Before diving into the startup world, federal income tax might have seemed like a distant concern. Now, as a founder, it’s front and center. Transition smoothly with this guide, bridging the gap between uncertainty and clarity. We break down the essentials, ensuring you’re well-prepared to handle your startup’s tax obligations with confidence.

Brief Overview of the Concept of Federal Income Tax

The Federal Income Tax is a tax levied by the U.S. government on the annual earnings of individuals, corporations, trusts, and other legal entities. It operates on a progressive system, meaning the tax rate increases as the taxable income increases. The revenue generated from these taxes is used to fund government programs, infrastructure, public services, and other aspects of the U.S. government.

Source: Google

What Are the Elements Considered in Federal Income Tax System?

The Federal Income Tax system in the United States considers several factors when determining an individual’s or a business’s tax liability. Here are some of the key elements:

- Income: This is the primary factor in determining tax liability. The IRS considers all income from various sources, including wages, salaries, tips, interest, dividends, business income, capital gains, pensions, rents, royalties, and more.

- Filing Status: Your filing status (e.g., single, married filing jointly, married filing separately, head of household) can affect the tax rates and the standard deduction amount.

- Deductions: These are specific expenses the IRS allows you to subtract from your taxable income. Deductions can be standard (a fixed amount you can deduct) or itemized (specific expenses like mortgage interest, state and local taxes, medical expenses, etc.).

- Federal Tax Credits: A federal tax credit is a reduction in the amount of tax owed to the U.S. government. Unlike deductions, which reduce taxable income, tax credits directly lower the tax bill. They are offered for various activities, like investing in renewable energy or hiring from specific groups.

- Exemptions: Before the 2018 tax year, taxpayers could claim personal and dependent exemptions to reduce taxable income. The Tax Cuts and Jobs Act of 2017 eliminated these exemptions but increased the standard deduction.

- Special Considerations: Certain situations can affect your tax liability, such as self-employment, owning a business, having foreign income, or experiencing a major life event (like marriage or the birth of a child).

Explanation of Tax Brackets and Rates

Tax brackets and rates are part of the income tax system used by the U.S. federal government. This system divides income into sections, or “brackets,” and each bracket is taxed differently.

Here’s a simplified explanation:

Tax Brackets

Tax brackets are ranges of income that are taxed at specific rates.

- Pass-Through Entities

For pass-through entities, the business itself doesn’t pay income taxes. Instead, the income “passes through” to the owners’ personal tax returns, and they pay tax based on their individual income tax brackets.

- Individual Tax Brackets

Since the income from pass-through entities is taxed at the individual owner’s level, understanding individual tax brackets is essential.

Tax Rates

Each tax bracket has a corresponding tax rate. The rate increases as the income bracket increases. This is why it’s called a “progressive” tax system: the more you earn, the higher the percentage of your income you’ll pay in taxes. For example, income in the first bracket might be taxed at 10%, income in the second bracket at 12%, and so on.

It’s important to note that the rate for each bracket applies only to the income within that bracket, not your entire income. So, if you’re in the 24% tax bracket, you don’t pay 24% on all your income, just the portion that falls into the 24% bracket.

- Corporate Tax Rate

In the U.S., after the Tax Cuts and Jobs Act of 2017, corporations (C-Corps) are taxed at a flat rate of 21% on their taxable income. This means that no matter how much a corporation earns, it pays a federal tax rate of 21%.

Understanding tax brackets and rates is crucial for financial planning, as it allows you to estimate your tax liability and make informed decisions about deductions and credits.

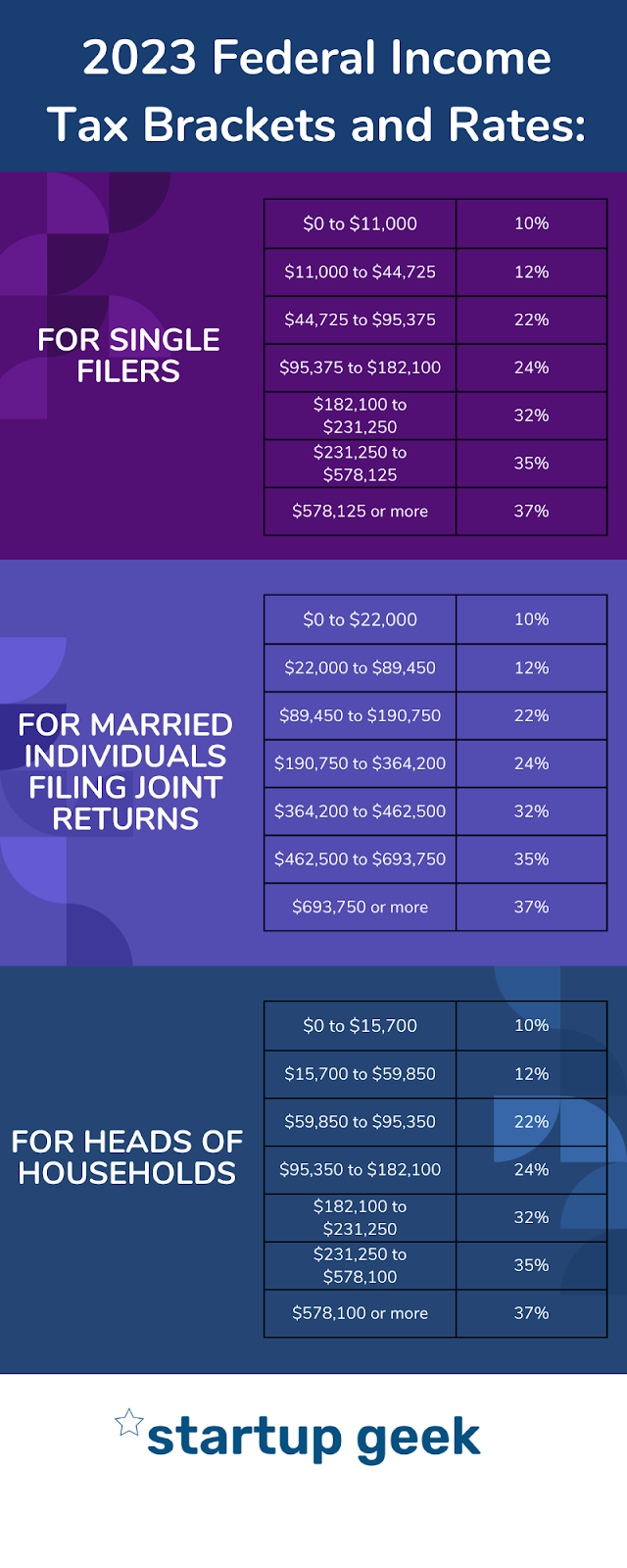

- Different Tax Brackets and The Tax Rates for Individuals

Here are the federal income tax brackets and rates for the year 2023:

Please note that these tax brackets are adjusted yearly to account for inflation. The income thresholds for the tax brackets are generally adjusted each year to reflect the inflation rate. This can help prevent taxpayers from ending up in a higher tax bracket as their cost of living rises.

Taxable Income for Startups

When we talk about taxable income, we’re referring to the amount of income that’s subject to taxes after all deductions and exemptions are applied. For startups, this is a crucial concept because it directly impacts how much tax you’ll owe. But how do you determine this amount? Let’s break it down.

Source: Google

- Business Income and Expenses

First and foremost, you’ve got your business income. This is the money your startup brings in from its operations, whether from selling products, providing services, or other revenue streams. Sounds straightforward, right?

But here’s the catch: not all money that comes in is pure profit. You’ve got expenses – the costs you incur to run your business. This could be anything from rent and salaries to utilities and software subscriptions. By subtracting these expenses from your total income, you get your net business income. And it’s this net amount that’s considered for taxation.

- Deductions – A Startup’s Best Friend

Now, let’s talk deductions. The IRS allows businesses to deduct certain expenses to reduce their taxable income.

For startups, some of the most common deductions include:

- Office Expenses: Whether you’re renting an office space or have a home office, you can deduct related expenses. This includes rent, utilities, and even office supplies.

- Travel: If you’re traveling for business – say, to meet a client or attend a conference – those expenses can be deducted. This covers airfare, accommodation, and even meals.

- Advertising: Money spent on advertising – from Facebook ads to billboards – is typically deductible.

- Depreciation and Amortization

Let’s tackle two slightly trickier concepts: depreciation and amortization. Boththese concepts help smooth out large expenses, ensuring you don’t take a massive tax hit in a single year.

- Depreciation: This applies to tangible assets, like machinery or office furniture. Instead of deducting the entire cost in the year you buy them, you spread it out over the asset’s useful life. So, if you buy a computer for your startup, you’d deduct a portion of its cost each year over several years.

- Amortization: This is the intangible cousin of depreciation. It applies to assets you can’t touch, like patents or copyrights. Just like with depreciation, you’ll spread out the cost over the asset’s useful life.

It’s essential to note that while these concepts are foundational for federal income tax, states may have their own income tax systems with varying rules and rates. It’s equally important to be aware of any state-specific tax rules if your startup operates in or has nexus in multiple states. Always consult with a tax professional to ensure you’re compliant at both the federal and state levels.

Strategic Tax Planning for Individual Businesses

Strategic tax planning is the process of aligning your business strategy with tax laws to minimize your tax liabilities and optimize your after-tax income. It involves forecasting your business’s tax situation, understanding current tax laws and regulations, and making the best use of allowances, deductions, exclusions, and exemptions. Here are some key elements:

- Utilizing Tax Credits

Tax credits reduce your tax liability and can sometimes result in a refund if they reduce your tax liability to below zero. There are various tax credits that businesses can take advantage of, such as the Research & Experimentation Tax Credit for businesses that engage in research and development activities, or the Work Opportunity Tax Credit for businesses that hire from certain targeted groups.

- Timing of Income and Expenses

The timing of when you recognize income and expenses can impact your tax liability. Generally, it’s beneficial to delay income (thus delaying tax) and accelerate deductions. This strategy, however, requires a careful understanding of cash and accrual accounting methods and might not be advantageous for all businesses or in all situations.

- Structuring Your Business

The way your business is structured (i.e., sole proprietorship, partnership, LLC, S Corp, C Corp) can have a significant impact on your tax obligations. Each structure has its own tax implications. As your business grows and changes, it may be advantageous to change your business structure.

- Retirement Contributions

Contributions to retirement plans can often be deducted from your income, reducing your tax liability. There are several retirement plans designed specifically for small businesses, like a Simplified Employee Pension (SEP) IRA or a Savings Incentive Match Plan for Employees (SIMPLE) IRA.

Tax Responsibility for Different Types of Individual Businesses

The tax responsibilities can vary depending on the structure of your individual business. Here’s a brief overview of different types of business entities and their tax responsibilities:

- Sole Proprietorship

In this simplest form of business structure, there is no legal distinction between the owner and the business, meaning the owner is personally responsible for all debts and obligations of the business. The owner reports business income and expenses on their personal tax return (Form 1040, Schedule C). They’re also responsible for self-employment taxes (Social Security and Medicare taxes) on the net earnings of the business (Form Schedule SE).

- Partnership

In a partnership, two or more people share ownership of a single business. Like sole proprietorships, partnerships are pass-through entities. The partnership itself does not pay income tax. Instead, income, deductions, and credits are passed through to the partners based on their distributive share. These are reported on the partners’ individual tax returns. Each partner is also subject to self-employment taxes on their share of the partnership’s income.

- Limited Liability Company (LLC)

An LLC provides some legal protection to the owner (like a corporation) but is typically taxed like a sole proprietorship or partnership. The IRS does not have a specific tax classification for LLCs, so an LLC is classified as a corporation, partnership, or as part of the LLC’s owner’s tax return (a “disregarded entity”). If the LLC has only one owner, it is treated as a disregarded entity and is taxed like a sole proprietorship. If it has two or more owners, it is treated as a partnership for tax purposes unless it elects to be treated as a corporation.

- S Corporation

S Corporations are corporations that elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders report this income and losses on their personal tax returns and are assessed tax at their individual income tax rates. This allows S corporations to avoid double taxation (once at the corporate level and again at the individual level). Unlike a regular corporation, an S Corporation is not eligible for a dividends received deduction. Another difference is that the shareholders of the S Corporation must be U.S. citizens or residents.

Tax Responsibilities for Different Types of Earners

Different types of earners have different tax responsibilities under the U.S. federal income tax system. Here’s a general overview:

- Employees: Employees have income tax withheld from their paychecks by their employers. This is done based on the employee’s information on their Form W-4. At the end of the year, the employer provides a W-2 form showing the total income earned and the amount of taxes withheld. Employees may also be responsible for paying any additional taxes owed if not enough was withheld during the year.

- Self-Employed Individuals: Self-employed individuals, such as freelancers and independent contractors, are responsible for paying their own income tax, as well as self-employment tax, which covers Social Security and Medicare taxes. They typically need to make estimated tax payments every quarter throughout the year.

- Business Owners: Owners of businesses, including corporations, partnerships, and LLCs, are typically responsible for paying taxes on the business’s profits. The specifics can vary depending on the type of business entity. For example, corporations pay corporate income tax, while owners of LLCs and partnerships often pay taxes on their share of the business income on their personal tax returns.

- Investors: Individuals who earn income from investments, such as stocks, bonds, or real estate, are typically responsible for paying taxes on their investment income. This can include capital gains tax, dividend tax, and interest income tax.

- Retirees: Individuals who receive income from pensions, annuities, or retirement accounts like a 401(k) or an IRA may be responsible for paying income tax on those distributions, depending on the type of account and other factors.

It’s important to note that tax laws can be complex and the specifics of a person’s tax responsibilities can vary widely based on their individual circumstances. Therefore, it’s often a good idea to consult with a tax professional or use reputable tax software to help navigate these responsibilities.

Step-By-Step Guide to Filing Taxes

Filing your taxes can seem like a daunting task, but breaking it down into steps can make the process more manageable. Here’s a basic step-by-step guide:

- Gather Your Documents: Collect all necessary documents. This includes W-2 forms from your employer, 1099 forms if you have additional income (like interest, dividends, or self-employment income), and records of any deductions or credits you plan to claim.

- Choose Your Filing Status: Determine your filing status. This could be single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependent child.

- Decide on a Form: Choose the correct tax form. Most people will use Form 1040, but variations depend on your specific circumstances.

- Take Deductions: Decide whether to take the standard deduction or itemize your deductions. Itemizing can be beneficial if your eligible expenses exceed the standard deduction amount.

- Calculate Your Tax: Calculate your tax liability. Subtract any deductions and credits from your income to calculate your taxable income, then apply the tax rates.

- Check for Credits: Apply any tax credits you’re eligible for. Credits reduce your tax liability and can sometimes result in a refund.

- Fill Out Your Tax Form: Fill out your chosen tax form with all the relevant information. Be sure to double-check everything for accuracy.

- Submit Your Tax Return: You can submit your tax return by mail or electronically. Electronic filing is faster and often more convenient.

- Pay Any Tax Due: If you owe tax, pay by the deadline (usually April 15) to avoid penalties and interest.

- Keep Records: Keep a copy of your tax return and all supporting documents for at least three years in case of an audit.

Remember, everyone’s tax situation is unique, and this is a very general guide. Depending on your circumstances, you may need to take additional steps or provide additional information. Consider consulting with a tax professional if you’re unsure.

Explanation of Tax Forms for Individual Businesses

- Schedule C (Form 1040 or 1040-SR): Profit or Loss from Business: Sole proprietors and single-member LLCs use this form to report their business income and expenses. This form calculates the business’s net profit or loss, which is then reported on the owner’s personal tax return (Form 1040 or 1040-SR).

- Schedule SE (Form 1040 or 1040-SR): Self-Employment Tax: This form calculates the self-employment tax owed on income from self-employment (i.e., earnings from a sole proprietorship or partnership). Self-employment tax covers Social Security and Medicare taxes.

- Form 1065: U.S. Return of Partnership Income: Partnerships use this form to report their income, gains, losses, deductions, credits, etc. The partnership must also provide each partner with a Schedule K-1 (Form 1065), which partners then use to report their share of the partnership’s income or loss on their personal tax return.

- Form 1120S: U.S. Income Tax Return for an S Corporation: S corporations use this form to report their income, gains, losses, deductions, credits, etc. Like a partnership, the S corporation must provide each shareholder with a Schedule K-1 (Form 1120S), which shareholders use to report their share of the S corporation’s income or loss on their personal tax return.

- Form 941: Employer’s Quarterly Federal Tax Return: This form is used to report income taxes, social security tax, or Medicare tax withheld from employee’s paychecks and to pay the employer’s portion of Social Security or Medicare tax.

- Form 940: Employer’s Annual Federal Unemployment (FUTA) Tax Return: This form is used to report and pay unemployment taxes you owe to your employees. You must file Form 940 if you paid wages of $1,500 or more to employees in any calendar quarter or had an employee work for you for at least some part of 20 or more weeks.

- Form 1099-NEC: Nonemployee Compensation: Businesses use this form to report payments of $600 or more to a nonemployee, such as independent contractors.

These are just a few examples of the most common forms individual businesses use. It’s always important to consult with a tax professional to ensure you meet all your tax obligations. They can provide guidance on what forms you need to fill out and help you understand how to properly complete them.

Bottom Line

In conclusion, understanding the Federal Income Tax system is crucial for financial planning and legal compliance. This system, which is progressive and managed by the Internal Revenue Service (IRS), impacts many entities, including individuals, businesses, and trusts.

With various tax brackets, rates, deductions, and exemptions, it’s essential to comprehend how these elements apply to your specific situation. Whether you’re an employee, self-employed, or a business owner, knowing your tax responsibilities can help you make informed decisions, optimize your tax savings, and ensure you meet all legal obligations.