A 2020 survey by Wilbur Labs revealed a stark truth: the leading cause of startup failure is financial depletion. Financial planning is more than just crunching numbers; it’s the strategic compass guiding startups. It directs resources, mitigates risks, and transforms visions into realities.

Moreover, a solid financial blueprint enhances credibility, attracting discerning investors.

For every entrepreneur startup founder here on LinkedIn: Embrace financial planning. It’s not just a tool; it’s your startup’s lifeline.

The Crucial Role of Financial Planning

At its core, financial planning for startups is the process of mapping out how your business will manage its financial resources to achieve its goals and sustain itself over time. While many entrepreneurs are drawn to the thrilling aspects of product development, marketing, and market disruption, a solid financial plan is the bedrock upon which everything rests.

Why is financial planning so crucial for startups? Consider it the blueprint for your business’s financial success. Here are several key reasons why it deserves your utmost attention:

- Setting Clear Objectives

Before you embark on any entrepreneurial journey, you need a destination in mind. Financial planning forces you to define your goals, both short-term and long-term. Are you aiming for rapid growth and market domination, or are you looking to steadily build a profitable niche business? Your financial plan should align with these objectives, serving as your roadmap.

- Resource Allocation

Startups often operate with limited resources, which means every dollar counts. Financial planning helps you allocate your resources efficiently. It answers crucial questions like: How much should you invest in product development? How much in marketing? How much is the operational costs? Without a clear plan, you risk misallocating resources and running out of capital prematurely.

- Attracting Investors

Investors, whether they are angel investors, venture capitalists, or crowdfunding backers, want to see that you have a solid financial plan in place. They need assurance that their investment will be used wisely and generate returns. A well-crafted financial plan can be the key to securing the funding you need to take your startup to the next level.

- Risk Mitigation

Entrepreneurship inherently involves risk, but financial planning helps you identify and mitigate those risks. By forecasting potential financial challenges and creating contingency plans, you can better navigate unexpected bumps in the road, ensuring your startup’s survival even when faced with adversity.

What Do We Know about a Startup’s Financial Planning?

Startup financial planning is the strategic process of charting a company’s financial course for future success. It involves making informed predictions and plans based on historical performance and industry research. This plan starts with an evaluation of the current financial situation and incorporates future goals, outlining the strategies required to achieve them.

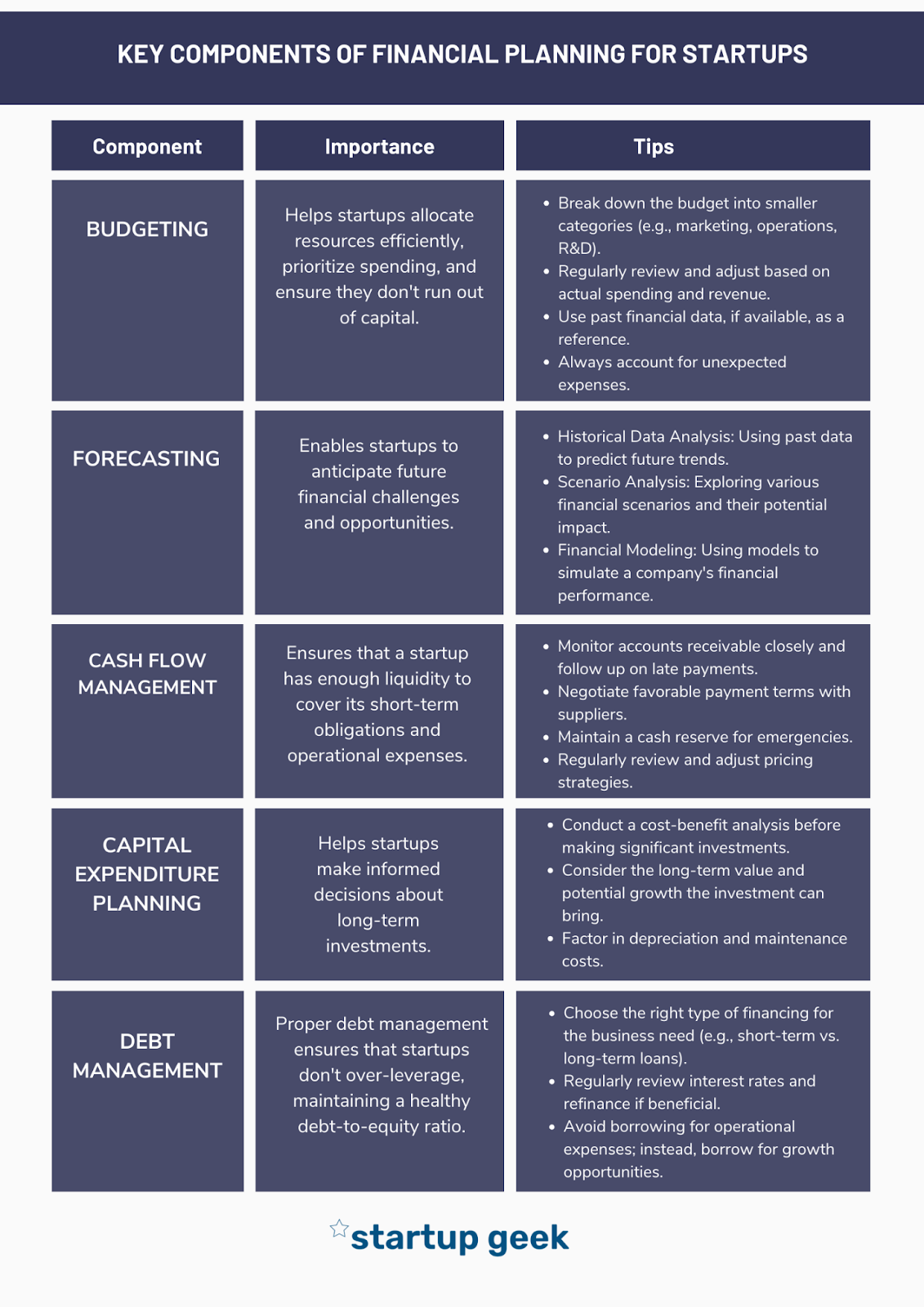

Key components of a financial plan encompass:

Navigating the Financial Foundations of Startup Success

To embark on this path, it’s crucial to start with a clear comprehension of your business’s financial landscape. This entails a firm grasp of your revenue, expenses, and cash flow dynamics. Armed with this knowledge, you can chart a financial course toward your long-term goals.

- Setting Clear Financial Goals:

Begin by defining your financial objectives, both short-term and long-term. Consider questions like: How much do you aim to increase revenue? Are expense reductions on your agenda? Having specific goals in mind lays the groundwork for a tailored financial plan.

- Mastering Cash Flow Management:

Ensuring a steady income to cover expenses is crucial for startups. Given their unpredictable cash flow, companies often face challenges in this area. The cash flow statement, a vital component of the financial statement, provides a detailed overview of inflows and outflows. Regularly reviewing this statement can help anticipate cash shortages, allowing for timely interventions with creditors.

Adopting strategies like upfront invoicing, utilizing accounting software for expense tracking, and establishing a bank credit line can prove invaluable. It’s essential to monitor your cash flow closely to steer your startup clear of financial hurdles. For a practical tool, check out our financial worksheet template.

- Navigating Capital Acquisition:

As your business expands, capital becomes a vital resource. To scale, consider options like loans, equity sales, or crowdfunding. Each has its pros and cons, so research well to find the right fit.

- Simplifying the Complex:

While financial planning for startups may initially appear unsettling, it doesn’t need to be overwhelming. By adhering to these fundamental principles, you can construct a financial roadmap that guides your business toward its long-term objectives.

Preparation for Financial Planning: Gathering Data and Selecting Tools

Before embarking on the journey of financial planning for your startup, it’s essential to lay the groundwork by collecting critical elements:

- Data:

- Financial Accounts: Identify and gather information on all financial accounts related to your business, such as bank accounts and credit cards. These accounts serve as sources for both income and expenses.

- Bookkeeping: Evaluate your bookkeeping practices. Determine the tools or software you use, whether it’s QuickBooks, Xero, NetSuite, or another platform. Ensure that your bookkeeping records are up-to-date and accurate.

To effectively create a financial plan, this existing financial data will be imported and integrated into the plan. Automated updates, either through software or other means, are preferable to maintain access to the most current data, facilitating agile decision-making.

- Tools:

- Spreadsheet: One option is using a spreadsheet, such as Excel or Google Sheets. You can either download a premade template from an online resource or create one from scratch. If you choose this route, someone within your team, like a finance analyst, HR manager, or office manager, can handle maintenance, with oversight from a CFO as your startup grows. However, spreadsheets can be less collaborative and automated.

- Financial Planning Software: Consider dedicated financial planning software like Pry, Finmark, Brixx, or Causal. Such software provides scalability as your startup expands, offering collaborative features and automation. This ensures version control and simplifies data updates, making it a robust choice for growing businesses.

- Outsourcing to a CPA: Another option is to enlist a Certified Public Accountant (CPA) to build your financial plan. While this provides peace of mind and professional expertise, it tends to be costlier than a DIY approach with spreadsheets or software. Creating the financial plan internally can also enhance your understanding of your business.

Crafting an Effective Financial Plan for Your Startup

Fortunately, creating a financial plan need not be a convoluted process. In fact, it can be as straightforward as devising a budget and monitoring your journey against it. Here are some essential steps to help you kickstart the process:

- Grasp Your Costs:

Every financial journey starts with recognizing costs. Whether it’s one-time investments like equipment or recurring expenses like salaries, understanding these figures is vital. When certain costs are uncertain, it’s wise to estimate both high and low ranges, ensuring you’re prepared for various financial scenarios.

Example: Launching a tech startup? Office rental costs can fluctuate. Estimating a range prepares you for diverse financial situations, offering flexibility.

- Ponder Over a Sales Forecast:

With expenses in your grasp, the next vital step is generating revenue that can cover these costs. The key here is constructing a sales forecast. Begin by projecting your startup’s monthly revenue for its inaugural year. But don’t stop there—break down this revenue by product or service. This granular approach not only offers better tracking but also provides the flexibility to adjust your sales strategy as market dynamics shift.

Example: Consider a food delivery startup. Your sales forecast includes monthly estimates for the number of orders, average order values, and growth rates. This detailed breakdown empowers you to adapt swiftly when, say, customer preferences shift toward healthier options.

- Forge Your Budget:

Once you’ve gauged costs and projected revenues, it’s time to design your budget. This plan outlines where your money goes and comes from. List out expenses and revenues, and evaluate the difference to gauge your financial health. If you’re spending more than you’re earning, consider cost-cutting or boosting sales. If you’re profiting, think about reinvesting or building a safety net.

Example: Starting an e-commerce site? If marketing costs surge unexpectedly, adjust your strategy or seek affordable alternatives.

- Embrace Accounting Software: Streamline Financial Management

In today’s digital age, accounting software is your ally. Tools like QuickBooks or FreshBooks automate financial tasks, making expense tracking and budgeting a breeze. These platforms offer real-time insights, so you’re always in the financial know.

Example: Using accounting software, you quickly generate a detailed financial report for potential investors, impressing them with your startup’s financial transparency and professionalism.

- Monitor Your Path:

The linchpin of financial success lies in active monitoring. Regularly tracking your progress against your budget is essential to ensure you stay on course and meet your financial objectives.

This serves as a powerful tool, providing a visual representation that enables you to identify any deviations from your plan promptly.

Example: Consider a scenario in your software startup where you uncover that development costs are surpassing your budget due to unforeseen technical challenges. The value of monitoring becomes evident as you promptly detect this discrepancy.

- Consider Professional Assistance:

If you find yourself overwhelmed or uncertain about certain financial aspects, seeking the expertise of a financial planner is a wise choice.

A financial planner brings invaluable insights to the table. They can help you make informed decisions, assist in crafting a comprehensive budget, and offer ongoing progress monitoring. While not mandatory, this professional assistance can be a pivotal asset for ensuring your startup’s long-term financial stability and success.

Example: Let’s say you’re launching a fintech startup with complex financial models. Engaging a financial planner with expertise in the fintech sector ensures that your financial plan aligns with industry best practices and regulatory requirements, providing confidence to both you and potential investors.

Securing Funding for Your Startup

In the dynamic realm of startups, securing the right funding stands as a pivotal determinant of success. Whether you’re self-funding or reaching out to external investors, a clear grasp of your financial avenues can be transformative. A crucial step in this journey is pitching to investors. Before you engage with potential backers, preparation is paramount. Your startup’s blueprint, the business plan, acts as your guiding star. It should articulate your vision, provide an in-depth market analysis, spotlight competitors, and outline your growth strategy.

Numbers often speak louder than words in the investment world. Investors seek concrete data to drive their decisions. Detailed financial projections, showcasing expected revenues, costs, and profit margins, can instill confidence in your venture’s potential. With these foundational elements in place, we can delve deeper into the nuances of startup funding.

Self-funding vs. External Funding: What’s Best for Your Startup?

Self-funding (Bootstrapping)

When entrepreneurs use their personal savings or the revenue from the startup to fund its operations, it’s known as self-funding or bootstrapping. Sarah, for instance, started a digital marketing agency using her savings. As her business grew, she reinvested the profits, ensuring a steady growth trajectory.

External Funding

On the other hand, external funding involves raising capital from outside sources. Consider John, who had a groundbreaking tech idea but lacked the funds. By pitching to venture capitalists, he secured the necessary capital in exchange for a stake in his company.

Startups navigate varied funding avenues, each with its own assumptions and things to consider. Venture capitalists, guided by financial statements, invest in high-potential tech innovations. Angel investors, often affluent individuals, are drawn to unique ventures, from tech to organic skincare brands. Crowdfunding platforms like Kickstarter democratize funding, aiding entrepreneurs, from board game designers to inventory-heavy businesses, in raising global capital. Traditional bank loans, meanwhile, stand as a steadfast guide for expanding businesses like local bakeries. Dive deeper into these nuances in our article about startup funding avenues.

Some Real Life Examples of Successful Startups:

Songe LaRon and Dave Salvant of Squire:

- Background: Both natives of New York City, they were familiar with the traditional barbershop experience.

- Problem Identified: The barbershop booking process had remained unchanged for years, requiring customers to wait for long hours and pay in cash.

- Solution: They developed Squire, a barbershop point-of-sales and management system. Initially, it was a customer-facing app for booking barber appointments. However, after buying a barbershop to understand the challenges better, they pivoted to a B2B model, targeting barbershop owners.

- Outcome: Squire is now available in three countries and has raised $165 million in funding.

Leah Busque Solivan of TaskRabbit:

- Background: One night in 2008, Leah ran out of dog food and wished there was a way to get someone nearby to buy it for her.

- Solution: This led to the creation of TaskRabbit, a platform where “runners” could complete errands for users.

- Challenges: Transitioning from a web platform to a mobile-first app was challenging, especially when introducing it to the U.S. market.

- Outcome: TaskRabbit expanded to nine countries and over 75 cities. It was later acquired by IKEA in 2017.

Steering Clear of Financial Pitfalls: Common Mistakes Startups Should Avoid

Many startups stumble into common financial pitfalls that can have significant repercussions. Let’s take a closer look at some of these prevalent mistakes and how to steer clear of them.

- Neglecting to Establish a Budget

One of the most fundamental financial errors startups make is not creating a budget. Without a budget, it’s like navigating a ship without a map—easy to veer off course and overspend. A well-structured budget is essential to monitor expenses and ensure they align with revenue.

Solution: Craft a detailed budget that outlines income and expenses, providing a clear financial roadmap. Regularly review and adjust it as needed to stay on track.

- Underinvesting in Marketing

Marketing is the lifeblood of any business, yet startups often make the mistake of cutting back on marketing expenses when facing budget constraints. This can hinder their ability to reach potential customers and hinder growth.

Solution: Allocate a reasonable portion of your budget to marketing efforts, exploring cost-effective strategies like social media marketing and content marketing if necessary.

- Failing to Plan for Taxes

Tax planning is frequently overlooked by startups, leading to financial stress when tax season arrives. Failure to set aside funds for taxes can result in substantial debt to the government.

Solution: Estimate your tax obligations and establish a separate account for tax payments. Regularly consult with a tax professional to stay informed about tax liabilities and deductions.

- Operating Without Insurance

Operating a business without adequate insurance is a substantial risk. Without it, you could face substantial financial loss if something goes wrong, potentially jeopardizing your business and personal finances.

Solution: Evaluate the types of insurance your startup requires, such as liability insurance, business property insurance, or health insurance for employees, and invest in appropriate coverage.

- Overlooking Retirement Savings

Retirement may seem distant, but failing to save for it is a common mistake. Without retirement savings, you may struggle financially in your later years.

Solution: Establish a retirement savings plan early, even if you can only contribute a small amount at first. Over time, these savings can grow significantly and provide financial security in retirement.