If your U.S.-based company owns a stake in a foreign affiliate, you may be required to file a BE-10 Benchmark Survey with the U.S. Bureau of Economic Analysis (BEA). This mandatory survey tracks U.S. investment abroad and helps shape foreign economic policy. Here’s a guide on what you need to know and how to file it—step by step.

What Is the BE-10 Survey?

The BE-10 is a benchmark survey of U.S. direct investment abroad, conducted every five years by the Bureau of Economic Analysis (BEA) and it is required under U.S. law, whether or not you are contacted by the BEA.

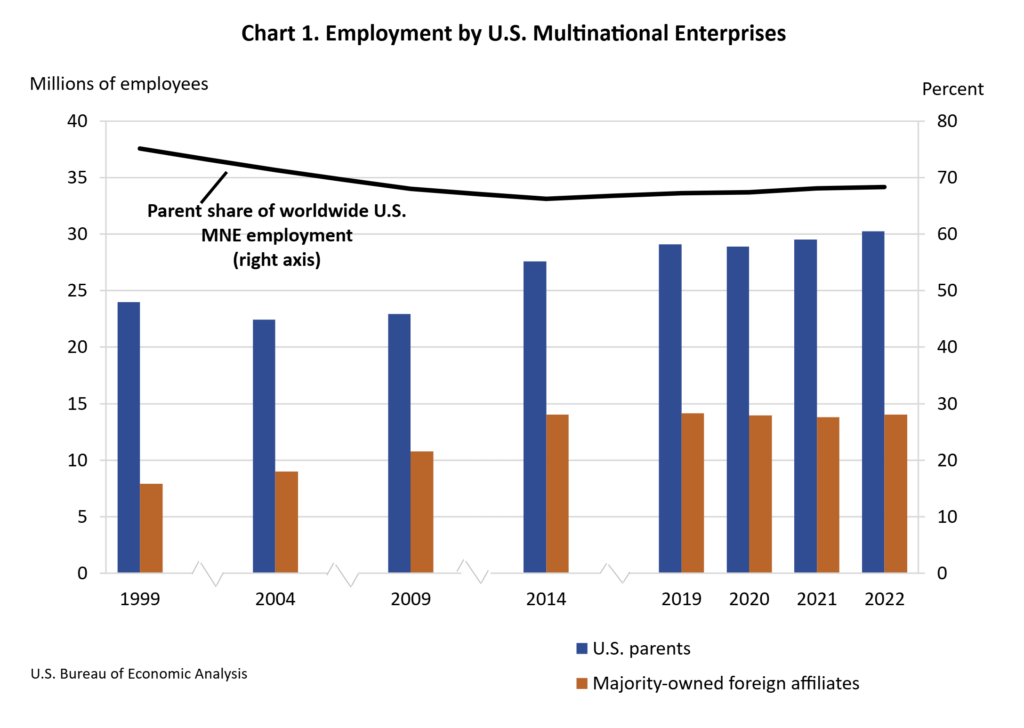

The goal is to collect comprehensive data on U.S. ownership and financial activity in foreign businesses, providing policymakers and economists with vital information on international investment trends.

source: BEA

Who Needs to File It?

U.S. companies or individuals must file if they directly or indirectly own 10% or more of the voting stock of a foreign business enterprise at the end of the reporting year.

When filing the BE-10 Benchmark Survey with the Bureau of Economic Analysis (BEA), the specific form(s) you need to complete depend on your company’s role (U.S. parent or foreign affiliate) and the financial size of your foreign affiliates. Here’s a breakdown of each form and when it’s used.

Form BE-10A

This form is required for all U.S. reporters that own foreign affiliates. It covers the overall financial information of the U.S. company, including total assets, total sales or operating revenues, and net income. If you’re the U.S.-based parent company, this is your main form.

Form BE-10B

Use this form for each majority-owned foreign affiliate (where the U.S. parent owns more than 50%) if that affiliate has assets, sales, or net income greater than $80 million. It collects detailed data about the affiliate’s financials and operations.

Form BE-10C

This form is used for:

- Each majority-owned foreign affiliate with assets, sales, or net income between $25 million and $80 million, and

- Each minority-owned foreign affiliate (U.S. ownership of 10%–50%) with assets, sales, or net income over $25 million.

Form BE-10D

This is the simplest form, required for each foreign affiliate—majority or minority-owned—that has assets, sales, or net income of $25 million or less. Here is an extra page for reporting additional BE-10D affiliates

Form BE-10: Claim for Not Filing

If, after reviewing your company’s structure, you determine that you are not required to file any of the BE-10 forms (for example, you don’t own any qualifying foreign affiliates), you still have to submit this claim to notify the BEA that no filing is necessary.

What Is the Due Date for Filing the Form Be-10?

The BE-10 is conducted every five years (e.g., 2020, 2025).

The deadline to submit the BE-10 Benchmark Survey depends on how many forms your business needs to file. If you’re filing fewer than 50 forms (including BE-10B, BE-10C, and BE-10D), the deadline is May 30. If you’re filing 50 or more forms, the deadline extends to June 30.

Each foreign affiliate requires its own separate form, so large international businesses may have many to complete. Missing the deadline can lead to serious consequences: civil penalties of up to $60,000, and in cases of willful non-compliance, criminal penalties—including fines up to $10,000 or even one year in prison.

How to File the BE-10 Survey: A Step-by-Step Guide

Filing the BE-10 Benchmark Survey with the Bureau of Economic Analysis (BEA) is a multi-step process, but following these steps will help ensure a smooth and compliant submission:

Step 1: Obtain Your BEA Reporter ID

Before you can file, you need a BEA Reporter ID.

- New filers must register on the BEA’s website to receive a six-digit Reporter ID.

- Existing filers can retrieve their ID from prior filings or contact the BEA directly if needed.

Step 2: Access the BE-10 Forms

Go to the BEA BE-10 Survey page to download the correct forms and filing instructions.

- You’ll need to determine which forms apply: BE-10A, BE-10B, BE-10C, or BE-10D, based on your ownership and the size of each foreign affiliate.

- The page also includes detailed guidance to help you choose and complete the right documents.

Step 3: Complete the Forms

Fill out each required form accurately:

- Provide data on total assets, sales, net income, ownership details, and other requested financial and operational information.

- Make sure the forms are complete and validated before submission.

- Use BEA’s instructions to ensure proper classification of affiliates (majority-owned vs. minority-owned, size thresholds, etc.).

Each foreign affiliate requires its own separate form, even if multiple affiliates fall under the same parent company.

Step 4: Submit the Forms

You can submit your BE-10 filings in one of two ways:

- Electronically via the BEA eFile system (recommended)

- By mail to the address listed in the form instructions.

PS: Double-check ownership thresholds and financial figures and contact the BEA with technical or eligibility questions. They also have a FAQs page for whatever questions you may have. Also remember to keep a copy of all submissions and confirmations for your records.

What Happens After Filing?

After you submit your BE-10 forms, the BEA reviews your data for accuracy. During this process, they may reach out for clarifications or request corrections if anything appears inconsistent or incomplete. While individual company information remains confidential, the BEA uses the data in aggregate—combining it with submissions from other companies—to produce official reports that help track U.S. investments abroad and inform economic policy.

Conclusion

Filing a BE-10 is a legal obligation, not an optional survey. It ensures your business stays compliant and supports U.S. economic analysis and policy making. Even if you’re unsure whether your company qualifies, it’s better to confirm with the BEA than to risk non-compliance. Good luck!