Have you ever wondered why startup founders consider non-dilutive government funding as an alternative to Shark Tank-style deals?

Well, if you’ve watched a few episodes, you’ve probably noticed a common theme: the investors always want a piece of equity in exchange for their investment. So, on one hand, startup founders are asking for more money to grow their businesses, on the other hand, they are trying not to give away too much of their company (equity).

Traditional venture capital can do wonders for a growing business. Still, it comes at a cost—dilution of ownership, loss of control, and possibly pressure to exit quickly—which is why a lot of startup owners opt for non-dilutive funding, as it allows them to grow their startups while maintaining full ownership.

There are various non-dilutive funding options available; however, this article will focus on those offered by Uncle Sam. We’ll cover how it works, the types the government offers, and how to decide if it’s right for you. Let’s get to it!

What is Non-Dilutive Funding?

Non-dilutive funding (also referred to as non-equity funding) refers to any form of capital that doesn’t require you to give up equity in your company. Like it’s implied in its naming, it means you don’t have to dilute your company or give up some of its equity in exchange for an influx of funds.

Non-dilutive funding vs Equity Investment

Unlike the previous example about Shark Tank startup pitches, where founders offer some of their company for funding, non-dilutive capital allows you to maintain 100% control of your business while securing the money and resources you need to grow.

There are multiple means you can secure capital from a non-dilutive standpoint. You have options ranging from revenue-based financing to foundation grants. For the intents and purposes of this article, however, we will focus primarily on securing non-dilutive government funding.

What is Non-Dilutive Government Funding?

Non-dilutive government funding is a type of funding offered by the government. This encompasses grants, contracts, and other financial instruments. It is provided by federal, state, and local government agencies in a bid to support research, development, and commercialization of innovative technologies.

And why is the government so nice? What’s in it for the government? Well, these programs are designed to drive innovation, meet government research needs, and strengthen the economy—all without requiring startups to give up equity. The most prominent federal programs include the Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs, which collectively represent billions of dollars in annual funding opportunities.

Why Government Non-Dilutive Funding?

1. Scale of Opportunity: Government non-dilutive funding represents one of the largest pools of startup capital available. Federal programs alone distribute billions of dollars annually to small businesses through SBIR, STTR, and other initiatives. For example, a Phase II SBIR award typically ranges from $750,000 to $1.8 million, with no equity required and no repayment obligations. That’s substantial capital that can fund 12-24 months of critical R&D work.

2. Strategic Validation: Winning a competitive government award does more than provide capital. Research has shown that startups that have won government research awards in the clean energy sector were 12% more likely to acquire subsequent VC funding compared to similar companies without such awards. This “stamp of approval” from rigorous government review processes signals to private investors that your technology has merit and your team can execute.

3. Intellectual Property Retention: Government funding is fundamentally different from venture capital (VC) because it is typically driven by a public mission (e.g., scientific advancement, national security, or economic development) rather than maximizing investor financial returns. And because there are no bogus financial expectations, there is no pressure for quick exits or aggressive growth metrics. This “patient capital” approach allows companies to focus on long-term, challenging R&D with less fear of early failure or being forced into an acquisition before the technology is fully mature.

4. Access to Government Resources: When the Government backs you with money, it is also interested in seeing you succeed. This means your capital is not just where the Government help stops. You also get access to government resources. This access can include use of technical facilities (e.g., advanced laboratory equipment at national labs), scientific expertise (connecting with world-class agency scientists and engineers), and powerful networks that can lead to partnerships with other major players in the government or defense industry.

5. Pathway to Procurement: Government funding is frequently designed to be a starting point, not an end goal, especially for technology that has a clear public-sector application. This means initial research grants could be structured as stepping stones toward becoming a long-term government vendor. Completing the initial, smaller phases of an award can qualify the company for follow-ons on government contracts and projects.

Types of Government Non-Dilutive Funding

1. SBIR (Small Business Innovation Research)

The SBIR program is America’s largest source of early-stage technology funding, supporting R&D startups developing high-risk technical products that need approximately 2 years of runway and align with federal agency missions.

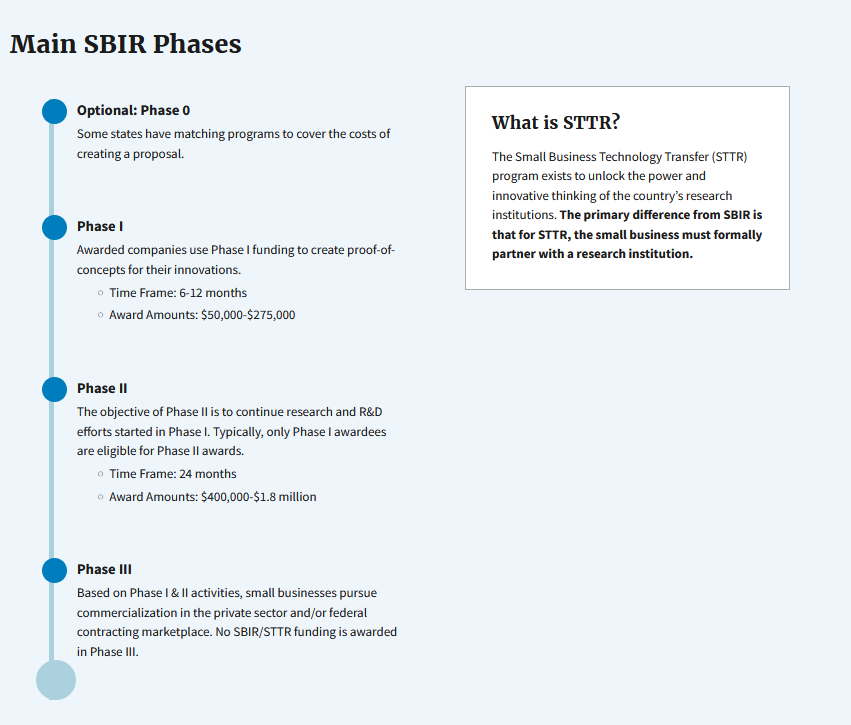

It operates through a three-phase structure:

- Phase I provides $50,000-$275,000 for 6-12 months to establish proof of concept and feasibility;

- Phase II offers $750,000-$1.8 million over 24 months for continued development and prototyping; and

- Phase III focuses on commercialization through non-SBIR funding sources.

To be eligible, your company must be a for-profit U.S. business with fewer than 500 employees, at least 51% owned by U.S. citizens or permanent residents, with the Principal Investigator primarily employed by the company. Eleven federal agencies participate in SBIR, each with its own mission-specific solicitations.

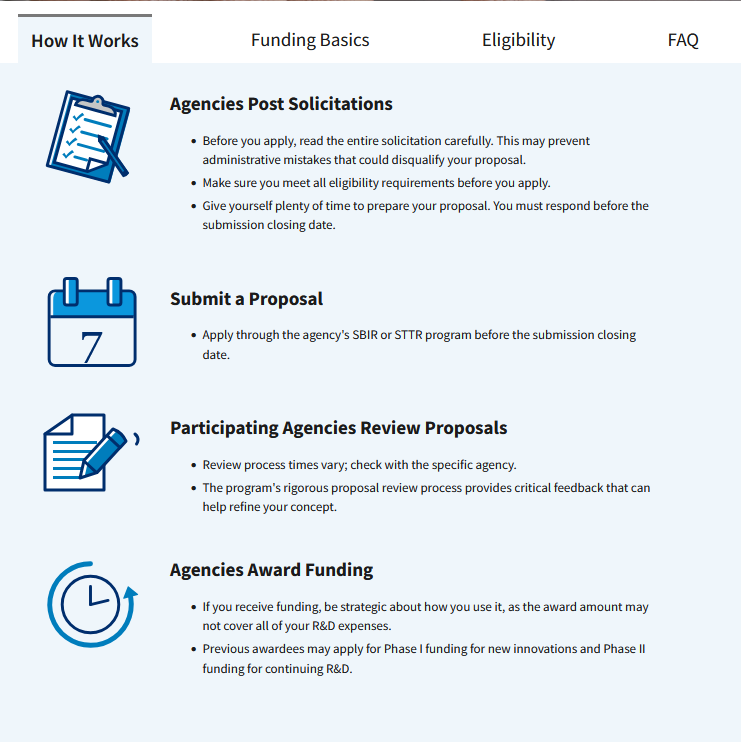

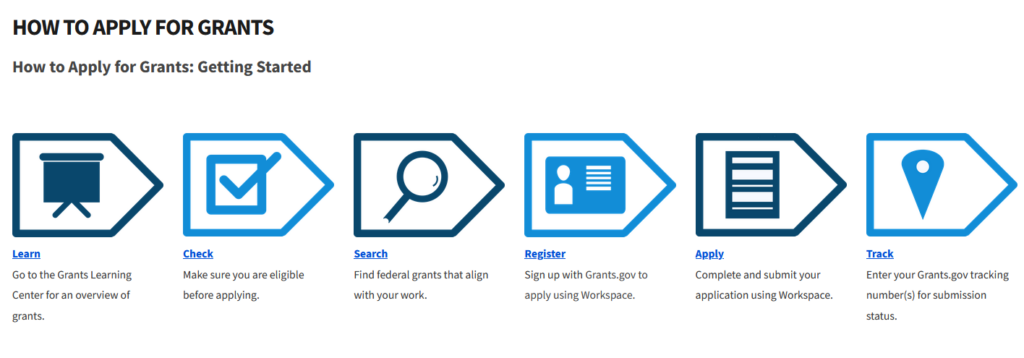

The application process requires advance preparation—allow 4-6 weeks for registrations at SAM.gov (for your UEI), Grants.gov, and the SBA Company Registry, plus any agency-specific systems. From application to funding typically takes 6-9 months, so plan accordingly. Most agencies issue solicitations 1-2 times per year with specific deadlines. You can apply through the SBIR website or specific portals like NIH SEED for the NIH, or the Department of War.

You retain full commercial rights to any intellectual property developed, though the government maintains certain usage rights for its own purposes. You also get 20 years of data right protection.

2. STTR (Small Business Technology Transfer)

STTR is structurally similar to SBIR but with one critical requirement: you must formally partner with a university or research institution throughout the project. This makes STTR ideal for spinning research out of academia or leveraging existing academic expertise and infrastructure. The program works particularly well for startups that need access to specialized facilities, cutting-edge research, or deep faculty expertise that would be prohibitively expensive to develop independently.

This is the route Numat took, partnering with a research team from Northwestern University (specifically Professor Omar Farha’s team) to develop advanced Metal-Organic Frameworks for chemical filtration, eventually scaling production for military gas masks and protective gear.

To be eligible, your small business must perform at least 40% of the R&D work while your research partner (university, federal lab, or FFRDC) performs at least 30%, with the Principal Investigator able to come from either organization, depending on the agency. Eligibility requirements match SBIR, which is, you need a for-profit U.S. company with fewer than 500 employees and at least 51% U.S. citizen or permanent resident ownership.

The application process mirrors SBIR, using the same portals (SAM.gov, Grants.gov, SBA Registry) with the same 6-9 month timeline from application to funding. You’ll need to document your partnership formally and clearly define roles and work allocation in your proposal. NuMat Technologies exemplifies STTR success—they partnered with Northwestern University through Army STTR to develop advanced Metal-Organic Frameworks for chemical filtration, eventually scaling production for military gas masks and protective gear.

Phase I awards range from $50,000-$275,000 for 6-12 months, while Phase II provides $750,000-$1.8 million over 24 months. IP rights are negotiated between your small business and the research institution, with both parties typically maintaining rights to developed IP under terms defined in your partnership agreement, although you retain commercial exploitation rights.

3. OTA (Other Transaction Authority)

Other Transaction Agreements represent a fundamentally different approach to government funding. Contrary to the previous ones we covered, they’re flexible, non-traditional instruments specifically designed to attract commercial companies and startups unfamiliar with the bureaucracy of standard government contracting.

Unlike Federal Acquisition Regulation (FAR)-based contracts that burden companies with extensive paperwork and rigid rules, OTAs allow the government to move at commercial speeds with negotiable terms and significantly less administrative burden.

These agreements are perfect for startups developing dual-use technologies that serve both commercial and government markets, particularly prototype development, where innovation and speed matter more than following established procurement procedures.

OTAs specifically welcome non-traditional contractors—companies new to government work—making them accessible to startups that would struggle with conventional defense contracting. OTA funding varies widely based on project scope—pilot projects may provide $50,000 to $500,000, while full prototype development can exceed $10 million, depending on the technology and agency interest.

The timeline moves much faster than SBIR/STTR—typically 3-6 months from application to award—because OTAs are built for rapid execution. You’ll need SAM.gov registration for your UEI, and specific consortia may have additional membership requirements.

4. BAA (Broad Agency Announcement)

Broad Agency Announcements take a different approach from SBIR’s structured phases or OTA’s prototype focus. They are open-ended, competitive solicitations where government agencies describe broad research areas of interest and invite proposals for exploratory scientific work.

BAAs are specifically designed for advancing fundamental science and solving complex technical challenges where breakthrough approaches are needed, making them ideal for startups with deep scientific capabilities tackling problems where the solution path isn’t yet clear.

How is it different from the other ones? BAAs reward scientific merit and advancing “state of the art” knowledge in fields aligned with agency missions as opposed to SBIR, which emphasizes commercialization, or OTA, which requires prototype development.

Most BAAs follow a two-step process:

- An optional but highly recommended white paper for initial concept review, followed by a full proposal with detailed technical approach, team qualifications, and

- Budget if your concept generates interest.

Finding BAA opportunities requires monitoring multiple channels like https://www.grants.gov/ by searching “Broad Agency Announcement,” https://sam.gov/ for government-wide opportunities, or agency-specific sites like https://www.darpa.mil/research/opportunities/baa for DARPA or https://arl.devcom.army.mil/collaborate-with-us/opportunity/arl-baa/ for Army Research Lab.

The timeline typically runs 4-8 months from solicitation to award, and you’ll need the same basic registrations as other federal programs: SAM.gov, Grants.gov, and your UEI.

BAA awards typically range from $500,000 to $5 million or more, depending on the scope and technical complexity, with project timelines often extending 1-3+ years to allow for genuine scientific exploration. The main advantage over SBIR is larger funding amounts and significantly more flexibility in methodology and approach, though you’ll need to demonstrate stronger scientific foundations and theoretical grounding.

Pro tip: Before investing significant proposal development time, contact the Technical Point of Contact (TPOC) listed in the BAA to discuss your concept—program managers appreciate this engagement and can provide valuable guidance on whether your approach aligns with their interests.

Cons of Government Funding

1. Lengthy Timeline and Competitive Process:

From application submission to receiving funds takes 6-12 months, and you may need to apply multiple times before winning, with acceptance rates typically ranging from 10-20%.

Process for applying for grants

A competitive Phase II SBIR proposal can require 100-200+ hours to prepare, including detailed technical narratives, commercialization plans, and budgets. This means you need sufficient runway to survive both the application development period and the waiting period before funds arrive, if it arrives.

2. Strict Compliance and Reporting Requirements:

Nearly 30% of startups that received government funding faced compliance issues that hindered their growth. You must submit regular progress reports (quarterly or semi-annually), maintain detailed time tracking for all personnel, properly allocate direct and indirect costs, document every expenditure, and remain prepared for audits that can occur anytime during the award period and up to three years after completion.

3. Limited Flexibility and Use Restrictions:

Government grants specify exactly how funds must be used. You cannot simply pivot the project if you discover a better opportunity. The funds are locked to the specific research scope outlined in your proposal. Major changes require formal modification requests that may be denied, and unlike venture capital, where you have broad spending discretion, government funds are tightly scoped and must align with the stated technical objectives.

4. Risk of Non-Compliance Penalties:

Non-compliance can result in hefty fines, an obligation to repay misused funds, and exclusion from future funding opportunities. A poor track record with one agency can affect your reputation across the entire federal government, as agencies share information about problematic awardees. In extreme cases of intentional fraud or misappropriation, individuals can face criminal charges, though this typically involves deliberate malfeasance rather than honest mistakes.

Who is Non-Dilutive Government Capital Best Suited For?

Government non-dilutive funding is best suited for deep tech and hardware startups requiring substantial R&D investment before reaching commercial viability. This includes companies developing medical devices, robotics, clean energy technologies, or aerospace systems. These niches fit government funding better because they require patient capital (no pressure for quick exits or aggressive growth) and extensive validation before commercialization.

Mission-aligned companies whose technologies directly address federal agency priorities represent another ideal fit. If your startup develops solutions for defense and national security (DoD, DHS), public health and medicine (NIH, FDA, BARDA), energy and climate (DOE), space exploration (NASA), or agriculture (USDA), government programs are specifically structured to support your work.

A good example of this is Squishy Robotics. They developed tensegrity-based robots for disaster response through NSF SBIR funding, creating technology that perfectly matched government emergency response needs while building a foundation for commercial applications.

These types of alignment in goals, speed of return on investment, and general direction are what make a startup ideal for government funding.

Conclusion

Government non-dilutive funding represents one of the most substantial and strategic capital sources available to early-stage technology companies, with billions of dollars distributed annually through programs like SBIR, STTR, OTAs, and BAAs that allow qualifying startups to secure significant funding without sacrificing equity or taking on debt. Do you think your business has a shot at landing government funding? Start by visiting SBIR.gov to explore your options.