.,” or similar designations. The reservation process involves a fee of $75 and can be completed online or by mail. It is advisable to print the confirmation page for online transactions, as fees are non-refundable.

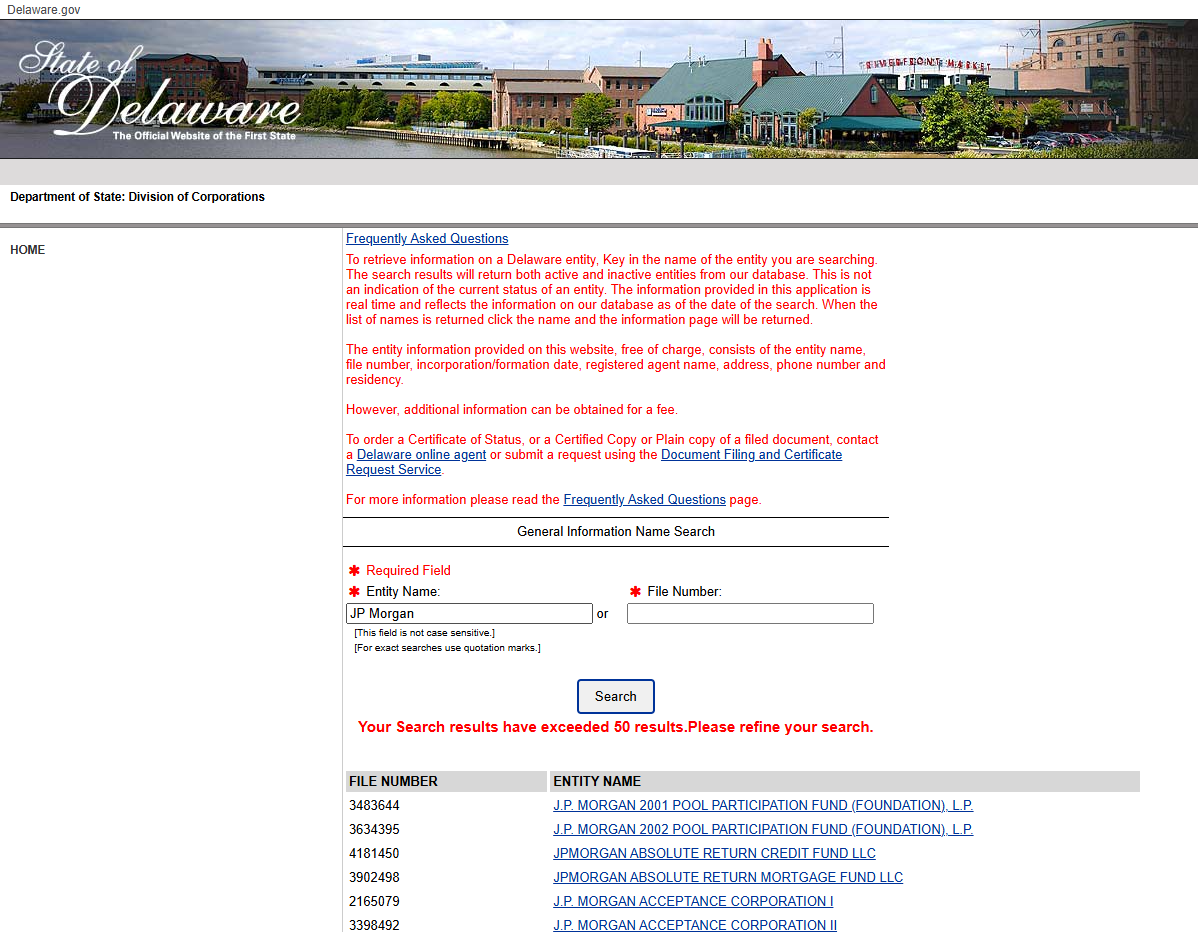

3. Choose a Registered Agent

Delaware requires every business to designate a registered agent within the state, responsible for handling legal notices and official correspondence. A registered agent can be an individual resident or an authorized business entity with a Delaware street address. Businesses physically located in Delaware can serve as their registered agents. Otherwise, companies should select and inform a qualified registered agent listed with the Delaware Division of Corporations.

4. Fulfill Regulatory Requirements

Compliance with regulatory requirements is essential for legally operating a business in Delaware. Below are key regulatory obligations you must fulfill:

Federal Employer Identification Number (EIN)

All businesses operating in Delaware must secure an Employer Identification Number (EIN) from the IRS. The EIN functions like a Social Security number for your business, required for tax reporting, opening bank accounts, hiring employees, and completing federal filings. Note that the tool is available Monday to Friday, 7 a.m. to 10 p.m. Eastern time, and you can apply for only 1 EIN per responsible party per day.

Delaware Business License

If your business will have a physical location, employ staff, or generate sales within Delaware, you must register and obtain a business license from the Delaware Division of Revenue. This license legally authorizes your business operations within the state and ensures compliance with state tax and employment regulations.

Local Permits

In addition to state requirements, businesses must confirm with local city or county authorities whether additional permits or licenses are required. These local permits typically apply to businesses with physical premises, covering zoning, health, safety, and operational standards necessary for local compliance.

Carefully fulfilling these regulatory requirements will help your business maintain compliance, avoid penalties, and ensure smooth operations within Delaware.

5. File Your Certificate of Incorporation or Formation

Once you’ve selected your business structure and finalized your business name, the next critical step involves officially registering your entity with Delaware’s Division of Corporations. This involves completing and submitting key legal documents, known as a Certificate of Incorporation (for corporations) or a Certificate of Formation (for LLCs).

Certificate of Incorporation / Formation Forms

To officially establish your business in Delaware, you’ll first need to complete specific formation documents. The state provides fillable PDF forms with clear instructions, detailing required information and applicable fees. You can access these forms directly from the Delaware Division of Corporations website.

When completing your forms, ensure all information, such as the official name of your business, registered agent information, and business structure details, is accurately provided as errors or omissions can delay the approval process.

6. Submit Your Completed Certificate

After completing your certificate, you’ll submit it directly to the Delaware Division of Corporations. You have two submission options:

- Online Submission: You can use Delaware’s Document Filing and Certificate Request Service, a convenient electronic platform for faster processing.

- Mail Submission: If you prefer mail, you’ll need to attach a completed cover sheet clearly stating your name (or entity name), return address, and phone number. You’d be mailing your documents and the required fees to:

Division of Corporations

John G. Townsend Building

401 Federal Street – Suite 4

Dover, DE 19901

You are required to pay for filing fees upon submission. Documents filed by mail will be returned via regular First Class mail unless you provide a FedEx or UPS account number for expedited returns, but they cannot be returned via fax or email.

7. Beneficial Ownership Reporting

Following the enactment of the Corporate Transparency Act (CTA) on January 1, 2024, entities, particularly foreign entities registering in the U.S., must disclose information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). This step aims to enhance transparency and combat money laundering and fraud. It’s critical to ensure compliance with these federal requirements alongside your Delaware filings.

8. Certified Copies and Certificates of Status (Good Standing)

When registering your business, many banks and financial institutions will require additional documents verifying your business’s legal status. It is important to check with your financial institution to determine whether they require additional information to establish a business account with them. The two primary documents requested are:

- Certificate of Status (Good Standing):

- Short Form Certificate ($50.00): Confirms the name and current standing of your business in Delaware.

- Long Form Certificate ($175.00): Provides extensive details, including your entity’s status and a historical record of all filings.

- Certified Copies of Formation Documents: Official, stamped copies of your original filing documents, often requested by banks or for legal verification purposes.

You can order these documents at the time of filing by specifying your request clearly in the comment section of your Document Filing Sheet. Expedited services are also available upon request, but will incur additional fees.

9. Obtain Licenses, Permits, and Compliance

Delaware businesses must obtain necessary federal, state, local, professional, and industry-specific licenses and permits:

- Federal Requirements: Businesses in industries such as transportation, broadcasting, or firearms must adhere to federal licensing.

- State Requirements: Delaware mandates licensing for specific industries, which can be reviewed via state resources.

- Local Requirements: City or county-specific permits may be required, varying by locality.

- Professional Licenses: Required for regulated professions such as healthcare, law, and construction.

- Special Permits: Necessary for businesses such as restaurants, including health, building, and signage permits.

Compliance involves maintaining detailed records:

- Annual Reports: Corporations must file these annually, detailing business addresses and officer/director information.

- Meeting Minutes: Records of official business meetings and decisions.

- Stock Ledgers: Required for corporations, documenting stock transactions.

- License Records: Maintained centrally, noting expiration and renewal dates.

- Employment Records: Comprehensive employee documentation, including contracts and tax withholding details.

It’s important to regularly review and update these records to maintain compliance and avoid penalties or disruptions.

10. Learn Tax Management

All businesses registered in Delaware have specific annual tax obligations based on their entity structure. Understanding and meeting these requirements is critical for maintaining good standing and avoiding penalties.

Annual Reports and Franchise Taxes for Corporations

Delaware mandates that all corporations incorporated within the state file an Annual Report and pay a corresponding Franchise Tax annually. These reports provide the state with updated information about the corporation, including details of its officers, directors, and business address.

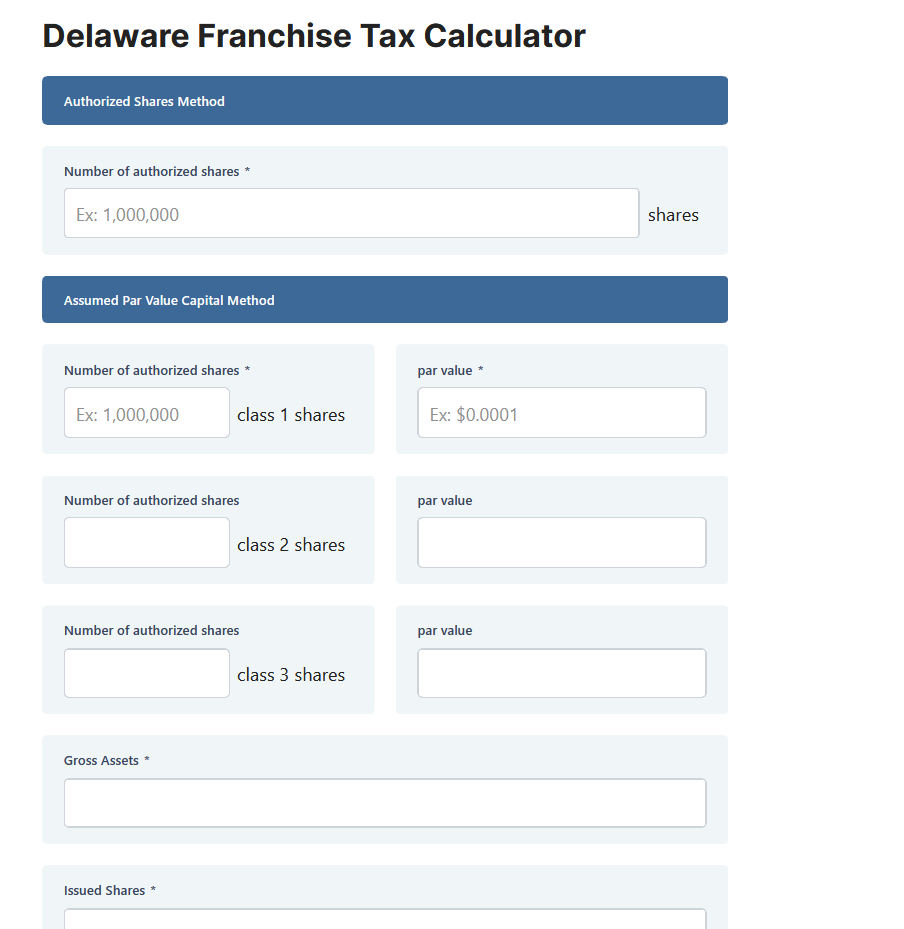

Now, there are Exempt Domestic Corporations that must file an Annual Report, but are exempt from paying the franchise tax. However, they must pay a filing fee of $25 for the Annual Report or any amendments to it. We also have Non-Exempt Domestic Corporations that must pay a franchise tax along with filing their Annual Report, which carries a filing fee of $50. Franchise taxes start at a minimum of $175 and can reach a maximum of $200,000, depending on the corporation’s share structure and valuation.

Annual Reports and Franchise Taxes must be filed and paid by March 1st each year, and all domestic corporations must submit their Annual Reports electronically. If your corporation owes $5,000 or more in franchise taxes annually, Delaware requires payment through quarterly installments as follows:

- 40% due by June 1

- 20% due by September 1

- 20% due by December 1

- The remaining 20% is due by March 1

Failure to file the Annual Report by March 1 results in a penalty of $200, along with interest charged at a rate of 1.5% per month on any outstanding tax balances. But if you are afraid you’d forget, don’t worry. Delaware sends notifications regarding upcoming deadlines directly to registered agents each December.

Annual Taxes for Limited Partnerships (LP), Limited Liability Companies (LLC), and General Partnerships (GP)

Unlike corporations, Limited Partnerships, LLCs, and General Partnerships are not required to file Annual Reports in Delaware. However, these entities must pay a fixed annual tax of $300, due by June 1st every year. This requirement is simpler and doesn’t fluctuate based on shares or valuation, offering clarity and ease of compliance.

11. Learn Insurance Requirements

Proper insurance coverage is crucial for protecting your business against significant financial losses and legal liabilities. Among these coverages, Workers’ Compensation Insurance is particularly important, as Delaware law mandates it for all businesses with employees. This coverage provides essential protection for both employees and employers by covering medical expenses, lost wages, and recovery support resulting from workplace injuries or illnesses.

Other important insurance coverages include General Liability Insurance for protection against bodily injuries, property damage, and legal defense costs; Professional Liability Insurance to safeguard businesses offering professional services from claims of malpractice or negligence; Property Insurance, which covers your business’s physical assets against damage or loss; Cyber Liability Insurance, vital for businesses managing sensitive data to guard against cyber threats and data breaches; Business Interruption Insurance, offering financial assistance during unexpected disruptions; and various industry-specific coverages such as product liability insurance or commercial auto insurance, depending on your operational risks.

Trademark Registration in Delaware

Trademark registration is a valuable step for businesses seeking to protect their brand identity and intellectual property within Delaware. At the state level, businesses may register trademarks or service marks with the Delaware Division of Corporations, providing protection exclusively within the state’s jurisdiction.

Before applying, it’s essential to conduct a thorough trademark availability search to confirm that your chosen mark isn’t already registered or in use within Delaware, thus avoiding potential infringement conflicts. The application requires submission of the proposed trademark, a detailed description of associated goods or services, and a practical example showing how the trademark is actively used in commerce.

A Delaware state trademark registration generally remains valid for 10 years, after which it can be renewed according to state guidelines, allowing continued protection and enforcement rights within Delaware. To learn extensively about the laws guiding trademark registration in Delaware, you can read more about the Delaware code online regarding trademarks, brands, and labels.

Conclusion

Launching a business in Delaware involves navigating several steps—from choosing the correct business structure to managing taxes, ensuring compliance, and protecting intellectual property. Regular consultations with legal and financial experts help businesses leverage Delaware’s favorable business climate and ensure sustained operational success.