In the dynamic startup ecosystem, the role of the CFO has transformed. No longer just the financial gatekeeper, today’s CFO is a strategic visionary, pivotal in shaping a startup’s trajectory. Venture capital, once just a financial lifeline, has evolved into a strategic partnership. For modern CFOs, attracting this capital isn’t just about funds; it’s about aligning visions, securing mentorship, and accessing networks that can catapult a startup to success. This guide delves into the CFO’s multifaceted role in this journey, offering insights and strategies for navigating the venture capital landscape.

What Is Venture Capital?

Venture capital (VC) is a form of funding that provides a significant financial boost for start-ups. While angel investors can offer initial funding to help entrepreneurs kickstart their businesses, venture capitalists invest substantial sums, often ranging from $25 million to a billion. These people believe in the idea behind your company and its potential for high returns on their investment. This money isn’t a loan; it’s an investment to scale and enhance your business model.

However, in return, venture capitalists take a share of your profit and equity. Their perspective and expertise in various industries can be invaluable, especially if they have a strong track record. Therefore, having a solid business plan, showcasing traction, demonstrating technology prowess, and highlighting your management team’s credibility through research and a proven track record can increase your chances of securing VC funding.

CFOs: The Pillars of Venture Capital Success

The backbone of any VC firm is undeniably its CFO. Tasked with multifaceted responsibilities, they navigate the intricate financial landscape, oversee deal executions, and monitor the growth trajectories of burgeoning companies. In a market where valuations soar unprecedentedly, venture CFOs are entrusted with the delicate task of ensuring realistic portfolio valuations.

Often seen as the “reality check” in the VC world, CFOs balance the enthusiasm of deal teams with the practicalities of available capital in a fund. Their strategic pacing ensures the fund remains sustainable, preventing any undue finance-related strain.

Given their comprehensive role, venture CFOs possess a unique vantage point. They recognize the limitations of existing processes and tools, positioning them as the perfect catalysts for ushering in necessary changes. Their leadership is pivotal in ensuring VC firms remain at the forefront of a competitive market.

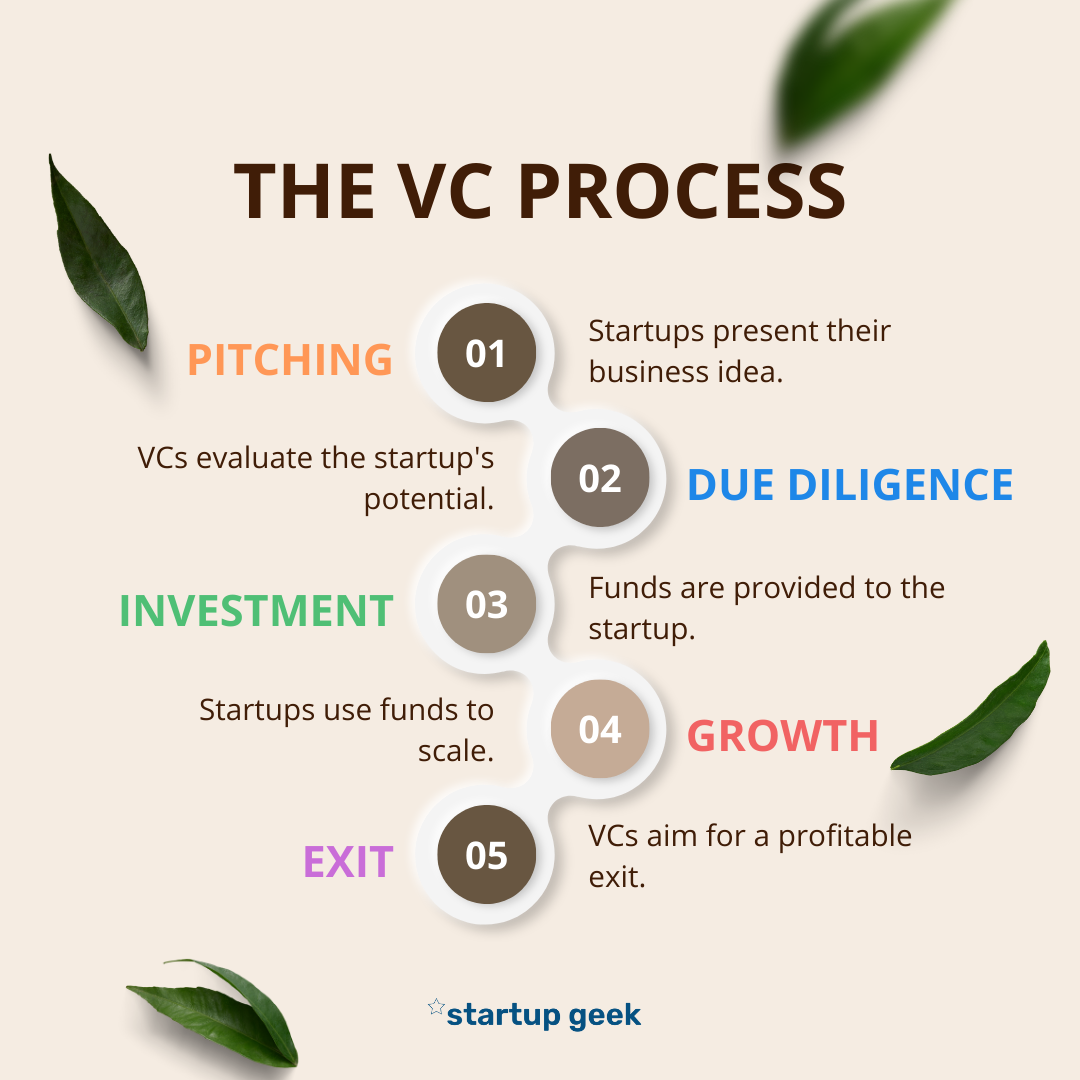

The Process Of Venture Capital:

- Pitching: Startups Present Their Business Idea.

At this initial stage, startups introduce their business concept, vision, and plans to potential venture capitalists (VCs). This is often done through presentations, business plans, and demos to convince VCs of the startup’s potential.

- Due Diligence: VCs Evaluate The Startup’s Potential.

Once interested, VCs delve deeper into the startup’s operations, financials, team, and market potential. This rigorous assessment ensures that the startup is a viable investment and aligns with the VC’s investment criteria.

- Investment: Funds Are Provided To The Startup.

After a successful due diligence process, VCs agree to invest a specific amount of money in the startup. In return, they typically receive equity or an ownership stake in the company.

- Growth: Startups Use Funds To Scale.

With the newly acquired funds, startups can expand their operations, hire more staff, increase marketing efforts, develop products, and enter new markets. This phase is all about leveraging the investment to accelerate growth and increase the company’s value.

- Exit: VCs Aim For A Profitable Exit.

The ultimate goal for VCs is to achieve a substantial return on their investment. This is often realized when the startup goes public through an Initial Public Offering (IPO) or is acquired by another company. At this point, VCs sell their shares and recoup their investment, ideally at a significant profit.

Empowering CFOs: Six Strategic Steps to Attract Venture Capital

In the dynamic world of startups, the role of a Chief Financial Officer (CFO) extends beyond just managing finances. Today’s CFOs are visionaries, strategists, and leaders, pivotal in shaping the company’s future. As startups seek venture capital to fuel their growth, the CFO’s approach, backed by the right tips and data-driven numbers, can make all the difference. Here are six strategic steps every CFO can adopt to attract venture capital effectively and ensure the startup’s long-term success.

Step 1: The Visionary CFO

In the bustling corridors of the startup world, visionaries stand out, and among them, the modern CFO shines brightly. Gone are the days when CFOs were confined to finance roles; today, they are at the forefront of innovation, often visualizing the next big thing.

Scenario:

Sarah, a seasoned CFO, isn’t just adept at financial forecasting. She possesses a keen sense of market trends and consumer needs. One day, during a brainstorming session, she envisioned a product that could potentially disrupt the industry. It’s not just an incremental improvement but a groundbreaking innovation that could redefine how consumers interact with the sector.

Action:

- Sarah recognizes that numbers alone won’t capture the product’s transformative potential.

- She crafts a narrative, emphasizing the product’s unique value, its potential market impact, and scalability.

- This story, rooted in market insights and supported by data, is tailored to appeal to investors.

- Beyond just financial prospects, it highlights the product’s potential to redefine industry standards, making it a compelling pitch for venture capital.

Step 2: Building a Diverse Brigade

In the intricate tapestry of a startup, each thread, each role, plays a crucial part. A CFO, while pivotal, is just one piece of the puzzle. The strength of a startup often lies in the diversity of its team, where varied backgrounds, expertise, and perspectives converge to create innovation. Respecting the rights of every team member can foster a harmonious work environment.

Scenario:

John, a dynamic CFO, has always been proud of his team’s accomplishments. However, as they venture into new territories, he notices certain gaps. While they excel in some areas, there are domains where their expertise is limited. John realizes that to truly innovate and compete, they need a broader spectrum of skills and experiences.

Action:

- John initiates a drive to diversify the team’s skill set and background.

- He leverages industry networks, partners with HR, and engages with alumni groups.

- The aim is to onboard talent with varied technical skills, cultural insights, and industry knowledge.

- The enriched team dynamics lead to diverse ideas, multifaceted problem-solving, and comprehensive solutions.

- This diverse team not only addresses the skill gaps but also boosts the startup’s adaptability and innovation.

Step 3: Real Impact in the Real World

While impressive sales figures and growth metrics are essential to a startup’s success, they only tell part of the story. In today’s socially conscious business environment, the real impact—a product’s ability to effect meaningful change—holds significant weight. For example, a tech startup’s software might have something groundbreaking that addresses societal issues.

Scenario:

Alex, an astute CFO, is proud of the startup’s soaring sales numbers. The charts are trending upwards, and stakeholders are pleased. However, Alex believes that their product’s value extends beyond just revenue. It’s about the lives it touches, the problems it solves, and the communities it uplifts. He recognizes that in the eyes of potential investors, partners, and even customers, these stories of real-world impact can be as compelling as any financial metric.

Action:

- Alex teams up with marketing and customer relations to spotlight this impact.

- They launch a campaign to collect user testimonials, case studies, and impactful stories.

- These narratives highlight the product’s positive influence on businesses, communities, and individuals.

- These stories are integrated into the startup’s branding, social media, and investor pitches.

- By emphasizing both financial success and real-world impact, Alex crafts a compelling narrative for the startup.

Step 4: Beyond Networking – Building Genuine Bonds

In the world of startups and venture capital, networking is often seen as the golden ticket to success. However, while making connections is crucial, building genuine, lasting relationships can pave the way to achieving the goals set by founders. It’s not just about collecting a number of business cards; it’s about forging bonds that stand the test of time and can influence decisions.

Scenario:

Mia, a proactive CFO and budding entrepreneur, is no stranger to the networking circuit. She’s a regular at industry events, seminars, and investor meet-ups, often fielding questions from potential venture capitalists. Yet, amidst the sea of handshakes and the competition of voices, she often feels a sense of emptiness. The interactions, while numerous, seem fleeting and surface-level. Mia yearns for more depth, for connections that go beyond just business. With confidence, she starts to curate her content on professional sites, seeking advice and offering insights, allowing her to lay the ground for deeper relationships of a different type.

Action:

- Mia shifts her approach from quantity to quality in networking.

- She targets potential investors aligned with her startup’s vision.

- Mia invests time in understanding the aspirations and challenges of those she meets.

- She engages in meaningful follow-ups, shares resources, and arranges personal meetups.

- This strategy fosters genuine, long-lasting relationships beneficial for investments, mentorship, and partnerships.

- Mia’s method emphasizes the significance of depth in business relationships.

Step 5: Tapping into the Global Pulse

In an increasingly interconnected world, startups can no longer afford to operate in silos. The global market offers a plethora of opportunities, insights, and collaborations. For startups aiming for exponential growth, tapping into the global pulse is not just beneficial—it’s imperative. In addition, understanding different types of markets and cultures can provide a competitive edge.

Scenario:

Raj, an ambitious CFO, has always been an active member of his local startup community. He attends local events, participates in regional workshops, and is well-acquainted with the local investor scene. However, as time progresses, he starts feeling a sense of confinement. The local ecosystem, while supportive, seems repetitive and limiting. Raj yearns to explore beyond the local boundaries, immerse himself in the global startup scene, and bring valuable insights to his team.

Action:

- Raj embarks on a global exploration by joining international startup forums and VC communities.

- He gains insights from diverse global perspectives and learns about challenges in different regions.

- Raj attends international conferences and webinars to deepen his knowledge and network.

- His active participation and collaborations position his startup on the global stage.

- The startup garners international attention, partnerships, and investment opportunities.

- Raj’s efforts bridge the local-global gap, positioning the startup for global success.

Step 6: The Marathon Mindset

The startup journey, especially in the service sector and when it comes to securing venture capital, is often likened to a marathon, not a sprint. Initial interest from VCs can be exhilarating, but it’s just the beginning of a long and often challenging journey. Entrepreneurs face various issues and risks, and maintaining momentum, staying resilient, and keeping the team aligned is crucial for long-term success. To navigate potential failure, leveraging information from websites and other resources can be invaluable.

Scenario:

- Carlos, a seasoned CFO, has recently pitched to a group of potential investors. The response has been overwhelmingly positive, with several VCs expressing keen interest. The team is ecstatic, and the atmosphere is charged with excitement. However, Carlos, with his years of experience, knows that this is just the starting line. Ahead lies a path filled with negotiations, due diligence, potential pivots, and unforeseen challenges. The initial euphoria is great, but sustaining the momentum and navigating the complexities requires a different mindset.

Action:

- Carlos convenes a team meeting to discuss the feedback.

- He emphasizes the ‘marathon mindset’ and the need for patience and adaptability.

- Carlos sets clear expectations about the lengthy investment process.

- He promotes open communication within the team.

- Carlos organizes mentorship sessions and workshops on key topics like negotiations and investor relations.

- His approach ensures the team is prepared for the long venture capitalist journey ahead.

Call to Action:

Have you navigated the maze of venture capital? Have you faced challenges that tested your mettle or experienced moments that changed the game? We want to hear from you. Share your stories, the insights you’ve gleaned, and the strategies that worked for you. By sharing, you not only enrich this community but also inspire and guide fellow CFOs on their VC journey.