A quite complex form and often incorrectly completed, form 3921 needs to be treated with caution, or you might suffer a few headaches further down the line as a result.

Aware that so many people seem to get this wrong, we figured a little help was in order. Through this short article, we intend to do just that and guide you through the process.

Forewarned is forearmed, and by the end of this article you will be filing your taxes correctly and avoiding any potential penalties or fines.

What Is Form 3921?

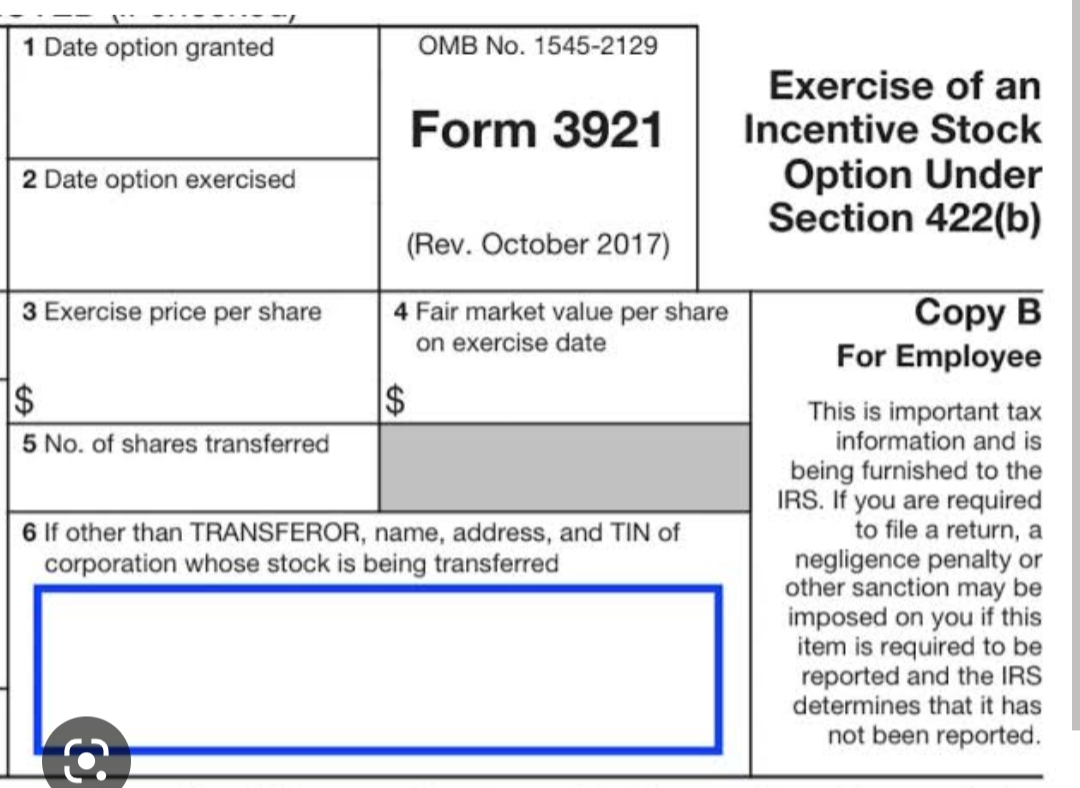

Form 3921 is a tax form used to report that a shareholder has exercised the incentive stock that the company has granted.

The form is filed with the Internal Revenue Service (IRS). The corporation must file IRS FORM 3921 for each person who exercised an ISO (Incentive Stock Option) during the year.

The form determines the tax consequences of exercising an ISO. The exercise price and the stock’s fair market value on the exercise date are reported on FORM 3921.

When employees exercise their ISOs, they pay what is known as the strike price for the stock acquired. This difference between the strike price and the stock’s fair market value on the day the ISO is exercised is called the spread.

The spread is used to calculate the alternative minimum tax (AMT). Corporations must provide FORM 3921 to employees who exercised an Incentive Stock Option within 30 days after the exercise date.

FORM 3921 is not required to be filed with an employee’s income tax return. However, it must be kept as part of the employee’s records.

What Are Incentive Stock Options (ISOs)?

For many, the word “stock” conjures images of Wall Street and high-powered investors. However, one type of stock is more likely to be found in a garage than a boardroom: incentive stock options (ISOs).

ISOs are a type of employee stock option that offers some tax advantages over other types of stock options. If granted an Incentive Stock Option, you are at liberty to buy your company’s stock at a price that is agreed upon.

Usually, the price is set at the stock’s fair market without being subject to a maximum tax burden. However, you may have to pay an alternative minimum tax if you exercise an Incentive Stock Option at a later date when the value of the stock acquired has risen.

In general, ISOs are subject to fewer rules and restrictions than other types of stock options, making them a more attractive incentive for employees.

Who Needs To File Form 3921?

Form 3921 is used to report the transfer of stock from a corporation to an employee. This form is used to calculate the employee’s tax liability.

Corporations with employees who have exercised an incentive stock option need to file this form. They have 30 days after the transfer to do so.

So if you’re unsure whether you need to file Form 3921, it’s always best to consult with a tax professional.

When Is The Deadline For Filing Form 3921?

It is a requirement by law for Corporations to fill out Form 3921 by specific dates. You must be aware of the steps necessary to avoid any penalties.

Section 6039 of the Internal Revenue Code requires businesses to provide the employee with Copy B of the Form. The form reports the grant date, exercise price, and fair market value of the stock. Copy B should be given to the employee at the time the stock is transferred.

The company should submit Copy A of the form by February 28 of the following year after the Incentive Stock Option exercise. If it is done electronically, the due date is March 31.

For electronic filing, Copy A of Form 3921 should be submitted by March 31 next year after the employee incentive stock option is exercised. Copy A of Form 3921 is an IRS tax form used to report the transfer of employee stock options that were exercised during the year.

The purpose of the form is to help the IRS track whether the employee has met the tax-reporting requirements for these types of stock options. Failure to file Copy A of Form 3921 can result in penalties for both the employer and the employee.

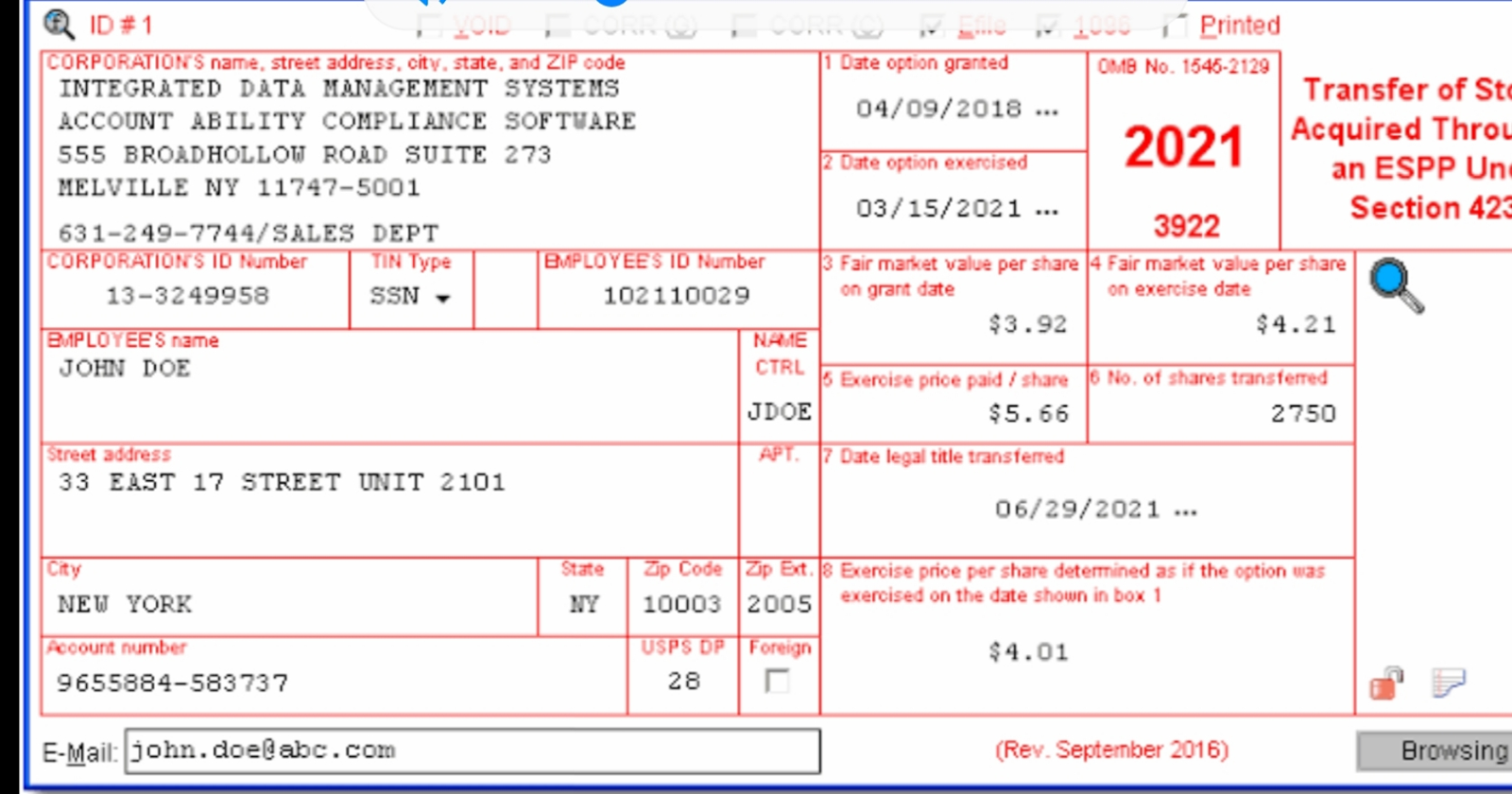

What Information Is Required To Complete Form 3921?

You need to gather a lot of information before filing Form 3921. The form can be filed online or via email. If you need to file more than 250 of 3921 forms, you will need to do this online. For filing the form, you will need the following things:

- List of those who utilized their ISOs the previous year with name and address

- Your business transmitter control code if you are filing electronically

- If you file electronically, ensure you have an account with the Filing Information Returns Electronically (FIRE) system. Filer’s code from the IRS

- The price per share for the exercise

- The date the company granted the employee the Incentive Stock Option

- The date of the exercise of an incentive stock option.

- The amount of stock acquired following the exercise of the ISO

- Name and address of the company

- Fair market value of stock acquired on the date of the exercise of an incentive stock option

How Do I Fill Out Form 3921?

The good news is that this code is easy to obtain. Visit the IRS website and enter your information into the designated form. Within minutes, you will receive a code that you can use to file your Form 3921 electronically.

Don’t let the filer’s code from the IRS stop you from e-filing your taxes – it’s easy to get and will make the process much simpler.

Form 3921 is an essential document for any taxpayer. Here are the steps to fill it out correctly:

Step 1: Enter the name and address of the company.

Step 2: On the left-hand side of the form, you will see a section labeled “Stock Information.” In this section, you will need to enter the date of the stock transfer, the date of exercise of an incentive stock option, the shares acquired, and the fair market value per share.

Step 3: Next, you will need to calculate the “Income from Exercise of Incentive Stock Options.” To do this, take the fair market value per share and multiply it by the number of shares acquired.

Step 4: Once you have completed the calculation, enter the total amount in box one on the form.

Step 5: The next step is to complete box 2 of the form. In this box, you will need to enter the date of sale or stock transfer.

Step 6: After you have entered the date of sale or transfer, you will need to calculate the gain or loss from the sale. To do this, subtract the selling price from the fair market value per share.

Step 7: Enter the total amount in box two on the form.

Step 8: The final step is to sign and date the form. Once you have done this, you are ready to file your taxes!

Penalties For Not Filing In Time

If you don’t file Form 3921 as required, you may be subject to penalties. The minimum penalty is $10 per form. You may also be subject to interest and other penalties.

If you knowingly fail to file Form 3921, you may be subject to criminal penalties, including fines and imprisonment. The amount you pay depends on how long after the due date you filed.

- If you file after the deadline, but before 30 days are over, you will pay $50 for every form. The maximum you can pay is $547,000 yearly and $191,000 if it is a small company.

- If you file more than 30 days after the deadline, but by August 1, the fine is $100 per form. The maximum amount per year is $1,641,000 and $547,000 for smaller companies.

- If you file after August 1, you will be treated as one who never filed at all. You will pay $270. You can pay up to $3,282,500 per year and $1,094,000 for small companies.

- A more significant penalty will apply if the IRS can show evidence that you refused to file form 3921 intentionally.

- However, if you can show that the failure to file was due to reasonable cause, the IRS will waive the penalty. So it’s essential to keep track of deadlines and ensure all required forms are filed on time.

Exception For Filing Form 3921

There are a few exceptions when you have to file Form 3921, which are used to report the sale or exchange of stock or securities. If you meet any of these conditions, you don’t have to file the form:

- If a non-resident alien exercised Incentive Stock Options, for example, a company giving ISOs for the stock of a US-based company to employees of a branch in a foreign branch.

- You were not the transferor in the transaction.

- You were not a partner in, a shareholder of, or a beneficiary of the transferred property.

- You did not acquire control of the transferred property within 60 days before or after the transfer.

- If you sell or otherwise dispose of ISO shares more than one year after the exercise of an incentive stock option.

FAQ

Do I Need To Include Form 3921 On My Tax Return?

IRS Form 3921 reports that an employee can exercise the Incentive Stock Option (ISO) but this is a statutory stock option with no tax consequences.

So no, you don’t need to include this form on your tax return. It is an informational form only.

However, if you sold the stock acquired, you are subject to an alternative minimum tax.

Can I File Form 3921 Online?

Absolutely, and the process is quite simple, but first, you’ll need to gather all the required information. The process is simple and easy to follow. First, you’ll need to gather the necessary information. It includes your employer identification number (EIN), the grant date of the option, and the exercise price per share.

Once you have this information, you’ll be able to log into the Online Filing System and complete the form. Just enter the requested information and click the “submit” button. If you fear a long, complicated process, don’t worry – it really is quite simple. Well, for a form relating to tax, it is pretty simple, we should say.

When Do Startups Need To File A 3921 Form?

It depends on various factors. If your startup has granted Incentive Stock Options to its employees, then you need to fill out form 3921 for every employee who exercises the IOS. However, there are some exceptions, so it’s always best to check with an accountant or tax professional to be sure.

What Is The Difference Between FORM 3921 And FORM 3922?

You should be aware of a few key differences between FORM 3921 and FORM 3922. FORM 3921 is used for transfers during the calendar year, while FORM 3922 is used for transfers during the prior year.

Additionally, FORM 3921 requires reporting additional information, such as the grant date and exercise price, while FORM 3922 only requires reporting when you sell or otherwise dispose of the stock acquired.

Finally, only FORM 3921 must be filed with the transferee (the person receiving the stock). So, if you’re planning on transferring stock this year, use the correct form!

Wrap Up

Form 3921 is a basic form for tracking employee stock options. If you have received stock options from your employer, it’s essential to ensure that they are filed and kept for record purposes. Filing your taxes can be complex, but with the help of a professional, it doesn’t have to be daunting.